Global Advanced Driver Assistance System Adas Sensors Market

Market Size in USD Billion

CAGR :

%

USD

24.95 Billion

USD

71.69 Billion

2024

2032

USD

24.95 Billion

USD

71.69 Billion

2024

2032

| 2025 –2032 | |

| USD 24.95 Billion | |

| USD 71.69 Billion | |

|

|

|

|

Advanced Driver Assistance System (ADAS) Sensors Market Size

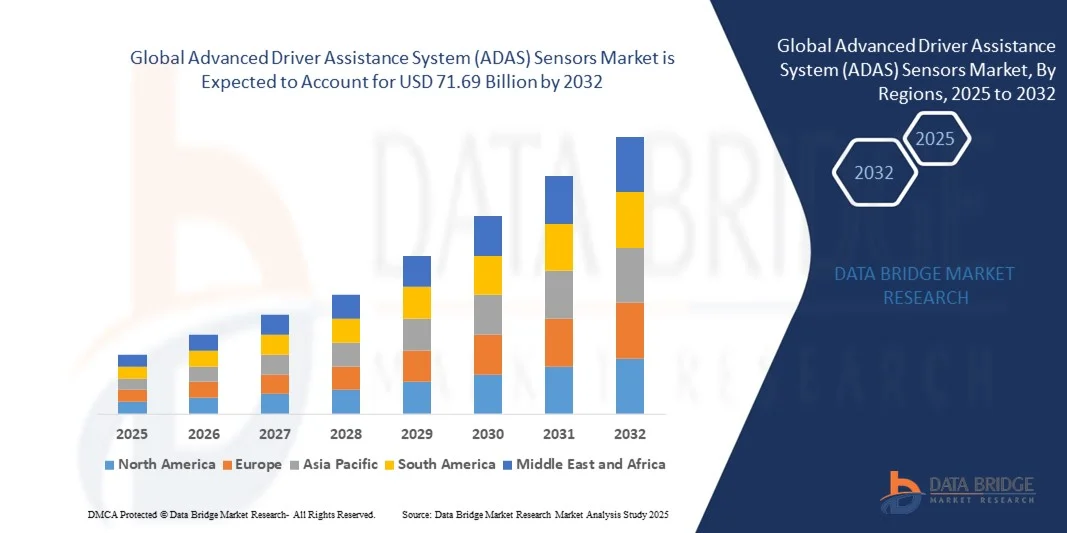

- The global advanced driver assistance system (ADAS) sensors market size was valued at USD 24.95 billion in 2024 and is expected to reach USD 71.69 billion by 2032, at a CAGR of 14.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of autonomous and semi-autonomous vehicles, rising emphasis on vehicle and passenger safety, and technological advancements in radar, LiDAR, camera, and ultrasonic sensors

- The growing integration of ADAS features in mid-range and economy vehicles is expanding the overall market scope, as automakers aim to make advanced safety technologies more accessible to a wider consumer base

Advanced Driver Assistance System (ADAS) Sensors Market Analysis

- The growing integration of ADAS technologies in vehicles is enhancing driving comfort and safety, driving steady market expansion

- Advancements in sensor fusion technologies—combining data from multiple sensors—are improving the accuracy and reliability of ADAS functions such as adaptive cruise control, lane departure warning, and automatic emergency braking

- North America dominated the ADAS sensors market with the largest revenue share of 38.5% in 2024, driven by high adoption of advanced vehicle safety technologies, stringent government safety regulations, and increasing consumer demand for semi-autonomous and connected vehicles

- Asia-Pacific region is expected to witness the highest growth rate in the global advanced driver assistance system (ADAS) sensors market, driven by rising urbanization, increasing vehicle production, government initiatives promoting road safety, and expanding automotive electronics manufacturing in countries such as China, Japan, and South Korea

- The radar sensor segment held the largest market revenue share in 2024, driven by its long-range detection capability, high accuracy in various weather conditions, and widespread adoption in adaptive cruise control and collision avoidance systems. Radar sensors provide reliable performance for both passenger and commercial vehicles, supporting real-time decision-making for safer driving.

Report Scope and Advanced Driver Assistance System (ADAS) Sensors Market Segmentation

|

Attributes |

Advanced Driver Assistance System (ADAS) Sensors Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Advanced Driver Assistance System (ADAS) Sensors Market Trends

Rise of Sensor Fusion and AI-Driven Safety Systems

- The growing integration of sensor fusion technologies and AI-driven algorithms is transforming the ADAS landscape by enabling real-time, multi-sensor data processing for enhanced vehicle safety. Combining inputs from radar, LiDAR, cameras, and ultrasonic sensors allows for accurate detection of obstacles, pedestrians, and road conditions, supporting timely driver interventions and automated responses. These technologies also enable predictive analytics for collision avoidance and adaptive driving strategies, improving overall traffic safety

- Increasing demand for high-precision ADAS in urban and congested traffic environments is accelerating the adoption of advanced sensor suites. These systems improve accident prevention and traffic management, particularly in regions with rising vehicle density. Integration with vehicle-to-everything (V2X) communication and intelligent traffic infrastructure further enhances efficiency and reduces congestion-related incidents

- The declining cost and miniaturization of sensors are making advanced ADAS solutions accessible for mid-range and economy vehicles. Automakers can integrate features such as adaptive cruise control, lane departure warning, and automated parking without significantly increasing vehicle cost, thereby expanding market penetration. In addition, modular sensor designs allow easier upgrades and retrofitting in existing vehicle platforms

- For instance, in 2024, several European and Asian automakers reported enhanced safety ratings after equipping new vehicle models with AI-enhanced sensor fusion packages. These systems enabled early detection of pedestrians and cyclists, reducing accident rates and insurance claims while improving overall road safety. Pilot programs in smart cities further validated their performance in complex traffic scenarios

- While ADAS sensor adoption is rapidly growing, its impact relies on continued innovation, regulatory alignment, and consumer awareness. Manufacturers must focus on scalable, cost-effective, and interoperable solutions to fully capitalize on this evolving market. Collaborative initiatives between OEMs and tech providers are also crucial to standardizing sensor protocols and improving compatibility across vehicle models

Advanced Driver Assistance System (ADAS) Sensors Market Dynamics

Driver

Increasing Vehicle Safety Regulations and Rising Demand for Semi-Autonomous Features

- The tightening of vehicle safety regulations globally is pushing automakers to integrate ADAS sensors as standard features. Governments and transport authorities mandate technologies such as automatic emergency braking, blind-spot detection, and lane-keeping assistance to reduce road accidents and fatalities. Compliance with regional safety protocols is driving innovation in cost-effective, scalable sensor systems

- Consumer demand for semi-autonomous and connected vehicles is driving the adoption of advanced ADAS technologies. Drivers increasingly prefer vehicles with features that enhance comfort, reduce fatigue, and support safer driving, even in congested urban areas. Growing awareness of accident risks and insurance incentives also encourages buyers to choose vehicles equipped with advanced driver assistance features

- Investments in AI and machine learning are improving object recognition, predictive capabilities, and real-time decision-making in ADAS systems. This has accelerated the development of next-generation safety solutions capable of supporting higher levels of vehicle autonomy. Integration with cloud-based analytics and over-the-air updates ensures continuous improvement in vehicle safety performance

- For instance, in 2023, several U.S. and Japanese automakers integrated multi-sensor ADAS platforms across flagship models, resulting in improved NCAP safety ratings and positive consumer reception. Pilot deployments in ride-hailing and fleet vehicles demonstrated measurable reductions in accident frequency and response times

- While regulatory compliance and consumer demand are major growth drivers, market expansion depends on continuous innovation, interoperability, and affordability of sensor technologies. Partnerships between OEMs, technology providers, and governments are essential to accelerate adoption and maintain safety standards

Restraint/Challenge

High Cost Of Advanced Sensors And Integration Complexity

- The high cost of sophisticated ADAS sensors such as LiDAR and high-resolution cameras limits adoption in entry-level vehicles. These systems are often reserved for premium models, creating barriers for widespread penetration in emerging markets. R&D expenses and limited mass production further contribute to high price points, delaying broader accessibility

- Complex integration and calibration requirements pose challenges for automakers. Proper alignment of multi-sensor systems is critical for accurate data interpretation, which requires skilled engineers and robust testing infrastructure. Any misalignment or software misconfiguration can reduce sensor effectiveness, creating potential safety risks

- Supply chain constraints, including semiconductor shortages and raw material price volatility, can impact sensor availability and production timelines, restricting market growth. Delays in procurement or manufacturing bottlenecks can result in extended lead times for vehicles equipped with ADAS features

- For instance, in 2024, several European and North American automotive manufacturers reported delays in ADAS-equipped vehicle deliveries due to sensor supply limitations and integration challenges. Some models had to temporarily downgrade safety features until sensor availability improved, impacting market competitiveness

- While sensor technology continues to advance, addressing cost, integration complexity, and supply chain issues is essential for broader adoption, particularly in mid-range and economy vehicle segments. Developing standardized, modular, and cost-effective solutions is key to accelerating global ADAS sensor deployment

Advanced Driver Assistance System (ADAS) Sensors Market Scope

The market is segmented on the basis of sensor type, application, vehicle type, and distribution channel.

- By Sensor Type

On the basis of sensor type, the ADAS sensors market is segmented into Temperature Sensor, Radar Sensor, LiDAR Sensor, Infrared Sensor, Laser Sensor, Ultrasonic Sensor, Pressure Sensor, and Others. The Radar Sensor segment held the largest market revenue share in 2024, driven by its long-range detection capability, high accuracy in various weather conditions, and widespread adoption in adaptive cruise control and collision avoidance systems. Radar sensors provide reliable performance for both passenger and commercial vehicles, supporting real-time decision-making for safer driving.

The LiDAR Sensor segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its precise 3D mapping capabilities and increasing integration in autonomous driving systems. LiDAR sensors are highly valued for enabling accurate object detection, lane tracking, and navigation in complex traffic scenarios.

- By Application

On the basis of application, the ADAS sensors market is segmented into Adaptive Cruise Control (ACC), Adaptive Head Lamp (AHL), Automatic/Intelligent Emergency Braking (AEB), Blind Spot Detection System (BSD), Cross Traffic Alert (CTA), Drowsiness Monitor System (DMS), Lane Departure Warning System (LDS), Night Vision, Park Assist (PA), Surround View Camera System (SVC), Time Pressure Monitoring System, and Others. The Automatic/Intelligent Emergency Braking (AEB) segment held the largest market revenue share in 2024, driven by mandatory safety regulations and increasing consumer demand for collision prevention features. AEB systems enhance driver safety by detecting obstacles and applying brakes automatically.

The Lane Departure Warning System (LDS) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by the rising adoption of semi-autonomous driving features and urban traffic safety requirements. LDS helps maintain lane discipline and reduces accident risks, particularly in congested traffic scenarios.

- By Vehicle Type

On the basis of vehicle type, the ADAS sensors market is segmented into Passenger Cars and Commercial Vehicles. The Passenger Cars segment held the largest market revenue share in 2024, supported by growing consumer preference for enhanced safety features and increasing integration of ADAS sensors in new models. These sensors improve driving safety, comfort, and accident prevention.

The Commercial Vehicles segment is expected to witness the fastest growth rate from 2025 to 2032, driven by fleet operators focusing on accident reduction, cargo protection, and operational efficiency. ADAS sensors in commercial vehicles help monitor surroundings and prevent collisions during logistics and transportation operations.

- By Distribution Channel

On the basis of distribution channel, the ADAS sensors market is segmented into Original Equipment Manufacturer (OEM), Original Equipment Spares (OES), and Independent Aftermarket (IAM). The OEM segment held the largest market revenue share in 2024, as most automakers integrate ADAS sensors during vehicle production to ensure regulatory compliance and enhanced vehicle safety. OEM-installed sensors provide standardized performance and reliable integration with vehicle systems.

The Independent Aftermarket (IAM) segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for retrofitting advanced sensor systems in existing vehicles. IAM growth is supported by expanding service networks and sensor replacement options for older vehicle models.

Advanced Driver Assistance System (ADAS) Sensors Market Regional Analysis

- North America dominated the ADAS sensors market with the largest revenue share of 38.5% in 2024, driven by high adoption of advanced vehicle safety technologies, stringent government safety regulations, and increasing consumer demand for semi-autonomous and connected vehicles

- Consumers in the region highly value the enhanced safety, collision prevention features, and driving convenience offered by vehicles equipped with ADAS sensors

- This widespread adoption is further supported by a technologically advanced automotive industry, strong R&D capabilities, and increasing integration of AI-powered sensor systems, establishing ADAS sensors as a critical component for both passenger and commercial vehicles

U.S. ADAS Sensors Market Insight

The U.S. ADAS sensors market captured the largest revenue share of 82% in 2024 within North America, fueled by the rapid adoption of semi-autonomous and connected vehicles. Automakers are increasingly equipping vehicles with radar, LiDAR, camera, and ultrasonic sensors to enhance safety and comply with federal regulations. The growing demand for adaptive cruise control, automatic emergency braking, and lane-keeping assistance is further propelling market growth. Moreover, integration with advanced driver monitoring systems and connected vehicle platforms is significantly contributing to market expansion.

Europe ADAS Sensors Market Insight

The Europe ADAS sensors market is expected to witness the fastest growth rate from 2025 to 2032, driven by stringent vehicle safety regulations and increasing focus on reducing road accidents. Rising urbanization, coupled with growing adoption of connected and semi-autonomous vehicles, is fostering the integration of ADAS sensors. European consumers and fleet operators are drawn to enhanced safety, traffic efficiency, and fuel savings offered by advanced sensor technologies. The market is witnessing growth across passenger cars and commercial vehicles, with sensor-equipped systems being incorporated into both new and retrofitted models.

U.K. ADAS Sensors Market Insight

The U.K. ADAS sensors market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising safety concerns and government initiatives promoting intelligent transport systems. Increasing consumer awareness of advanced vehicle safety features and accident prevention technologies is encouraging both individual buyers and fleet operators to adopt vehicles equipped with radar, LiDAR, and camera-based sensors. Strong automotive R&D capabilities and a robust regulatory framework are expected to continue supporting market growth.

Germany ADAS Sensors Market Insight

The Germany ADAS sensors market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the country’s focus on automotive innovation, safety, and sustainability. Increasing demand for semi-autonomous vehicles, combined with strict EU safety mandates, promotes the integration of ADAS sensors in both passenger and commercial vehicles. Germany’s well-established automotive infrastructure, emphasis on technological advancement, and consumer preference for reliable safety solutions are driving adoption.

Asia-Pacific ADAS Sensors Market Insight

The Asia-Pacific ADAS sensors market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising vehicle production, urbanization, and technological advancements in countries such as China, Japan, and India. The region’s increasing focus on road safety, government incentives for advanced vehicle technologies, and growing consumer awareness of ADAS features are boosting market adoption. In addition, APAC’s role as a hub for automotive electronics manufacturing is making ADAS sensors more affordable and widely accessible.

Japan ADAS Sensors Market Insight

The Japan ADAS sensors market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech automotive culture, strong focus on road safety, and increasing adoption of connected and semi-autonomous vehicles. Consumers and fleet operators are seeking vehicles equipped with adaptive cruise control, emergency braking systems, and lane-keeping assistance. Integration with IoT and AI-enabled sensor systems further supports market growth, particularly in passenger cars and commercial fleets.

China ADAS Sensors Market Insight

The China ADAS sensors market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, a growing middle class, and high rates of technological adoption. The country is emerging as a leading market for connected and semi-autonomous vehicles, with increasing integration of radar, LiDAR, and camera-based sensors. Government initiatives promoting intelligent transport systems, smart city projects, and domestic manufacturing capabilities are key factors propelling market expansion in China.

Advanced Driver Assistance System (ADAS) Sensors Market Share

The Advanced Driver Assistance System (ADAS) Sensors industry is primarily led by well-established companies, including:

- AISIN SEIKI Co., Ltd. (Japan)

- Autoliv Inc. (Sweden)

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- BorgWarner Inc. (U.S.)

- DENSO CORPORATION (Japan)

- GENTEX CORPORATION (U.S.)

- HARMAN International (U.S.)

- HELLA GmbH & Co. KGaA (Germany)

- HYUNDAI MOBIS (South Korea)

- Magna International Inc. (Canada)

- NXP Semiconductors (Netherlands)

- Panasonic Automotive Systems Europe GmbH (Germany)

- FINNA SENSORS (Germany)

- Oxford Technical Solutions Ltd. (U.K.)

- Texas Instruments Incorporated (U.S.)

- Valeo (France)

- ZF Friedrichshafen AG (Germany)

- Siemens (Germany)

- FLIR Systems, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.