Global Adhesion Laminated Surface Protection Films Market

Market Size in USD Billion

CAGR :

%

USD

5.02 Billion

USD

7.31 Billion

2024

2032

USD

5.02 Billion

USD

7.31 Billion

2024

2032

| 2025 –2032 | |

| USD 5.02 Billion | |

| USD 7.31 Billion | |

|

|

|

|

Adhesion Laminated Surface Protection Films Market Size

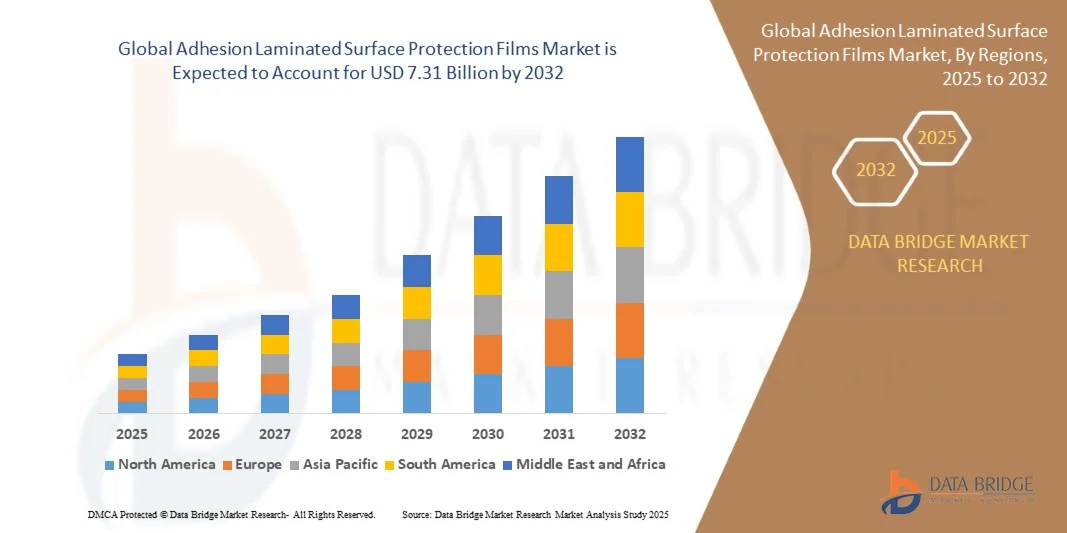

- The global adhesion laminated surface protection films market size was valued at USD 5.02 billion in 2024 and is expected to reach USD 7.31 billion by 2032, at a CAGR of 4.82% during the forecast period

- The market growth is largely fueled by the increasing demand for surface protection across industries such as automotive, electronics, construction, and industrial manufacturing, where high-value components require scratch- and abrasion-resistant films

- Furthermore, rising emphasis on product quality, durability, and aesthetics, combined with the need for efficient application and residue-free removal, is driving adoption of adhesion laminated surface protection films. These converging factors are accelerating uptake across end-user industries, thereby significantly boosting the market's growth

Adhesion Laminated Surface Protection Films Market Analysis

- Adhesion laminated surface protection films are multi-layered protective films designed to safeguard surfaces from scratches, abrasions, contamination, and environmental damage during manufacturing, transportation, and installation. They are compatible with metals, plastics, glass, and painted surfaces, and are available in various thicknesses, adhesive strengths, and lamination technologies to suit diverse applications

- The escalating demand for these films is primarily fueled by rapid industrialization, expansion of automotive and electronics manufacturing, growing urbanization, and increasing adoption of high-quality protective solutions. In addition, the focus on sustainable and recyclable film options is further contributing to market growth across regions and industries

- North America dominated the adhesion laminated surface protection films market with a share of over 40% in 2024, due to the high demand for surface protection solutions across automotive, electronics, and construction industries

- Asia-Pacific is expected to be the fastest growing region in the adhesion laminated surface protection films market during the forecast period due to rapid industrialization, rising automotive and electronics production, and increasing urbanization in countries such as China, Japan, and India

- 50-100 microns segment dominated the market with a market share of 42.5% in 2024, due to its optimal balance between durability and flexibility. Films within this thickness range offer robust protection against scratches, abrasions, and minor impacts while maintaining easy application and removal, making them highly preferred in both industrial and consumer applications. Manufacturers also favor this segment for its adaptability across different substrates, including metals, plastics, and glass, enhancing product protection without compromising surface aesthetics

Report Scope and Adhesion Laminated Surface Protection Films Market Segmentation

|

Attributes |

Adhesion Laminated Surface Protection Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Adhesion Laminated Surface Protection Films Market Trends

“Adoption of Ultra-Thin, High-Performance Films in Electronics and Automotive”

- The adhesion laminated surface protection films market is witnessing increased adoption of ultra-thin, high-performance films as electronics and automotive industries demand durable yet lightweight solutions. These films protect sensitive surfaces during manufacturing, transportation, and final use while maintaining visual quality and functional integrity

- For instance, Toray Industries has developed advanced ultra-thin film materials designed for use in smartphones and automotive displays, while Nitto Denko offers high-performance laminated protection films engineered to withstand demanding environments without leaving residue. These instances illustrate how major players are responding to technical requirements in high-value industries

- In electronics, ultra-thin laminated films are increasingly used for protecting screens, touch panels, and semiconductor components. Their precise adhesion, resistance to scratches, and optical clarity help maintain functionality of devices while enhancing consumer satisfaction in premium products

- In the automotive sector, the rising use of glossy interior panels, infotainment systems, and exterior trims has created demand for high-performance surface protection. Laminated films ensure surfaces remain free from abrasions during manufacturing and end use, maintaining aesthetics and durability of high-value components

- The emphasis on ultra-thin films enables manufacturers to reduce weight while ensuring reliable protection. This aligns well with industry needs for compact form factors in electronics and lightweighting strategies in automotive to enhance fuel efficiency and sustainability goals

- The adoption of ultra-thin, high-performance films highlights the market’s shift toward precision-engineered protection solutions. As both electronics and automotive segments continue to expand, these films are emerging as critical enablers of quality, performance, and customer experience in demanding applications

Adhesion Laminated Surface Protection Films Market Dynamics

Driver

“Rising Demand for Scratch- and Damage-Resistant Surface Protection”

- The rising importance of scratch- and damage-resistant surfaces in consumer and industrial products is a major driver for the adhesion laminated surface protection films market. Industries are increasingly relying on films to safeguard valuable surfaces throughout production and usage cycles

- For instance, 3M has developed specialized laminated protection films that ensure automotive paint and display panels remain resistant to scratches, while Avery Dennison provides films for electronic displays to enhance durability during transportation and retail shelf life. These innovation efforts highlight market momentum for value-added protection solutions

- The proliferation of electronic devices such as smartphones, tablets, and laptops has expanded demand for protective films that combine thinness with high adhesion and transparency. By maintaining screen clarity and preventing scratches, they enhance user experience and prolong product lifecycles

- In addition, industrial and construction applications are benefitting from laminated films that protect metals, glass, and coated materials from abrasion and damage. This reduces rework, cuts costs, and ensures maximum longevity of high-value assets in these sectors

- The growing demand for scratch- and damage-resistant films reflects their role in ensuring both functional and aesthetic quality in a wide range of applications. As industries prioritize quality assurance and product longevity, these films are positioned as indispensable components of modern manufacturing and end-user experience strategies

Restraint/Challenge

“High Raw Material Costs”

- The high cost of raw materials used in manufacturing adhesion laminated surface protection films presents a primary challenge to market growth. Materials such as specialty polymers, adhesives, and advanced laminates significantly increase production expenses and limit affordability in cost-sensitive regions

- For instance, materials sourced by companies such as Eastman Chemical and Covestro for high-performance protection films involve advanced polymer grades that increase cost structures. These factors challenge producers to balance innovation with price competitiveness in global markets

- The fluctuating cost of polymers, adhesives, and specialty coatings further adds instability, impacting the ability of manufacturers to offer consistent pricing. This constraint is particularly critical for industries requiring large volumes of protective films at competitive costs

- In addition, sustainability initiatives that involve bio-based or recyclable raw materials elevate production expenses, as greener alternatives often require advanced processing and limited sourcing compared to conventional petroleum-based inputs. This adds complexity for manufacturers navigating both sustainability and cost requirements

- To address this challenge, the industry will need greater focus on material innovations, recycling processes, and scaling production efficiency. Cost optimization strategies aimed at reducing dependency on expensive inputs will be essential for ensuring broader market availability and long-term growth of adhesion laminated surface protection films

Adhesion Laminated Surface Protection Films Market Scope

The market is segmented on the basis of product thickness, lamination technology, and end-user industry.

• By Product Thickness

On the basis of product thickness, the adhesion laminated surface protection films market is segmented into up to 25 microns, 25–50 microns, 50–100 microns, 100–150 microns, and above 150 microns. The 50–100 microns segment dominated the largest market revenue share of 42.5% in 2024, driven by its optimal balance between durability and flexibility. Films within this thickness range offer robust protection against scratches, abrasions, and minor impacts while maintaining easy application and removal, making them highly preferred in both industrial and consumer applications. Manufacturers also favor this segment for its adaptability across different substrates, including metals, plastics, and glass, enhancing product protection without compromising surface aesthetics.

The up to 25 microns segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand in electronics and delicate surface applications. Thin films provide lightweight, cost-effective protection while preserving the finish of sensitive surfaces, particularly in smartphones, tablets, and display panels. Their ease of handling, combined with minimal material usage, drives adoption in high-volume consumer goods manufacturing, contributing to the accelerated market growth for ultra-thin protective films.

• By Lamination Technology

On the basis of lamination technology, the market is segmented into dry bond lamination, wet bond lamination, energy curable lamination, hot melt seal coating, solventless lamination, and others. The dry bond lamination segment held the largest market revenue share in 2024 due to its consistent performance and compatibility with a wide range of adhesive systems. Dry bond lamination ensures uniform adhesion, reduces risk of air entrapment, and provides long-lasting protection, making it ideal for industrial, automotive, and construction applications. Its ability to maintain film integrity under various environmental conditions further strengthens its market dominance.

The energy curable lamination segment is expected to witness the fastest CAGR from 2025 to 2032, driven by growing emphasis on sustainability and process efficiency. Energy curable technologies, such as UV or electron-beam curing, enable rapid processing, reduced solvent usage, and lower environmental impact, aligning with stricter regulatory norms. In addition, energy curable lamination films offer enhanced clarity, superior adhesion, and resistance to chemical and mechanical stress, making them increasingly attractive across high-end industrial and electronics applications.

• By End User Industry

On the basis of end user industry, the market is segmented into construction and interior, electrical and electronics, automotive, industrial, healthcare, and others. The automotive segment dominated the largest market revenue share in 2024, supported by the increasing need to protect high-value vehicle surfaces during manufacturing, transportation, and assembly. Adhesion laminated surface protection films are widely used on painted panels, glass, and interior components to prevent scratches and contamination, ensuring premium quality and minimizing rework costs. Automotive OEMs and suppliers increasingly prefer films that combine durability with ease of application and residue-free removal, reinforcing the segment’s market leadership.

The electrical and electronics segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the rapid expansion of consumer electronics and smart devices. Protective films for displays, touch panels, and delicate components are in high demand to maintain surface quality during production and logistics. Innovations in thin, transparent, and high-adhesion films are enhancing user experience while providing reliable protection, contributing to the accelerated adoption of adhesion laminated surface protection films in this sector.

Adhesion Laminated Surface Protection Films Market Regional Analysis

- North America dominated the adhesion laminated surface protection films market with the largest revenue share of over 40% in 2024, driven by the high demand for surface protection solutions across automotive, electronics, and construction industries

- Consumers and industrial manufacturers in the region prioritize high-quality films that ensure scratch resistance, durability, and easy application across various surfaces

- This widespread adoption is further supported by advanced manufacturing infrastructure, stringent quality standards, and a technologically inclined industrial base, establishing laminated surface protection films as a preferred solution across multiple sectors

U.S. Adhesion Laminated Surface Protection Films Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, fueled by strong automotive production, electronics manufacturing, and construction activity. The increasing emphasis on protecting high-value components during production, assembly, and transportation is driving demand. In addition, manufacturers are seeking films that provide durability without affecting aesthetics or performance. The growth of smart device manufacturing, coupled with the need for residue-free, easy-to-remove films, is further propelling the market.

Europe Adhesion Laminated Surface Protection Films Market Insight

The Europe market is projected to expand at a notable CAGR during the forecast period, primarily driven by growing industrialization, automotive production, and regulatory requirements for surface protection. The adoption of these films is rising across construction, electronics, and automotive sectors. European manufacturers emphasize high-quality films with consistent adhesion, environmental compliance, and efficient application, boosting overall demand.

U.K. Adhesion Laminated Surface Protection Films Market Insight

The U.K. market is anticipated to grow at a steady CAGR, driven by increasing demand for protective films in the automotive and electronics sectors. Rising awareness regarding surface damage prevention during manufacturing and logistics encourages the adoption of high-performance laminated films. The U.K.’s advanced industrial base and growing preference for innovative protection solutions continue to stimulate market growth.

Germany Adhesion Laminated Surface Protection Films Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by robust automotive production, electronics manufacturing, and strict quality standards. Manufacturers are increasingly implementing adhesion laminated surface protection films to prevent scratches, abrasion, and contamination during production and transportation. Germany’s focus on technological innovation and sustainable manufacturing practices supports the adoption of energy-efficient and environmentally friendly laminated films.

Asia-Pacific Adhesion Laminated Surface Protection Films Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, rising automotive and electronics production, and increasing urbanization in countries such as China, Japan, and India. The region’s growing manufacturing base, combined with the need for cost-effective and reliable surface protection solutions, is boosting adoption. Government initiatives supporting industrial modernization and export-oriented manufacturing further enhance market growth.

Japan Adhesion Laminated Surface Protection Films Market Insight

The Japan market is gaining traction due to the country’s high-tech manufacturing sector, strong automotive and electronics industries, and emphasis on quality assurance. Adhesion laminated surface protection films are increasingly used to protect sensitive surfaces during production and assembly. The growing demand for films that provide both durability and easy removal aligns with Japan’s focus on efficiency and precision in manufacturing.

China Adhesion Laminated Surface Protection Films Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid industrial growth, expansion of automotive and electronics manufacturing, and increasing urbanization. Domestic manufacturers are offering cost-effective, high-quality films, driving adoption across multiple sectors. The push toward industrial modernization, coupled with strong export-oriented production, is fueling the market’s expansion

Adhesion Laminated Surface Protection Films Market Share

The adhesion laminated surface protection films industry is primarily led by well-established companies, including:

- NITTO DENKO CORPORATION. (Japan)

- Henkel Adhesives Technologies India Private Limited (India)

- tesa Tapes Private Limited (Germany)

- DuPont (U.S.)

- Saint-Gobain (France)

- AVERY DENNISON CORPORATION (U.S.)

- LINTEC Corporation. (Japan)

- ECHOtape. (U.S.)

- SEKISUI CHEMICAL CO., LTD. (Japan)

- ECOPLAST LTD (India)

- Possible Polymer (India)

- Surface Armor (U.S.)

- Specialty Polyfilms Pvt. Ltd. (India)

- Permapack AG (Switzerland)

- Pentaflex (U.S.)

- Protective Film (U.S.)

- LyondellBasell Industries Holdings B.V. (U.S.)

- 3M (U.S.)

- Intertape Polymer Group (U.S.)

- Scapa Group plc (U.K.)

Latest Developments in Adhesion Laminated Surface Protection Films Market

- In October 2024, Avient Corporation introduced an ultra-high adhesion series within its Versaflex PF Thermoplastic Elastomers line, specifically designed for co-extruded protective films. This innovation addresses the growing demand for high-performance protection in industries such as electronics, appliances, construction, and transportation. The new series enhances adhesion by up to 20% compared to previous formulations, offers excellent flexibility, and supports sustainability by reducing volatile organic compound (VOC) emissions and enabling recyclability. Manufactured in Asia and available globally, this development positions Avient as a leader in providing advanced protective film solutions

- In May 2024, Arkema acquired Dow’s flexible packaging laminating adhesives business for USD 150 million. This strategic move allows Arkema to enhance its portfolio and strengthen its position in the flexible packaging market, which is witnessing significant growth due to increasing use of flexible packaging solutions across various industries. The acquisition enables Arkema to offer a broader range of high-performance laminating adhesives, catering to the rising demand for sustainable and efficient packaging solutions

- In February 2024, Berry Global Inc. expanded its adhesive film production capabilities in Asia to meet the growing demand for surface protection films in the region. This expansion aims to enhance Berry Global's ability to supply high-quality adhesive films to industries such as electronics, automotive, and construction, which are experiencing rapid growth in Asia. By increasing production capacity, Berry Global intends to improve lead times and better serve its customers in the region

- In January 2024, 3M launched a new eco-friendly surface protection film made from recyclable materials, targeting the growing demand for sustainable solutions in the market. This product is designed to provide effective protection for surfaces during manufacturing, transportation, and installation processes while minimizing environmental impact. The introduction of this eco-friendly film aligns with the increasing consumer and industrial preference for environmentally responsible products

- In December 2023, Intertape Polymer Group entered into a strategic partnership with a leading electronics manufacturer to supply custom-designed surface protection films for their products. This collaboration aims to provide tailored solutions that meet the specific needs of the electronics industry, ensuring optimal protection during manufacturing and shipping processes. The partnership underscores Intertape's commitment to innovation and customer-centric solutions in the surface protection film market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Adhesion Laminated Surface Protection Films Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Adhesion Laminated Surface Protection Films Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Adhesion Laminated Surface Protection Films Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.