Global Activated Carbon Market

Market Size in USD Billion

CAGR :

%

USD

4.86 Billion

USD

9.68 Billion

2024

2032

USD

4.86 Billion

USD

9.68 Billion

2024

2032

| 2025 –2032 | |

| USD 4.86 Billion | |

| USD 9.68 Billion | |

|

|

|

|

Activated Carbon Market Size

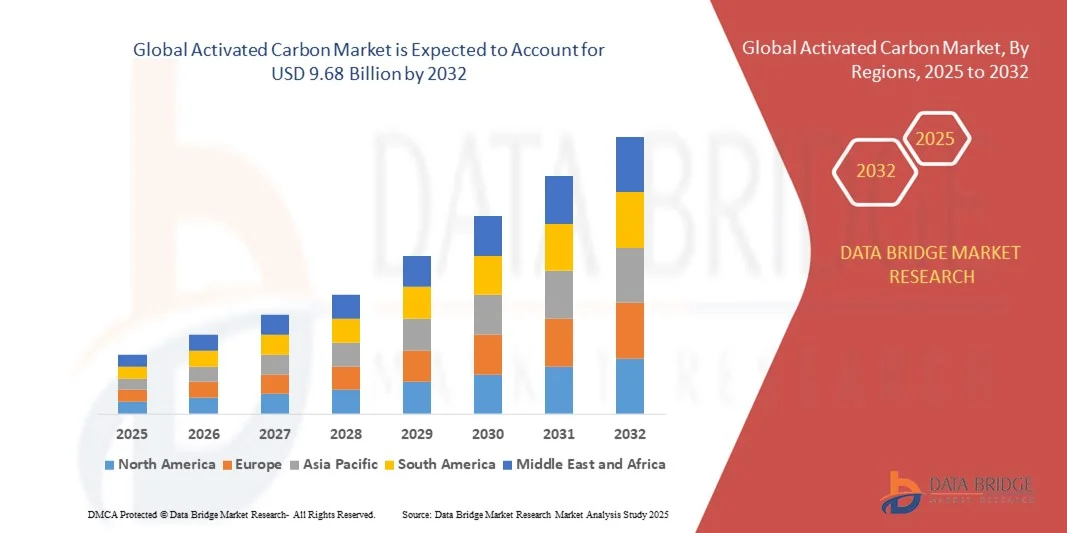

- The global activated carbon market size was valued at USD 4.86 billion in 2024 and is expected to reach USD 9.68 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is largely fuelled by the rising demand for water and air purification solutions across industrial, municipal, and residential sectors

- Increasing environmental regulations and stricter emission standards are pushing industries to adopt activated carbon for pollutant removal and sustainability initiatives

Activated Carbon Market Analysis

- Rising industrialization and stringent environmental regulations are driving the demand for activated carbon in water and air purification processes. Industries such as chemicals, pharmaceuticals, and food & beverages increasingly rely on activated carbon for contaminant removal and quality assurance

- Technological advancements in the production of high-performance activated carbon, including granular, powdered, and extruded forms, are enabling more efficient adsorption and purification processes. This innovation is expanding its applications across multiple sectors, including energy storage and gas purification

- North America dominated the activated carbon market with the largest revenue share of 36.5% in 2024, driven by rising demand for water and air purification across industrial, municipal, and residential sectors, along with stringent environmental regulations

- Asia-Pacific region is expected to witness the highest growth rate in the global activated carbon market, driven by expansion of industrial sectors, rising pollution levels, increasing investment in water and air treatment infrastructure, and growing demand for eco-friendly purification technologies

- The powdered segment held the largest market revenue share in 2024, driven by its high adsorption efficiency, versatility in water and wastewater treatment, and ease of handling for large-scale industrial applications. Powdered activated carbon is widely used in municipal and industrial purification systems due to its fast contaminant removal capabilities and adaptability across various treatment processes

Report Scope and Activated Carbon Market Segmentation

|

Attributes |

Activated Carbon Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Activated Carbon Market Trends

Rising Demand for Water and Air Purification Applications

- The increasing need for clean water and air across industrial, municipal, and residential sectors is driving adoption of activated carbon. Its ability to remove contaminants, impurities, and odors in real time supports environmental compliance and sustainability goals. In addition, governments and environmental agencies are promoting stricter air and water quality standards, further boosting adoption. The integration of activated carbon in both point-of-use and large-scale purification systems enhances overall public health outcomes

- Rapid urbanization and industrialization are fueling demand for portable and large-scale purification systems using activated carbon, particularly in regions with rising pollution levels. These solutions help industries and municipalities maintain regulatory standards. Moreover, the expansion of industrial zones and urban settlements increases wastewater and emissions, creating a continuous need for effective purification solutions. Activated carbon systems are also being incorporated into smart city and industrial IoT frameworks for real-time monitoring

- The growing focus on sustainability and green technologies is promoting activated carbon use in energy, chemical, and food & beverage sectors for eco-friendly purification processes. Manufacturers benefit from improved product quality and reduced environmental footprint. Companies are increasingly replacing chemical-intensive purification methods with activated carbon-based solutions to reduce environmental liabilities and achieve sustainability certifications

- For instance, in 2023, several municipal water treatment facilities in Europe upgraded to granular and powdered activated carbon systems, resulting in enhanced water quality and compliance with stricter environmental regulations. These upgrades also enabled facilities to handle higher volumes of wastewater more efficiently, reducing downtime and operational risks. In addition, the move to automated systems lowered labor costs and minimized human error in purification processes

- While demand is increasing, effective deployment depends on continued innovation, material efficiency, and cost optimization to meet diverse purification needs globally. R&D in high-capacity and long-life activated carbon products is key to reducing operational costs and improving adoption rates. Emerging applications in air purification, industrial effluent treatment, and renewable energy sectors are expected to further drive market expansion

Activated Carbon Market Dynamics

Driver

Increasing Industrialization and Environmental Regulations

- Stricter environmental regulations and emission standards across industries are compelling companies to adopt activated carbon for pollutant removal and compliance purposes. This has accelerated market growth across manufacturing and municipal sectors. Companies are also leveraging activated carbon to achieve ESG goals, attract eco-conscious consumers, and secure government incentives. Enhanced monitoring and reporting capabilities with activated carbon systems further support regulatory adherence

- Growing industrialization in developing regions is creating high demand for effective purification technologies, including activated carbon filters, granules, and powders. Industries such as chemicals, pharmaceuticals, and food & beverages increasingly rely on these solutions. Rising industrial wastewater volumes and air pollution levels drive investments in advanced purification systems, while partnerships with local suppliers help reduce implementation costs. Activated carbon also allows scalable solutions adaptable to small and large industrial setups

- Heightened awareness among consumers and organizations regarding water and air quality is promoting the adoption of activated carbon-based purification solutions. Companies implementing these systems often gain better market acceptance and brand value. Corporate sustainability initiatives, green certifications, and consumer demand for eco-friendly products are contributing to wider deployment. Educational campaigns and environmental advocacy programs are further accelerating awareness and adoption

- For instance, in 2022, several chemical manufacturing plants in North America installed powdered activated carbon systems to reduce effluent contaminants, improving compliance and reducing environmental liabilities. These installations also enhanced process efficiency and reduced downtime, leading to lower operational costs. Integration with monitoring systems provided real-time analytics for better process control and regulatory reporting

- While industrial growth and regulation drive market expansion, cost-effective production and supply chain optimization remain critical for sustained adoption. Innovation in low-cost, high-capacity activated carbon materials and manufacturing techniques is essential to meet growing demand. Strategic partnerships and localized production can help mitigate logistical challenges in remote or high-demand areas

Restraint/Challenge

High Cost Of Premium Activated Carbon And Supply Chain Constraints

- Advanced activated carbon products, including impregnated and high-adsorption variants, are costly, limiting adoption among small and medium-sized enterprises. High upfront costs restrict widespread deployment, particularly in developing markets. Maintenance and replacement expenses further increase the total cost of ownership, discouraging smaller operators from adopting these solutions

- In many regions, lack of technical knowledge to optimize activated carbon usage results in inefficient performance or underutilization, impacting purification effectiveness. Training and technical support are essential for maximizing benefits. Improper installation, incorrect flow rates, or unsuitable carbon types can reduce pollutant removal efficiency, affecting regulatory compliance and product quality

- Supply chain disruptions and limited availability of specialty activated carbon products can hinder consistent use, especially in remote or underdeveloped regions. This can lead to operational delays and reduced purification efficiency. Geopolitical tensions, raw material shortages, and high transportation costs exacerbate the challenge, making reliable sourcing a critical concern for manufacturers

- For instance, in 2023, several water treatment companies in Sub-Saharan Africa faced difficulties sourcing high-quality activated carbon, leading to lower purification performance and regulatory challenges. Delays in shipments disrupted production schedules and increased operational costs. The scarcity of certified suppliers also limited the adoption of advanced purification technologies in emerging regions

- While the market continues to innovate with eco-friendly and high-performance solutions, addressing cost, knowledge, and supply chain constraints is essential to unlock the full potential of the global activated carbon market. Investments in local manufacturing, workforce training, and scalable deployment models are crucial to overcoming these barriers

Activated Carbon Market Scope

The market is segmented on the basis of product, raw material, application, and end use.

- By Product

On the basis of product, the activated carbon market is segmented into powdered, granular, extruded/pelletized, and others. The powdered segment held the largest market revenue share in 2024, driven by its high adsorption efficiency, versatility in water and wastewater treatment, and ease of handling for large-scale industrial applications. Powdered activated carbon is widely used in municipal and industrial purification systems due to its fast contaminant removal capabilities and adaptability across various treatment processes.

The granular segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its durability, reusability, and suitability for continuous filtration systems. Granular activated carbon is particularly preferred for liquid and gas phase purification, offering longer operational life and improved adsorption efficiency. Its applications span water treatment, air purification, and industrial chemical processes, making it a popular choice for commercial and industrial users.

- By Raw Material

On the basis of raw material, the activated carbon market is segmented into coal-based, coconut shell-based, wood-based, and others. The coal-based segment held the largest market revenue share in 2024, driven by its high surface area, consistent quality, and suitability for large-scale industrial and municipal purification applications. Coal-based activated carbon is widely used in water treatment, air purification, and chemical processing due to its reliable performance and availability.

The coconut shell-based segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its renewable nature, high microporosity, and efficiency in adsorption processes. Coconut shell-based activated carbon is preferred for liquid and gas phase purification, offering eco-friendly and high-performance solutions. Its applications include water purification, air treatment, and food & beverage processing, making it increasingly popular in sustainable industries.

- By Application

On the basis of application, the activated carbon market is segmented into liquid phase and gas phase. The liquid phase segment held the largest market revenue share in 2024, driven by its extensive use in water and wastewater treatment, food and beverage processing, and pharmaceutical purification. Liquid phase activated carbon ensures rapid contaminant removal and improved product quality, making it essential for industrial and municipal operations.

The gas phase segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising air pollution regulations, industrial gas purification, and emission control needs. Gas phase activated carbon is preferred for air treatment, odor removal, and industrial gas cleaning applications, offering long-term efficiency and compliance with environmental standards.

- By End Use

On the basis of end use, the activated carbon market is segmented into water and wastewater treatment, food and beverage processing, industrial chemicals, pharmaceutical and medical, automotive, gas and air purification, mining, and others. The water and wastewater treatment segment held the largest market revenue share in 2024, driven by increasing urbanization, industrialization, and stringent environmental regulations. Activated carbon in this segment ensures safe water supply, efficient contaminant removal, and regulatory compliance.

The industrial chemicals and food & beverage processing segment is expected to witness the fastest growth rate from 2025 to 2032, driven by high-purity requirements, increased adoption of eco-friendly purification technologies, and process optimization needs. Activated carbon is preferred for refining chemicals, purifying beverages, and improving product quality, making it critical for industrial and commercial applications.

Activated Carbon Market Regional Analysis

- North America dominated the activated carbon market with the largest revenue share of 36.5% in 2024, driven by rising demand for water and air purification across industrial, municipal, and residential sectors, along with stringent environmental regulations

- Consumers and organizations in the region are increasingly adopting activated carbon solutions to meet sustainability targets, ensure compliance, and improve operational efficiency in treatment and filtration systems

- This widespread adoption is further supported by advanced infrastructure, high industrialization, and increasing awareness of air and water quality standards, establishing activated carbon as a preferred purification solution across multiple sectors

U.S. Activated Carbon Market Insight

The U.S. activated carbon market captured the largest revenue share in 2024 within North America, fueled by growing industrialization, stricter environmental regulations, and rising awareness of pollution control. Companies are increasingly implementing powdered, granular, and extruded activated carbon in water and air purification systems. The demand for sustainable and eco-friendly purification solutions, combined with technological advancements in treatment processes, is significantly propelling market expansion.

Europe Activated Carbon Market Insight

The Europe activated carbon market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by environmental regulations, increasing industrial emissions control, and the need for safe drinking water. Rapid urbanization and adoption of energy-efficient purification technologies are fostering market growth. European industries are investing in high-performance activated carbon solutions for water treatment, gas purification, and industrial chemical processes.

U.K. Activated Carbon Market Insight

The U.K. activated carbon market is expected to witness the fastest growth rate from 2025 to 2032, driven by growing industrial applications and government mandates for pollution control. Rising demand from municipal water treatment facilities and industrial sectors is encouraging adoption of advanced activated carbon solutions. In addition, the UK’s emphasis on sustainable practices and technological integration supports widespread market growth.

Germany Activated Carbon Market Insight

The Germany activated carbon market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing industrialization, stringent environmental standards, and demand for high-efficiency purification solutions. Germany’s strong infrastructure and focus on sustainability promote the adoption of advanced activated carbon systems in industrial, municipal, and environmental applications. The integration of these solutions into water, air, and chemical processing facilities is becoming increasingly prevalent.

Asia-Pacific Activated Carbon Market Insight

The Asia-Pacific activated carbon market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, urbanization, and increasing pollution levels in countries such as China, India, and Japan. Rising demand for clean water, air purification, and industrial effluent treatment is fueling adoption. APAC’s emergence as a manufacturing hub for activated carbon, along with growing investments in environmental and water treatment infrastructure, is expanding accessibility to cost-effective purification solutions.

Japan Activated Carbon Market Insight

The Japan activated carbon market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high industrial and technological standards, emphasis on environmental protection, and stringent water and air quality regulations. Activated carbon adoption is driven by demand in municipal water treatment, chemical processing, and industrial air purification. Advanced solutions integrated with modern filtration and purification systems are fueling growth across residential, commercial, and industrial sectors.

China Activated Carbon Market Insight

The China activated carbon market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, industrial expansion, and heightened environmental awareness. China’s large-scale manufacturing, municipal water treatment projects, and industrial purification needs are driving adoption of powdered, granular, and extruded activated carbon. Government initiatives promoting clean water, pollution control, and sustainable industrial practices further accelerate market growth.

Activated Carbon Market Share

The Activated Carbon industry is primarily led by well-established companies, including:

- Osaka Gas Chemicals Co., Ltd. (Japan)

- Cabot Corporation (U.S.)

- KURARAY CO., LTD. (Japan)

- HAYCARB (PVT) LTD. (Sri Lanka)

- KUREHA CORPORATION (Japan)

- Donau Carbon GmbH (Germany)

- Silcarbon Aktivkohle GmbH (Germany)

- Prominent Systems, Inc. (U.S.)

- OXBOW ACTIVATED CARBON (U.S.)

- PURAGEN ACTIVATED CARBONS (U.S.)

- Advanced Emissions Solutions, Inc. (U.S.)

- Albemarle Corporation (U.S.)

- Carbon Activated Corporation (U.S.)

- Evoqua Water Technologies LLC (U.S.)

- Ingevity (U.S.)

- CarboTech (Germany)

- Boyce Activated Carbon (U.S.)

- JACOBI CARBONS GROUP (Sweden)

- Donau Chemie AG (Austria)

- Calgon Carbon Corporation (U.S.)

Latest Developments in Global Activated Carbon Market

- In March 2023, Evoqua Water Technologies LLC, through a strategic acquisition of the Texas-based industrial water treatment service business from Kemco Systems, strengthened its presence in North America, enhancing service capabilities and expanding its market share in the industrial water treatment sector

- In August 2022, Ingevity completed the acquisition of Nexeon Limited to enter the electric vehicle (EV) market, leveraging its existing activated carbon expertise to diversify offerings, capture emerging EV-related opportunities, and strengthen its global competitive positio

- In March 2021, Evoqua Water Technologies LLC announced the expansion of its Global Engineering and Technology Center in Chennai, India, aimed at boosting R&D capabilities, accelerating innovation in water treatment technologies, and supporting regional market growth

- In June 2022, Albemarle Corporation declared a restructuring of its Bromine and Lithium global business units, intending to improve operational efficiency, better meet customer demands, and build the talent necessary to maintain competitiveness in the global specialty chemicals market

- In October 2021, Evoqua Water Technologies LLC inaugurated a Sustainability and Innovation Hub in Pittsburgh, Pennsylvania, focused on developing advanced water treatment technologies, promoting sustainable solutions, and strengthening its market leadership in environmental services

- In February 2021, Ingevity announced the expansion of its activated carbon manufacturing plant in China, increasing production capacity, meeting rising regional demand, and supporting the growth of industrial and environmental applications across Asia-Pacific

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Activated Carbon Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Activated Carbon Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Activated Carbon Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.