Global Activated Clotting Time Testing Market

Market Size in USD Million

CAGR :

%

USD

489.77 Million

USD

701.85 Million

2024

2032

USD

489.77 Million

USD

701.85 Million

2024

2032

| 2025 –2032 | |

| USD 489.77 Million | |

| USD 701.85 Million | |

|

|

|

|

Activated Clotting Time Testing Market Size

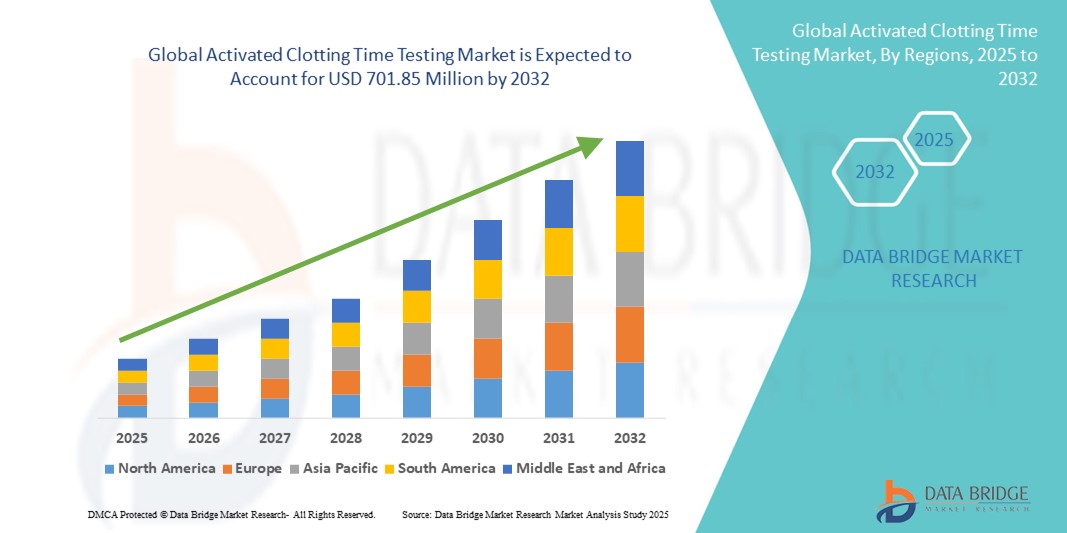

- The global activated clotting time testing market size was valued at USD 489.77 Million in 2024 and is expected to reach USD 701.85 Million by 2032, at a CAGR of 4.60% during the forecast period

- The growth of the activated clotting time (ACT) testing market is primarily driven by increasing adoption of advanced diagnostic technologies and rising awareness about the importance of real-time monitoring of blood coagulation during surgeries and critical care. Technological advancements in point-of-care testing devices have improved the accuracy, ease of use, and turnaround time for ACT tests, making them more accessible in clinical settings

- In addition, the growing prevalence of cardiovascular diseases, increasing number of surgeries requiring anticoagulation monitoring, and expanding use of minimally invasive procedures are fueling demand for reliable and rapid coagulation testing solutions. The rising focus on personalized patient care and the need to reduce complications related to bleeding or thrombosis further support the market’s expansion

Activated Clotting Time Testing Market Analysis

- Activated clotting time testing, which provides rapid assessment of blood coagulation during surgeries and critical care, is becoming an essential tool in modern healthcare settings due to its accuracy, quick results, and ease of use in both hospital and outpatient environments

- The growing adoption of activated clotting time testing is driven by increased awareness of coagulation disorders, rising surgical procedures worldwide, and the demand for real-time monitoring to improve patient safety and outcomes

- North America dominated the activated clotting time testing market with the largest revenue share of 42.5% in 2024, supported by advanced healthcare infrastructure, high healthcare expenditure, and a strong presence of key market players. The U.S. market, in particular, witnessed substantial growth in installations across hospitals and surgical centers, boosted by continuous innovations from established firms and startups developing AI-enabled and voice-activated diagnostic solutions

- Asia-Pacific is projected to be the fastest-growing region in the activated clotting time testing market during the forecast period, with a compound annual growth rate (CAGR) of around 12.8%, owing to rapid urbanization, expanding healthcare facilities, increasing disposable incomes, and greater focus on improving surgical care in emerging economies

- The point of care segment dominated the activated clotting time testing market with a revenue share of 46.5% in 2024, driven by its ability to deliver rapid results directly at the patient’s bedside, which minimizes delays in decision-making and supports timely intervention during surgeries and critical care procedures

Report Scope and Activated Clotting Time Testing Market Segmentation

|

Attributes |

Activated Clotting Time Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Activated Clotting Time Testing Market Trends

Enhanced Convenience Through Technological Advancements in Activated Clotting Time Testing

- A significant and accelerating trend in the global activated clotting time testing market is the continuous advancement of diagnostic technologies, which are improving the accuracy, speed, and ease of coagulation monitoring during surgeries and critical care

- For instance, modern point-of-care ACT testing devices are becoming more compact and user-friendly, enabling healthcare professionals to perform rapid tests bedside and obtain real-time results essential for effective anticoagulation management

- Technological improvements in detection methods — including optical, laser-based, mechanical, and fluorescent technologies — are enhancing test sensitivity and reliability, thereby supporting better clinical decision-making and patient outcomes

- The integration of ACT testing with hospital information systems and electronic medical records is streamlining data management and facilitating personalized patient care through improved monitoring and reporting

- These technological innovations are reshaping clinical expectations, with a growing emphasis on fast, precise, and minimally invasive coagulation testing solutions

- Consequently, demand for advanced activated clotting time testing products is rising rapidly across hospitals, cardiac catheterization labs, and critical care units, driven by the need for effective management of anticoagulation therapy during complex medical procedures

Activated Clotting Time Testing Market Dynamics

Driver

Growing Need Due to Rising Awareness of Coagulation Monitoring

- The increasing prevalence of cardiovascular diseases, a rising number of complex surgical procedures, and growing awareness among healthcare professionals regarding the critical importance of monitoring blood coagulation are significant drivers for the heightened demand for activated clotting time (ACT) testing solutions. Real-time coagulation monitoring during surgeries and critical care is becoming essential to prevent complications such as excessive bleeding or thrombosis

- For instance, the growing use of minimally invasive cardiac procedures, ECMO therapy, and cardiac catheterization has significantly increased the need for rapid and highly reliable ACT testing, enabling clinicians to make timely and informed decisions for anticoagulation management

- Hospitals, critical care units, and hemodialysis centers are increasingly adopting advanced ACT testing systems that offer faster turnaround times, improved precision, and bedside usability. This adoption trend is fueled by the need to optimize patient outcomes, reduce procedural risks, and enhance overall workflow efficiency

- Furthermore, the trend toward personalized medicine and tailored anticoagulation therapy is driving demand for ACT testing solutions, as clinicians increasingly rely on real-time patient-specific data to determine precise heparin and protamine dosing

- The convenience of point-of-care testing, integration with hospital information systems, and seamless reporting capabilities are further propelling the adoption of ACT testing solutions across various healthcare settings, including cardiac catheterization laboratories, intensive care units, and academic research institutes

Restraint/Challenge

High Costs and Technical Limitations

- The relatively high initial cost of advanced activated clotting time (ACT) testing systems, when compared to traditional coagulation testing methods, remains a significant barrier to adoption. This is particularly pronounced in smaller hospitals, outpatient clinics, and healthcare facilities in developing regions, where budget constraints often limit the procurement of sophisticated diagnostic equipment

- Moreover, many ACT testing devices require specialized training and technical expertise to ensure accurate operation and reliable interpretation of results. In healthcare settings where skilled personnel are limited, this requirement can slow down the adoption process and reduce overall testing efficiency

- Operational challenges also arise from the need to maintain precise device calibration and ensure consistent, high-quality test results over time. These issues are especially critical in high-volume hospitals or resource-constrained environments, where even minor deviations in test accuracy can have serious clinical implications

- Addressing these challenges will be essential for sustained market growth. The development of cost-effective, user-friendly ACT testing solutions can help broaden accessibility, while robust clinician training programs can enhance operational proficiency. In addition, incorporating features such as automated calibration and enhanced device reliability will reduce technical barriers, ensuring that healthcare providers can consistently deliver accurate and timely coagulation testing

Activated Clotting Time Testing Market Scope

The market is segmented on the basis of product type, application, technology, end-user, and test.

- By Product Type

On the basis of product type, the activated clotting time testing market is segmented into point of care and clinical laboratory analyzer. The point of care segment held the largest market revenue share of 46.5% in 2024, driven by its ability to deliver rapid results directly at the patient’s bedside, which minimizes delays in decision-making and supports timely intervention during surgeries and critical care procedures. This segment is particularly valued in high-pressure clinical environments where immediate coagulation assessment can significantly impact patient outcomes, enabling healthcare professionals to monitor and adjust anticoagulation therapy in real time.

The clinical laboratory analyzer segment is expected to witness the fastest CAGR of around 12.5% from 2025 to 2032, propelled by the increasing adoption of automated laboratory systems in hospitals and diagnostic centers. These analyzers facilitate high-throughput testing, reduce manual errors, and streamline workflow efficiency, making them an attractive choice for institutions managing large patient volumes.

- By Application

On the basis of application, the market is segmented into cardiovascular and vascular surgery, ECMO, cardiac catheterization laboratories, critical care units, and hemodialysis units. The cardiovascular and vascular surgery segment accounted for the largest market revenue share of 38.7% in 2024, owing to the essential role of real-time coagulation monitoring during complex surgical procedures, which helps minimize bleeding risks and optimize patient safety.

Critical Care Units are projected to witness the fastest CAGR of 13.2% from 2025 to 2032, fueled by the rising use of life-support procedures, increasing critically ill patient populations, and the growing need for precise anticoagulation management to prevent complications in intensive care settings.

- By Technology

On the basis of technology, the market is segmented into optical detection, laser-based detection, mechanical detection, and fluorescent-based detection. The optical detection segment held the largest market revenue share of 41.8% in 2024, attributed to its long-standing reliability, straightforward operation, and rapid turnaround time, which make it particularly suitable for time-sensitive environments such as surgical theaters and critical care units. Its widespread adoption is also supported by consistent accuracy and minimal maintenance requirements, allowing healthcare professionals to make quick, informed decisions during procedures.

The laser-based detection segment is expected to witness the fastest CAGR of 14.0% from 2025 to 2032, driven by its exceptional sensitivity, high precision, and ability to deliver highly accurate coagulation measurements, making it ideal for advanced clinical applications and specialized testing scenarios where precision is critical.

- By End-User

On the basis of end-user, the market is segmented into hospitals, clinical laboratories, ambulatory surgical centers, and academic & research institutes. The hospitals segment dominated the market with a revenue share of 44.3% in 2024, fueled by the high volume of surgical procedures, the need for continuous critical care monitoring, and the growing integration of point-of-care testing into routine hospital workflows. This integration allows for faster diagnosis and improved patient management.

Ambulatory surgical centers is expected to register the fastest CAGR of 12.8% from 2025 to 2032, supported by the rising demand for rapid testing solutions in research and outpatient surgical procedures, as well as the adoption of modern diagnostic technologies for education and clinical studies.

- By Test

On the basis of test, the market is segmented into prothrombin time, fibrinogen, activated partial thromboplastin time, activated clotting time, D-Dimer, platelet function, heparin and protamine dose response test for ACT, and others. The activated clotting time test segment held the largest market revenue share of 39.5% in 2024, owing to its critical role in monitoring anticoagulation therapy during high-risk surgeries and critical care procedures. Its widespread use ensures patient safety by enabling real-time adjustment of anticoagulant doses.

Platelet Function tests are expected to witness the fastest CAGR of 13.5% from 2025 to 2032, driven by their growing application in cardiovascular diagnostics, perioperative monitoring, and personalized patient care, helping clinicians make precise treatment decisions and reduce potential complications.

Activated Clotting Time Testing Market Regional Analysis

- North America dominated the activated clotting time testing market with the largest revenue share of 42.5% in 2024

- This leadership is attributed to the region’s advanced healthcare infrastructure, growing prevalence of cardiovascular and vascular diseases, rising number of surgical procedures requiring anticoagulation monitoring, and increasing adoption of point-of-care testing devices

- The growing trend of integration with hospital information systems (HIS) and electronic medical records (EMR) is further driving market growth in North America. By enabling seamless data management, automated reporting, and real-time result tracking, healthcare providers can streamline workflows, reduce errors, and enhance decision-making during surgeries and critical care procedures

U.S. Activated Clotting Time Testing Market Insight

The U.S. activated clotting time testing market captured the largest revenue share of 76% in 2024 within North America, making it the dominant contributor to the regional market. This leadership is primarily driven by the rapid adoption of both point-of-care devices and clinical laboratory analyzers, which allow healthcare providers to perform timely and accurate coagulation monitoring. Technological advancements in detection methods—including optical, laser-based, mechanical, and fluorescent technologies—have improved test sensitivity, reliability, and speed, enabling clinicians to obtain faster turnaround times and make critical treatment decisions more efficiently.

Europe Activated Clotting Time Testing Market Insight

The Europe activated clotting time testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing awareness of the importance of perioperative anticoagulation monitoring, rising number of cardiovascular and vascular procedures, and adoption of advanced hospital technologies. Hospitals and clinical laboratories across Europe are increasingly implementing ACT testing solutions to improve patient outcomes, reduce procedural complications, and enhance clinical efficiency. Significant growth is observed across cardiovascular surgery units, ECMO therapy, critical care units, and hemodialysis centers.

U.K. Activated Clotting Time Testing Market Insight

The U.K. activated clotting time testing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising prevalence of cardiac surgeries, increasing geriatric population, and growing focus on bedside diagnostic solutions. Adoption of point-of-care ACT testing devices in hospitals, ambulatory surgical centers, and critical care units is accelerating as clinicians seek rapid, accurate, and reliable coagulation monitoring to enhance patient safety and improve clinical workflow.

Germany Activated Clotting Time Testing Market Insight

The Germany activated clotting time testing market is expected to expand at a considerable CAGR during the forecast period, driven by advanced healthcare infrastructure, rising investments in hospital technologies, and growing awareness of the importance of coagulation monitoring in surgeries and critical care. The preference for precise, automated, and reliable the activated clotting time testing solutions that seamlessly integrate into hospital workflows is contributing to adoption across both residential and commercial healthcare facilities, particularly in cardiac catheterization labs, critical care units, and surgical centers.

Asia-Pacific Activated Clotting Time Testing Market Insight

The Asia-Pacific activated clotting time testing market is poised to grow at the fastest CAGR of 12.8% during the forecast period of 2025 to 2032. This growth is driven by increasing cardiovascular disease prevalence, rapid urbanization, rising healthcare expenditure, and expanding access to advanced diagnostic technologies. Countries such as China, Japan, and India are witnessing growing adoption of point-of-care ACT testing devices in hospitals, critical care units, cardiac catheterization laboratories, and dialysis centers, driven by the need for real-time coagulation monitoring and improved patient outcomes.

Japan Activated Clotting Time Testing Market Insight

The Japan activated clotting time testing market is gaining momentum due to the country’s advanced healthcare infrastructure, high demand for minimally invasive surgeries, and an aging population requiring increased clinical care. Growing emphasis on patient safety, real-time anticoagulation monitoring, and integration of ACT testing into surgical and critical care workflows are driving market growth. Hospitals and clinical laboratories are increasingly adopting technologically advanced testing devices to ensure precise and timely coagulation management.

China Activated Clotting Time Testing Market Insight

The China activated clotting time testing market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rising healthcare expenditure, expanding hospital networks, rapid urbanization, and increased adoption of advanced diagnostic technologies. The growing number of cardiovascular surgeries, hemodialysis procedures, and critical care treatments is fueling the demand for accurate, rapid, and reliable ACT testing solutions. In addition, government initiatives to improve healthcare access and technology adoption are further accelerating market expansion

Activated Clotting Time Testing Market Share

The activated clotting time testing industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Thermo Fisher Scientific (U.S.)

- Abbott (U.S.)

- Helena Laboratories Corporation (U.S.)

- Sysmex Corporation (Japan)

- NIHON KOHDEN CORPORATION (Japan)

- Instrumentation Laboratory India Pvt Ltd (India)

- Medtronic (Ireland)

- Diagnostica Stago S.A.S (France)

- WerfenLife, S.A. (Spain)

- Laboratory Corporation of America Holdings (U.S.)

- Danaher Corporation (U.S.)

- Horiba Ltd. (Japan)

- Hycel Medical (France)

- Meril Life Sciences Pvt. Ltd. (India)

- ACON (U.S.)

- BIO GROUP MEDICAL SYSTEM (Canada)

- Beijing Succeeder Technology Inc. (China)

- Maccura Biotechnology Co. (China)

Latest Developments in Global Activated Clotting Time Testing Market

- In October 2021, a Class-2 FDA recall/alert was posted for certain HemosIL liquid heparin/Anti-Xa reagents, a regulatory event that affected reagents used to monitor heparin and indirectly influenced laboratory testing choices for anticoagulation monitoring. The recall record (initiated by firm Aug 25, 2021; create date Oct 19, 2021) is available in the FDA recall database and underscores how reagent recalls can shift hospital procurement and point-of-care testing practices relevant to ACT and heparin monitoring

- In December 2021, the GEM Hemochron 100 System received FDA 510(k) clearance for point-of-care whole-blood hemostasis testing (including ACT+ and ACT-LR tests). Werfen/Accriva’s clearance and early-2022 commercialization broadened the available rapid ACT platforms in the U.S. and Europe, offering modernized optics and sample processing for quicker, actionable ACT results in cardiovascular operating rooms and cath labs

- In July 2022, Werfen publicly showcased the GEM Hemochron 100 and other acute-care diagnostic introductions at the AACC conference, promoting the device’s point-of-care ACT capabilities and expanded test menu (ACT+, ACT-LR, PT, APTT). The conference demonstrations and subsequent commercial rollouts helped drive adoption of next-generation ACT platforms in acute cardiac care workflows

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.