Global Acrylonitrile Butadiene Styrene Market

Market Size in USD Billion

CAGR :

%

USD

30.07 Billion

USD

44.94 Billion

2024

2032

USD

30.07 Billion

USD

44.94 Billion

2024

2032

| 2025 –2032 | |

| USD 30.07 Billion | |

| USD 44.94 Billion | |

|

|

|

|

What is the Global Acrylonitrile Butadiene Styrene Market Size and Growth Rate?

- The global acrylonitrile butadiene styrene market size was valued at USD 30.07 billion in 2024 and is expected to reach USD 44.94 billion by 2032, at a CAGR of 5.15% during the forecast period

- Major factors that are expected to boost the growth of the acrylonitrile butadiene styrene market in the forecast period are the increase in the penetration of acrylonitrile butadiene styrene implementations in the construction industry. Furthermore, the rise in the spending in the construction industry chiefly in the advancing nations is further anticipated to propel the growth of the acrylonitrile butadiene styrene market

- Moreover, the rise in the disposable income is further estimated to cushion the growth of the acrylonitrile butadiene styrene market. On the other hand, the struggle from other thermoplastics is further projected to impede the growth of the acrylonitrile butadiene styrene market in the timeline period

What are the Major Takeaways of Acrylonitrile Butadiene Styrene Market?

- The rise in the need for light weight automobiles to acquire better fuel effectiveness will further provide potential opportunities for the growth of the acrylonitrile butadiene styrene market in the coming years. However, the concerning issues regarding the environment might further challenge the growth of the acrylonitrile butadiene styrene market in the near future

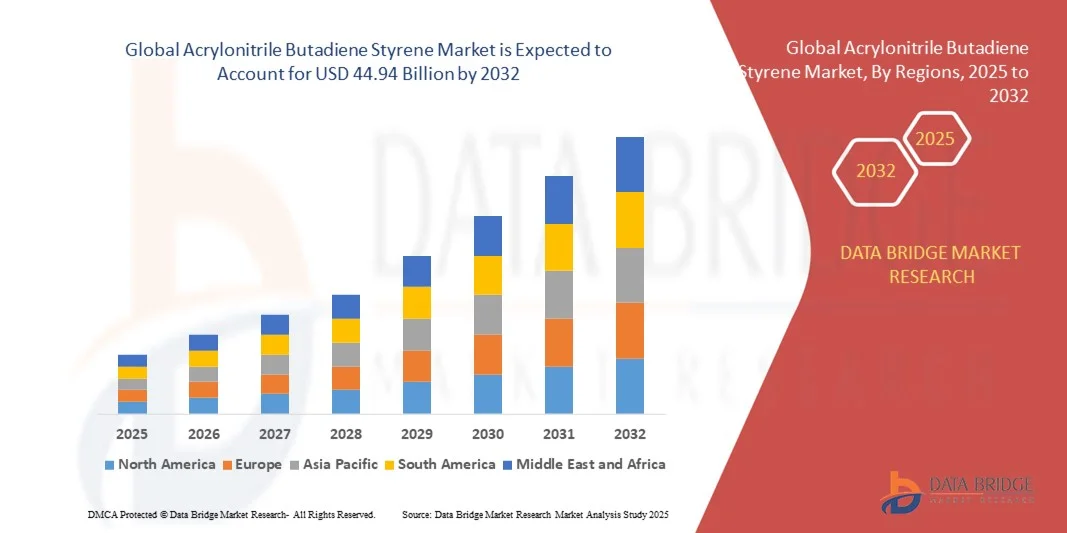

- Asia-Pacific dominated the acrylonitrile butadiene styrene market with the largest revenue share of 39.54% in 2024, driven by rapid industrialization, urbanization, and the strong presence of automotive, construction, and electronics industries

- The North America acrylonitrile butadiene styrene market is poised to grow at the fastest CAGR of 8.36% from 2025 to 2032, driven by increasing industrial production, rising demand for lightweight automotive components, and growing construction activities.

- The styrene monomer segment dominated the market with the largest revenue share of 45% in 2024, driven by its role in providing high rigidity, excellent surface finish, and ease of processing for a wide range of applications

Report Scope and Acrylonitrile Butadiene Styrene Market Segmentation

|

Attributes |

Acrylonitrile Butadiene Styrene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Acrylonitrile Butadiene Styrene Market?

Rising Demand for Lightweight and High-Performance Application

- A significant trend in the global acrylonitrile butadiene styrene market is the increasing demand for lightweight, high-strength acrylonitrile butadiene styrene in automotive, electronics, and consumer goods. Manufacturers are leveraging acrylonitrile butadiene styrene for its superior impact resistance, durability, and ease of processing, enabling the production of high-performance, cost-effective components

- For instance, automotive companies are increasingly using acrylonitrile butadiene styrene blends for interior panels, dashboards, and bumper systems to reduce vehicle weight while maintaining safety standards. In electronics, acrylonitrile butadiene styrene is widely used for housings and enclosures of devices, balancing mechanical strength with aesthetic appeal

- The trend toward eco-friendly and recyclable acrylonitrile butadiene styrene variants is also gaining momentum, with manufacturers introducing bio-based acrylonitrile butadiene styrene to align with sustainability goals. This shift is expected to drive innovation and adoption across industries, reshaping material selection standards

What are the Key Drivers of Acrylonitrile Butadiene Styrene Market?

- The growing adoption of acrylonitrile butadiene styrene in automotive, electronics, and 3D printing industries is a primary driver, as the material offers a balance of mechanical strength, heat resistance, and surface finish

- Increasing urbanization and industrialization are boosting demand for durable consumer goods, appliances, and infrastructure components, where acrylonitrile butadiene styrene serves as a preferred polymer due to its versatility

- The rising need for lightweight materials in vehicles to enhance fuel efficiency and meet emission regulations is further fueling acrylonitrile butadiene styrene consumption

- Expanding 3D printing applications are also driving acrylonitrile butadiene styrene demand, as its dimensional stability and printability make it ideal for prototyping and functional parts

- Moreover, manufacturers’ efforts to develop recyclable and bio-based acrylonitrile butadiene styrene variants are creating new growth opportunities, attracting environmentally conscious consumers and industries

Which Factor is Challenging the Growth of the Acrylonitrile Butadiene Styrene Market?

- Fluctuating raw material prices of styrene, acrylonitrile, and butadiene pose a major challenge, impacting production costs and profit margins

- ABS products face competition from alternative polymers such as polypropylene, polycarbonate blends, and high-performance engineering plastics, which can offer similar or superior performance in specific applications

- Environmental concerns around non-biodegradable plastics are pressuring manufacturers to adopt sustainable practices and recyclable materials, adding complexity and cost to production

- High initial costs for advanced acrylonitrile butadiene styrene variants with enhanced flame retardancy or bio-based compositions can deter adoption in cost-sensitive market

- Addressing these challenges requires innovation in recycled and sustainable acrylonitrile butadiene styrene, stable supply chains, and cost optimization to ensure steady growth in both emerging and developed markets

How is the Acrylonitrile Butadiene Styrene Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Source

On the basis of source, the acrylonitrile butadiene styrene market is segmented into acrylonitrile, butadiene, and styrene monomers. The styrene monomer segment dominated the market with the largest revenue share of 45% in 2024, driven by its role in providing high rigidity, excellent surface finish, and ease of processing for a wide range of applications. Styrene-based acrylonitrile butadiene styrene is widely used in automotive parts, electronics housings, and consumer goods due to its superior dimensional stability and aesthetic appeal.

The butadiene segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, as manufacturers increasingly favor high-impact acrylonitrile butadiene styrene grades in construction, automotive, and safety-critical applications. The high demand for impact-resistant, durable acrylonitrile butadiene styrene materials is driving the adoption of butadiene-rich formulations, particularly in regions with expanding industrial and automotive sectors.

- By Process

On the basis of process, the acrylonitrile butadiene styrene market is segmented into extrusion and injection molding. The injection molding segment dominated the market with a revenue share of 52% in 2024, owing to its widespread use in producing complex, high-precision components for automotive, electronics, and consumer goods. Injection molding offers superior consistency, high throughput, and design flexibility, making it ideal for large-scale manufacturing.

The extrusion segment is expected to grow at the fastest CAGR of 18.7% from 2025 to 2032, driven by increasing demand for acrylonitrile butadiene styrene sheets, films, and profiles in construction, packaging, and plumbing industries. Extrusion processes allow cost-effective production of long profiles and continuous shapes, contributing to adoption in infrastructure and industrial applications globally.

- By Additives

On the basis of additives, the acrylonitrile butadiene styrene market is segmented into glass, polyvinyl chloride (PVC), and others. The glass additive segment dominated the market with a revenue share of 41% in 2024, due to its ability to enhance mechanical strength, dimensional stability, and heat resistance in acrylonitrile butadiene styrene materials. Glass-reinforced acrylonitrile butadiene styrene is widely used in automotive panels, electrical enclosures, and industrial machinery parts.

The PVC additive segment is expected to witness the fastest CAGR of 20% from 2025 to 2032, as it improves flame retardancy, chemical resistance, and processability for applications in construction, plumbing, and marine equipment. The rising demand for high-performance, safety-compliant ABS formulations is driving growth across end-use industries globally.

- By Product Type

On the basis of product type, the acrylonitrile butadiene styrene market is segmented into opaque, transparent, and coloured. The opaque segment dominated the market with the largest revenue share of 49% in 2024, owing to its versatility and widespread application in automotive interiors, electronics, and consumer products. Opaque acrylonitrile butadiene styrene offers excellent surface finish, UV resistance, and colorability, making it suitable for aesthetic and functional purposes.

The coloured ABS segment is expected to witness the fastest CAGR of 17.5% from 2025 to 2032, driven by the growing demand for customized, aesthetically appealing components in consumer electronics, home appliances, and decorative construction materials. The flexibility in color options supports branding and product differentiation, boosting market adoption.

- By Application

On the basis of application, the acrylonitrile butadiene styrene market is segmented into construction, automotive, marine, furniture, plumbing, and others. The automotive segment dominated the market with a revenue share of 43% in 2024, attributed to the material’s lightweight, high-impact resistance, and excellent surface finish, which support vehicle weight reduction and fuel efficiency initiatives. ABS is extensively used in dashboards, interior trims, and bumpers.

The construction segment is expected to witness the fastest CAGR of 18.2% from 2025 to 2032, fueled by increasing demand for durable acrylonitrile butadiene styrene pipes, fittings, profiles, and panels. Rising urbanization, infrastructural development, and regulatory standards for building materials are driving growth in construction applications worldwide.

Which Region Holds the Largest Share of the Acrylonitrile Butadiene Styrene Market?

- Asia-Pacific dominated the ABS market with the largest revenue share of 39.54% in 2024, driven by rapid industrialization, urbanization, and the strong presence of automotive, construction, and electronics industries

- Consumers and manufacturers in the region highly value the material's versatility, durability, and cost-effectiveness, which supports its extensive use in construction materials, automotive parts, consumer electronics, and plumbing components

- The widespread adoption is further reinforced by supportive government policies for manufacturing, the expansion of industrial parks, and increasing demand for high-performance plastics in infrastructure and consumer applications, establishing acrylonitrile butadiene styrene as a preferred material across multiple sectors

China Acrylonitrile Butadiene Styrene Market Insight

The China acrylonitrile butadiene styrene market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by the country’s booming automotive and electronics manufacturing sectors. Rapid urbanization and rising disposable incomes are boosting demand for acrylonitrile butadiene styrene -based products in construction, consumer electronics, and household appliances. The push towards smart cities and advanced infrastructure projects, combined with the availability of cost-effective domestic acrylonitrile butadiene styrene production, is further strengthening the market. In addition, local manufacturers are increasingly investing in R&D to develop high-performance ABS grades, catering to both domestic and export markets, thereby solidifying China’s position as a dominant contributor to the regional market.

Japan Acrylonitrile Butadiene Styrene Market Insight

The Japan acrylonitrile butadiene styrene market is witnessing steady growth due to the country’s high-tech industrial ecosystem and strong automotive and electronics sectors. The increasing emphasis on lightweight, durable, and aesthetically versatile materials is driving acrylonitrile butadiene styrene adoption. Moreover, Japan’s focus on environmentally friendly manufacturing and recycling initiatives encourages the use of high-quality acrylonitrile butadiene styrene for sustainable construction, automotive interiors, and electronic housings. The integration of acrylonitrile butadiene styrene components in precision-engineered products, coupled with technological advancements, continues to support market expansion.

Which Region is the Fastest Growing Region in the Acrylonitrile Butadiene Styrene Market?

The North America acrylonitrile butadiene styrene market is poised to grow at the fastest CAGR of 8.36% from 2025 to 2032, driven by increasing industrial production, rising demand for lightweight automotive components, and growing construction activities. The region’s adoption of advanced manufacturing technologies, including 3D printing and smart factories, is creating new opportunities for acrylonitrile butadiene styrene applications. In addition, North America’s emphasis on sustainable and high-performance materials in automotive, electronics, and household sectors is fueling market expansion.

U.S. Acrylonitrile Butadiene Styrene Market Insight

The U.S. acrylonitrile butadiene styrene market captured the largest revenue share of 79% in North America in 2024, attributed to the extensive automotive, electronics, and construction industries. Rising consumer demand for durable, high-quality consumer goods and innovative automotive components is propelling acrylonitrile butadiene styrene adoption. Moreover, government initiatives promoting advanced manufacturing and industrial automation, combined with increasing R&D investments in high-performance acrylonitrile butadiene styrene grades, are supporting market growth. The ongoing trend of lightweight, impact-resistant, and eco-friendly plastics in automotive and industrial applications further strengthens the U.S. market.

Canada Acrylonitrile Butadiene Styrene Market Insight

The Canada acrylonitrile butadiene styrene market is expanding steadily, driven by the growth of construction, automotive, and consumer goods industries. Increasing urbanization and infrastructure development projects are fueling demand for acrylonitrile butadiene styrene pipes, fittings, and panels. In addition, the country’s focus on sustainable manufacturing practices and high-performance plastics for automotive and electronics sectors is promoting acrylonitrile butadiene styrene adoption. The availability of skilled labor, advanced production technologies, and strong industrial infrastructure supports the development of high-quality acrylonitrile butadiene styrene products, creating opportunities for both domestic manufacturers and imports to meet growing market needs.

Which are the Top Companies in Acrylonitrile Butadiene Styrene Market?

The Acrylonitrile Butadiene Styrene industry is primarily led by well-established companies, including:

- LG Chem (South Korea)

- LOTTE Chemical Corporation (South Korea)

- Trinseo (U.S.)

- Formosa Plastics Corporation (Taiwan)

- SABIC (Saudi Arabia)

- SeaGate Plastics, Inc. (U.S.)

- The Spiratex Company (U.S.)

- Bixby International (U.S.)

- UNITED PLASTIC COMPONENTS INC. (U.S.)

- INEOS (U.K.)

- Plastic Extrusion Technologies (U.S.)

- RTP Company (U.S.)

- Preferred Plastics, Inc. (U.S.)

- Crafted Plastics Inc. (U.S.)

- Select Plastics (U.S.)

- Chi Mei Corporation (Taiwan)

- KUMHO PETROCHEMICAL (South Korea)

- TORAY INDUSTRIES INC. (Japan)

- Mitsui Chemicals, Inc. (Japan)

- Ravago Americas LLC (U.S.)

What are the Recent Developments in Global Acrylonitrile Butadiene Styrene Market?

- In June 2024, Trinseo introduced SAN and ABS resins containing up to 60% recycled content, marketed under the trade names MAGNUM CR, MAGNUM ECO+, and TYRIL CR, marking a significant step toward sustainable materials in the plastics industry and reinforcing the company’s commitment to circular economy solutions

- In June 2023, MBA Polymers UK launched a high-quality recycled ABS product, named ABS 4125 UL, which contains over 95% post-consumer recycled content, providing a sustainable alternative for electronics, automotive, and cosmetics industries while supporting global efforts to reduce carbon footprints and plastic waste

- In June 2021, Nexeo Plastics and Covestro launched the new Polycarbonate/ABS 3D printing filament Addigy FPB 2684 3D, available through Nexeo Plastics’ distribution platform, enhancing their 3D printing product portfolio and offering versatile, high-performance materials for advanced prototyping and manufacturing applications

- In January 2021, INEOS Styrolution built a demonstration plant at its Antwerp, Belgium site to test production of ABS plastic from recycled feedstock, under the project “LIFE ABSolutely Circular,” showcasing the environmental and economic benefits of advanced recycling technologies and promoting the circular economy in plastics manufacturing

- In July 2020, BigRep introduced ABS and ASA, two new BigRep-certified, engineering-grade materials suitable for automotive and consumer applications such as outdoor and sports products, offering versatile and impact-resistant solutions while expanding options for sustainable, high-performance plastics in mobility and consumer markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Acrylonitrile Butadiene Styrene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Acrylonitrile Butadiene Styrene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Acrylonitrile Butadiene Styrene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.