Global Advanced Phase Change Material Market

Market Size in USD Billion

CAGR :

%

USD

2.22 Billion

USD

7.77 Billion

2024

2032

USD

2.22 Billion

USD

7.77 Billion

2024

2032

| 2025 –2032 | |

| USD 2.22 Billion | |

| USD 7.77 Billion | |

|

|

|

|

Advanced Phase Change Material Market Size

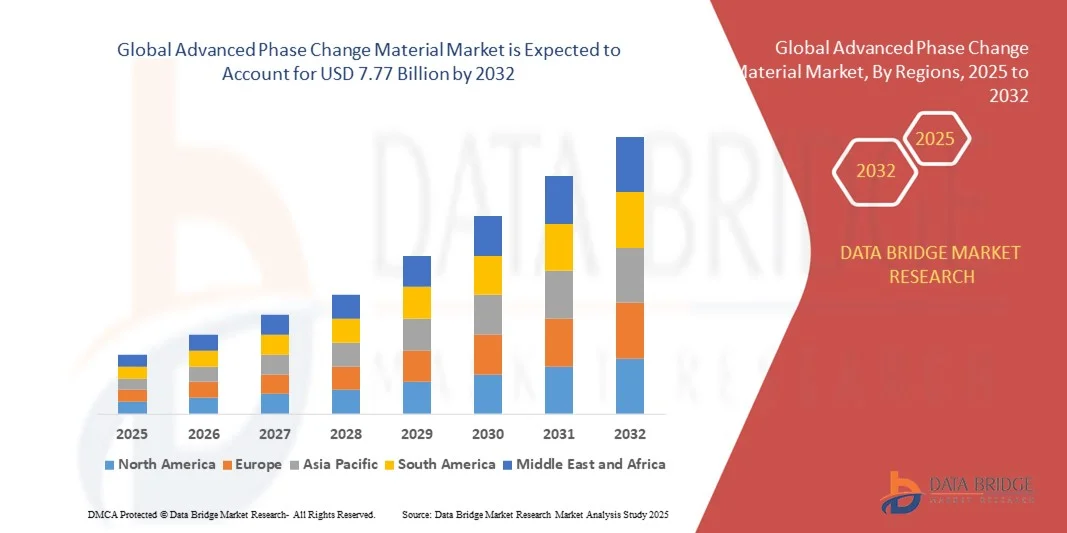

- The global advanced phase change material market size was valued at USD 2.22 billion in 2024 and is expected to reach USD 7.77 billion by 2032, at a CAGR of 16.97% during the forecast period

- The market growth is largely fueled by the increasing demand for energy-efficient building materials, advanced thermal management solutions, and sustainable energy storage systems across residential, commercial, and industrial sectors

- Furthermore, rising adoption of electric vehicles, renewable energy infrastructure, and temperature-sensitive supply chains is driving the need for phase change materials that can optimize thermal regulation and reduce energy consumption. These converging factors are accelerating the uptake of APCMs, thereby significantly boosting the industry's growth

Advanced Phase Change Material Market Analysis

- Advanced phase change materials, used for thermal energy storage, heat dissipation, and temperature regulation, are becoming essential in building and construction, electronics, HVAC, cold chain logistics, and automotive applications due to their ability to maintain stable temperatures and improve energy efficiency

- The escalating demand for APCMs is primarily fueled by growing environmental regulations, increasing awareness of sustainability practices, and the push for energy-efficient technologies in construction, industrial operations, and electronics, driving broader market adoption

- Europe dominated the advanced phase change material market with a share of 37.4% in 2024, due to growing adoption of energy-efficient building materials, stringent environmental regulations, and rising demand for sustainable energy storage solutions

- Asia-Pacific is expected to be the fastest growing region in the advanced phase change material market during the forecast period due to rising urbanization, infrastructure development, and increasing focus on energy efficiency in countries such as China, Japan, and India

- Organic segment dominated the market with a market share of 45.73% in 2024, due to its superior chemical stability, non-corrosive nature, and compatibility with building materials. Organic PCMs such as paraffin and fatty acids are widely used in construction and HVAC systems for thermal regulation due to their ability to maintain consistent temperatures and prevent overheating. Their environmental safety and ease of handling further drive adoption across residential and commercial sectors, making them a preferred choice for sustainable thermal management solutions

Report Scope and Advanced Phase Change Material Market Segmentation

|

Attributes |

Advanced Phase Change Material Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Advanced Phase Change Material Market Trends

Growing Use of Phase Change Materials in Energy-Efficient Applications

- The adoption of advanced phase change materials (PCMs) is increasing significantly as they offer efficient thermal management solutions for buildings, electronics, and industrial systems, helping to maintain stable temperatures, reduce energy consumption, and lower operational costs over time

- For instance, BASF’s Micronal PCM is incorporated in building materials such as wall panels and ceilings to stabilize indoor temperatures throughout the day, reducing the dependency on HVAC systems and contributing to more sustainable and energy-efficient building practices

- PCMs are being implemented in thermal energy storage, cold chain logistics, and HVAC systems to provide precise temperature control, prevent overheating, and optimize energy usage, improving performance and reducing electricity costs in commercial and residential applications

- The versatility of PCMs allows integration into renewable energy systems such as solar thermal storage, which stores excess heat during peak sunlight hours and releases it when needed, thereby increasing energy utilization efficiency and improving system reliability

- Growing environmental awareness, stricter energy regulations, and corporate sustainability goals are encouraging industries to implement PCMs in construction, packaging, and industrial processes, ensuring compliance while reducing carbon footprints and operational expenses

- The increasing demand for energy-efficient and sustainable thermal management solutions is fostering innovation in PCM technologies, with companies developing new formulations and applications, positioning PCMs as indispensable components in modern energy management strategies

Advanced Phase Change Material Market Dynamics

Driver

Increasing Demand for Sustainable Thermal Management Solutions

- The rising global emphasis on energy efficiency and environmental responsibility is driving demand for PCMs as they enable effective heat storage and release, reducing energy consumption and improving the sustainability of thermal management systems

- For instance, Honeywell’s PCM-based insulation products are being adopted in commercial refrigeration and construction sectors to optimize energy usage, lower electricity bills, and support compliance with green building standards, demonstrating strong market adoption

- Automotive, electronics, and aerospace industries are increasingly using PCMs to regulate temperatures in batteries, electronic devices, and critical components, enhancing operational efficiency, extending equipment lifespan, and reducing maintenance costs

- The trend toward green buildings, energy-efficient industrial processes, and eco-friendly product design is accelerating PCM integration into construction materials, cold storage solutions, and thermal management systems to achieve measurable energy savings and sustainability targets

- The combined effects of rising energy costs, environmental regulations, and growing demand for reliable and sustainable thermal solutions are fueling consistent market growth, driving innovation, and expanding opportunities for PCM manufacturers and solution providers

Restraint/Challenge

High Production Costs and Technical Complexity

- The production of advanced PCMs requires complex chemical processes, specialized materials, and rigorous quality control, resulting in high manufacturing costs that restrict adoption, particularly in price-sensitive markets

- For instance, smaller construction and industrial firms may be hesitant to implement PCM-based products from companies such as BASF or Honeywell due to their premium pricing, limiting market penetration and widespread deployment

- Integrating PCMs into applications such as thermal storage systems, HVAC solutions, and electronics demands precise engineering, testing, and system compatibility to ensure consistent thermal performance, adding technical complexity and potential implementation risks

- Maintaining long-term stability, thermal reliability, and compatibility with host materials is critical, as failure to sustain performance can reduce energy efficiency, compromise system safety, and deter potential customers from adopting PCMs

- Overcoming high production costs, simplifying integration processes, and developing standardized, user-friendly PCM solutions are essential for expanding adoption across industries, while continuous R&D efforts aim to make PCMs more commercially viable and accessible

Advanced Phase Change Material Market Scope

The market is segmented on the basis of product, application, and encapsulation and packaging method.

- By Product

On the basis of product, the Advanced Phase Change Material (PCM) market is segmented into organic, inorganic, and bio-based types. The organic PCM segment dominated the market with the largest revenue share of 45.73% in 2024, attributed to its superior chemical stability, non-corrosive nature, and compatibility with building materials. Organic PCMs such as paraffin and fatty acids are widely used in construction and HVAC systems for thermal regulation due to their ability to maintain consistent temperatures and prevent overheating. Their environmental safety and ease of handling further drive adoption across residential and commercial sectors, making them a preferred choice for sustainable thermal management solutions.

The bio-based PCM segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing emphasis on sustainability and the shift toward renewable, biodegradable materials. These materials, derived from natural sources such as plant oils, offer low toxicity and a reduced carbon footprint, aligning with global green building initiatives. Growing R&D investments to enhance the thermal reliability and performance of bio-based PCMs have also supported their integration into energy-efficient construction and packaging applications, boosting market expansion in the coming years.

- By Application

On the basis of application, the market is categorized into building and construction, commercial refrigeration, HVAC, energy storage, shipping and transportation, and others. The building and construction segment held the largest market share in 2024, driven by increasing adoption of PCMs in walls, floors, and roofs to regulate indoor temperature and reduce HVAC energy loads. With the rising demand for net-zero energy buildings, PCMs are being used to improve energy efficiency and thermal comfort. The material’s ability to store and release heat based on temperature fluctuations makes it ideal for passive thermal control, promoting widespread usage across residential and commercial structures.

The energy storage segment is expected to register the fastest growth rate from 2025 to 2032, propelled by the global transition toward renewable power sources and grid stability requirements. PCMs are increasingly utilized in thermal energy storage systems to store excess heat from solar and industrial processes for later use, improving energy efficiency and reliability. Advancements in high-performance encapsulated PCMs have enhanced their applicability in large-scale energy storage units, making them critical components in sustainable power infrastructure.

- By Encapsulation and Packaging Method

On the basis of encapsulation and packaging method, the market is segmented into nano-encapsulation, micro-encapsulation, and macro-encapsulation. The micro-encapsulation segment dominated the market in 2024 due to its superior ability to protect PCMs from leakage and degradation while maintaining efficient heat transfer. This method involves coating PCM particles with polymer shells, improving their thermal cycling stability and durability. Micro-encapsulated PCMs are extensively used in textiles, construction materials, and electronics, as they ensure uniform distribution and long-term performance, contributing to their strong market demand.

The nano-encapsulation segment is projected to witness the fastest growth from 2025 to 2032, driven by technological advancements enhancing heat transfer efficiency and PCM responsiveness. Nano-encapsulation offers higher surface area-to-volume ratios, allowing quicker energy exchange and improved thermal conductivity, making it ideal for compact electronic devices and advanced energy systems. Increasing R&D investments focused on nanomaterial integration and scalable production techniques are further accelerating adoption, positioning nano-encapsulation as a key innovation trend in the Advanced PCM market.

Advanced Phase Change Material Market Regional Analysis

- Europe dominated the advanced phase change material market with the largest revenue share of 37.4% in 2024, driven by growing adoption of energy-efficient building materials, stringent environmental regulations, and rising demand for sustainable energy storage solutions

- Consumers and businesses in the region increasingly prioritize thermal energy management, reduced energy consumption, and integration of advanced phase change materials into construction and industrial applications

- This widespread adoption is further supported by strong government incentives, increasing urbanization, and high awareness of sustainability practices, positioning Europe as a key hub for advanced phase change material innovations

Germany Advanced Phase Change Material Market Insight

The Germany advanced phase change material market captured the largest revenue share in Europe in 2024, fueled by the country’s focus on energy-efficient construction, renewable energy integration, and industrial sustainability initiatives. German consumers and industries are prioritizing materials that improve thermal regulation, reduce heating and cooling costs, and contribute to carbon footprint reduction. The integration of APCMs into residential, commercial, and industrial projects, coupled with technological advancements in encapsulation and energy storage, is propelling market growth.

U.K. Advanced Phase Change Material Market Insight

The U.K. advanced phase change material market is expected to grow at a notable CAGR during the forecast period, driven by increasing adoption of green building standards, energy conservation policies, and demand for temperature-regulated materials. Both residential and commercial sectors are embracing APCMs to enhance thermal comfort and reduce energy expenses. Rising investments in sustainable construction and awareness of climate change mitigation are further fostering market expansion.

North America Advanced Phase Change Material Market Insight

The North America advanced phase change material market is witnessing steady growth, driven by adoption in HVAC systems, cold chain logistics, and energy storage applications. Consumers and industries are increasingly leveraging APCMs for thermal energy management and cost reduction. The U.S., in particular, contributes a significant revenue share due to incentives for energy-efficient technologies, smart building adoption, and innovation in encapsulation techniques.

U.S. Advanced Phase Change Material Market Insight

The U.S. advanced phase change material market accounted for the largest share in North America in 2024, driven by demand for energy-efficient building materials, growing deployment in HVAC and refrigeration systems, and expanding renewable energy projects. Technological advancements and increased R&D activities in micro- and nano-encapsulation further enhance market growth.

Asia-Pacific Advanced Phase Change Material Market Insight

The Asia-Pacific advanced phase change material market is poised to grow at the fastest CAGR during the forecast period, driven by rising urbanization, infrastructure development, and increasing focus on energy efficiency in countries such as China, Japan, and India. Governments are supporting green building initiatives and energy storage projects, which is boosting APCM adoption. Furthermore, the region’s manufacturing capabilities and growing awareness of sustainable technologies are enhancing market penetration.

China Advanced Phase Change Material Market Insight

The China advanced phase change material market held the largest revenue share in APAC in 2024, fueled by rapid urbanization, expansion of the commercial and residential construction sectors, and increasing focus on energy conservation. Government initiatives supporting energy-efficient infrastructure, combined with domestic production capabilities and cost-effective APCM solutions, are key factors driving market growth.

Japan Advanced Phase Change Material Market Insight

The Japan advanced phase change material market is gaining traction due to high technological adoption, increasing smart building projects, and demand for thermal energy storage solutions. Integration of APCMs in commercial refrigeration, HVAC systems, and energy-efficient buildings is driving market expansion. In addition, Japan’s aging population is prompting adoption of temperature-controlled environments for healthcare and residential facilities, supporting sustained demand.

Advanced Phase Change Material Market Share

The advanced phase change material industry is primarily led by well-established companies, including:

- Phase Change Solutions (U.S.)

- Henkel Adhesives Technologies India Private Limited (India)

- Rubitherm Technologies GmbH (Germany)

- PCM Products Ltd (U.K.)

- Climator SWEDEN AB (Sweden)

- Outlast Technologies LLC (U.S.)

- Cryopak A TCP Company (U.S.)

- BASF SE (Germany)

- AI Technology, Inc. (U.S.)

- Laird (U.K.)

- Microtek Laboratories, Inc. (U.S.)

- RGEES, LLC (U.S.)

- VWR International, LLC (U.S.)

- Croda International Plc (U.K.)

- Insolcorp, LLC (U.S.)

Latest Developments in Global Advanced Phase Change Material Market

- In March 2025, Henkel introduced the Bergquist Liqui Form TLF 6500CGel-SF, a thermal cure gel designed for advanced heat dissipation in autonomous driving applications. This product addresses the growing thermal management challenges posed by high-performance electronics in electric vehicles and autonomous systems. By providing efficient heat transfer and stability under high loads, it enhances the reliability and performance of critical automotive components. This development is expected to accelerate the adoption of APCMs in the automotive sector, particularly in electric and autonomous vehicle manufacturing, and reinforces Henkel’s position as a leading provider of innovative thermal management solutions

- In February 2024, 3M launched the Novec 7300 Phase Change Material, engineered to deliver high-efficiency cooling for data centers, electronic devices, and industrial equipment. This PCM offers superior thermal regulation, long-term stability, and energy-saving performance, reducing operational costs associated with cooling. The launch strengthens the integration of APCMs in IT infrastructure and industrial applications, supporting the increasing demand for energy-efficient thermal management solutions, and contributes to sustainable operations in sectors that rely on high-performance electronics

- In November 2023, BASF expanded its EcoPCM product line by introducing enhanced organic and bio-based phase change materials specifically targeted for building and construction applications. These materials improve indoor thermal comfort, reduce energy consumption for heating and cooling, and support compliance with green building standards. The expansion enhances BASF’s presence in the sustainable construction segment and promotes broader adoption of APCMs across Europe and North America. This strategic move also aligns with global initiatives for energy-efficient and eco-friendly building materials, positioning APCMs as a key technology for sustainable urban development

- In June 2023, BASF established a co-located battery materials and recycling center in Schwarzheide, Germany, integrating cathode active material production with a black mass recycling facility. This development is a significant step toward creating a circular economy in battery manufacturing by recovering valuable materials from used batteries. The facility enhances resource efficiency and sustainability in energy storage systems, driving the adoption of APCMs in battery applications and energy storage solutions. This initiative supports the growing demand for eco-friendly and cost-effective energy storage technologies in Europe and globally

- In May 2023, Henkel announced the commercial availability of the Bergquist Hi Flow THF 5000UT, a phase change film capable of forming an ultra-thin bond line with minimal mechanical pressure. This innovation enables efficient thermal management in high-performance computing and electronic devices by reducing thermal resistance and mechanical stress. By improving reliability, longevity, and heat dissipation of critical electronic components, the product encourages broader adoption of APCMs in IT, telecommunications, and other high-tech sectors. It represents a significant technological advancement in phase change materials, supporting the growth of energy-efficient electronics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Advanced Phase Change Material Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Advanced Phase Change Material Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Advanced Phase Change Material Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.