Global Advanced Driver Assistance Systems Calibration Equipment Market

Market Size in USD Million

CAGR :

%

USD

392.54 Million

USD

917.74 Million

2024

2032

USD

392.54 Million

USD

917.74 Million

2024

2032

| 2025 –2032 | |

| USD 392.54 Million | |

| USD 917.74 Million | |

|

|

|

|

Advanced Driver Assistance Systems Calibration Equipment Market Size

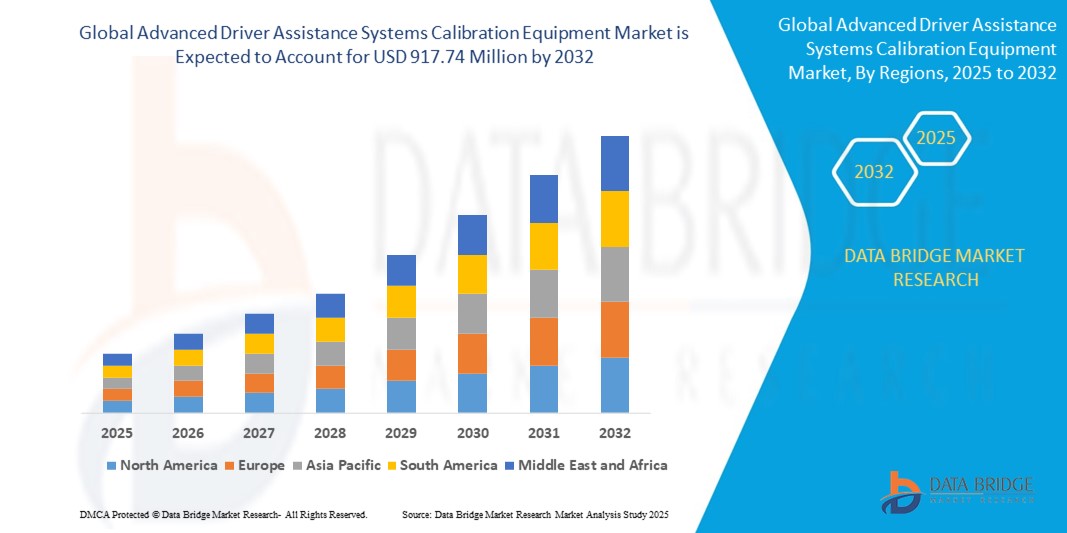

- The global advanced driver assistance systems calibration equipment market size was valued at USD 392.54 million in 2024 and is expected to reach USD 917.74 million by 2032, at a CAGR of 11.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of Advanced Driver Assistance Systems in modern vehicles and the growing demand for accurate vehicle calibration services to ensure the optimal performance of these systems

- Furthermore, stringent government regulations mandating the integration of ADAS technologies and rising consumer awareness and demand for enhanced driving comfort and safety are significant drivers

Advanced Driver Assistance Systems Calibration Equipment Market Analysis

- Advanced driver assistance systems calibration equipment, essential for ensuring the precise functioning of sensors, cameras, and radar systems in advanced driver-assistance systems, is increasingly vital in the automotive sector due to the growing integration of advanced driver assistance systems features in vehicles

- The escalating demand for advanced driver assistance systems calibration equipment is primarily fueled by the widespread adoption of advanced driver assistance systems technologies, rising consumer awareness and demand for enhanced driving safety and comfort, and the increasing complexity of modern vehicle architectures

- North America dominated the advanced driver assistance systems calibration equipment market with a significant market share of 36.9% in 2024, characterized by stringent safety regulations, early adoption of advanced automotive technologies, and a strong presence of key automotive manufacturers and R&D infrastructure

- Asia-Pacific is expected to be the fastest-growing region in the advanced driver assistance systems calibration equipment market during the forecast period, driven by increasing vehicle production, particularly in China and India, rising consumer awareness, and supportive government initiatives aimed at enhancing road safety

- The camera calibration tools segment dominated the largest market revenue share of 43.6% in 2024, driven by the widespread integration of cameras in various advanced driver assistance systems features such as lane keeping assist, automatic emergency braking, and blind-spot monitoring

Report Scope and Advanced Driver Assistance Systems Calibration Equipment Market Segmentation

|

Attributes |

Advanced Driver Assistance Systems Calibration Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand |

Advanced Driver Assistance Systems Calibration Equipment Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The Global advanced driver assistance systems Calibration Equipment Market is experiencing a significant trend of integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing and analysis, providing deeper insights into the precise calibration needs of various ADAS components, such as cameras, radar, and LiDAR

- AI-powered advanced driver assistance systems calibration solutions allow for more accurate and efficient calibration processes, reducing human error and ensuring optimal performance of safety features

- For instance, companies are developing AI-driven platforms that analyze vehicle data and sensor readings to recommend specific calibration procedures or even automate parts of the calibration process

- This trend is enhancing the precision and reliability of ADAS calibration, making it more robust and appealing to both automotive OEMs and aftermarket service providers

- AI algorithms can analyze a vast array of sensor data to detect minute misalignments or performance deviations, leading to more effective calibration and safer vehicle operation

Advanced Driver Assistance Systems Calibration Equipment Market Dynamics

Driver

“Rising Demand for Connected Vehicles and Advanced Safety Features”

- The increasing consumer demand for vehicles equipped with Advanced Driver-Assistance Systems, such as automatic emergency braking, lane-keeping assist, and adaptive cruise control, is a major driver for the Global advanced driver assistance systems Calibration Equipment Market

- ADAS systems enhance vehicle safety by preventing accidents and mitigating their severity, and their proper functioning relies heavily on accurate calibration

- Government mandates and stringent safety regulations in regions such as North America and Europe, which increasingly require advanced driver assistance systems features in new vehicles, are significantly contributing to the widespread adoption of advanced driver assistance systems and, consequently, the demand for calibration equipment

- The proliferation of IoT and the development of 5G technology are further enabling the expansion of advanced driver assistance systems applications, offering faster data transmission and lower latency for more sophisticated in-vehicle safety and assistance features, all of which necessitate precise calibration

- Automakers are increasingly offering factory-fitted advanced driver assistance systems systems as standard or optional features to meet consumer expectations and enhance vehicle value, directly driving the demand for calibration equipment in manufacturing and servicing

Restraint/Challenge

“High Cost of Implementation and Data Security Concerns”

- The substantial initial investment required for high-precision hardware, sophisticated software, and specialized training for advanced driver assistance systems calibration equipment can be a significant barrier to adoption for many independent repair shops and smaller service centers, especially in emerging markets

- Integrating ADAS calibration devices into existing workshop infrastructure can be complex and costly, requiring dedicated space and technical expertise

- In addition, data security and privacy concerns pose a major challenge. Advanced driver assistance systems calibration systems often interact with sensitive vehicle diagnostics and potentially driver-specific data, raising concerns about potential breaches, misuse of information, and compliance with evolving data protection regulations

- The fragmented regulatory landscape across different countries regarding data collection, storage, and usage further complicates operations for international manufacturers and service providers of advanced driver assistance systems calibration equipment

- These factors can deter potential buyers and limit market expansion, particularly in regions where cost sensitivity is a significant factor or where awareness of data privacy is high

Advance Driver Assistance Systems Calibration Equipment market Scope

The market is segmented on the basis of type, vehicle type, end-user, and calibration type.

- By Type

On the basis of type, the advanced driver assistance systems calibration equipment market is segmented into camera calibration tools, radar calibration tools, diagnostic scan tools, alignment machines, and others. The camera calibration tools segment dominated the largest market revenue share of 43.6% in 2024, driven by the widespread integration of cameras in various advanced driver assistance systems features such as lane keeping assist, automatic emergency braking, and blind-spot monitoring. The increasing adoption of vision-based advanced driver assistance systems in new vehicles directly fuels the demand for precise camera calibration.

The diagnostic scan tools segment is expected to witness the fastest growth rate from 2025 to 2032. This is driven by the increasing complexity of advanced driver assistance systems, which require sophisticated diagnostic tools to identify and troubleshoot issues accurately. The need for comprehensive diagnostic capabilities that can interpret data from multiple advanced driver assistance systems sensors and ECUs is accelerating the adoption of these tools.

- By Vehicle Type

On the basis of vehicle type, the advanced driver assistance systems calibration equipment market is segmented into passenger vehicles and commercial vehicles. The passenger vehicles segment hold the largest market revenue share in 2024, primarily due to the higher volume of passenger car sales globally and the rapid proliferation of ADAS features in these vehicles across various price points. Consumer demand for enhanced safety and convenience features is a key driver for the adoption of ADAS in passenger cars, thereby increasing the need for calibration equipment.

The commercial vehicles segment is anticipated to witness rapid growth from 2025 to 2032, fueled by increasing regulations pertaining to vehicle safety in commercial fleets and the growing awareness of the benefits of ADAS in reducing accidents and improving operational efficiency for trucks and buses.

- By End-User

On the basis of end-user, the advanced driver assistance systems calibration equipment market is segmented into automotive oems, aftermarket service providers, and others. The aftermarket service providers segment dominated the largest market revenue share in 2024, driven by the increasing number of vehicles with ADAS features requiring calibration after repairs, replacements, or even minor incidents. As the installed base of ADAS-equipped vehicles grows, the demand for calibration services from independent workshops and garages also rises significantly.

The automotive OEMs segment is anticipated to experience robust growth from 2025 to 2032. This is due to the increasing volume of new vehicles being manufactured with integrated ADAS, necessitating in-house calibration processes during production. In addition, OEMs are increasingly developing their own certified service networks that require specific calibration equipment.

- By Calibration Type

On the basis of calibration type, the advanced driver assistance systems calibration equipment market is segmented into static calibration and dynamic calibration. The static calibration segment dominated the largest market revenue share in 2024, primarily driven by its widespread use for precise and controlled calibration in a workshop environment. Many advanced driver assistance systems, especially camera-based ones, require static calibration using specific targets and tools to ensure accurate alignment.

The dynamic calibration segment is anticipated to witness significant growth from 2025 to 2032, driven by the convenience and efficiency it offers, particularly for radar and some camera systems that can be calibrated while the vehicle is driven under specific conditions. As advanced driver assistance systems become more advanced, the ability to perform accurate dynamic calibration becomes increasingly important.

Advanced Driver Assistance Systems Calibration Equipment Market Regional Analysis

- North America dominated the advanced driver assistance systems calibration equipment market with a significant market share of 36.9% in 2024, characterized by stringent safety regulations, early adoption of advanced automotive technologies, and a strong presence of key automotive manufacturers and R&D infrastructure

- The increasing complexity of advanced driver assistance systems technologies and the rising number of vehicles equipped with these systems necessitate precise calibration, further boosting market growth in North America

- Growth is supported by continuous technological advancements in calibration equipment, including the integration of AI and cloud-based solutions, catering to both OEM and aftermarket segments

U.S. Advanced Driver Assistance Systems Calibration Equipment Market Insight

The U.S. advanced driver assistance systems calibration equipment market captured the largest revenue share of 78.8% in 2024 within North America, fueled by strong aftermarket demand and increasing consumer awareness of vehicle safety. The widespread integration of advanced driver assistance systems features in new and used vehicles, coupled with evolving safety regulations, drives the need for accurate calibration tools. The trend towards autonomous driving features and the growing market for electric vehicles further contribute to market expansion, requiring highly specialized calibration solutions.

Europe Advanced Driver Assistance Systems Calibration Equipment Market Insight

The Europe advanced driver assistance systems calibration equipment market is expected to witness substantial growth, supported by regulatory emphasis on vehicle safety and a robust automotive manufacturing sector. European consumers prioritize advanced safety features, driving the demand for accurate advanced driver assistance systems calibration after repairs or part replacements. The market sees prominent growth in both new vehicle installations and aftermarket service centers, with countries such as Germany and the UK showing significant uptake due to stringent safety standards and the increasing penetration of ADAS in various vehicle segments.

U.K. Advanced Driver Assistance Systems Calibration Equipment Market Insight

The U.K. market for ADA advanced driver assistance systems S calibration equipment is expected to witness significant growth, driven by increasing awareness of road safety and the high adoption of ADAS features in vehicles. The demand for precise calibration is fueled by the need to ensure optimal performance of systems such as automatic emergency braking and lane keeping assist. Evolving vehicle safety regulations and increasing interest in vehicle technology also encourage the adoption of advanced calibration solutions in both franchised and independent workshops.

Germany Advanced Driver Assistance Systems Calibration Equipment Market Insight

Germany is expected to witness strong growth in advanced driver assistance systems calibration equipment, attributed to its advanced automotive manufacturing sector and a high consumer focus on vehicle safety and technological innovation. German consumers and manufacturers prefer highly accurate and technologically advanced calibration equipment to ensure the reliability of ADAS in premium and mass-market vehicles. The integration of advanced driver assistance systems in new models and the need for post-repair calibration in the aftermarket support sustained market growth.

Asia-Pacific Advanced Driver Assistance Systems Calibration Equipment Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate in the advanced driver assistance systems calibration equipment market, driven by expanding automotive production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of vehicle safety and the rapid adoption of ADAS technologies are boosting demand. Government initiatives promoting road safety and the growth of electric and autonomous vehicles further encourage the use of advanced calibration equipment.

Japan Advanced Driver Assistance Systems Calibration Equipment Market Insight

Japan's advanced driver assistance systems calibration equipment market is expected to witness significant growth due to a strong consumer preference for high-quality, technologically advanced vehicles with integrated safety features. The presence of major automotive manufacturers and the increasing integration of ADAS in OEM vehicles accelerate market penetration. Rising interest in aftermarket servicing for complex ADAS also contributes to market expansion, driven by continuous innovation in calibration tools and techniques.

China Advanced Driver Assistance Systems Calibration Equipment Market Insight

China holds the largest share of the Asia-Pacific advanced driver assistance systems calibration equipment market, propelled by rapid urbanization, increasing vehicle ownership, and a growing emphasis on vehicle safety. The country's expanding middle class and focus on smart mobility solutions support the adoption of advanced ADAS and, consequently, the demand for sophisticated calibration equipment. Strong domestic manufacturing capabilities and increasing investments in autonomous driving technologies further enhance market accessibility and growth.

Advance Driver Assistance Systems Calibration Equipment Market Share

The advanced driver assistance systems AS calibration equipment industry is primarily led by well-established companies, including:

- Autel Intelligent Technology Corp. Ltd. (China)

- HELLA GmbH & Co. KGaA (Germany)

- Hofmann Megaplan GmbH (Germany)

- Hunter Engineering Company (U.S.)

- Launch Tech Co. Ltd. (China)

- Mahle GmbH (Germany)

- Robert Bosch GmbH (Germany)

- Snap-on Incorporated (U.S.)

- TEXA S.p.A. (Italy)

- The Burke Porter Group (U.S.)

- Continental AG (Germany)

- DENSO Corporation (Japan)

- AVL LIST GmbH (Austria)

- Cojali S.L. (Spain)

What are the Recent Developments in Global Advance Driver Assistance Systems Calibration Equipment Market?

- In February 2025, Elitek Vehicle Services, a subsidiary of LKQ Corporation, introduced the advanced driver assistance systems MAP (Advanced Driver Assistance Systems Mapping) solution. This innovative tool, powered by OPUS IVS technology, enhances ADAS calibration accuracy for repairers and vehicle maintenance service providers. The system ensures precise identification and calibration of ADAS components, streamlining diagnostics and repairs based on OEM specifications. It also simplifies insurance documentation, improving workflow efficiency. The launch reinforces Elitek’s commitment to advanced automotive solution

- In April 2024, Bosch Automotive Service Solutions launched a next-generation ADAS calibration system, integrating cloud diagnostics for enhanced precision. This update, part of Bosch ADS / ADS X Software Version 5.18, includes over 6,000 new special tests, improved DTC scans, and expanded ADAS calibration coverage for 2024 vehicle models. The system streamlines sensor alignment, ensuring accurate calibration for advanced driver assistance systems

- In November 2023, Autel and Repairify strengthened their partnership, integrating Repairify’s remote services and OEM tool scans into the Autel Remote Expert platform. This collaboration enhances collision and glass repair workflows, improving efficiency and documentation. The integration is now available on Autel MaxiSYS Ultra series tablets and MaxiFlash XLink devices, reducing the need for multiple in-shop tools for diagnostics, calibrations, and programming. The initiative builds on previous joint efforts, including adasThink for Autel users, which provides pre-repair insights

- In October 2023, Opus IVS introduced ADAS Map, a comprehensive software platform designed to identify ADAS systems, components, calibration needs, and reasons for calibration. This cutting-edge solution streamlines the diagnostic and calibration process for the automotive industry, integrating seamlessly with CCC, Mitchell, Opus IVS DriveSafe, and CoPilot platforms. The system automatically reviews estimates, providing detailed ADAS requirements while enhancing workflow efficiency. With automated reporting and Alldata integration, ADAS Map improves repair accuracy and reduces calibration research time

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Advanced Driver Assistance Systems Calibration Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Advanced Driver Assistance Systems Calibration Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Advanced Driver Assistance Systems Calibration Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.