Global Advanced Ceramic Additives Market

Market Size in USD Million

CAGR :

%

USD

602.26 Million

USD

931.32 Million

2024

2032

USD

602.26 Million

USD

931.32 Million

2024

2032

| 2025 –2032 | |

| USD 602.26 Million | |

| USD 931.32 Million | |

|

|

|

|

Advanced Ceramic Additives Market Size

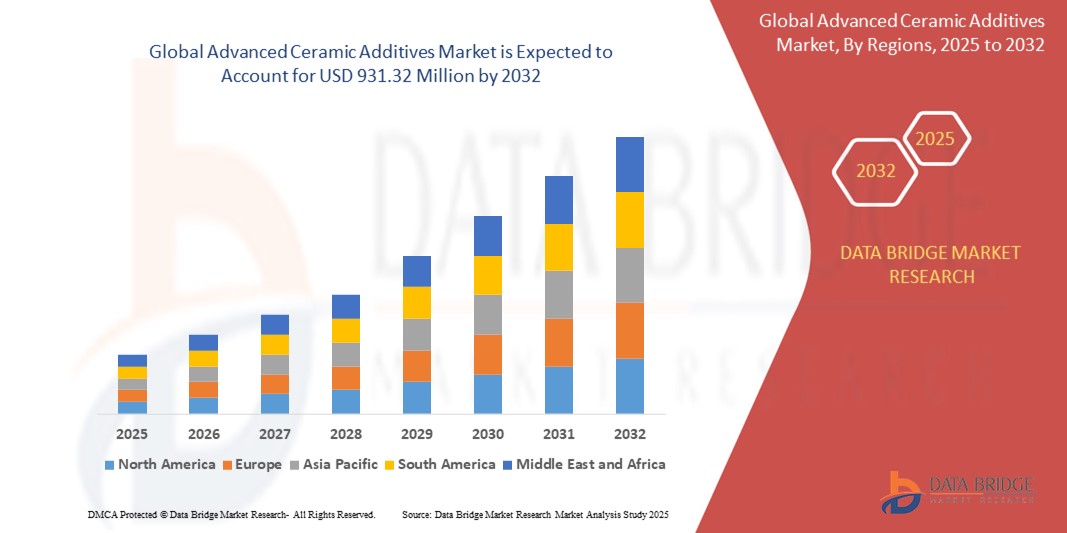

- The global advanced ceramic additives market size was valued at USD 602.26 million in 2024 and is expected to reach USD 931.32 million by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by increasing demand for high-performance materials across industries such as electronics, automotive, aerospace, and medical, where advanced ceramic additives enhance strength, durability, and thermal stability in end products

- Furthermore, rising environmental concerns and regulatory pressures are encouraging the use of ceramic-based solutions due to their recyclability, corrosion resistance, and energy-efficient processing, significantly accelerating adoption across manufacturing sectors and boosting overall market expansion

Advanced Ceramic Additives Market Analysis

- Advanced ceramic additives are specialized compounds used to improve the processing and performance characteristics of ceramic materials, including binders, dispersants, and coatings that optimize strength, thermal resistance, and mechanical stability

- Market demand is driven by rapid industrialization, miniaturization of electronic components, growing adoption of additive manufacturing, and the need for sustainable and lightweight materials across diverse sectors, positioning ceramic additives as a key enabler of next-generation technologies

- North America dominated the advanced ceramic additives market with a share of 35.5% in 2024, due to the strong presence of advanced manufacturing sectors and high demand for high-performance materials across electronics, aerospace, and medical applications

- Asia-Pacific is expected to be the fastest growing region in the advanced ceramic additives market during the forecast period due to rapid industrialization, urban infrastructure development, and growing investments in electronics and clean energy technologies

- Alumina ceramics segment dominated the market with a market share of 41.8% in 2024, due to its excellent mechanical strength, high thermal stability, and widespread usage across electrical insulation and cutting tool applications. Its chemical resistance and cost-effectiveness make it the preferred choice in large-volume manufacturing settings, particularly in electronics and automotive industries. The segment continues to benefit from consistent demand in high-performance electrical components and protective mechanical parts

Report Scope and Advanced Ceramic Additives Market Segmentation

|

Attributes |

Advanced Ceramic Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Advanced Ceramic Additives Market Trends

“Growing Demand for Lightweight Materials”

- The advanced ceramic additives market is growing due to increasing demand for lightweight, durable, and thermally stable materials in high-performance applications spanning automotive, aerospace, and electronics industries

- For instance, the U.S. Department of Commerce projects rising adoption of electric vehicles and miniaturization of electronics to drive demand for lightweight advanced ceramics incorporating specialized additives, with the market valued at around USD 4.5 billion in 2025

- Advances in nanotechnology and additive manufacturing are improving the performance characteristics of ceramic additives, enabling lighter components with enhanced mechanical and thermal properties

- Increasing requirements for fuel efficiency and reduced emissions in transportation sectors are pushing manufacturers to incorporate lightweight ceramic additives in composites and coatings

- Consumer electronics demand for miniaturized yet robust components fuels growth in additives that enhance electrical insulation and heat resistance without adding significant weight

- Environmental regulations encouraging material efficiency and recyclability are motivating R&D toward multifunctional ceramic additives that reduce overall material usage while maintaining product performance

Advanced Ceramic Additives Market Dynamics

Driver

“Growing Electronics Industry”

- Expansion of the global electronics sector is a primary driver for advanced ceramic additives, owing to the need for high-performance substrates, insulators, and thermally conductive materials in semiconductors, PCBs, and sensors

- For instance, companies integrating advanced ceramic additives into electronic components benefit from enhanced thermal management and miniaturization demanded by the smartphone, automotive electronics, and renewable energy markets

- The rise of 5G technology, IoT devices, and electric vehicles further elevates the requirement for durable, lightweight ceramic-enhanced materials that sustain performance under high operational stress

- Increasing investment in research and development for flexible and wearable electronics creates opportunities for novel ceramic additive formulations optimized for mechanical flexibility and conductivity

- Supply chain improvements focusing on rare earth elements and precision processing technologies support the steady growth of additive volumes used in electronics manufacturing

Restraint/Challenge

“High Production Costs”

- The production of advanced ceramic additives involves energy-intensive processes, reliance on costly raw materials such as rare earth elements, and sophisticated manufacturing techniques, leading to high overall costs that can limit widespread adoption

- For instance, fluctuations in alumina and zirconia prices driven by China’s control of rare earth supply significantly affect cost structures for ceramic additive manufacturers, complicating price stability and profitability

- Energy consumption accounts for 40–50% of manufacturing expenses, making the sector vulnerable to volatile energy prices as seen during geopolitical conflicts that disrupted natural gas supplies and led to plant shutdowns

- The complexity of manufacturing high-purity, nano-sized additives requires significant capital investment in specialized equipment and skilled personnel, imposing barriers especially for smaller producers

- These high initial and operational costs can hinder integration of advanced ceramic additives in cost-sensitive end-use industries, slowing market penetration despite performance advantages

Advanced Ceramic Additives Market Scope

The market is segmented on the basis of material, product, and end-user industry.

- By Material

On the basis of material, the advanced ceramic additives market is segmented into alumina ceramics, titanate ceramics, zirconate ceramics, and ferrite ceramics. The alumina ceramics segment dominated the market with the largest revenue share of 41.8% in 2024, attributed to its excellent mechanical strength, high thermal stability, and widespread usage across electrical insulation and cutting tool applications. Its chemical resistance and cost-effectiveness make it the preferred choice in large-volume manufacturing settings, particularly in electronics and automotive industries. The segment continues to benefit from consistent demand in high-performance electrical components and protective mechanical parts.

The zirconate ceramics segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by its superior thermal shock resistance and applicability in extreme environments. Zirconate ceramics are increasingly adopted in aerospace, medical, and energy industries for their exceptional resistance to high temperatures and corrosion. The rising focus on advanced thermal barrier coatings and biocompatible materials is also contributing to the segment’s robust growth trajectory.

- By Product

On the basis of product, the advanced ceramic additives market is segmented into dispersant, binder, monolithic, matrix, and coatings. The binder segment accounted for the largest revenue share in 2024, owing to its crucial role in improving the mechanical integrity and shape retention of ceramic bodies during forming and sintering processes. Binders are widely utilized in structural and functional ceramic manufacturing, where precise shaping and high dimensional stability are essential. The demand for binders is reinforced by the ongoing expansion of additive manufacturing techniques and powder injection molding in ceramic processing.

The coatings segment is anticipated to grow at the highest CAGR from 2025 to 2032, driven by the increasing use of ceramic coatings in high-wear and corrosive environments. These coatings provide superior surface hardness, thermal insulation, and resistance to oxidation, making them indispensable in aerospace, automotive exhaust systems, and electronic device protection. Technological advances in deposition techniques and nanostructured ceramic coatings are further propelling this segment’s rapid adoption.

- By End-User Industry

On the basis of end-user industry, the advanced ceramic additives market is segmented into electronics and electricals, automotive, environmental, medical, and machinery. The electronics and electricals segment held the largest market revenue share in 2024, supported by the increasing use of advanced ceramics in capacitors, insulators, substrates, and semiconductor components. Their electrical insulation properties, thermal stability, and miniaturization capabilities make them vital in the development of compact and high-performance electronic devices. The segment benefits from growing demand for consumer electronics, electric vehicles, and 5G communication infrastructure.

The medical segment is expected to register the fastest growth rate from 2025 to 2032, driven by the surging use of bioceramics in orthopedic implants, dental applications, and diagnostic equipment. The high biocompatibility, non-toxicity, and wear resistance of ceramic additives make them ideal for long-term implantation and imaging applications. Technological advancements in regenerative medicine and minimally invasive surgical tools are further amplifying the role of ceramics in the healthcare sector.

Advanced Ceramic Additives Market Regional Analysis

- North America dominated the advanced ceramic additives market with the largest revenue share of 35.5% in 2024, driven by the strong presence of advanced manufacturing sectors and high demand for high-performance materials across electronics, aerospace, and medical applications

- The region benefits from substantial investments in R&D, a well-established industrial base, and technological innovations that support the widespread adoption of advanced ceramic additives

- Growth is further reinforced by the presence of key market players, robust academic research, and the increasing need for lightweight, durable materials in both defense and energy sectors

U.S. Advanced Ceramic Additives Market Insight

The U.S. advanced ceramic additives market accounted for the largest revenue share in 2024 within North America, propelled by high consumption in electronics, semiconductors, and automotive industries. The country’s focus on precision engineering, sustainability, and renewable energy has driven increased adoption of ceramic additives for applications such as battery components, filtration systems, and medical implants. The U.S. market is further strengthened by strong university-industry collaborations and growing usage of 3D printing and additive manufacturing technologies incorporating ceramics.

Europe Advanced Ceramic Additives Market Insight

The Europe advanced ceramic additives market is projected to expand at a significant CAGR over the forecast period, supported by stringent environmental regulations, a strong industrial base, and increasing demand for energy-efficient and sustainable materials. Applications in clean energy technologies, electric vehicles, and environmental protection systems are boosting the use of ceramic additives. European companies are also adopting advanced ceramic solutions to improve durability and reduce weight in automotive and aerospace components, promoting further market growth.

U.K. Advanced Ceramic Additives Market Insight

The U.K. advanced ceramic additives market is expected to grow at a notable CAGR, backed by an innovation-driven manufacturing sector and rising emphasis on sustainability and circular economy practices. Demand is being driven by applications in healthcare, electronics, and environmental monitoring systems. Government-backed research initiatives and strategic partnerships with universities are also supporting the development and commercialization of advanced ceramic materials in the U.K.

Germany Advanced Ceramic Additives Market Insight

Germany’s advanced ceramic additives market is forecast to grow steadily, driven by the country’s engineering excellence, leadership in automotive innovation, and commitment to renewable technologies. The strong presence of global manufacturing giants and a well-established infrastructure for materials science research are supporting the use of ceramic additives in high-precision and high-durability applications. Environmental policies and energy efficiency mandates are also accelerating the use of ceramic coatings and dispersants across various sectors.

Asia-Pacific Advanced Ceramic Additives Market Insight

The Asia-Pacific advanced ceramic additives market is projected to grow at the fastest CAGR from 2025 to 2032, fueled by rapid industrialization, urban infrastructure development, and growing investments in electronics and clean energy technologies. Countries such as China, Japan, and South Korea are at the forefront of this growth, supported by government incentives, low-cost manufacturing, and rising demand for high-performance materials in domestic production.

Japan Advanced Ceramic Additives Market Insight

Japan’s market for advanced ceramic additives is growing steadily, driven by the country’s established electronics and automotive industries and a culture of precision manufacturing. Advanced ceramics are widely used in high-frequency devices, semiconductor packaging, and medical equipment. The push for energy-efficient solutions and environmental performance is encouraging manufacturers to adopt ceramic-based coatings and matrices.

China Advanced Ceramic Additives Market Insight

China dominated the Asia-Pacific region with the largest revenue share in 2024, supported by robust industrial output, government-led innovation programs, and a massive manufacturing base. The country’s strong presence in consumer electronics, electric vehicles, and renewable energy sectors is driving the demand for advanced ceramic additives. Domestic producers are investing in material science R&D and scaling up ceramic additive production for mass-market applications across multiple industries.

Advanced Ceramic Additives Market Share

The advanced ceramic additives industry is primarily led by well-established companies, including:

- 3DCeram (France)

- AGC Inc. (Japan)

- BioCote Limited (U.K.)

- BASF SE (Germany)

- CARBO Ceramics Inc. (U.S.)

- ENVISIONTEC INC. (U.S.)

- EOS (Germany)

- Exone (U.S.)

- Lamberti S.p.A (Italy)

- MakerBot Industries, LLC (U.S.)

- Novabeans Prototyping Labs LLP (India)

- Optomec, Inc. (U.S.)

- SANYO CHEMICAL INDUSTRIES, LTD. (Japan)

- Johnson Matthey (U.K.)

- Wöllner GmbH (Germany)

- Bentonite Performance Minerals, LLC (U.S.)

- Ferro Corporation (U.S.)

- Stratasys Ltd. (U.S.)

- Xjet Applied Ceramics, Inc. (Israel)

- Ortech Advanced Ceramics (U.S.)

- Anoop Ceramics (India)

- Vinayak Techno Ceramics (India)

- Khyati Ceramics (India)

Latest Developments in Global Advanced Ceramic Additives Market

- In September 2024, Honeywell’s integration of ceramic Additive Manufacturing into jet engine production marks a pivotal advancement in the aerospace sector, significantly impacting the advanced ceramic additives market. By developing a new generation of lighter, quieter, and more powerful turbofan engines capable of running on 100% sustainable aviation fuel, Honeywell is accelerating the adoption of high-performance ceramic materials. This move shortens the engine development timeline and also boosts demand for ceramic additives used in precision-engineered, sustainable aviation components

- In January 2023, BASF’s Monomers division announced a comprehensive sustainability roadmap aimed at expanding its product portfolio with low-CO2 footprint solutions, directly influencing the advanced ceramic additives market. The initiative to introduce circular economy options across all major product lines by 2025 underscores a broader shift toward environmentally responsible manufacturing practices. This strategic direction is expected to increase the use of eco-friendly ceramic additives in industrial applications, aligning with the growing market demand for sustainable materials

- In April 2023, Mills Rock Advanced Material, a division of Mills Rock Capital, successfully completed its acquisition of Asbury Carbons, a leading provider of advanced materials solutions. This strategic acquisition is designed to expand Mills Rock Advanced Material’s business portfolio while facilitating further investments in the advanced materials and additive solutions sector. This move positions the company to leverage emerging opportunities in the rapidly evolving market

- In April 2021, CeramTec, in collaboration with the Fraunhofer Institute for Integrated Systems and Device Technology, launched an innovative ceramic power module aimed at enhancing drive inverters for e-mobility solutions. This partnership focused on developing advanced cooling solutions for power electronics within e-mobility drive trains, showcasing CeramTec's commitment to sustainable technology. The official launch of this cutting-edge product was announced for May 2021

- In February 2021, Coorstek announced the establishment of a new manufacturing facility for engineered ceramics in Southeast Asia, specifically in Rayong, Thailand. The expansive facility will span 400,000 square feet and is being developed in phases. The ground-breaking ceremony took place on January 25, 2021, and construction commenced shortly after, marking a significant investment in production capabilities to meet growing demand in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Advanced Ceramic Additives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Advanced Ceramic Additives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Advanced Ceramic Additives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.