Global Acrylamide Monomer Market

Market Size in USD Billion

CAGR :

%

USD

13.35 Billion

USD

27.49 Billion

2025

2033

USD

13.35 Billion

USD

27.49 Billion

2025

2033

| 2026 –2033 | |

| USD 13.35 Billion | |

| USD 27.49 Billion | |

|

|

|

|

Acrylamide Monomer Market Size

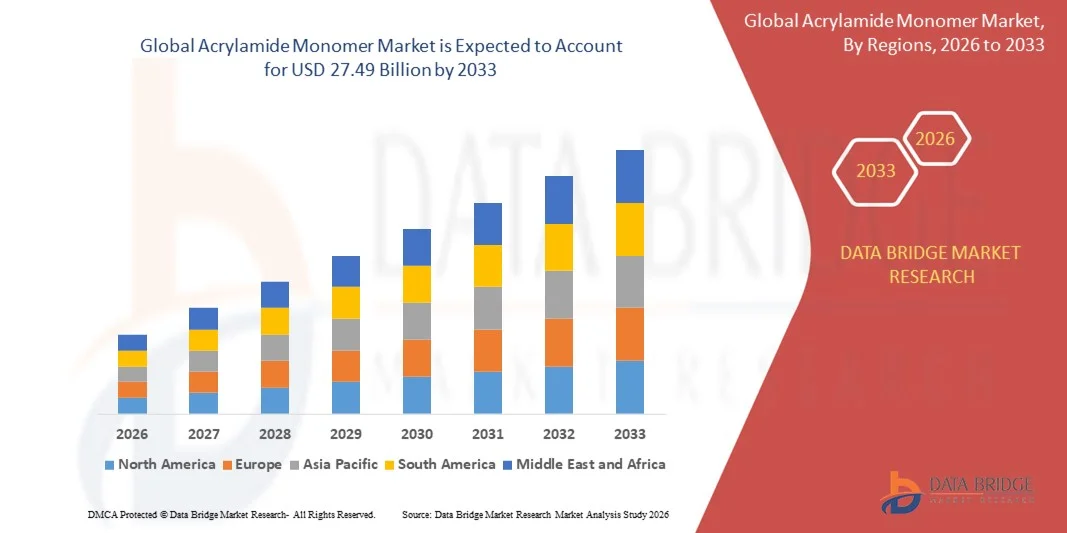

- The global acrylamide monomer market size was valued at USD 13.35 billion in 2025 and is expected to reach USD 27.49 billion by 2033, at a CAGR of 9.45% during the forecast period

- The market growth is largely driven by increasing demand for efficient water and wastewater treatment solutions, supported by rapid urbanization, industrial expansion, and stricter environmental regulations across both developed and developing economies

- Furthermore, rising usage of acrylamide monomer in enhanced oil recovery, pulp and paper processing, and industrial flocculation applications is accelerating consumption, as industries seek cost-effective and high-performance polymer-based solutions, thereby significantly boosting overall market growth

Acrylamide Monomer Market Analysis

- Acrylamide monomer, serving as a key raw material for polyacrylamide polymers, plays a critical role in water treatment, oil & gas recovery, and industrial processing due to its effectiveness in solid–liquid separation, viscosity modification, and flow control

- The growing demand for acrylamide monomer is primarily fueled by expanding municipal water infrastructure, increasing enhanced oil recovery activities, and rising industrial wastewater treatment needs, supported by continuous investments in environmental compliance and resource efficiency

- Asia-Pacific dominated the acrylamide monomer market with a share of 53.32% in 2025, due to rapid industrialization, expanding water treatment infrastructure, and strong demand from pulp and paper as well as oil & gas industries

- North America is expected to be the fastest growing region in the acrylamide monomer market during the forecast period due to rising demand for enhanced oil recovery, advanced water treatment, and industrial wastewater management

- Flocculent segment dominated the market with a market share of 49% in 2025, due to the extensive use of acrylamide-based polymers in water and wastewater treatment processes. Flocculents derived from acrylamide monomer play a critical role in solid–liquid separation, sludge dewatering, and clarification, supporting large-scale municipal and industrial treatment facilities. The segment benefits from rising investments in water infrastructure and stricter discharge regulations across developing and developed economies. Consistent demand from municipal utilities and industrial users ensures stable consumption volumes. In addition, the cost-effectiveness and high efficiency of acrylamide-based flocculants strengthen their preference over alternative chemistries

Report Scope and Acrylamide Monomer Market Segmentation

|

Attributes |

Acrylamide Monomer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acrylamide Monomer Market Trends

Growing Use of Acrylamide Polymers in Water Treatment

- A major trend shaping the acrylamide monomer market is the increasing use of acrylamide-based polymers in municipal and industrial water treatment processes, driven by rising global demand for clean water and stricter wastewater discharge standards. Acrylamide monomer is a key precursor for polyacrylamide flocculants that improve solid–liquid separation, sludge dewatering, and clarification efficiency in treatment plants

- For instance, SNF Group supplies acrylamide-based flocculants that are widely used by municipal water utilities and industrial wastewater treatment facilities across Asia-Pacific, Europe, and North America. These products support large-scale treatment operations by improving processing efficiency and reducing operational downtime

- The trend is further strengthened by increasing investments in wastewater reuse and recycling projects, where high-performance flocculants are required to meet regulatory quality standards. Acrylamide polymers enable treatment plants to handle higher contaminant loads while maintaining consistent output quality

- Industrial sectors such as pulp and paper, mining, and food processing are increasingly adopting acrylamide-based solutions to manage effluents more effectively. This supports compliance with environmental norms while optimizing water usage and reducing discharge volumes

- Urbanization and population growth are placing additional pressure on aging water infrastructure, accelerating the adoption of advanced chemical treatment solutions. Acrylamide monomer consumption benefits directly from this shift toward modernized treatment technologies

- The growing reliance on polymer-based water treatment chemicals is reinforcing the role of acrylamide monomer as a foundational raw material, positioning water treatment as a long-term demand driver for the market

Acrylamide Monomer Market Dynamics

Driver

Rising Demand for Municipal and Industrial Water Treatment

- The rising demand for municipal and industrial water treatment is a key driver of the acrylamide monomer market, supported by stricter environmental regulations and increasing awareness of water pollution control. Governments and regulatory bodies are mandating higher treatment standards, boosting the need for efficient flocculation and purification chemicals

- For instance, Kemira Oyj supplies acrylamide-based polymers to municipal water treatment plants and industrial users, supporting large-scale drinking water purification and wastewater management projects. These solutions help operators achieve regulatory compliance while maintaining cost efficiency

- Rapid industrialization has led to higher volumes of wastewater generation from manufacturing, energy, and processing industries, increasing dependence on polymer-based treatment chemicals. Acrylamide monomer plays a central role in producing polymers that enhance treatment capacity and operational reliability

- Public investments in water infrastructure upgrades are further strengthening demand, particularly in emerging economies where new treatment plants are being commissioned. Acrylamide-based flocculants are preferred for their effectiveness across varied water conditions

- The continued expansion of water treatment infrastructure globally reinforces this driver and positions acrylamide monomer as an essential input for environmental management and water security initiatives

Restraint/Challenge

Stringent Environmental and Health Regulations

- The acrylamide monomer market faces challenges from stringent environmental and health regulations due to concerns over acrylamide toxicity and potential exposure risks. Regulatory agencies impose strict limits on residual acrylamide levels in treated water and downstream applications, increasing compliance requirements for manufacturers

- For instance, regulatory guidelines enforced by organizations such as the European Chemicals Agency require careful monitoring and control of acrylamide usage and emissions during production and application. Compliance with these regulations increases operational complexity for chemical producers

- Manufacturers must invest in advanced production technologies, safety systems, and quality control measures to minimize residual monomer content in polymer products. These requirements raise production costs and can limit flexibility in scaling output

- Environmental scrutiny also impacts approval timelines for new plants and capacity expansions, slowing market entry for new suppliers. This can constrain supply growth in regions with rapidly increasing demand

- These regulatory and health-related challenges collectively act as a restraint on market expansion, requiring continuous investment in compliance, process optimization, and responsible chemical management practices

Acrylamide Monomer Market Scope

The market is segmented on the basis of application and end-use.

- By Application

On the basis of application, the acrylamide monomer market is segmented into enhanced oil recovery, pulp and paper manufacturing, flocculent, thickener, and others. The flocculent segment dominated the market with the largest revenue share of 49% in 2025, driven by the extensive use of acrylamide-based polymers in water and wastewater treatment processes. Flocculents derived from acrylamide monomer play a critical role in solid–liquid separation, sludge dewatering, and clarification, supporting large-scale municipal and industrial treatment facilities. The segment benefits from rising investments in water infrastructure and stricter discharge regulations across developing and developed economies. Consistent demand from municipal utilities and industrial users ensures stable consumption volumes. In addition, the cost-effectiveness and high efficiency of acrylamide-based flocculants strengthen their preference over alternative chemistries.

The enhanced oil recovery segment is anticipated to witness the fastest growth rate from 2026 to 2033, supported by increasing efforts to maximize output from mature oil fields. Acrylamide monomer is widely used in the production of polyacrylamide polymers that improve sweep efficiency and reduce water mobility in reservoirs. Growing energy demand and the need to optimize existing oil assets are encouraging oil producers to adopt chemical EOR techniques. The segment also benefits from technological improvements that enhance polymer stability under high temperature and salinity conditions. Expansion of offshore and unconventional oil projects further supports growth prospects.

- By End-Use

On the basis of end-use, the acrylamide monomer market is segmented into water treatment, oil & gas, cosmetics, pulp and paper, food packaging, and others. The water treatment segment accounted for the dominant market share in 2025 due to the critical role of acrylamide-derived polymers in drinking water purification and wastewater management. Rapid urbanization, population growth, and industrial expansion have significantly increased the demand for efficient water treatment solutions. Municipal authorities and industrial operators rely heavily on acrylamide-based flocculants for regulatory compliance and operational efficiency. The segment also benefits from continuous public and private investments in water infrastructure upgrades. Stable recurring demand makes water treatment the backbone of acrylamide monomer consumption.

The oil & gas segment is expected to register the fastest growth during the forecast period, driven by rising adoption of polymer flooding and drilling fluid applications. Acrylamide monomer is essential for producing polymers that enhance viscosity control and improve recovery rates in challenging reservoir conditions. Increasing exploration and production activities, particularly in mature and technically complex fields, support higher consumption. The focus on improving operational efficiency and reducing extraction costs further accelerates adoption. Advancements in polymer formulation tailored for extreme environments also contribute to the strong growth outlook of this segment.

Acrylamide Monomer Market Regional Analysis

- Asia-Pacific dominated the acrylamide monomer market with the largest revenue share of 53.32% in 2025, driven by rapid industrialization, expanding water treatment infrastructure, and strong demand from pulp and paper as well as oil & gas industries

- The region’s large-scale chemical manufacturing capacity, cost-efficient production, and increasing investments in wastewater management projects are accelerating overall market growth

- Rising urban population, stricter environmental regulations, and growing adoption of acrylamide-based flocculants across municipal and industrial applications are strengthening regional consumption

China Acrylamide Monomer Market Insight

China held the largest share in the Asia-Pacific acrylamide monomer market in 2025, supported by its dominant position in chemical manufacturing and extensive water and wastewater treatment projects. The country’s strong industrial base, large pulp and paper industry, and widespread use of polymer-based flocculants drive sustained demand. Government initiatives focused on pollution control and water reuse further reinforce market expansion.

India Acrylamide Monomer Market Insight

India is the fastest-growing market in the Asia-Pacific region, fueled by increasing investments in municipal water treatment, rapid industrial growth, and rising oil & gas activities. Expanding pulp and paper production and stricter wastewater discharge norms are boosting the use of acrylamide-based polymers. Government-led programs for clean water and industrial infrastructure development continue to support strong growth momentum.

Europe Acrylamide Monomer Market Insight

The Europe acrylamide monomer market is growing steadily, supported by stringent environmental regulations and high adoption of advanced water treatment technologies. Demand remains strong from wastewater treatment plants, pulp and paper manufacturing, and specialty chemical applications. The region’s focus on sustainable processing and efficient sludge management is reinforcing long-term consumption.

Germany Acrylamide Monomer Market Insight

Germany’s market is driven by its advanced industrial base, strong presence of pulp and paper manufacturers, and high compliance with environmental standards. The country emphasizes efficient wastewater treatment and resource recovery, supporting consistent demand for acrylamide-based flocculants. Strong R&D capabilities and technological innovation further enhance market stability.

U.K. Acrylamide Monomer Market Insight

The U.K. market benefits from rising investments in water infrastructure modernization and increasing focus on sustainable wastewater treatment solutions. Demand from municipal utilities and industrial users remains stable, supported by regulatory pressure to improve water quality. The presence of established chemical suppliers strengthens supply reliability across applications.

North America Acrylamide Monomer Market Insight

North America is projected to register the fastest CAGR from 2026 to 2033, driven by rising demand for enhanced oil recovery, advanced water treatment, and industrial wastewater management. Growing shale oil activities and increasing emphasis on efficient polymer-based solutions are key growth drivers. Technological advancements in polymer chemistry further support market expansion.

U.S. Acrylamide Monomer Market Insight

The U.S. accounted for the largest share of the North America market in 2025, supported by strong demand from water treatment facilities and oil & gas operations. Extensive use of acrylamide-based polymers in enhanced oil recovery and municipal wastewater treatment underpins consumption. A well-established chemical industry and continuous infrastructure investments reinforce the country’s leading position.

Acrylamide Monomer Market Share

The acrylamide monomer industry is primarily led by well-established companies, including:

- SNF Group (France)

- Kemira Oyj (Finland)

- INEOS Group Limited (U.K.)

- PetroChina Company Limited (China)

- Rudong Tongyuan Chemicals Co., Ltd (China)

- NALCO India Limited (India)

- Beijing Hengju Chemical Group Co., Ltd (China)

- BASF SE (Germany)

- Mitsubishi Chemical Group Corporation (Japan)

- Sumitomo Chemical Co., Ltd (Japan)

- Evonik Industries AG (Germany)

- Zibo Xinye Chemical Co., Ltd (China)

- Anhui Tianrun Chemicals Co., Ltd (China)

Latest Developments in Global Acrylamide Monomer Market

- In September 2024, BASF SE completed a major expansion of its acrylamide monomer production facility in Ludwigshafen, Germany, significantly increasing annual output capacity to meet rising regional demand. This expansion directly supports the growing consumption of acrylamide monomer in water treatment, pulp and paper, and enhanced oil recovery applications across Europe. By strengthening supply security and reducing dependence on imports, the development improves market stability and allows downstream users to scale operations more efficiently

- In July 2024, SNF Group established a joint venture with Saudi Aramco to develop a large-scale acrylamide monomer manufacturing plant in Jubail Industrial City. This initiative enhances local production capabilities in the Middle East, enabling faster supply to oil & gas and municipal water treatment projects. The partnership accelerates regional market growth by lowering logistics costs, improving supply responsiveness, and supporting large enhanced oil recovery programs

- In May 2024, Kemira Oyj implemented a new low-carbon acrylamide monomer production technology at its Finland facility, reducing emissions while maintaining product quality and performance. This development aligns the acrylamide monomer market with stricter environmental regulations and sustainability goals adopted by industrial customers. The innovation increases acceptance of acrylamide-based solutions among environmentally regulated end users, supporting long-term market expansion

- In March 2024, Mitsui Chemicals entered a strategic collaboration with China National Chemical Corporation to develop advanced acrylamide polymer formulations for challenging enhanced oil recovery environments. This partnership improves polymer performance under high temperature and salinity conditions, driving higher demand for acrylamide monomer in complex oilfield applications. The collaboration strengthens technological advancement within the market and supports increased adoption in mature and technically demanding reservoirs

- In January 2024, Ecolab Inc. completed the acquisition of Purolite’s acrylamide monomer operations, expanding its water treatment chemical portfolio and global reach. This acquisition enhances Ecolab’s ability to provide integrated water treatment solutions, increasing downstream consumption of acrylamide monomer. The development consolidates market presence among leading suppliers and supports growth through improved distribution and customer access across municipal and industrial sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Acrylamide Monomer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acrylamide Monomer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acrylamide Monomer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.