Global Ad Server Advertising Software Market

Market Size in USD Billion

CAGR :

%

USD

1.25 Billion

USD

3.13 Billion

2025

2033

USD

1.25 Billion

USD

3.13 Billion

2025

2033

| 2026 –2033 | |

| USD 1.25 Billion | |

| USD 3.13 Billion | |

|

|

|

|

Ad Server Advertising Software Market Size

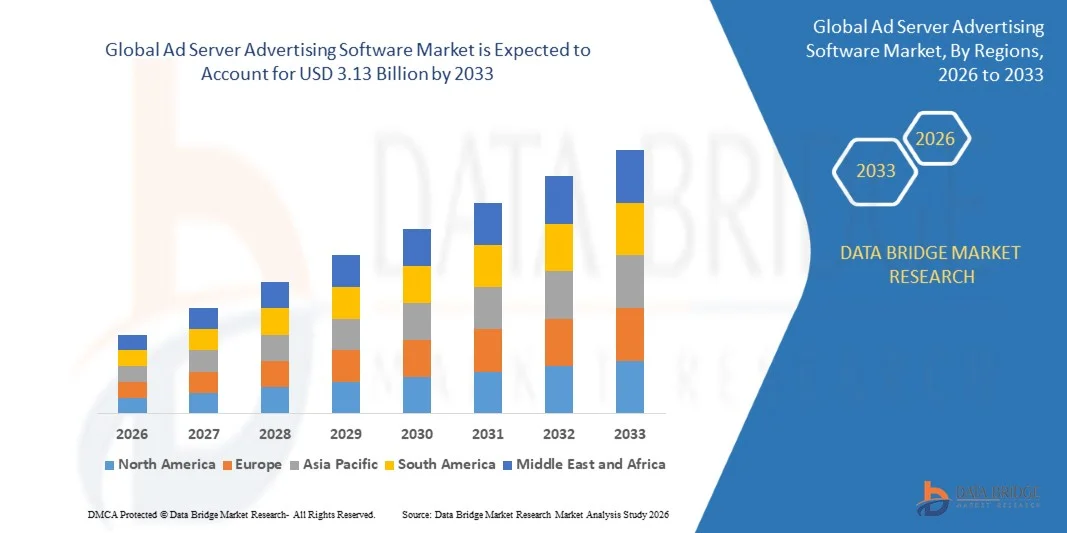

- The global ad server advertising software market size was valued at USD 1.25 billion in 2025 and is expected to reach USD 3.13 billion by 2033, at a CAGR of 12.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of programmatic advertising and demand for real-time ad delivery and targeting across multiple digital channels

- Rising focus on personalized marketing and advanced analytics to enhance campaign performance is driving investments in ad server solutions

Ad Server Advertising Software Market Analysis

- The market is witnessing robust growth due to the increasing need for effective ad campaign management, measurement, and optimization

- Enhanced capabilities such as audience segmentation, cross-channel tracking, and AI-driven recommendations are contributing to widespread adoption among advertisers and publishers

- North America dominated the ad server advertising software market with the largest revenue share of 38.45% in 2025, driven by the increasing adoption of digital marketing strategies and programmatic advertising platforms across businesses of all sizes

- Asia-Pacific region is expected to witness the highest growth rate in the global ad server advertising software market, driven by increasing digital marketing spend, rapid smartphone adoption, expanding online retail sector, and growing awareness of advanced advertising technologies across developing economies

- The On-Cloud segment held the largest market revenue share in 2025, driven by the flexibility, scalability, and cost-effectiveness offered by cloud-based solutions. Cloud deployment allows marketers to manage campaigns remotely, access real-time analytics, and integrate seamlessly with other digital marketing tools, making it a preferred choice for businesses of all sizes.

Report Scope and Ad Server Advertising Software Market Segmentation

|

Attributes |

Ad Server Advertising Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Ad Server Advertising Software Market Trends

“Rise of Programmatic And AI-Driven Advertising”

• The growing shift toward programmatic advertising and AI-driven ad solutions is transforming the digital marketing landscape by enabling real-time campaign optimization and precise audience targeting. These platforms allow marketers to deliver personalized ads efficiently, improving ROI and engagement rates. In addition, AI algorithms can analyze consumer behavior patterns, enabling predictive targeting and automated bidding for maximum campaign effectiveness

• The increasing demand for automated ad delivery and real-time analytics is accelerating the adoption of ad server software across small, medium, and large enterprises. These tools are particularly effective for managing cross-channel campaigns and optimizing ad spend in highly competitive markets. They also provide advanced reporting dashboards and performance insights, allowing marketers to make data-driven adjustments rapidly

• The scalability and ease of use of modern ad server platforms are making them attractive for routine campaign management, leading to better campaign insights and performance tracking. Advertisers benefit from enhanced targeting and reporting capabilities without incurring excessive operational costs. Cloud-based platforms further enable remote access and seamless integration with other digital marketing tools, reducing dependency on IT support

• For instance, in 2023, several e-commerce and retail companies in North America implemented AI-powered ad servers, resulting in improved click-through rates, conversion metrics, and audience engagement, while optimizing advertising budgets. Companies also reported reduced manual intervention in campaign management and faster campaign launch times

• While programmatic and AI-driven ad servers are accelerating campaign efficiency and ROI, their impact depends on continued innovation, data integration, and user training. Providers must focus on customizable solutions and seamless integration with marketing stacks to fully capitalize on growing demand. In addition, platforms that can adapt to evolving consumer privacy regulations and cross-device tracking limitations will gain a competitive edge

Ad Server Advertising Software Market Dynamics

Driver

“Rising Digital Marketing Spend And Focus On Personalization”

• The surge in digital marketing budgets is pushing businesses to adopt ad server software as a central tool for managing campaigns across multiple channels. Companies are prioritizing precision targeting and automation to optimize ad performance and reduce manual efforts. Moreover, the ability to segment audiences at a granular level enhances campaign relevance and brand engagement

• Marketers are increasingly aware of the competitive advantage offered by real-time analytics, audience segmentation, and AI-based optimization. This awareness is driving widespread adoption of ad server platforms among SMEs and large enterprises across various industries. In addition, predictive analytics enables better resource allocation and more efficient ad spend distribution across campaigns

• The proliferation of online and mobile advertising channels has further reinforced the demand for efficient ad delivery solutions. Businesses are leveraging ad servers to track performance metrics, ensure brand consistency, and comply with data privacy regulations. Integration with social media platforms and programmatic exchanges also allows broader reach and more targeted ad placements

• For instance, in 2022, leading global media agencies implemented ad server solutions to manage large-scale campaigns, improving audience reach, engagement, and overall ad efficiency. They also reported enhanced real-time optimization and cross-platform reporting capabilities, enabling faster strategic decisions

• While digital marketing investment and personalization trends are driving the market, companies must address challenges related to data integration, platform interoperability, and campaign complexity to sustain adoption. Providers focusing on ease of use, scalable solutions, and multi-channel functionality are likely to attract more clients

Restraint/Challenge

“High Implementation Costs And Technical Complexity”

• The high cost of enterprise-grade ad server platforms, especially those integrated with AI and advanced analytics, limits adoption among smaller advertisers. Cost remains a significant barrier to full-scale deployment, particularly in developing regions. In addition, subscription and licensing fees, along with ongoing maintenance costs, can strain marketing budgets

• Integration of ad server software with existing CRM, analytics, and marketing automation systems can be complex and time-consuming. Skilled personnel are often required for implementation and ongoing management, which can reduce immediate ROI. Companies without dedicated IT teams may face delays and operational inefficiencies during deployment

• Data privacy, compliance with advertising regulations, and cybersecurity concerns further restrict adoption, particularly in regions with strict digital marketing laws. Failure to comply can result in penalties and reputational risks. Moreover, frequent updates and evolving legislation require continuous monitoring, adding to operational challenges

• For instance, in 2023, several small and medium-sized businesses in Asia-Pacific were unable to fully adopt advanced ad server platforms due to integration challenges, limited IT expertise, and budget constraints. These businesses often relied on simpler ad management tools, limiting campaign performance and analytics capabilities

• While technology continues to advance, addressing cost, integration, and compliance challenges is essential. Market stakeholders must focus on modular, scalable, and secure ad server solutions to drive long-term growth in the digital advertising ecosystem. In addition, providing comprehensive training, customer support, and seamless onboarding can increase adoption among SMEs and emerging markets

Ad Server Advertising Software Market Scope

The market is segmented on the basis of deployment, software type, advertising type, advertising platform, and vertical

• By Deployment

On the basis of deployment, the ad server advertising software market is segmented into On-Cloud and On-Premises. The On-Cloud segment held the largest market revenue share in 2025, driven by the flexibility, scalability, and cost-effectiveness offered by cloud-based solutions. Cloud deployment allows marketers to manage campaigns remotely, access real-time analytics, and integrate seamlessly with other digital marketing tools, making it a preferred choice for businesses of all sizes.

The On-Premises segment is expected to witness the fastest growth rate from 2026 to 2033, driven by organizations seeking greater control over data security, compliance, and customization. On-Premises solutions are particularly popular among enterprises with strict internal IT policies or sensitive customer data, offering localized hosting and dedicated management for enhanced operational reliability.

• By Software Type

On the basis of software type, the market is segmented into Programmatic and Non-Programmatic. The Programmatic segment held the largest market revenue share in 2025 due to the rising adoption of AI-driven ad placement, automated bidding, and real-time audience targeting. Programmatic solutions allow advertisers to optimize campaign performance, maximize ROI, and deliver personalized content efficiently.

The Non-Programmatic segment is expected to witness the fastest growth rate from 2026 to 2033, driven by small and medium enterprises adopting traditional ad server solutions for controlled, direct media placements. These solutions are preferred where automated infrastructure is not yet feasible or where simpler, targeted campaigns are sufficient.

• By Advertising Type

On the basis of advertising type, the market is segmented into Search Advertising, Display Advertising, Video Advertising, E-mail Advertising, and Social Media Advertising. The Display Advertising segment held the largest market revenue share in 2025, fueled by its wide reach, visual engagement, and effectiveness across multiple digital channels. Display campaigns allow brands to target specific audiences and measure performance using advanced analytics.

The Video Advertising segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing consumption of video content on social media platforms, OTT channels, and mobile apps. Video ads offer high engagement, storytelling potential, and measurable impact, making them increasingly preferred by marketers.

• By Advertising Platform

On the basis of advertising platform, the market is segmented into Web-Based and Mobile-Based. The Web-Based segment held the largest market revenue share in 2025, owing to the extensive reach of online websites and e-commerce portals. Web platforms support cross-channel campaigns, robust analytics, and integration with CRM and marketing automation tools.

The Mobile-Based segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rapid increase in smartphone penetration, mobile app usage, and on-the-go content consumption. Mobile advertising enables precise location-based targeting, push notifications, and interactive ad formats, enhancing user engagement.

• By Vertical

On the basis of vertical, the market is segmented into Banking, Financial Services and Insurance (BFSI), Transportation and Logistics, Consumer Goods and Retail, Education, Healthcare, Manufacturing, Media and Entertainment, IT and Telecommunications, Travel and Hospitality, and Others. The BFSI segment held the largest market revenue share in 2025, fueled by the increasing need for targeted customer engagement, lead generation, and brand awareness in competitive financial markets.

The Consumer Goods and Retail segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising adoption of e-commerce, online shopping, and personalized marketing campaigns. Retailers are leveraging ad server platforms to optimize digital promotions, enhance customer loyalty, and track campaign effectiveness across multiple channels.

Ad Server Advertising Software Market Regional Analysis

• North America dominated the ad server advertising software market with the largest revenue share of 38.45% in 2025, driven by the increasing adoption of digital marketing strategies and programmatic advertising platforms across businesses of all sizes

• Advertisers in the region highly value the efficiency, real-time analytics, and precision targeting offered by ad server solutions, enabling optimized ad spend and improved ROI across multiple channels

• This widespread adoption is further supported by high internet penetration, strong e-commerce growth, and a technologically savvy marketing workforce, establishing ad server software as a critical tool for both SMEs and large enterprises

U.S. Ad Server Advertising Software Market Insight

The U.S. ad server advertising software market captured the largest revenue share in 2025 within North America, fueled by rapid digitization of marketing processes and the increasing focus on programmatic ad solutions. Companies are increasingly prioritizing personalized campaigns and real-time campaign optimization. The growing integration of AI-driven analytics, data management platforms, and mobile advertising solutions further propels market growth. Moreover, the widespread presence of leading ad tech companies and startups in the U.S. is significantly contributing to market expansion.

Europe Ad Server Advertising Software Market Insight

The Europe ad server advertising software market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by the rising demand for automated marketing platforms and compliance with stringent GDPR regulations. The increase in digital advertising spend, combined with the adoption of AI and machine learning tools for audience targeting, is fostering market growth. European advertisers are also drawn to platforms that provide cross-channel campaign management and advanced analytics. The region is experiencing significant growth across retail, BFSI, and media sectors, with ad servers being incorporated into both established and emerging enterprises.

U.K. Ad Server Advertising Software Market Insight

The U.K. ad server advertising software market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investments in programmatic and data-driven advertising solutions. The country’s strong digital infrastructure, combined with robust e-commerce and retail sectors, encourages businesses to adopt advanced ad platforms. In addition, the need for targeted advertising and performance measurement is motivating marketers to implement AI-enabled and cloud-based ad servers. The U.K.’s emphasis on digital marketing innovation is expected to continue fueling market expansion.

Germany Ad Server Advertising Software Market Insight

The Germany ad server advertising software market is expected to witness the fastest growth rate from 2026 to 2033, fueled by the growing digital advertising ecosystem and the adoption of AI-powered analytics platforms. Germany’s well-established advertising and media infrastructure, along with high internet penetration and technology adoption, promotes market growth. Companies across automotive, BFSI, and retail sectors are increasingly leveraging ad server solutions for real-time optimization and personalized campaigns. The integration of cloud-based and programmatic advertising technologies is also becoming more prevalent, aligning with local enterprise needs.

Asia-Pacific Ad Server Advertising Software Market Insight

The Asia-Pacific ad server advertising software market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising digital advertising spend, increasing mobile device penetration, and the expansion of e-commerce platforms in countries such as China, India, and Japan. The region's growing focus on programmatic advertising, AI-powered targeting, and analytics is driving adoption. Furthermore, APAC is emerging as a key hub for ad tech innovation, providing affordable and scalable ad server solutions to enterprises of all sizes.

Japan Ad Server Advertising Software Market Insight

The Japan ad server advertising software market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s strong digital ecosystem, high mobile usage, and increasing investments in personalized advertising solutions. Japanese businesses are prioritizing real-time campaign optimization and cross-platform ad delivery to enhance customer engagement. The integration of AI, cloud-based analytics, and automated ad servers with existing marketing systems is fueling growth. Moreover, Japan’s mature e-commerce and retail markets are likely to sustain demand for advanced advertising platforms.

China Ad Server Advertising Software Market Insight

The China ad server advertising software market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapidly growing digital advertising landscape, extensive e-commerce penetration, and high adoption of AI-driven marketing tools. China represents one of the largest markets for programmatic and cloud-based ad server solutions, with businesses across retail, BFSI, and technology sectors increasingly leveraging these platforms. The government’s support for digital economy initiatives, combined with the availability of domestic ad tech providers, is a key factor propelling market growth.

Ad Server Advertising Software Market Share

The Ad Server Advertising Software industry is primarily led by well-established companies, including:

- Criteo (France)

- Google (U.S.)

- MediaMath (U.S.)

- Adobe (U.S.)

- AppNexus (U.S.)

- NextRoll, Inc. (U.S.)

- The Trade Desk (U.S.)

- Comcast Cable Communications Management, LLC dba Comcast Technology Solutions (U.S.)

- Amazon (U.S.)

- Oracle (U.S.)

- Roku, Inc. (U.S.)

- Adform (Denmark)

- Neustar, Inc. (U.S.)

- The Rubicon Project, Inc. (U.S.)

- Centro, Inc. (U.S.)

- Salesforce (U.S.)

- Facebook (U.S.)

- PubMatic, Inc. (U.S.)

- OpenX (U.S.)

- INDEX EXCHANGE (Canada)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.