Global Advanced Malware Protection Market

Market Size in USD Billion

CAGR :

%

USD

5.96 Billion

USD

17.36 Billion

2025

2033

USD

5.96 Billion

USD

17.36 Billion

2025

2033

| 2026 –2033 | |

| USD 5.96 Billion | |

| USD 17.36 Billion | |

|

|

|

|

Global Advanced Malware Protection Market Size

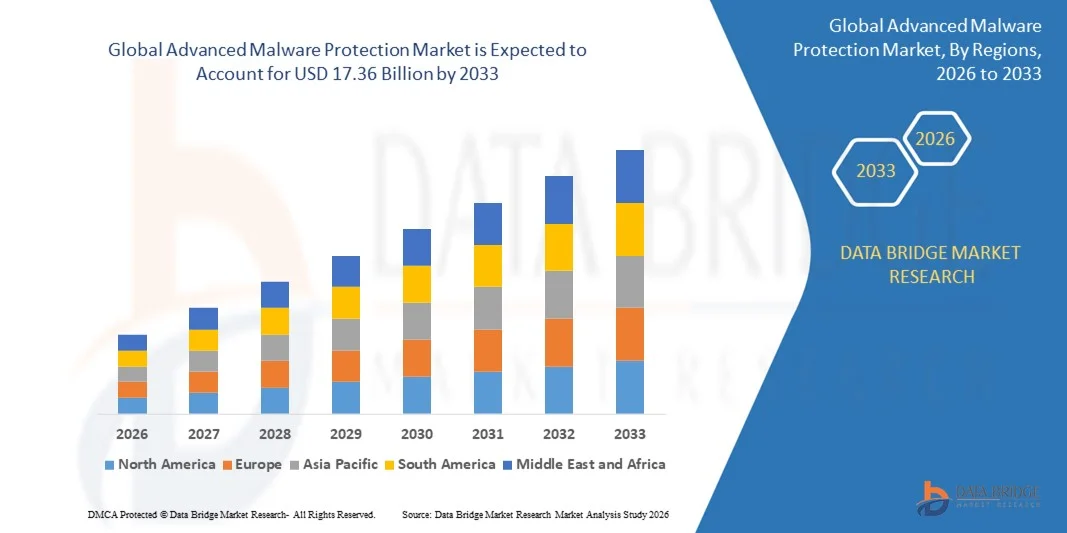

- The global Advanced Malware Protection Market size was valued at USD 5.96 billion in 2025 and is expected to reach USD 17.36 billion by 2033, at a CAGR of 14.30% during the forecast period.

- The market growth is primarily driven by the increasing frequency and sophistication of cyber threats, alongside the rising adoption of cloud computing, IoT devices, and digital transformation initiatives across enterprises.

- Moreover, growing awareness among businesses and consumers about data security, coupled with the demand for proactive, AI-driven, and real-time threat detection solutions, is positioning advanced malware protection as a critical component of modern cybersecurity infrastructure. These factors collectively are propelling market expansion and driving widespread adoption.

Global Advanced Malware Protection Market Analysis

- Advanced Malware Protection solutions, providing real-time threat detection, prevention, and response across endpoints, networks, and cloud environments, are becoming essential components of modern cybersecurity frameworks in both enterprise and consumer settings due to their ability to mitigate sophisticated cyberattacks and minimize data breaches.

- The growing demand for advanced malware protection is primarily driven by the increasing frequency and complexity of cyber threats, rising adoption of IoT and cloud technologies, and stringent regulatory requirements for data security across industries.

- North America dominated the Global Advanced Malware Protection Market with the largest revenue share of 35% in 2025, supported by early adoption of cybersecurity solutions, high digital infrastructure investments, and a strong presence of key market players, with the U.S. witnessing significant growth in deployment of AI-driven malware protection solutions, particularly across enterprises and critical infrastructure sectors.

- Asia-Pacific is expected to be the fastest-growing region in the Global Advanced Malware Protection Market during the forecast period due to rapid digitalization, increasing internet penetration, and rising awareness about cybersecurity threats.

- The solutions segment dominated the market with the largest revenue share of 61.5% in 2025, driven by the growing demand for comprehensive malware protection software that includes antivirus, endpoint detection and response (EDR), threat intelligence, and cloud security solutions.

Report Scope and Global Advanced Malware Protection Market Segmentation

|

Attributes |

Advanced Malware Protection Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Cisco Systems (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Advanced Malware Protection Market Trends

Enhanced Protection Through AI and Behavioral Analytics

- A significant and accelerating trend in the global Advanced Malware Protection Market is the deepening integration of artificial intelligence (AI) and machine learning (ML) technologies for proactive threat detection, response, and remediation. This fusion of technologies is significantly enhancing the efficiency, accuracy, and automation of cybersecurity systems.

- For instance, CrowdStrike Falcon and Palo Alto Networks Cortex XDR leverage AI and ML to analyze massive volumes of endpoint and network data, detecting anomalies and potential threats in real time before they can cause damage. Similarly, Microsoft Defender for Endpoint uses behavioral analytics to identify suspicious activities and automatically initiate preventive measures.

- AI integration in malware protection enables features such as predictive threat intelligence, automated incident response, and adaptive defense mechanisms that continuously learn from new attack patterns. For example, Sophos Intercept X uses deep learning models to improve malware detection rates over time and can generate intelligent alerts for unusual system behavior. Furthermore, AI-driven analytics reduce false positives, allowing security teams to focus on high-priority threats.

- The seamless integration of advanced malware protection solutions with broader IT infrastructure, cloud environments, and endpoint management platforms facilitates centralized monitoring and control over enterprise cybersecurity. Through a single interface, IT teams can manage malware protection, firewall policies, and threat intelligence, creating a unified and automated security ecosystem.

- This trend towards more intelligent, adaptive, and interconnected cybersecurity solutions is fundamentally reshaping enterprise expectations for malware protection. Consequently, companies such as SentinelOne and Cybereason are developing AI-enabled platforms with features such as autonomous threat response, behavioral anomaly detection, and integration with cloud and SIEM systems.

- The demand for malware protection solutions that offer seamless AI and behavioral analytics integration is growing rapidly across both enterprise and consumer sectors, as organizations increasingly prioritize proactive, automated, and comprehensive cybersecurity defenses.

Global Advanced Malware Protection Market Dynamics

Driver

Growing Need Due to Rising Cybersecurity Threats and Digital Transformation

- The increasing prevalence of sophisticated cyber threats among enterprises and consumers, coupled with the accelerating adoption of digital transformation initiatives, is a significant driver for the heightened demand for advanced malware protection solutions.

- For instance, in March 2025, Palo Alto Networks announced enhancements to its Cortex XDR platform, integrating advanced AI-driven threat detection and automated response capabilities to better protect cloud, network, and endpoint environments. Such innovations by key companies are expected to drive market growth during the forecast period.

- As organizations become more aware of potential cyber risks and seek to safeguard sensitive data, advanced malware protection solutions offer features such as real-time threat intelligence, automated remediation, and behavioral analysis, providing a compelling upgrade over traditional antivirus software.

- Furthermore, the growing adoption of cloud services, IoT devices, and connected enterprise environments is making advanced malware protection an integral component of cybersecurity strategies, offering seamless integration with other security tools and platforms.

- The ability to proactively detect zero-day threats, manage endpoint security across distributed networks, and provide centralized monitoring through unified platforms are key factors propelling the adoption of advanced malware protection in both enterprise and consumer sectors. The trend towards managed security services and AI-driven solutions further contributes to market growth.

Restraint/Challenge

Concerns Regarding Implementation Complexity and High Costs

- Concerns surrounding the complexity of deploying and managing advanced malware protection solutions pose a significant challenge to broader market penetration. As these solutions often involve integration across endpoints, networks, and cloud environments, some organizations may face operational or technical difficulties, raising concerns about implementation and ongoing management.

- For instance, reports of misconfigured security platforms or inadequate staff training have caused delays or suboptimal protection in certain enterprises, making some organizations hesitant to adopt advanced solutions.

- Addressing these challenges through user-friendly platforms, AI-assisted automation, and managed security services is crucial for building organizational trust. Companies such as CrowdStrike and SentinelOne emphasize their cloud-based, automated threat detection features to reduce administrative burden and improve ease of use. Additionally, the relatively high initial cost of enterprise-grade malware protection solutions compared to traditional antivirus software can be a barrier for small and medium-sized businesses, particularly in developing regions.

- While pricing models such as subscription-based services are gradually making solutions more accessible, the perceived premium for comprehensive, AI-driven protection can still hinder widespread adoption, especially for organizations with limited cybersecurity budgets.

- Overcoming these challenges through simplified deployment, scalable solutions, managed services, and targeted education on cybersecurity best practices will be vital for sustained market growth.

Global Advanced Malware Protection Market Scope

Advanced malware protection market is segmented on the basis of component, organization size, deployment mode and application.

- By Component

On the basis of component, the Global Advanced Malware Protection Market is segmented into services and solutions. The solutions segment dominated the market with the largest revenue share of 61.5% in 2025, driven by the growing demand for comprehensive malware protection software that includes antivirus, endpoint detection and response (EDR), threat intelligence, and cloud security solutions. Organizations increasingly prefer integrated platforms that provide proactive threat detection, real-time monitoring, and automated response capabilities, reducing the need for manual intervention.

The services segment, which includes managed security services, consulting, and implementation support, is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, fueled by the increasing complexity of cyber threats, shortage of skilled cybersecurity professionals, and growing reliance on outsourced security operations to enhance enterprise security posture.

- By Organization Size

On the basis of organization size, the Global Advanced Malware Protection Market is segmented into large enterprises and SMEs. The large enterprise segment dominated the market with a revenue share of 65.8% in 2025, owing to higher cybersecurity budgets, complex IT infrastructure, and stringent regulatory compliance requirements across sectors such as banking, healthcare, and IT. Large enterprises often adopt advanced malware protection solutions with AI-driven threat intelligence, centralized management, and endpoint monitoring to safeguard their global operations.

The SME segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, driven by increasing awareness of cybersecurity threats, affordable subscription-based solutions, and the adoption of cloud-based protection platforms that require minimal IT resources and support remote workforce security.

- By Deployment Mode

On the basis of deployment mode, the Global Advanced Malware Protection Market is segmented into cloud and on-premise solutions. The cloud segment dominated the market with the largest revenue share of 58.7% in 2025, attributed to the rapid adoption of cloud computing, remote work environments, and the flexibility offered by scalable, subscription-based security solutions. Cloud deployment allows organizations to receive real-time updates, centralized monitoring, and automated threat intelligence without the need for heavy on-site infrastructure.

The on-premise segment is expected to witness the fastest CAGR of 21.8% from 2026 to 2033, as certain industries such as government, defense, and banking prefer on-premise deployments for enhanced control, data privacy, and compliance with strict regulatory requirements.

- By Application

On the basis of application, the Global Advanced Malware Protection Market is segmented into multiple verticals. The IT & Telecom segment dominated the market with a revenue share of 24.5% in 2025, driven by the critical need to protect sensitive data, network infrastructure, and cloud environments from increasingly sophisticated cyberattacks. Organizations in IT and telecom require advanced malware protection solutions that offer real-time monitoring, threat intelligence, and automated incident response.

The healthcare segment is expected to witness the fastest CAGR of 25.0% from 2026 to 2033, fueled by the rising digitization of patient records, adoption of connected medical devices, and growing regulatory emphasis on data protection. Additionally, sectors such as banking, government, and financial services continue to invest heavily in malware protection to safeguard critical infrastructure and maintain trust.

Global Advanced Malware Protection Market Regional Analysis

- North America dominated the Global Advanced Malware Protection Market with the largest revenue share of 35% in 2025, driven by increasing cyber threats, stringent data protection regulations, and high adoption of advanced IT infrastructure across enterprises.

- Organizations and consumers in the region prioritize real-time threat detection, AI-driven malware protection, and comprehensive cybersecurity solutions to safeguard sensitive data and critical digital assets.

- This widespread adoption is further supported by high cybersecurity awareness, substantial IT budgets, and a strong presence of leading market players offering innovative solutions. The growing reliance on cloud computing, remote work, and connected enterprise environments has further accelerated demand, establishing advanced malware protection as a critical component of cybersecurity strategies for both large enterprises and small-to-medium businesses in North America.

U.S. Advanced Malware Protection Market Insight

The U.S. advanced malware protection market captured the largest revenue share of 81% in 2025 within North America, fueled by the increasing frequency of cyberattacks and widespread adoption of cloud services, IoT, and enterprise IT infrastructure. Organizations are prioritizing AI-driven, real-time threat detection and automated response solutions to protect sensitive data and critical business operations. The growing preference for integrated security platforms, alongside regulatory compliance requirements such as HIPAA and CCPA, further propels the market. Additionally, the U.S. market benefits from a strong presence of leading cybersecurity vendors offering innovative solutions for both large enterprises and SMEs.

Europe Advanced Malware Protection Market Insight

The Europe advanced malware protection market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent data protection regulations like GDPR and the growing need for secure digital transformation across industries. Rising adoption of cloud infrastructure, AI-based cybersecurity tools, and managed security services are fostering the deployment of advanced malware protection solutions. Both residential users and enterprises are investing in proactive threat detection and incident response platforms, further fueling regional market growth.

U.K. Advanced Malware Protection Market Insight

The U.K. advanced malware protection market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing trend of digitalization and remote work, which has heightened the demand for robust endpoint and cloud security solutions. Cybersecurity awareness among businesses and regulatory compliance requirements continue to encourage adoption. The U.K.’s strong IT infrastructure and adoption of connected enterprise solutions further stimulate the market.

Germany Advanced Malware Protection Market Insight

The Germany advanced malware protection market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing cyber threats, advanced IT infrastructure, and strong regulatory focus on data security. Enterprises are increasingly adopting AI-enabled threat detection and response solutions, while public sector organizations invest in secure digital platforms. Germany’s emphasis on technological innovation and data privacy promotes the deployment of advanced malware protection across residential, commercial, and industrial sectors.

Asia-Pacific Advanced Malware Protection Market Insight

The Asia-Pacific advanced malware protection market is poised to grow at the fastest CAGR of 24% from 2026 to 2033, driven by rapid digitalization, increasing internet penetration, and rising cybercrime incidents in countries such as China, Japan, and India. Government initiatives supporting digital transformation, cloud adoption, and smart city projects are encouraging enterprises and SMEs to implement advanced malware protection solutions. Additionally, the increasing availability of cost-effective cybersecurity solutions is expanding market accessibility across the region.

Japan Advanced Malware Protection Market Insight

The Japan advanced malware protection market is gaining momentum due to high technological adoption, increasing cloud and IoT deployments, and strong emphasis on data privacy. Japanese enterprises are investing heavily in AI-driven malware detection, endpoint security, and cloud-based security platforms. The rising trend of smart manufacturing, connected infrastructure, and remote work is further driving demand for advanced malware protection across both commercial and industrial sectors.

China Advanced Malware Protection Market Insight

The China advanced malware protection market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid digital transformation, the expanding enterprise sector, and increasing cyber threats. Enterprises and government organizations are prioritizing the deployment of AI-based threat detection, endpoint protection, and cloud security solutions. Additionally, China’s large IT services industry, coupled with domestic cybersecurity vendors offering cost-effective solutions, is propelling market growth across both commercial and public sectors.

Global Advanced Malware Protection Market Share

The Advanced Malware Protection industry is primarily led by well-established companies, including:

• Cisco Systems (U.S.)

• Symantec / Broadcom (U.S.)

• McAfee (U.S.)

• Trend Micro (Japan)

• Palo Alto Networks (U.S.)

• FireEye / Trellix (U.S.)

• Check Point Software Technologies (Israel)

• Bitdefender (Romania)

• Kaspersky (Russia)

• Fortinet (U.S.)

• Sophos (U.K.)

• CrowdStrike (U.S.)

• Microsoft (U.S.)

• IBM Security (U.S.)

• VMware Carbon Black (U.S.)

• Cybereason (U.S.)

• BlackBerry Cylance (Canada)

• ESET (Slovakia)

• Malwarebytes (U.S.)

• SentinelOne (U.S.)

What are the Recent Developments in Global Advanced Malware Protection Market?

- In April 2024, Cisco Systems, a global leader in networking and cybersecurity solutions, launched a strategic initiative in South Africa aimed at strengthening enterprise cybersecurity through its advanced malware protection technologies. This initiative underscores the company's dedication to delivering innovative, reliable threat detection and response solutions tailored to the unique security needs of regional businesses. By leveraging its global expertise and cutting-edge product offerings, Cisco is addressing local cybersecurity challenges while reinforcing its position in the rapidly growing global Advanced Malware Protection Market.

- In March 2024, CrowdStrike Inc., a leading cybersecurity company based in the U.S., introduced the Falcon XDR 2.0 platform, specifically engineered for critical infrastructure and large enterprises. The advanced platform enhances threat detection, incident response, and automated remediation capabilities, offering a robust solution to protect sensitive data and IT networks. This advancement highlights CrowdStrike’s commitment to developing next-generation cybersecurity technologies that safeguard complex enterprise environments.

- In March 2024, Honeywell International Inc. successfully deployed its cybersecurity solutions as part of the Bengaluru Smart City initiative, aimed at enhancing urban digital safety through advanced malware protection and threat intelligence technologies. This initiative leverages state-of-the-art solutions to protect critical municipal IT infrastructure, underscoring Honeywell's dedication to innovative cybersecurity systems and highlighting the increasing significance of malware protection in urban and smart city environments.

- In February 2024, SentinelOne, Inc., a leading provider of AI-driven endpoint security, announced a strategic partnership with the Asia-Pacific Financial Security Alliance to deploy advanced malware protection across multiple financial institutions. This collaboration is designed to enhance threat detection, automate incident response, and strengthen cybersecurity resilience, facilitating secure digital operations. The initiative underscores SentinelOne’s commitment to innovation and operational effectiveness within the financial sector.

- In January 2024, Palo Alto Networks, a global cybersecurity leader, unveiled the Cortex XDR 4.0 platform at the RSA Conference 2024. This advanced solution integrates AI-powered threat analytics, endpoint protection, and cloud security, enabling organizations to detect and respond to sophisticated cyberattacks in real time. Cortex XDR 4.0 highlights the company’s commitment to integrating cutting-edge technology into enterprise cybersecurity frameworks, offering businesses enhanced protection, visibility, and operational efficiency.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.