Global Adhesive Equipment Market

Market Size in USD Billion

CAGR :

%

USD

35.07 Billion

USD

51.74 Billion

2024

2032

USD

35.07 Billion

USD

51.74 Billion

2024

2032

| 2025 –2032 | |

| USD 35.07 Billion | |

| USD 51.74 Billion | |

|

|

|

|

Adhesive Equipment Market Size

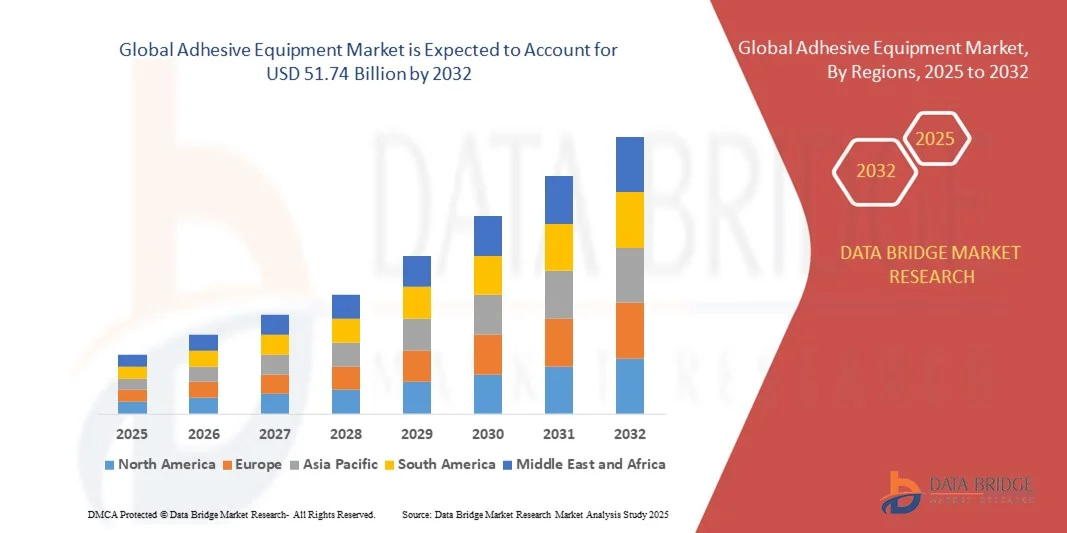

- The global adhesive equipment market size was valued at USD 35.07 billion in 2024 and is expected to reach USD 51.74 billion by 2032, at a CAGR of 4.98% during the forecast period

- The market growth is largely fueled by increasing automation and technological advancements in manufacturing, packaging, construction, and automotive industries, driving higher adoption of precision adhesive application equipment

- Furthermore, rising demand for efficient, high-speed, and reliable bonding solutions across diverse industrial applications is establishing advanced adhesive equipment as a critical component of modern production lines. These converging factors are accelerating the uptake of adhesive technologies, thereby significantly boosting the industry’s growth

Adhesive Equipment Market Analysis

- Adhesive equipment, including hot melt systems, controllers, applicators, and pumping systems, is increasingly vital in industrial, packaging, construction, automotive, and electronics sectors due to its ability to enhance bonding efficiency, precision, and operational speed

- The escalating demand for adhesive equipment is primarily fueled by growing industrialization, increasing automation in production lines, rising focus on operational efficiency, and the need for consistent, high-quality bonding across various materials and substrates

- Asia-Pacific dominated the adhesive equipment market in 2024, due to rapid industrialization, expanding manufacturing sectors, and growing adoption of automated production technologies

- North America is expected to be the fastest growing region in the adhesive equipment market during the forecast period due to growing adoption of automation, advanced manufacturing technologies, and rising demand across packaging, automotive, and construction industries

- Industrial hot melt segment dominated the market with a market share of 36.8% in 2024, due to its high efficiency, rapid bonding capabilities, and versatility across multiple substrates. This segment is widely preferred in packaging, woodworking, and automotive industries where speed and reliability are critical. Industrial hot melt equipment is also favored for its compatibility with automated production lines, reducing labor costs while ensuring consistent adhesive application. Manufacturers continue to innovate in hot melt technology, enhancing precision, temperature control, and energy efficiency, further driving adoption across industrial operations

Report Scope and Adhesive Equipment Market Segmentation

|

Attributes |

Adhesive Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Adhesive Equipment Market Trends

Growing Use of Automated Adhesive Application Systems

- The adhesive equipment market is undergoing rapid transformation driven by the increasing adoption of automated adhesive application systems across manufacturing industries. Automation is enabling greater precision, speed, and consistency in adhesive dispensing and bonding operations, particularly in automotive, electronics, packaging, and construction sectors seeking higher productivity and quality control

- For instance, Nordson Corporation has introduced advanced robotic and vision-guided adhesive dispensing systems used in automotive assembly lines and electronic packaging. The company’s automation-forward approach highlights the shift toward integrated adhesive application technologies that reduce waste, improve repeatability, and enhance operational efficiency

- Automated adhesive systems, including robotic dispensers, jetting valves, and temperature-controlled melting units, are replacing manual processes due to their ability to deliver uniform coating thickness and optimized material usage. This transition supports industry demands for clean, efficient, and high-throughput assembly lines

- In addition, the growing adoption of Industry 4.0 and smart manufacturing practices is driving integration of adhesive equipment with digital monitoring, predictive maintenance, and process feedback systems. These innovations allow real-time control over dispensing parameters, minimizing defects and improving product reliability

- The packaging sector is particularly benefiting from automation, where precision adhesive application enhances bonding strength while reducing production downtime. Similarly, in electronics and automotive manufacturing, miniaturized and complex component assembly requires precise adhesive placement achievable only through automated machinery

- As production environments evolve toward data-driven, sustainable, and efficient manufacturing, automated adhesive application systems are becoming a cornerstone of process modernization. The ongoing convergence of robotics, sensor technology, and material science will continue to shape the next generation of adhesive equipment globally

Adhesive Equipment Market Dynamics

Driver

Rising Demand for Precise and Efficient Bonding Solutions

- The rising global demand for high-precision, efficient bonding solutions across industrial sectors is a major driver for the adhesive equipment market. Industries are increasingly relying on adhesives as key joining solutions due to their ability to bond dissimilar materials, reduce component weight, and simplify assembly processes compared to mechanical fastening

- For instance, Henkel AG & Co. KGaA has expanded its range of precision dispensing systems for electronics and automotive manufacturing, enabling seamless integration into high-speed production lines. The company’s focus on accuracy and material optimization reflects the growing market demand for equipment that ensures reliability and process efficiency

- Modern manufacturing requires adhesives to be applied with extreme consistency and minimal waste to meet stringent product tolerances. Adhesive dispensing equipment provides controlled application volumes, consistent bead placement, and stable curing outcomes that improve product performance and reduce rework rates

- In addition, growth in electric vehicle production, flexible packaging, and lightweight construction materials has accelerated the usage of specialized adhesives requiring controlled application systems. Manufacturers are adopting advanced equipment solutions that offer temperature regulation, viscosity control, and automated pattern customization for diverse bonding materials

- With increasing global competition and quality standardization, the emphasis on precision bonding is expanding across industries. This ongoing trend toward automation, scalability, and performance optimization ensures sustained demand for advanced adhesive application equipment in the coming years

Restraint/Challenge

High Cost of Advanced Adhesive Equipment

- The high cost of acquiring and maintaining advanced adhesive application equipment presents a significant challenge to market growth, especially for small and medium-sized enterprises. Modern automated systems—integrating robotics, sensors, and control technologies—require substantial initial investment and infrastructure adaptation to ensure seamless operation

- For instance, Graco Inc. and Valco Melton have highlighted that the high precision, programmable adhesive dispensing machinery necessary for automotive and electronics production involves considerable capital expenditure for setup, calibration, and training. This limits adoption among manufacturers with constrained budgets or lower production volumes

- The complexity of integrating advanced adhesive systems into existing production lines further increases implementation costs. Specialized operators and regular maintenance are required to sustain performance accuracy, adding to operational expenditure and total cost of ownership

- Moreover, equipment suppliers must comply with specific safety, performance, and material handling standards, leading to added certification and customization costs. Rapid technology advancements may also result in shorter upgrade cycles, creating additional financial pressure for users to remain competitive

- Industry players are addressing these challenges by developing modular, scalable adhesive systems and introducing leasing or servicing models to reduce upfront costs. As automation technologies mature and manufacturing efficiency improves, the cost-to-performance ratio of advanced adhesive equipment is expected to become more favorable, accelerating market adoption globally

Adhesive Equipment Market Scope

The market is segmented on the basis of product, application, and industry vertical.

- By Product

On the basis of product, the adhesive equipment market is segmented into industrial hot melt, adhesive controllers, cold glue applicators, pneumatic adhesive applicators, adhesive pumping systems, and adhesive application guns. The industrial hot melt segment dominated the market with the largest revenue share of 36.8% in 2024, owing to its high efficiency, rapid bonding capabilities, and versatility across multiple substrates. This segment is widely preferred in packaging, woodworking, and automotive industries where speed and reliability are critical. Industrial hot melt equipment is also favored for its compatibility with automated production lines, reducing labor costs while ensuring consistent adhesive application. Manufacturers continue to innovate in hot melt technology, enhancing precision, temperature control, and energy efficiency, further driving adoption across industrial operations.

The adhesive controllers segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increasing automation and the need for precise adhesive dispensing. These controllers provide accurate temperature and flow control, minimizing material waste and improving production efficiency. Their adoption is growing across packaging, electronics, and disposable hygiene product sectors, where consistent adhesive performance is critical. The ability to integrate adhesive controllers with robotic and automated systems further enhances productivity and quality, making them an attractive investment for modern manufacturing setups.

- By Application

On the basis of application, the adhesive equipment market is segmented into packaging, construction, lamination, disposable hygiene products, and technical textiles. The packaging segment dominated the market in 2024, driven by the global rise in e-commerce, fast-moving consumer goods, and automated packaging solutions. Adhesive equipment is critical in sealing cartons, corrugated boxes, and flexible packaging materials efficiently, ensuring product protection during transit. The high demand for precise, high-speed adhesive application in packaging lines, coupled with the adoption of automated systems, contributes to the segment’s leading revenue share.

The disposable hygiene products segment is expected to witness the fastest growth from 2025 to 2032, driven by rising consumer awareness and demand for diapers, sanitary napkins, and wipes. Adhesive equipment in this segment ensures consistent bonding of delicate materials without compromising comfort or quality. Innovations in applicator precision and automation enhance production efficiency, while the surge in personal hygiene consumption across emerging economies accelerates market growth.

- By Industry Vertical

On the basis of industry vertical, the adhesive equipment market is segmented into furniture and woodworking, packaging, textiles, automotive, building and construction, paper, healthcare, electronics, leather and footwear, and others. The packaging industry vertical dominated the market in 2024, attributed to the rapid expansion of logistics, retail, and consumer goods sectors. Adhesive equipment ensures high-speed, precise bonding of packaging materials, improving productivity and reducing material waste. Advanced adhesive systems also support sustainable packaging initiatives by optimizing adhesive usage and compatibility with recyclable materials.

The automotive industry vertical is projected to witness the fastest growth from 2025 to 2032, driven by increasing use of adhesives in lightweight vehicle assembly, interior component bonding, and safety-critical applications. Adhesive equipment enables uniform and durable application, enhancing structural integrity and production efficiency. The growing shift toward electric vehicles, along with stricter fuel efficiency and safety standards, further propels the adoption of advanced adhesive technologies in automotive manufacturing.

Adhesive Equipment Market Regional Analysis

- Asia-Pacific dominated the adhesive equipment market with the largest revenue share in 2024, driven by rapid industrialization, expanding manufacturing sectors, and growing adoption of automated production technologies

- The region’s cost-effective manufacturing landscape, increasing investments in industrial machinery, and rising demand for packaging, automotive, and construction solutions are accelerating market expansion

- Availability of skilled labor, supportive government policies, and strong growth in end-use industries are contributing to increased adoption of advanced adhesive equipment across both developed and emerging economies

China Adhesive Equipment Market Insight

China held the largest share in the Asia-Pacific adhesive equipment market in 2024, owing to its status as a global manufacturing hub and a leader in packaging, automotive, and construction sectors. The country’s strong industrial base, extensive production capabilities, and focus on automation are major growth drivers. Rising investments in modern adhesive technologies, integration of robotic systems in production lines, and increasing exports of manufactured goods further strengthen demand for adhesive equipment.

India Adhesive Equipment Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapid industrial expansion, increasing packaging and automotive production, and growing adoption of automation technologies. Government initiatives supporting Make in India, infrastructure development, and industrial modernization are enhancing market opportunities. In addition, rising consumer demand for high-quality packaging, textiles, and hygiene products is driving adoption of efficient adhesive application systems across the country.

Europe Adhesive Equipment Market Insight

The Europe adhesive equipment market is expanding steadily, supported by advanced manufacturing practices, high demand for precision bonding, and investments in sustainable production solutions. The region emphasizes quality, environmental compliance, and innovation, particularly in automotive, packaging, and electronics sectors. Increasing use of automated adhesive systems and focus on energy-efficient technologies are further propelling market growth.

Germany Adhesive Equipment Market Insight

Germany’s adhesive equipment market is driven by its leadership in precision manufacturing, strong industrial heritage, and export-oriented production model. The country’s advanced R&D capabilities, integration of robotics in production, and adoption of automated adhesive technologies for automotive and construction applications support market growth. Demand is particularly strong in high-value industrial applications requiring consistent and reliable bonding.

U.K. Adhesive Equipment Market Insight

The U.K. market is supported by a mature industrial and manufacturing ecosystem, focus on automation, and rising investments in sustainable production methods. Increasing R&D initiatives, academic-industry collaborations, and adoption of advanced adhesive application technologies in packaging, electronics, and construction sectors are driving growth. The emphasis on efficiency, precision, and regulatory compliance strengthens demand for modern adhesive equipment.

North America Adhesive Equipment Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by growing adoption of automation, advanced manufacturing technologies, and rising demand across packaging, automotive, and construction industries. Strong industrial infrastructure, focus on innovation, and expansion of production facilities are boosting market adoption. Increasing reshoring of manufacturing and integration of high-precision adhesive systems in industrial processes are further supporting growth.

U.S. Adhesive Equipment Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by a mature manufacturing sector, high adoption of automated systems, and strong industrial R&D capabilities. Rising demand for precision adhesive application in packaging, automotive, and electronics industries, along with investments in energy-efficient and sustainable equipment, reinforces market leadership. Presence of key manufacturers and a well-established distribution network further consolidate the U.S.’s leading position in the region.

Adhesive Equipment Market Share

The adhesive equipment industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Henkel AG (Germany)

- Huntsman International LLC (U.S.)

- AVERY DENNISON CORPORATION (U.S.)

- Sika AG (Switzerland)

- RPM International Inc. (U.S.)

- Graco Inc (U.S.)

- Nordson Corporation (U.S.)

- Atlas Copco AB (Sweden)

- SUPERGLUE CORPORATION (U.S.)

- Adhesives Research, Inc. (U.S.)

- Dymax Corporation (U.S.)

- Hernon Manufacturing, INC (U.S.)

- ITW DYNATEC (U.S.)

- Adhesive Packaging, LLC (U.S.)

- Valco Melton (U.S.)

- HAECO (Hong Kong)

- H.B. Fuller Company (U.S.)

- Ashland (U.S.)

Latest Developments in Global Adhesive Equipment Market

- In September 2025, Henkel inaugurated its new Inspiration Center for Adhesive Technologies in Shanghai, China, with an investment exceeding 60 million euros. The facility is designed to accelerate the development of sustainable and high-performance adhesive solutions while fostering close collaboration with industrial and commercial customers. This strategic move strengthens Henkel’s footprint in the Asia-Pacific region, one of the fastest-growing markets for adhesive equipment, and supports innovation in sectors such as packaging, automotive, electronics, and construction. The center enhances Henkel’s capability to deliver customer-specific solutions rapidly, thereby consolidating its position as a leading global adhesive technology provider

- In July 2024, Henkel expanded its largest Indian manufacturing facility in Kurkumbh, Maharashtra, introducing a new Loctite production line aimed at addressing rising demand in manufacturing, automotive, and maintenance applications. This investment improves local production capacity, reduces reliance on imports, and enhances the speed and efficiency of product delivery in the Indian market. By localizing manufacturing and integrating advanced adhesive technologies, Henkel strengthens its competitive advantage, supports regional industrial growth, and reinforces its position as a preferred supplier of adhesive solutions in one of the world’s fastest-growing markets

- In November 2023, Henkel completed the acquisition of Seal for Life Industries LLC, a U.S.-based provider of protective coatings and sealing solutions across infrastructure sectors including oil, gas, renewable energy, and water. This acquisition broadens Henkel’s portfolio in maintenance, repair, and industrial sealing applications, enhancing its capacity to deliver specialized solutions for critical infrastructure projects globally. With Seal for Life’s established market presence and expertise, Henkel can leverage advanced coating and sealing technologies to capture emerging opportunities in both industrial and infrastructure markets

- In August 2023, Nordson Corporation acquired ARAG Group and its affiliated companies, strengthening its global position in precision fluid dispensing systems for agricultural applications. This strategic expansion allows Nordson to enter the precision agriculture market, offering intelligent spraying and dispensing solutions that improve efficiency and reduce chemical waste. The acquisition supports Nordson’s growth strategy by diversifying its product portfolio and enabling innovation in sustainable agriculture technologies, meeting the rising demand for smart and precise fluid control systems worldwide

- In March 2020, Henkel AG & Co. KGaA collaborated with Covestro AG to develop a solution for efficient fixation of cylindrical lithium-ion battery cells inside plastic holders. The combination of Henkel’s UV-curing adhesive with Covestro’s UV-transparent polycarbonate blend enabled automated and high-precision assembly of battery modules. This innovation addresses the growing need for electric vehicle production efficiency, improves assembly accuracy, and demonstrates the application of advanced adhesive solutions in high-tech and energy storage industries, marking a significant step in industrial automation and sustainable battery manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Adhesive Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Adhesive Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Adhesive Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.