Global Adhesives Sealants Market

Market Size in USD Billion

CAGR :

%

USD

121.27 Billion

USD

237.07 Billion

2024

2032

USD

121.27 Billion

USD

237.07 Billion

2024

2032

| 2025 –2032 | |

| USD 121.27 Billion | |

| USD 237.07 Billion | |

|

|

|

|

Adhesives & Sealants Market Size

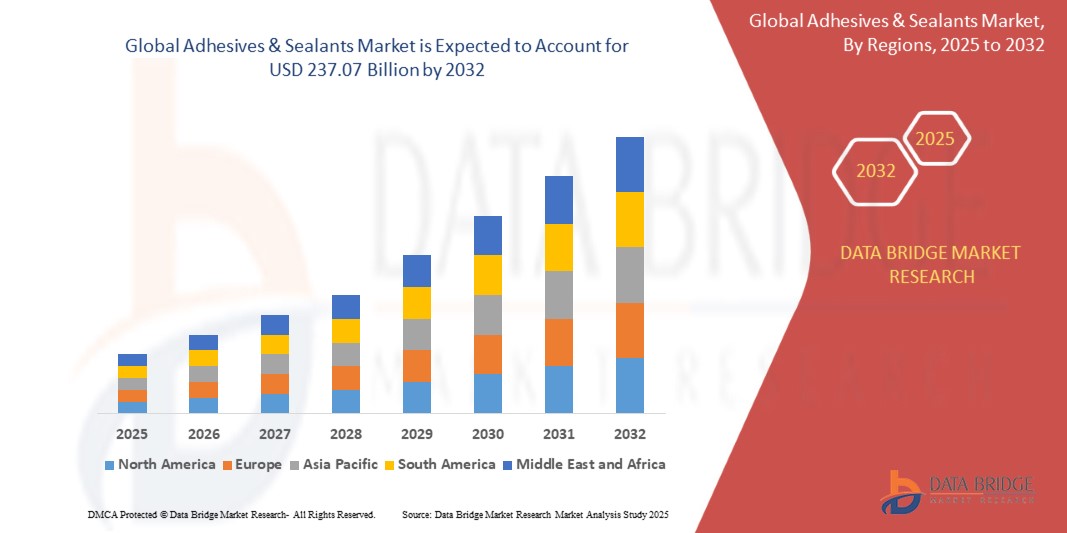

- The global adhesives and sealants market was valued at USD 121.27 billion in 2023 and is projected to reach USD 237.07 billion by 2030, growing at a CAGR of 10.1% during the forecast period.

- The segment's growth is driven by increasing demand for high-performance bonding solutions across automotive, construction, electronics, and renewable energy sectors.

Adhesives & Sealants Market Analysis

- The market's growth is driven by its extensive use in assembling materials like glass, metal, and rubber during automobile manufacturing and construction projects.

- The increasing demand for high-performance sealants in lightweight vehicle production contributes to economic efficiency and reduces reliance on traditional materials such as metals and plastics.

- Asia Pacific is the leading consumer, accounting for 41.3% of the global market share in 2023, propelled by rising consumption in building and construction across countries like China, India, and Indonesia.

- North America and Europe are experiencing steady growth due to increased building activities and automotive production, respectively.

- Water-Based Adhesives dominated the market with a 31.7% share in 2023. Their versatility and environmental benefits make them suitable for various applications across industries.

- Reactive & Other technologies are expected to witness growth at a CAGR of 8.9%, driven by their advanced bonding capabilities.

Report Scope and Adhesives & Sealants Market Segmentation

|

Attributes |

Adhesives & Sealants Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Adhesives & Sealants Market Trends

“Growing Preference for Sustainable, Low-VOC Adhesives & Sealants”

- One of the prominent trends shaping the global adhesives & sealants market is the growing preference for sustainable and low-VOC formulations.

- This trend is largely fueled by increasing regulatory pressure to reduce emissions, heightened consumer awareness of health and environmental impacts, and the sustainability commitments adopted by key end-user industries such as automotive, packaging, and construction.

For instance, companies like Henkel AG and H.B. Fuller Company have developed bio-based adhesives and waterborne sealant solutions that align with global green building codes and environmental compliance standards.

- The adoption of these low-VOC and solvent-free products enables manufacturers to meet eco-certifications while maintaining high bonding performance.

- As industries prioritize greener chemistries without compromising on strength or durability, innovations in sustainable adhesive and sealant technologies are expected to accelerate and define the competitive edge in the coming years.

Adhesives & Sealants Market Dynamics

Driver

“Rising Demand for Lightweight and High-Performance Bonding Solutions”

- The increasing demand for lightweight and high-performance bonding solutions is a major driver of growth in the adhesives & sealants market.

- This shift is especially evident in sectors such as automotive, aerospace, electronics, and construction, where reducing weight without sacrificing performance is essential for efficiency, durability, and energy conservation.

- Adhesives and sealants offer advantages such as uniform stress distribution, resistance to thermal expansion, and superior aesthetics over traditional mechanical fasteners.

For example, Sika AG has developed advanced polyurethane and epoxy adhesives designed for structural bonding in lightweight vehicle assemblies. Similarly, 3M Company provides acrylic and silicone-based sealants tailored for electronics and construction applications where high thermal stability and moisture resistance are critical.

- As industries increasingly focus on design flexibility, fuel efficiency, and enhanced mechanical properties, the demand for specialized adhesive and sealant solutions is expected to remain strong, driving both volume and value growth in the global market.

Restraint/Challenge

“Volatility in Raw Material Prices and Supply Chain Disruptions”

- A major restraint impacting the adhesives & sealants market is the volatility in raw material prices, particularly those derived from petrochemicals, such as resins, solvents, and isocyanates.

- Fluctuations in crude oil prices, coupled with geopolitical tensions and supply chain bottlenecks, have led to increased uncertainty in material costs and availability. This volatility puts pressure on manufacturers’ margins and limits pricing flexibility in highly competitive end-use industries.

For instance, producers of polyurethane and epoxy adhesives face periodic cost surges due to disrupted feedstock supply, especially in regions heavily reliant on imports. Additionally, the push toward bio-based raw materials often entails higher input costs and longer development cycles, further constraining affordability.

- These challenges can impede the adoption of advanced adhesives and sealants, particularly in cost-sensitive sectors such as furniture, footwear, and construction. Addressing raw material cost volatility and ensuring reliable supply chains will remain critical for sustaining growth in the adhesives & sealants market.

Adhesives & Sealants Market Scope

The market is segmented on the basis of technology, product, and application.

- By Technology

On the basis of technology, the adhesives & sealants market is segmented into Water-Based, Solvent-Based, Hot-Melt, Reactive, and Others. The Water-Based segment holds the largest market revenue share of 38.5% in 2025, attributed to its widespread adoption across packaging, construction, and labeling applications, driven by regulatory pressure to reduce VOC emissions and growing end-user preference for non-toxic, environmentally friendly formulations. Water-based adhesives offer easy application, cost-effectiveness, and excellent performance across porous substrates, supporting their dominance.

However, the Reactive segment is expected to grow at the highest CAGR of 7.86% during the forecast period of 2025–2032. This growth is driven by increasing demand for high-strength, durable bonding in automotive, electronics, and aerospace sectors, where reactive technologies such as polyurethane and epoxy-based adhesives offer superior resistance to heat, chemicals, and moisture.

- By Product

On the basis of product, the market is segmented into Acrylic, Polyvinyl Acetate (PVA), Polyurethanes, Styrenic Block Copolymers, Epoxy, Ethylene-Vinyl Acetate (EVA), and Others. The Acrylic segment dominates with the largest revenue share of 30.7% in 2025, owing to its versatility, fast curing times, and strong adhesion to a variety of substrates. Acrylic adhesives are widely used in construction, electronics, and packaging industries due to their excellent UV resistance and durability.

Meanwhile, the Polyurethanes segment is projected to exhibit the highest CAGR of 8.14% over the forecast period. This is driven by growing applications in automotive, footwear, and construction sectors where flexibility, weather resistance, and superior bonding on varied surfaces are critical performance parameters. The development of moisture-curing and two-component polyurethane systems is further propelling segment growth.

- By End-Use Industry

On the basis of end-use industry, the market is categorized into Biomedical, Electronics, Paints & Coatings, and Others. The Biomedical segment is anticipated to dominate the market by 2025 owing to the growing use of Adhesives & Sealants in drug delivery systems, implants, and anti-fouling medical devices. Their superior biocompatibility, non-toxicity, and customizable surface functionality are critical for advanced healthcare applications.

The Electronics segment is expected to grow with the highest CAGR through 2032, attributed to increasing demand for nanoscale surface modification in electronic components, semiconductors, and wearable devices where Adhesives & Sealants enhance performance, insulation, and durability.

- By Application

Based on application, the adhesives & sealants market is segmented into Paper & Packaging, Consumer & DIY, Building & Construction, Furniture & Woodworking, Footwear & Leather, Automotive & Transportation, Medical, and Others. The Paper & Packaging segment is expected to account for the largest share of 23.9% in 2025, primarily due to the surge in e-commerce and FMCG sectors, where fast-setting and food-safe adhesive solutions are essential for corrugated boxes, labels, and cartons.

In contrast, the Automotive & Transportation segment is projected to witness the highest CAGR of 8.32% during the forecast period. Increasing emphasis on vehicle light-weighting, structural integrity, and NVH (noise, vibration, and harshness) performance is driving the use of structural adhesives and advanced sealants in electric vehicles, interiors, and under-the-hood applications.

Global Adhesives & Sealants Market Regional Analysis

North America Adhesives & Sealants Market Insight

North America holds a prominent position in the global adhesives & sealants market, accounting for 32.1% of the total market revenue in 2025. The market is driven by well-established end-use industries such as construction, automotive, packaging, and electronics.

The region’s focus on sustainability, innovation in low-VOC and solvent-free technologies, and the presence of key global manufacturers are contributing to robust demand. Additionally, growing infrastructure renovation activities and consumer preference for durable, lightweight bonding solutions continue to boost growth.

- U.S. Adhesives & Sealants Market Insight

The U.S. leads the North American market with the largest revenue share, fueled by high consumption across packaging, construction, and automotive sectors. Increased demand for green building solutions and energy-efficient technologies has led to rapid adoption of reactive and water-based adhesives. R&D investment in bio-based formulations and strong OEM partnerships are further catalyzing growth.

- Canada Adhesives & Sealants Market Insight

The Canadian market is expected to experience steady growth, backed by ongoing investments in residential housing and infrastructure. Rising demand for high-performance adhesives in modular construction and the expanding wood-based furniture manufacturing industry are key contributors. Canada’s strong environmental regulatory framework is also encouraging the use of eco-friendly and non-toxic adhesive technologies.

Europe Adhesives & Sealants Market Insight

Europe represents a mature yet dynamic adhesives & sealants market, driven by strict environmental norms, energy-efficient building codes, and innovation in green chemistry. In 2025, Europe accounted for approximately 28.7% of the global market revenue. Applications across automotive, medical, and packaging industries are fostering continued demand for high-performance, compliant adhesive systems.

- Germany Adhesives & Sealants Market Insight

Germany stands as the largest market in Europe, thanks to its advanced automotive and engineering sectors. High adoption of reactive and polyurethane adhesives in vehicle assembly and lightweight structures is driving market expansion. Emphasis on product quality, VOC compliance, and recyclability further encourages the use of next-generation sealant systems in both OEM and aftermarket channels.

- France Adhesives & Sealants Market Insight

France is witnessing notable growth in the adhesives & sealants market, spurred by the government’s focus on sustainable urban development and energy renovation programs. The rise in eco-friendly building materials and increased deployment of renewables, including solar modules and wind turbines, are supporting the growing usage of structural adhesives and weather-resistant sealants.

Asia-Pacific Adhesives & Sealants Market Insight

The Asia-Pacific region is projected to register the highest CAGR of 8.74% during the forecast period (2025–2032), making it the fastest-growing regional market. This growth is underpinned by massive industrialization, rising consumer demand, and infrastructure development across emerging economies like China, India, and Southeast Asia. The region’s expanding electronics, packaging, and transportation industries are fueling robust consumption of various adhesive technologies.

- China Adhesives & Sealants Market Insight

China dominates the Asia-Pacific market, owing to its large-scale construction activities, rapid growth in automotive production, and leadership in consumer electronics manufacturing. Increased focus on sustainable urban infrastructure, coupled with governmental support for energy-efficient technologies, is fostering the adoption of advanced and solvent-free adhesive systems in key sectors.

- India Adhesives & Sealants Market Insight

India is expected to witness one of the fastest CAGRs in the region, driven by booming construction, expanding manufacturing capacity, and rising adoption of automation in packaging and FMCG industries. The government’s “Make in India” initiative and investments in transport and renewable energy are supporting market demand. Growing awareness about green chemistry and international quality standards is accelerating the use of water-based and hybrid adhesive technologies.

Adhesives & Sealants Market Players

The Adhesives & Sealants industry is primarily led by well-established companies, including:

- Henkel AG (Germany)

- 3M Company (U.S.)

- H.B. Fuller Company (U.S.)

- Sika AG (Switzerland)

- Pidilite Industries Ltd. (India)

- Dow Inc. (U.S.)

- RPM International Inc. (U.S.)

- Kuraray Co., Ltd. (Japan)

- Wacker Chemie AG (Germany)

- Ashland Inc. (U.S.)

- Mapei S.p.A. (Italy)

- Bostik (France)

- Franklin International (U.S.)

- Jowat SE (Germany)

- Permabond LLC (UK)

- Huntsman Corporation (U.S.)

Latest Developments in Global Adhesives & Sealants Market

- In April 2025, Henkel introduced a new range of polyurethane-based reactive hot melt adhesives under the Technomelt PUR series, tailored for the automotive interior and electronics assembly sectors. These adhesives offer enhanced thermal resistance and long-term durability while meeting low-emission standards. This product line is expected to strengthen Henkel’s competitive positioning in high-performance bonding applications and contribute to sustainability goals through improved environmental profiles.

- In February 2025, 3M launched an advanced structural adhesive, Scotch-Weld EC-9300, designed for lightweight composites used in aerospace and defense industries. The new adhesive delivers superior strength-to-weight ratio and high fatigue resistance, aligning with industry trends toward fuel efficiency and material optimization. This development reinforces 3M’s leadership in high-end structural adhesive technologies for critical applications.

- In August 2024, Arkema expanded its Bostik smart adhesives portfolio by acquiring a specialty adhesives plant in Vietnam. This strategic move is intended to increase its production capabilities in Southeast Asia and respond to rising regional demand from the packaging and construction sectors. The expansion supports Bostik’s regional footprint and enhances supply chain responsiveness for fast-growing Asian markets.

- In June 2024, Sika AG unveiled a new-generation silane-modified polymer (SMP)-based sealant, Sikaflex®-521 Evolution, formulated for transportation and industrial assembly. Offering improved elasticity, UV resistance, and green chemistry credentials, this innovation meets tightening regulatory requirements and end-user expectations for sustainable sealant technologies.

- In January 2024, H.B. Fuller introduced TEC® CleanBond™, a next-gen water-based adhesive designed for use in hygiene and medical applications. It provides strong adhesion to low-energy surfaces, improved skin compatibility, and minimal residue, making it ideal for wound care, wearable devices, and medical tapes. This launch is expected to boost H.B. Fuller’s presence in the fast-growing medical adhesives segment.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Adhesives Sealants Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Adhesives Sealants Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Adhesives Sealants Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.