Global Active Optical Cable And Extender Market

Market Size in USD Billion

CAGR :

%

USD

3.64 Billion

USD

5.97 Billion

2024

2032

USD

3.64 Billion

USD

5.97 Billion

2024

2032

| 2025 –2032 | |

| USD 3.64 Billion | |

| USD 5.97 Billion | |

|

|

|

|

Active Optical Cable and Extender Market Size

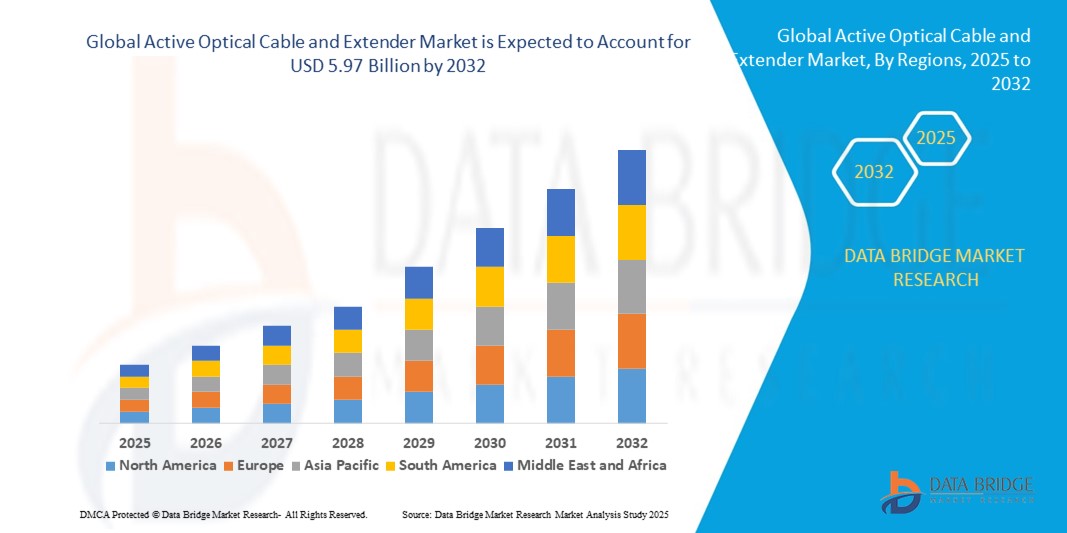

- The global active optical cable and extender market size was valued at USD 3.64 billion in 2024 and is expected to reach USD 5.97 billion by 2032, at a CAGR of 6.37% during the forecast period

- The market growth is largely fueled by the increasing demand for high-speed data transmission, low-latency connectivity, and energy-efficient interconnect solutions in hyperscale data centers, cloud computing, and enterprise networks

- Furthermore, the rising adoption of next-generation optical networking technologies, coupled with the need for scalable, reliable, and compact interconnect solutions, is driving the deployment of active optical cables and extenders across telecom, enterprise, and industrial applications, significantly boosting market growth

Active Optical Cable and Extender Market Analysis

- Active optical cables (AOCs) and extenders are high-speed data transmission solutions that convert electrical signals into optical signals to enable long-distance, high-bandwidth connectivity between servers, switches, and storage devices. They offer low latency, high reliability, and energy-efficient performance compared to traditional copper cabling, making them essential for modern data center and telecom infrastructure

- The escalating demand for AOCs and extenders is primarily driven by the exponential growth of data traffic, cloud adoption, and high-performance computing workloads, along with the need for compact, scalable, and energy-efficient solutions that support faster and more stable network communication across enterprise, hyperscale, and telecom environments

- North America dominated the active optical cable and extender market with a share of 37.9% in 2024, due to the rapid expansion of data centers, cloud computing, and high-performance computing infrastructure.

- Asia-Pacific is expected to be the fastest growing region in the active optical cable and extender market during the forecast period due to increasing investments in data centers, cloud computing infrastructure, and high-performance computing across countries such as China, Japan, and India

- Active optical cables segment dominated the market with a market share of 63% in 2024, due to their ability to deliver high-speed data transmission over longer distances than traditional copper cables while reducing signal degradation and electromagnetic interference. Data centers, telecommunications, and high-performance computing environments favor active optical cables for their reliability, low latency, and scalability, making them essential for modern network infrastructure. Their compact design, ease of deployment, and support for high-bandwidth protocols further enhance their adoption across enterprise and hyperscale environments

Report Scope and Active Optical Cable and Extender Market Segmentation

|

Attributes |

Active Optical Cable and Extender Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Active Optical Cable and Extender Market Trends

Rising Adoption of High-Speed Optical Interconnects

- The Active Optical Cable and Extender market is witnessing rapid growth as hyperscale data centers, cloud providers, and enterprises adopt high-speed optical interconnects to achieve scalable, energy-efficient, and reliable network performance under growing workloads

- For instance, Cisco has launched next-generation AOCs and optical extenders for high-performance computing applications. These products address the need for low-latency and high-throughput connectivity across data centers, networking equipment, and smart infrastructure environments globally

- Increasing reliance on cloud-based applications and streaming content is intensifying the demand for high-bandwidth connectivity solutions. AOCs and extenders are well suited to support faster data transfer rates while reducing transmission bottlenecks effectively

- In addition, adoption of 5G technology and edge computing requires high-speed optical interconnects capable of managing massive traffic loads. This need is reinforcing market growth as AOCs enhance performance in distributed computing environments globally

- Growth in artificial intelligence and machine learning applications is further driving interconnect adoption. These workloads demand high-throughput inputs and outputs, making AOCs essential in high-performance computing infrastructure and large-scale training data cluster deployments

- The move toward energy-efficient solutions is reshaping market innovation. Modern AOCs consume less power compared to copper interconnects, offering long-term operational savings while reducing heat generation, thus supporting sustainable advancements in high-density data infrastructure

Active Optical Cable and Extender Market Dynamics

Driver

Demand for Low-Latency, High-Bandwidth Solutions

- The growing demand for real-time processing in data-intensive environments is fueling adoption of AOCs and extenders. Their speed and low-latency performance enhance critical use cases such as cloud storage, data centers, healthcare imaging, and financial services

- For instance, Intel has been actively developing high-performance optical interconnects designed for demanding enterprise workloads. By addressing higher bandwidth needs and minimizing latency gaps, Intel supports next-generation computing operations across data hubs and smart networks

- The rising importance of remote collaboration and video communications has intensified requirements for uninterrupted data transfer. AOCs deliver a seamless user experience, enabling stable support for hybrid work models and streaming-intensive applications worldwide

- In addition, growth of e-commerce and transactional platforms requires rapid data processing to ensure operational efficiency. Optical interconnects provide the backbone for secure, fast, and scalable data exchanges across global online retail ecosystems seamlessly

- The gaming and streaming industries are contributing to widespread adoption of high-bandwidth, low-latency interconnects. AOCs play a vital role in ensuring smooth delivery of high-definition content, supporting immersive consumer experiences across multiple real-time applications globally

Restraint/Challenge

High Deployment Costs

- High installation and operational costs of AOCs and extenders remain a critical challenge for mass deployment. The specialized hardware, optical transceivers, and complex integration processes significantly increase upfront investment levels for enterprises and data operators

- For instance, Microsoft Azure’s data center expansion highlighted difficulties in balancing high-performance AOC deployments with overall budget targets. The elevated cost of cabling limited broader application despite long-term efficiency and performance benefits

- The higher costs compared to traditional copper cables prevent smaller enterprises from adopting advanced interconnects. This creates a digital divide, with budget-sensitive organizations struggling to justify their investment in high-capacity optical cabling solutions

- In addition, the need for skilled technicians and precise installation processes raises labor expenses. Incorrect installation risks operational inefficiencies, creating long-term maintenance burdens that smaller regional operators often struggle to afford effectively

- Although technological advances are gradually lowering costs, affordability challenges remain for developing markets. Without financial incentives or large-scale production efficiencies, adoption rates will stay highly skewed in favor of wealthier and more advanced IT economies

Active Optical Cable and Extender Market Scope

The market is segmented on the basis of product, protocol, form factor, and application.

- By Product

On the basis of product, the active optical cable and extender market is segmented into active optical cables and extenders. The active optical cables segment dominated the largest market revenue share of 63% in 2024, driven by their ability to deliver high-speed data transmission over longer distances than traditional copper cables while reducing signal degradation and electromagnetic interference. Data centers, telecommunications, and high-performance computing environments favor active optical cables for their reliability, low latency, and scalability, making them essential for modern network infrastructure. Their compact design, ease of deployment, and support for high-bandwidth protocols further enhance their adoption across enterprise and hyperscale environments.

The extender segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing demand for extending high-speed data transmission over longer distances without signal loss. Extenders are increasingly integrated into large-scale data centers, telecom networks, and high-performance computing setups, enabling seamless connectivity between distant network nodes. Their versatility in supporting multiple protocols and form factors, combined with compatibility with existing infrastructure, makes extenders a preferred solution for enterprises seeking flexible, cost-effective network expansion.

- By Protocol

On the basis of protocol, the active optical cable and extender market is segmented into InfiniBand, Ethernet, Serial Attached SCSI (SAS), DisplayPort, PCI Express (PCIe), HDMI, Thunderbolt, USB, MIPI, Fiber Channel, and other protocols. The Ethernet segment held the largest market revenue share in 2024, driven by its ubiquitous adoption across data centers, enterprise networks, and telecommunication setups. Ethernet-based AOCs and extenders offer high-speed, low-latency connectivity with standardized interfaces, enabling straightforward integration with network switches, routers, and servers. The widespread familiarity with Ethernet infrastructure, coupled with continuous upgrades to higher bandwidth versions such as 400G and 800G, reinforces its dominance in the market.

The InfiniBand segment is expected to witness the fastest CAGR from 2025 to 2032, owing to its ultra-low latency and high bandwidth capabilities, which are critical for high-performance computing and AI workloads. InfiniBand-enabled cables and extenders are increasingly deployed in supercomputing clusters and data-intensive applications, where rapid, reliable data transfer is essential. The protocol’s ability to scale efficiently with multi-node configurations and support advanced RDMA features positions it as a rapidly growing choice among enterprises seeking next-generation performance.

- By Form Factor

On the basis of form factor, the active optical cable and extender market is segmented into QSFP, QSFP-DD, OSPF/CFP8/COBO, SFP, SFP+, PCIE, CXP, CX4, CFP, CDFP, and other form factors. The QSFP form factor dominated the largest market revenue share in 2024, driven by its high-density design and capability to support high-speed data transmission up to 400G, making it ideal for hyperscale data centers and enterprise networks. QSFP modules enable flexible deployment across switches and servers while minimizing space and power requirements, which is critical in modern network infrastructure. The form factor’s compatibility with multiple protocols, including Ethernet and InfiniBand, further reinforces its market leadership.

The SFP+ segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by its cost-effectiveness, smaller size, and ability to support 10G to 25G speeds in enterprise and telecommunications networks. SFP+ form factors provide plug-and-play simplicity, ease of maintenance, and wide interoperability, making them an attractive choice for upgrading legacy systems without significant infrastructure changes. Their growing use in edge computing, campus networks, and telecom expansions is driving rapid adoption globally.

- By Application

On the basis of application, the active optical cable and extender market is segmented into data centers, telecommunications, high-performance computing, and other applications. The data center segment dominated the largest market revenue share in 2024, driven by the exponential growth of cloud computing, hyperscale facilities, and enterprise IT infrastructure. Data centers require high-speed, low-latency connections to manage massive data volumes, and active optical cables provide the necessary bandwidth, signal integrity, and scalability to meet these demands. The ongoing shift toward 400G and 800G networks, combined with the need for energy-efficient and compact interconnect solutions, further propels the use of AOCs in data centers.

The high-performance computing (HPC) segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing demand for supercomputing, AI workloads, and machine learning applications. HPC environments rely on ultra-low latency, high-bandwidth connectivity, and precise signal integrity, which active optical cables and extenders provide. The continuous expansion of AI research, scientific simulations, and complex financial modeling is driving rapid adoption of HPC-oriented interconnect solutions, making it one of the fastest-growing application segments globally.

Active Optical Cable and Extender Market Regional Analysis

- North America dominated the active optical cable and extender market with the largest revenue share of 37.9% in 2024, driven by the rapid expansion of data centers, cloud computing, and high-performance computing infrastructure

- Enterprises and telecom operators are increasingly adopting AOCs and extenders for high-speed, low-latency connectivity and efficient network management

- High disposable incomes, strong enterprise investments, and a technology-forward population further support widespread adoption, making North America a key market globally

U.S. Active Optical Cable and Extender Market Insight

The U.S. captured the largest revenue share in North America in 2024, fueled by the rapid deployment of hyperscale and enterprise data centers, growing cloud adoption, and increasing demand for low-latency, high-bandwidth interconnects. Companies are prioritizing the integration of AOCs and extenders to improve network efficiency and scalability. The expansion of AI, machine learning, and high-performance computing workloads further propels the market. In addition, the U.S. benefits from well-established telecom infrastructure and robust IT spending, encouraging adoption across both private and public sector applications.

Europe Active Optical Cable and Extender Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, driven by the increasing deployment of data centers, growing adoption of cloud services, and rising demand for high-speed interconnects in enterprise networks. Countries such as Germany, France, and the U.K. are focusing on upgrading network infrastructure to support digital transformation, AI workloads, and telecommunication advancements. The market growth is further supported by stringent IT standards, regulatory frameworks for data management, and a technology-oriented population that values efficient, high-performance connectivity solutions.

U.K. Active Optical Cable and Extender Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by expansion in cloud services, high-speed data center deployments, and increasing demand from telecom and enterprise sectors. Investments in smart city initiatives, digital infrastructure upgrades, and low-latency interconnect solutions are key growth drivers. The U.K.’s focus on next-generation computing, enterprise IT modernization, and robust network infrastructure encourages adoption of active optical cables and extenders across multiple industries.

Germany Active Optical Cable and Extender Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by rising adoption of high-performance computing, enterprise data center upgrades, and telecommunications modernization. The country’s emphasis on innovation, sustainability, and secure network solutions drives demand for AOCs and extenders. Integration with AI-driven workloads, HPC clusters, and cloud platforms is further supporting the market, making Germany a leading adopter of high-speed optical interconnect solutions in Europe.

Asia-Pacific Active Optical Cable and Extender Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing investments in data centers, cloud computing infrastructure, and high-performance computing across countries such as China, Japan, and India. The region’s rapid digitalization, urbanization, and expansion of telecommunication networks are fueling adoption. APAC also benefits from being a manufacturing hub for AOC components, making solutions more accessible and cost-effective. Growing demand from enterprises, telecom operators, and government initiatives supporting smart cities and digital networks further accelerate market growth.

Japan Active Optical Cable and Extender Market Insight

The Japan market is gaining momentum due to advanced IT infrastructure, high-speed connectivity demands, and widespread adoption of high-performance computing. Enterprises and government sectors are increasingly deploying AOCs and extenders to improve network efficiency and reliability. Integration with AI, IoT, and cloud applications supports the adoption of high-bandwidth interconnect solutions. Moreover, Japan’s technology-driven culture and emphasis on innovation are significant growth factors for the market.

China Active Optical Cable and Extender Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expansion of cloud computing and data center facilities, and strong adoption of high-performance computing solutions. The country’s large enterprise and telecom sectors require scalable, high-speed interconnects, making AOCs and extenders essential. Government initiatives supporting digital infrastructure, smart city projects, and the presence of domestic manufacturers providing cost-effective solutions are further propelling market growth in China.

Active Optical Cable and Extender Market Share

The active optical cable and extender industry is primarily led by well-established companies, including:

- Coherent Corp. (U.S.)

- Broadcom (U.S.)

- Amphenol Communications Solutions (U.S.)

- Corning Incorporated (U.S.)

- TE Connectivity (Switzerland)

- 3M (U.S.)

- Molex (U.S.)

- Sumitomo Electric Industries Ltd. (Japan)

- Dell Inc. (U.S.)

- Eaton (Ireland)

- EverPro Technology Co., Ltd. (China)

- Alysium-Tech GmbH (U.S.)

- Mobix Labs Inc. (U.S.)

- Unixtar Technology, Inc. (Taiwan)

- IOI Technology Corporation (Taiwan)

- GIGALIGHT (China)

- Siemen (U.S.)

- Koincable (China)

- Black Box (U.S.)

- ATEN INTERNATIONAL Co., Ltd. (Taiwan)

- T&S Communication Co., Ltd. (China)

- ACT (Netherlands)

- APAC Opto Electronics Inc. (Taiwan)

- Shenzhen Sopto Technology Co., Ltd., (China)

- Anfkom Telecom (China)

- Extron (U.S.)

- Roctest (Canada)

Latest Developments in Global Active Optical Cable and Extender Market

- In September 2023, Finisar launched a new series of 800G QSFP-DD AOCs with enhanced thermal management and reduced insertion loss, addressing the growing demand for high-throughput, compact, and energy-efficient interconnect solutions in hyperscale and cloud data centers. The improved thermal performance ensures reliable operation under sustained high-speed workloads, while reduced insertion loss enhances signal integrity over longer distances. This innovation enables faster, more stable data transmission and helps enterprises and cloud providers optimize network efficiency and operational costs, driving global adoption of next-generation 800G AOCs

- In March 2023, Broadcom unveiled the BCM85812 transceiver, optimized for 800G DR8, 2x400G FR4, and 800G AOC module applications, boosting performance and efficiency in hyperscale data centers. By supporting ultra-high bandwidth and low-latency transmission, the transceiver improves energy efficiency while handling growing enterprise and cloud workloads. This development facilitates more effective server-to-server and data center interconnects, accelerating the uptake of 800G AOCs and strengthening the market for advanced optical interconnect solutions

- In February 2023, Coherent Corp. introduced its 100G PAM4 VCSEL and photodiode arrays for 800G short-reach Datacom pluggable transceivers and AOCs, enhancing signal integrity and power efficiency in high-speed interconnects. These components allow data centers and telecom networks to manage increasing data volumes with minimal signal degradation, supporting scalable and reliable AOC deployments. By addressing the need for high-performance, energy-efficient optical solutions, this launch fuels adoption of next-generation AOCs in hyperscale and enterprise networks

- In February 2022, II-VI Incorporated launched the Pluggable Optical Line Subsystem in QSFP form factor for 400ZR/ZR+ transport, enabling full-duplex multichannel transmission while reducing power consumption and space requirements. Its compatibility with existing infrastructure allows data centers to upgrade interconnects efficiently, meeting rising bandwidth demands from cloud computing and high-performance computing workloads. This compact, efficient solution accelerated the deployment of high-speed AOCs, reinforcing market adoption in enterprise and hyperscale environments

- In June 2021, Broadcom introduced 100Gbps multimode AOCs and pluggable optical transceivers supporting up to 100G per lane, allowing enterprises to upgrade server interconnects with low-latency, high-bandwidth solutions. By improving network efficiency and reliability, this development laid the groundwork for broader adoption of AOCs across telecom and data center segments. It strengthened the early market for pluggable optical solutions, setting the stage for subsequent generations of high-speed optical interconnects

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Active Optical Cable And Extender Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Active Optical Cable And Extender Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Active Optical Cable And Extender Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.