Global Advanced Ic Substrates Market

Market Size in USD Billion

CAGR :

%

USD

11.35 Billion

USD

19.86 Billion

2024

2032

USD

11.35 Billion

USD

19.86 Billion

2024

2032

| 2025 –2032 | |

| USD 11.35 Billion | |

| USD 19.86 Billion | |

|

|

|

|

What is the Global Advanced IC Substrates Market Size and Growth Rate?

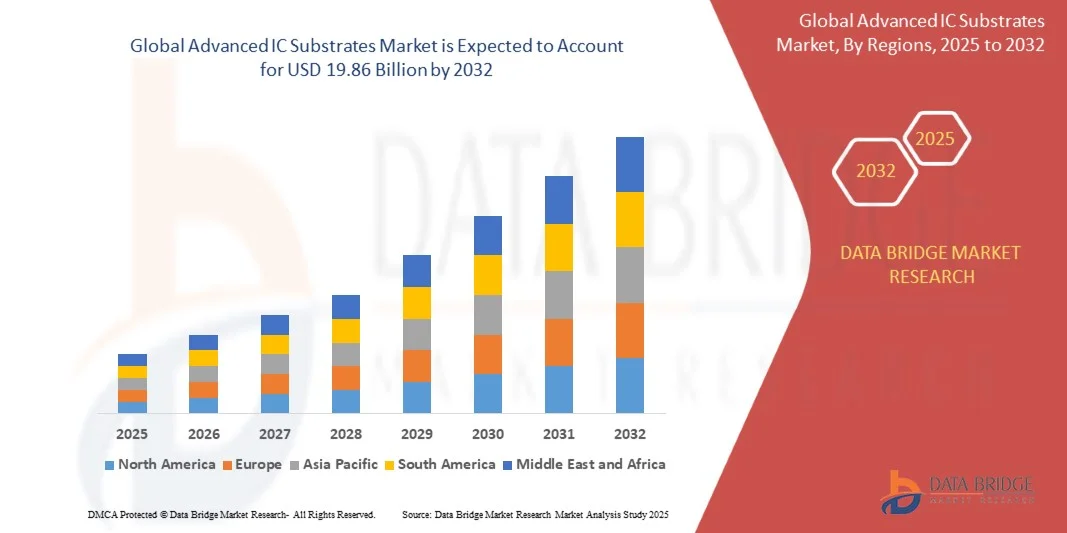

- The global advanced IC substrates market size was valued at USD 11.35 billion in 2024 and is expected to reach USD 19.86 billion by 2032, at a CAGR of 7.25% during the forecast period

- The market growth is driven by the rising demand for miniaturized, high-performance semiconductor devices in consumer electronics, automotive, IT, and telecom applications

- Increasing adoption of advanced packaging solutions such as FC BGA, FC CSP, and other high-density interconnect substrates, along with technological innovations in high-speed, high-frequency electronics, is significantly contributing to the market expansion

What are the Major Takeaways of Advanced IC Substrates Market?

- Advanced IC Substrates are essential components in semiconductor packaging, providing electrical interconnections, mechanical support, and thermal management for integrated circuits in high-performance devices

- The demand is fueled by trends such as the proliferation of 5G, AI-driven electronics, automotive electronics, and high-end consumer devices requiring high-density, reliable, and efficient substrates

- Key growth drivers include miniaturization of devices, increasing complexity of ICs, and the need for high thermal and electrical performance in next-generation electronics

- The Asia-Pacific Advanced IC Substrates market dominated the global market with a revenue share of 42.5% in 2024, driven by rapid industrialization, urbanization, and technological advancements in countries such as China, Japan, South Korea, and India

- The North America Advanced IC Substrates market is expected to grow at the fastest CAGR of 11.69% from 2025 to 2032, driven by rapid adoption of high-performance computing, data center expansion, and advanced consumer electronics

- The FC BGA segment dominated the market with a revenue share of 62% in 2024, driven by its established role in high-performance semiconductor packaging

Report Scope and Advanced IC Substrates Market Segmentation

|

Attributes |

Advanced IC Substrates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Advanced IC Substrates Market?

“Rising Adoption of High-Density and Miniaturized Packaging Solutions”

- A significant trend in the global Advanced IC Substrates market is the increasing demand for high-density interconnect (HDI) and miniaturized packaging solutions such as FC BGA, FC CSP, and embedded substrates. This trend is enhancing device performance while reducing size and weight, which is critical for next-generation electronics

- For instance, manufacturers are increasingly deploying substrates capable of supporting 2.5D and 3D packaging technologies, enabling high-speed signal transmission, superior thermal management, and higher I/O density for applications such as 5G, AI chips, and high-performance computing

- Substrate innovation now emphasizes materials with improved electrical performance, lower warpage, and enhanced thermal reliability. Companies such as Ibiden and Unimicron are investing in advanced substrate materials that improve signal integrity and reduce power loss

- The integration of advanced IC substrates with heterogeneous integration platforms is creating multi-functional, compact modules for mobile devices, automotive electronics, and telecom applications, driving higher adoption in high-tech sectors

- This trend toward high-density, performance-optimized substrates is reshaping the semiconductor packaging landscape, with manufacturers prioritizing smaller form factors without compromising reliability or performance

What are the Key Drivers of Advanced IC Substrates Market?

- The growing demand for miniaturized electronic devices and high-performance semiconductors is a major driver for Advanced IC Substrates, especially in mobile, automotive, and telecom applications

- Increasing adoption of 5G, AI, and IoT-enabled devices is pushing the need for substrates that can handle high-speed signal transmission and greater power densities. For instance, in 2024, Ibiden launched new high-density FC BGA substrates to support 5G smartphone processors, boosting market growth

- The expansion of automotive electronics, including ADAS, EV power modules, and infotainment systems, is accelerating the demand for high-reliability substrates capable of managing thermal and electrical stress

- Rising consumer expectations for lightweight, compact, and efficient devices are promoting the adoption of fine-pitch, embedded, and multi-layer substrate technologies

- Continuous RandD investments in substrate materials, process innovations, and fabrication techniques by major manufacturers are enhancing performance, lowering costs, and expanding applications, further fueling market growth

Which Factor is Challenging the Growth of the Advanced IC Substrates Market?

- High manufacturing costs and complex fabrication processes of advanced IC substrates pose a significant challenge, particularly for small- and medium-scale manufacturers. Advanced materials such as BT resin and high-density laminates require specialized handling and production capabilities, increasing capital expenditure.

- Supply chain constraints and raw material volatility, especially for specialty resins, copper foils, and ceramics, can disrupt production timelines and elevate costs, impacting market adoption.

- Rapid technological obsolescence due to continuous innovation in semiconductor packaging demands constant investment in R&D, which may limit the entry of new players.

- Thermal management, warpage control, and defect yield in high-density substrates remain technical challenges, requiring sophisticated testing and quality assurance protocols.

- Overcoming these challenges through process optimization, material innovations, strategic partnerships, and scaling production capabilities will be crucial to sustaining market growth and meeting the evolving demands of high-performance electronics.

How is the Advanced IC Substrates Market Segmented?

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Advanced IC Substrates market is segmented into FC BGA and FC CSP. The FC BGA segment dominated the market with a revenue share of 62% in 2024, driven by its established role in high-performance semiconductor packaging. FC BGA substrates are widely used in applications requiring superior thermal management, high input/output (I/O) density, and reliable electrical performance, making them the preferred choice for advanced computing, networking, and mobile processors. Their compatibility with 2.5D and 3D IC integration further strengthens their adoption across mobile, automotive, and telecom sectors.

The FC CSP segment is anticipated to witness the fastest growth at a CAGR of 14.8% from 2025 to 2032, fueled by the miniaturization trend in mobile and consumer electronics. FC CSP substrates provide compact, lightweight solutions while maintaining excellent signal integrity and thermal performance, making them ideal for smartphones, tablets, and wearable devices. Increasing demand for portable and high-performance devices is accelerating CSP adoption globally.

- By Application

On the basis of application, the Advanced IC Substrates market is segmented into Mobile and Consumer, Automotive and Transportation, IT and Telecom, and Others. The Mobile and Consumer segment dominated the market with a 54% revenue share in 2024, owing to the rising proliferation of smartphones, tablets, laptops, and wearable electronics. The demand for high-density substrates that support miniaturized, lightweight, and high-speed devices is driving adoption in this segment. Advanced IC substrates enhance performance, signal reliability, and thermal management, ensuring optimal device operation and longer lifespan, which is critical in consumer electronics.

The Automotive and Transportation segment is expected to witness the fastest CAGR of 12.5% from 2025 to 2032, propelled by the rapid growth of electric vehicles, advanced driver-assistance systems (ADAS), infotainment systems, and connected vehicle technologies. These applications require high-reliability substrates capable of handling thermal and electrical stress, accelerating demand for advanced IC substrates. Integration of next-generation semiconductors in vehicles is expected to further expand the market for this segment.

Which Region Holds the Largest Share of the Advanced IC Substrates Market?

- The Asia-Pacific Advanced IC Substrates market dominated the global market with a revenue share of 42.5% in 2024, driven by rapid industrialization, urbanization, and technological advancements in countries such as China, Japan, South Korea, and India. The region’s growing electronics manufacturing base, combined with high adoption rates of smartphones, consumer electronics, and automotive semiconductors, is boosting demand for Advanced IC Substrates

- The widespread presence of semiconductor manufacturers and RandD centers in APAC supports innovation and cost-effective production of high-performance substrates, reinforcing the region’s leading market position

- Increasing government initiatives to support smart manufacturing, IoT adoption, and digital infrastructure further accelerate the market, making Asia-Pacific the preferred hub for both production and consumption of Advanced IC Substrates

China Advanced IC Substrates Market Insight

The China Advanced IC Substrates market accounted for the largest revenue share in APAC in 2024, fueled by the country’s expanding electronics manufacturing industry, growing middle-class consumption, and rapid adoption of smartphones, consumer electronics, and automotive semiconductors. Domestic manufacturers are investing in advanced packaging technologies such as FC BGA and FC CSP, ensuring high performance and reliability. The push toward smart cities and industrial digitization is further boosting demand, with substrates being used extensively in mobile, automotive, and IT applications.

Japan Advanced IC Substrates Market Insight

The Japan Advanced IC Substrates market is witnessing strong growth, supported by the country’s high-tech manufacturing ecosystem, early adoption of advanced semiconductor technologies, and strong automotive and consumer electronics sectors. Japanese companies are focusing on miniaturization and high-density packaging, driving the use of advanced substrates for high-performance processors, automotive electronics, and IoT devices. Furthermore, increasing investment in 3D IC and heterogeneous integration is expected to strengthen market demand in the forecast period.

Which Region is the Fastest Growing Region in the Advanced IC Substrates Market?

The North America Advanced IC Substrates market is expected to grow at the fastest CAGR of 11.69% from 2025 to 2032, driven by rapid adoption of high-performance computing, data center expansion, and advanced consumer electronics. The region is a hub for semiconductor innovation and RandD, with strong demand from IT and telecom, automotive, and aerospace sectors. Advanced IC Substrates adoption is supported by increasing investment in next-generation packaging solutions, including FC BGA and FC CSP, for mobile devices, servers, and networking applications. The U.S. and Canada are emerging as leading markets due to the focus on AI, high-speed computing, and 5G technology, which require high-performance substrates for reliability and thermal efficiency.

U.S. Advanced IC Substrates Market Insight

The U.S. Advanced IC Substrates market captured a revenue share of 79% in North America in 2024, driven by strong semiconductor RandD, expansion of cloud computing infrastructure, and demand for advanced consumer electronics and automotive applications. Companies are investing in high-density packaging and advanced substrate materials to support miniaturization and higher I/O density. Moreover, rising adoption of AI, 5G, and data-intensive applications is accelerating substrate demand, ensuring North America remains the fastest-growing regional market globally.

Canada Advanced IC Substrates Market Insight

The Canada Advanced IC Substrates market is expanding steadily, supported by a growing electronics manufacturing sector, increasing focus on high-performance computing, and adoption of advanced automotive and IT technologies. Investments in semiconductor RandD, particularly in substrate innovation for mobile, consumer, and automotive applications, are contributing to the country’s market growth. Canada’s focus on sustainable and high-reliability packaging solutions further enhances demand for Advanced IC Substrates across diverse industries.

Which are the Top Companies in Advanced IC Substrates Market?

The advanced IC substrates industry is primarily led by well-established companies, including:

- ASE Group (Taiwan)

- ATandS Austria Technologie and Systemtechnik AG (Austria)

- Siliconware Precision Industries Co. Ltd (Taiwan)

- TTM Technologies Inc. (U.S.)

- IBIDEN Co. Ltd (Japan)

- KYOCERA Corporation (Japan)

- Fujitsu Ltd (Japan)

- Shinko Electric Industries Co. Ltd (Japan)

- Kinsus Interconnect Technology Corp. (Taiwan)

- Unimicron Corporation (Taiwan)

What are the Recent Developments in Global Advanced IC Substrates Market?

- In July 2025, Intel halted its in-house glass substrate program and opted to source materials externally, aiming to optimize RandD expenditures and enhance foundry profit margins, marking a strategic shift in its supply chain approach to improve long-term operational efficiency

- In June 2025, ASE Technology announced plans to expand its U.S. advanced packaging capacity, allocating USD 2.5 billion for its 2025 development, a move driven by the rising global demand for AI chips, positioning the company to strengthen its foothold in the semiconductor packaging segment

- In May 2025, Samsung Electro-Mechanics initiated mass production of ABF substrates for AI accelerators and commenced glass substrate trials, underscoring its commitment to technological advancement and competitiveness in the semiconductor materials market

- In May 2025, TSMC revealed plans for nine new manufacturing and packaging facilities and confirmed its strategy to double CoWoS capacity, signaling the company’s dedication to meeting surging global demand for high-performance computing solutions

- In July 2024, Onto Innovation Inc launched its glass substrate suite, featuring the JetStep® X500 panel-level packaging lithography system and Firefly® G3 sub-micron automatic metrology and inspection system. The innovation highlights Onto’s efforts to enhance efficiency in advanced integrated circuit substrate (AICS) manufacturing and panel-level packaging

- In May 2024, DuPont showcased its comprehensive portfolio of cutting-edge circuit materials and solutions at the Shanghai International Electronic Circuits Exhibition 2024, held from May 13 to May 15 at Booth #8L06 in the National Exhibition and Convention Center (NECC). The event reinforced DuPont’s leadership in fine line, signal integrity, power, and thermal management solutions across the electronics industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Advanced Ic Substrates Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Advanced Ic Substrates Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Advanced Ic Substrates Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.