Global Adtech Market

Market Size in USD Billion

CAGR :

%

USD

649.45 Billion

USD

1,911.93 Billion

2024

2032

USD

649.45 Billion

USD

1,911.93 Billion

2024

2032

| 2025 –2032 | |

| USD 649.45 Billion | |

| USD 1,911.93 Billion | |

|

|

|

|

AdTech Market Size

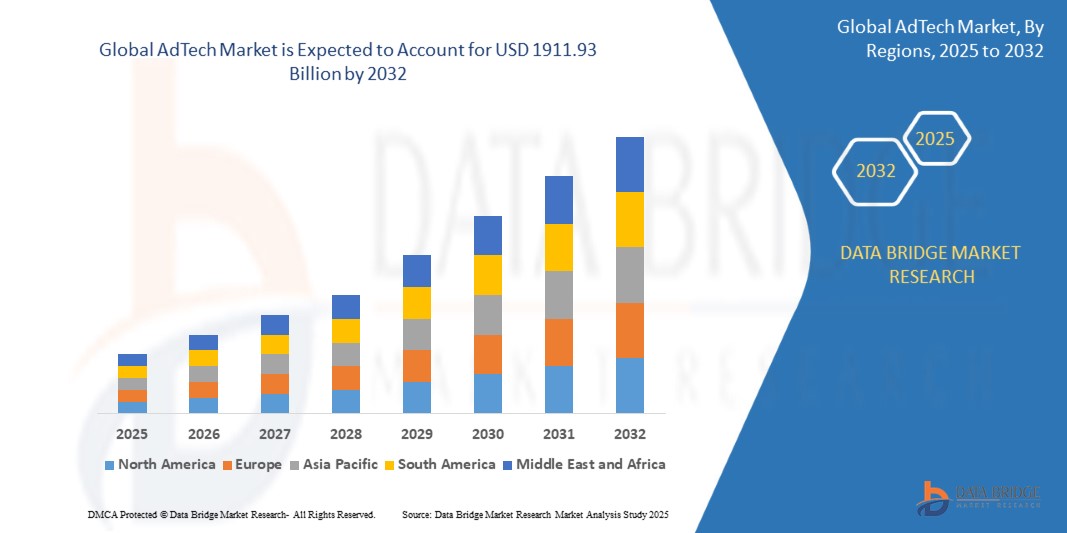

- The global AdTech market size was valued at USD 649.45 billion in 2024 and is expected to reach USD 1911.93 billion by 2032, at a CAGR of 14.45% during the forecast period

- The market growth is largely fueled by the increasing adoption of programmatic advertising and AI-driven platforms, enabling advertisers to automate media buying and deliver personalized campaigns at scale. The rising use of big data analytics, coupled with technological advancements in targeting and measurement, is driving digitalization across industries such as retail, BFSI, media, and healthcare

- Furthermore, growing demand for personalized, engaging, and cross-platform advertising experiences is establishing AdTech as the cornerstone of modern marketing strategies. These converging factors are accelerating the uptake of AdTech solutions, thereby significantly boosting the industry’s growth

AdTech Market Analysis

- AdTech encompasses platforms and technologies such as demand-side platforms (DSPs), supply-side platforms (SSPs), data management platforms (DMPs), and ad networks that facilitate digital advertising across mobile, web, and emerging channels. These solutions empower advertisers to manage campaigns, optimize ad spend, and target audiences with higher precision by leveraging data-driven insights

- The escalating demand for AdTech is primarily fueled by the rapid growth of digital media consumption, expansion of e-commerce, and rising mobile device penetration. Increasing emphasis on ROI-driven marketing and the integration of AI, AR/VR, and advanced analytics into advertising platforms further propel the market’s evolution, making it an essential component of global digital transformation strategies

- North America dominated the AdTech market with a share of 35.5% in 2024, due to strong digital advertising expenditures and the widespread adoption of programmatic platforms across industries

- Asia-Pacific is expected to be the fastest growing region in the AdTech market during the forecast period due to rapid urbanization, growing internet penetration, and increasing digital media consumption across countries such as China, India, and Japan

- Demand-Side Platforms (DSPs) segment dominated the market with a market share of 33.5% in 2024, due to its critical role in enabling advertisers to automate media buying, optimize campaigns in real-time, and efficiently target audiences across multiple channels. The rise of programmatic advertising and AI-driven decision-making has further strengthened the adoption of DSPs, as brands and agencies increasingly rely on them for cost-effective, data-driven campaigns. Their scalability, integration with data analytics, and ability to deliver measurable ROI make DSPs the backbone of AdTech strategies

Report Scope and AdTech Market Segmentation

|

Attributes |

AdTech Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

AdTech Market Trends

Growth of Programmatic and AI-Driven Advertising

- The AdTech industry is experiencing rapid transformation through the expansion of programmatic advertising and AI-driven platforms, enabling marketers to automate ad buying and deliver highly targeted campaigns at scale. This shift is allowing brands to maximize efficiency and ROI in competitive digital markets

- For instance, The Trade Desk has pioneered programmatic ad solutions powered by AI, helping advertisers optimize real-time bidding and campaign targeting across multiple digital channels. Their platform demonstrates how AI enhances performance and operational agility within advertising ecosystems

- The increasing capability of AI algorithms to analyze vast consumer datasets has made campaigns more precise and personalized. By identifying user preferences, behavioral patterns, and context-based triggers, AI-driven AdTech produces greater engagement and more measurable outcomes for advertisers

- In addition, programmatic platforms are expanding efficiency in omnichannel environments by unifying ad delivery across mobile, web, connected TV, and emerging digital spaces. This ensures consistent messaging for consumers, reducing fragmentation in complex advertising journeys

- As competition in digital markets intensifies, programmatic and AI integration is pushing advertisers to embrace advanced optimization strategies. Predictive analytics and automated decisioning are becoming central to AdTech platforms, creating new standards for precision in advertising

- Altogether, the ongoing integration of AI-powered intelligence with programmatic solutions highlights a pivotal trend reshaping the AdTech landscape, confirming its role as a cornerstone of modern marketing strategies in a highly fragmented digital ecosystem

AdTech Market Dynamics

Driver

Rising Digital Media Consumption

- The surge in digital media usage is directly fueling growth in the AdTech sector, as advertisers allocate increasing budgets toward online platforms. Streaming services, social media, and digital news outlets are now central channels for reaching target audiences effectively

- For instance, companies such as Google and Meta Platforms dominate the digital ad space by leveraging vast consumer engagement on platforms such as YouTube, Instagram, and Facebook. Their investments in advanced AdTech infrastructures support ongoing demand for precision advertising solutions

- The proliferation of smartphones and high-speed internet access across emerging markets is further driving digital content consumption. Consumers are spending larger portions of their daily lives interacting with digital media, providing advertisers with expanded opportunities for engagement

- In addition, the rising prominence of video, influencer content, and connected TV is diversifying digital consumption patterns. AdTech platforms are adapting by delivering integrated, multi-format campaigns that meet consumers wherever they are active online

- The continued rise in screen time and digital interactions confirms digital media consumption as a structural driver. As this trend gains further strength, the AdTech industry will remain central to helping brands engage audiences with greater relevance and efficiency

Restraint/Challenge

Data Privacy Regulations and Compliance Issues

- Data privacy challenges are imposing significant constraints on the AdTech sector as global regulations become stricter. New privacy laws such as GDPR in Europe and CCPA in California govern how consumer data is collected, stored, and used, placing pressure on advertising practices

- For instance, platforms such as Apple have introduced privacy features such as App Tracking Transparency, which have disrupted established targeting models for advertisers. Many AdTech providers must adjust strategies in response to declining access to third-party identifiers

- Compliance with fragmented regulatory frameworks across multiple jurisdictions complicates operations for global advertisers. Enterprises must invest heavily in compliance tools and legal audits, while ensuring user consent protocols do not harm customer engagement strategies

- In addition, the growing consumer awareness of data usage practices has intensified demand for transparency. Brands risk reputational damage and financial penalties when data privacy protections are insufficient or miscommunicated, raising stakes for AdTech providers

- Addressing these concerns will require stronger emphasis on first-party data strategies, consent-based targeting, and privacy-centric innovations. Building consumer trust while meeting regulatory compliance will be critical in ensuring the sustainable growth of the AdTech market

AdTech Market Scope

The market is segmented on the basis of solution, advertising type, enterprise size, platform, and industry vertical.

• By Solution

On the basis of solution, the AdTech market is segmented into Demand-Side Platforms (DSPs), Supply-Side Platforms (SSPs), Ad Networks, Data Management Platforms (DMPs), and Others. The DSP segment dominated the largest market revenue share of 33.5% in 2024, driven by its critical role in enabling advertisers to automate media buying, optimize campaigns in real-time, and efficiently target audiences across multiple channels. The rise of programmatic advertising and AI-driven decision-making has further strengthened the adoption of DSPs, as brands and agencies increasingly rely on them for cost-effective, data-driven campaigns. Their scalability, integration with data analytics, and ability to deliver measurable ROI make DSPs the backbone of AdTech strategies.

The DMP segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the escalating importance of first-party and third-party data in crafting hyper-personalized advertising experiences. As privacy regulations such as GDPR and CCPA reshape data practices, DMPs are becoming essential for unifying and analyzing customer data while ensuring compliance. Their growing integration with DSPs and SSPs enhances cross-channel targeting precision, making them indispensable in an era where advertisers demand granular audience insights and measurable campaign effectiveness.

• By Advertising Type

On the basis of advertising type, the AdTech market is segmented into Programmatic Advertising, Search Advertising, Display Advertising, Mobile Advertising, Email Marketing, Native Advertising, and Others. Programmatic advertising dominated the largest market revenue share in 2024, as advertisers favored automated, AI-powered platforms for buying and selling ad space in real time. Its efficiency in audience segmentation, scalability across digital channels, and strong ROI outcomes have made programmatic the preferred choice for both large enterprises and SMEs. Brands are increasingly prioritizing programmatic campaigns due to their measurable outcomes and ability to integrate with omnichannel strategies.

Mobile advertising is expected to witness the fastest growth from 2025 to 2032, driven by the rapid increase in smartphone penetration, mobile app usage, and the dominance of social media platforms as advertising hubs. With consumers spending a significant portion of their time on mobile devices, advertisers are allocating larger shares of budgets to mobile-first campaigns. The growth of location-based targeting, mobile commerce, and video ads on mobile further boosts this segment, making it the central pillar of next-generation digital ad strategies.

• By Enterprise Size

On the basis of enterprise size, the AdTech market is segmented into Small and Medium Enterprises (SMEs) and Large Enterprises. The large enterprise segment dominated the market revenue share in 2024, supported by their substantial advertising budgets and focus on advanced data-driven campaign execution. Large enterprises extensively use AdTech solutions such as DSPs, DMPs, and SSPs to optimize global campaigns, drive personalization, and track consumer journeys across channels. Their emphasis on cross-border campaigns and integration of AI-driven tools further reinforces their dominance in this segment.

The SME segment is projected to register the fastest growth from 2025 to 2032, as smaller businesses increasingly adopt AdTech platforms to compete with established brands. SMEs are leveraging cost-effective programmatic platforms, social media advertising, and data analytics to expand their reach and acquire customers more efficiently. Cloud-based AdTech solutions and self-service platforms are enabling SMEs to manage and optimize campaigns without heavy IT infrastructure, fueling accelerated adoption across diverse industries.

• By Platform

On the basis of platform, the AdTech market is segmented into Mobile, Web, and Others. The web segment dominated the largest market share in 2024, owing to the long-standing reliance on desktop-based advertising formats, including search and display. Enterprises continue to value web platforms for their higher ad visibility, well-established formats, and the ability to reach audiences engaged in transactional and informational searches. With strong adoption in e-commerce and B2B advertising, web platforms remain foundational to digital advertising strategies.

The mobile segment is projected to witness the fastest growth from 2025 to 2032, attributed to the surge in mobile device usage, app ecosystem expansion, and the increasing preference for mobile-first consumer interactions. Advertisers are increasingly focusing on in-app ads, mobile video, and interactive formats that engage audiences directly within their smartphones. The rise of 5G, mobile commerce, and immersive experiences through AR/VR advertising further strengthens mobile as the most dynamic platform for future AdTech growth.

• By Industry Vertical

On the basis of industry vertical, the AdTech market is segmented into Media & Entertainment, BFSI, Education, Retail & Consumer Goods, IT & Telecom, Healthcare, and Others. The media & entertainment segment dominated the largest market revenue share in 2024, as streaming platforms, online gaming, and digital content providers heavily invest in targeted advertising to monetize user engagement. The rising consumption of OTT content, video streaming, and personalized recommendations has made media & entertainment the frontrunner in leveraging AdTech solutions for revenue generation.

The retail & consumer goods segment is expected to register the fastest growth from 2025 to 2032, driven by the surge in e-commerce, direct-to-consumer (D2C) models, and personalized shopping experiences. Retailers are adopting programmatic, mobile, and native advertising to enhance customer engagement and drive conversions across digital touchpoints. The integration of AdTech with loyalty programs, data-driven promotions, and omnichannel campaigns makes this vertical highly adaptive to evolving consumer behavior, propelling rapid expansion in the coming years.

AdTech Market Regional Analysis

- North America dominated the AdTech market with the largest revenue share of 35.5% in 2024, driven by strong digital advertising expenditures and the widespread adoption of programmatic platforms across industries

- The region benefits from advanced technological infrastructure, a robust ecosystem of digital publishers, and advertisers with large budgets aiming for precision targeting

- High adoption of mobile devices, social media penetration, and the presence of major AdTech companies further strengthen the region’s leadership. The growing focus on AI-driven personalization and data-driven decision-making continues to accelerate demand for AdTech platforms in North America

U.S. AdTech Market Insight

The U.S. AdTech market captured the largest revenue share in 2024 within North America, fueled by the rapid uptake of programmatic advertising and high investments by leading brands across retail, BFSI, and media sectors. The U.S. leads in leveraging data management platforms and AI-based targeting solutions, reflecting the maturity of its digital ecosystem. Strong consumer adoption of e-commerce, mobile apps, and streaming services ensures a steady demand for AdTech platforms. The dominance of tech giants such as Google, Meta, and Amazon also reinforces the U.S. market’s central role in shaping global AdTech innovation.

Europe AdTech Market Insight

The Europe AdTech market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the enforcement of strict data protection laws such as GDPR, which has increased demand for compliant advertising solutions. European advertisers are shifting towards transparent and privacy-centric platforms while maintaining high investments in programmatic and display advertising. The growing popularity of OTT platforms, online retail, and digital banking services is fueling AdTech adoption across industries. Furthermore, the region’s focus on sustainable and ethical advertising practices is shaping innovative approaches in digital marketing.

U.K. AdTech Market Insight

The U.K. AdTech market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by its highly digitalized consumer base and strong retail and e-commerce presence. With London serving as a hub for global advertising agencies, the U.K. market benefits from advanced adoption of AI-driven and omnichannel advertising strategies. Increasing demand for personalized consumer engagement, combined with robust mobile usage, continues to stimulate investments in AdTech solutions.

Germany AdTech Market Insight

The Germany AdTech market is expected to expand at a considerable CAGR, fueled by its emphasis on innovation, sustainability, and strict adherence to privacy standards. German advertisers are adopting DMPs and programmatic solutions to improve targeting while maintaining compliance with local and EU regulations. The country’s well-developed industrial and retail sectors, coupled with a strong culture of digital adoption, make Germany a critical growth hub for AdTech in Europe.

Asia-Pacific AdTech Market Insight

The Asia-Pacific AdTech market is poised to grow at the fastest CAGR during 2025 to 2032, supported by rapid urbanization, growing internet penetration, and increasing digital media consumption across countries such as China, India, and Japan. Rising smartphone adoption, coupled with the expansion of e-commerce and mobile-first strategies, is driving demand for targeted and programmatic advertising solutions. Government initiatives supporting digital transformation, along with the emergence of regional AdTech startups, are further boosting the market.

Japan AdTech Market Insight

The Japan AdTech market is witnessing strong growth due to its tech-savvy consumer base, high adoption of mobile advertising, and the popularity of digital entertainment platforms. Advertisers are increasingly integrating AI, big data, and IoT-driven insights to deliver hyper-personalized campaigns. In addition, Japan’s focus on precision and innovation supports the adoption of advanced AdTech solutions across retail, finance, and media sectors.

China AdTech Market Insight

The China AdTech market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s vast internet user base, booming e-commerce industry, and dominance of domestic digital giants such as Alibaba, Tencent, and Baidu. Rapid urbanization and the expansion of mobile-first consumer behavior have accelerated programmatic and mobile advertising adoption. With strong government backing for smart city and digital infrastructure initiatives, China continues to be the largest and most dynamic AdTech hub in the region.

AdTech Market Share

The AdTech industry is primarily led by well-established companies, including:

- Google LLC (U.S.)

- Meta Platforms Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Criteo S.A. (France)

- Alibaba Group Holding Limited (China)

- Microsoft Corporation (U.S.)

- Adobe Inc. (U.S.)

- Quantcast (U.S.)

- Zeta Global Holdings Corp. (U.S.)

- Adform (Denmark)

Latest Developments in AdTech Market

- In February 2025, Amazon introduced its generative AI-powered advertising tool within Amazon Ads, enabling brands to automatically create engaging image and text-based ad creatives. This development is significantly impacting the market by lowering creative production costs and allowing advertisers, especially SMEs, to compete with larger players through high-quality campaigns. By leveraging Amazon’s rich commerce data, the tool enhances personalization and boosts campaign efficiency, further strengthening Amazon’s positioning in retail media advertising

- In 2025, Taboola partnered with Microsoft to sell display ads across Microsoft’s properties, including MSN and Outlook. This collaboration is reshaping the AdTech landscape by expanding Taboola’s native advertising inventory and empowering advertisers with Microsoft’s robust first-party data. The move improves targeting precision and allows brands to deliver more relevant, personalized ads to consumers across Microsoft’s ecosystem, thus driving higher engagement and performance in digital campaigns

- In 2024, Meta launched its “Immersive Ad Experience” powered by augmented reality (AR) and virtual reality (VR) technologies. This launch is transforming the digital advertising space by providing interactive and engaging formats that go beyond traditional ads. By enabling advertisers to connect with users in metaverse environments, Meta is creating new opportunities for brand storytelling, deeper consumer engagement, and positioning immersive ads as a cornerstone of the future AdTech ecosystem

- In 2024, Microsoft made Copilot generally available in the Microsoft Advertising Platform. This AI-driven assistant is reshaping advertising workflows by simplifying campaign creation, responding to queries in real time, and maximizing marketing outcomes. With generative AI at its core, Copilot enhances productivity, sparks creative campaign ideas, and enables advertisers to focus more on strategic decision-making. Its integration marks a significant step in mainstreaming AI-powered advertising, raising the overall efficiency of the AdTech market

- In 2024, Google launched Shopping Ads on Google Lens, tapping into the platform’s 20 billion monthly visual searches. This innovation has diversified Google’s AdTech offerings by merging visual search with commerce, giving advertisers the ability to target consumers at moments of high purchase intent. For the market, this development strengthens visual commerce as a growth driver, especially in retail and e-commerce advertising, while positioning Google Lens as a critical channel for product discovery and shopping-related engagement

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.