Global Advanced Probe Card Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

2.13 Billion

2024

2032

USD

1.30 Billion

USD

2.13 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 2.13 Billion | |

|

|

|

|

What is the Global Advanced Probe Card Market Size and Growth Rate?

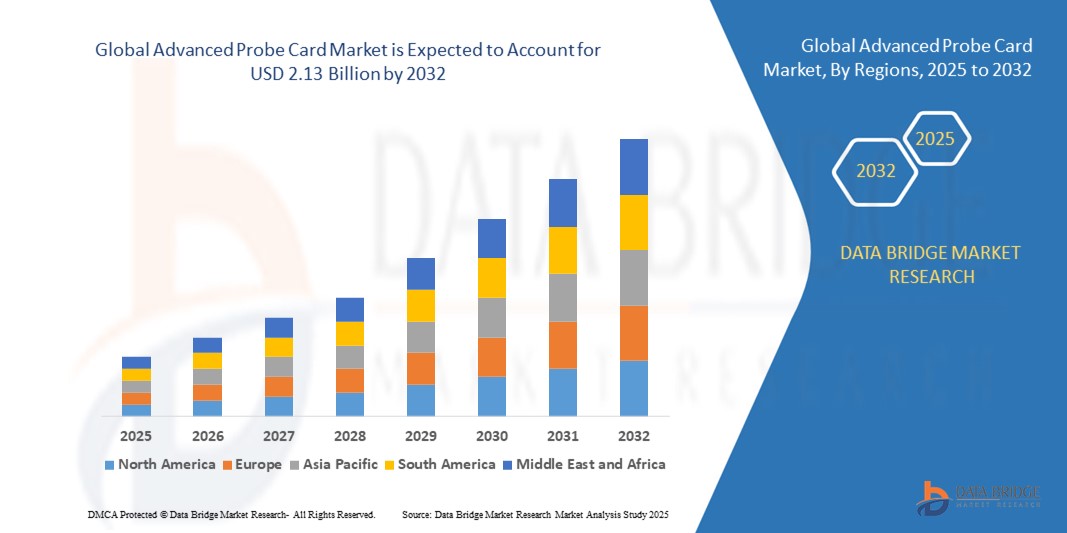

- The global advanced probe card market size was valued at USD 1.30 billion in 2024 and is expected to reach USD 2.13 billion by 2032, at a CAGR of 6.30% during the forecast period

- Demand for advanced probe cards with higher precision, greater functionality, and compatibility with smaller nodes was rising, driven by the growing adoption of technologies such as 5G, IoT, and AI

- In addition, there was a notable shift towards multi-chip and heterogeneous integration, prompting probe card manufacturers to develop innovative solutions capable of testing diverse chip architectures efficiently

What are the Major Takeaways of Advanced Probe Card Market?

- Ongoing advancements in semiconductor technology, including the development of smaller and more complex integrated circuits, drive the demand for advanced probe cards. As semiconductor devices become increasingly sophisticated, there is a greater need for probe cards capable of testing them with higher precision and accuracy

- The expanding consumer electronics market, fueled by IoT devices, smartphones, and automotive electronics trends, boosts the demand for semiconductor devices. This, in turn, drives the need for advanced probe cards to ensure the quality and reliability of these semiconductor components

- Asia-Pacific dominated the advanced probe card market with the largest revenue share of 44.2% in 2024, driven by rapid growth in the semiconductor industry, technological advancements, and the presence of major foundries in countries such as Taiwan, South Korea, Japan, and China

- North America advanced probe card market is projected to grow at the fastest CAGR of 11.8% during 2025–2032, driven by increased investment in semiconductor R&D, the expansion of advanced packaging facilities, and the region’s leadership in AI, high-performance computing, and data center infrastructure

- Deadbolt segment dominated the Advanced Probe Card market with a market share of 43.2% in 2024, driven by its established reputation for security and ease of retrofit into existing door setups

Report Scope and Advanced Probe Card Market Segmentation

|

Attributes |

Advanced Probe Card Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Advanced Probe Card Market?

Rising Adoption of AI-Driven and High-Precision Testing Solutions

- A significant and fast-emerging trend in the global advanced probe card market is the integration of artificial intelligence (AI) and advanced analytics into semiconductor testing processes. This technology fusion is enhancing precision, reducing test times, and improving overall yield in chip manufacturing

- For instance, leading players are developing AI-enabled probe cards that can automatically adjust test parameters in real-time based on wafer conditions, significantly reducing manual intervention and increasing throughput

- AI algorithms can analyze large volumes of test data to detect anomalies earlier, predict potential defects, and recommend process optimizations, thereby reducing costs and improving production efficiency

- In addition, probe cards integrated with IoT connectivity allow remote monitoring, predictive maintenance, and performance tracking, enabling semiconductor fabs to operate with higher efficiency and less downtime

- The ability to integrate these smart probe cards with automated test equipment (ATE) platforms creates a streamlined testing ecosystem where parameters can be adjusted dynamically without halting operations

- This trend towards intelligent, data-driven, and interconnected probe card solutions is reshaping semiconductor testing standards, with companies such as FormFactor and Japan Electronic Materials investing in AI-based innovations to meet the industry’s demand for faster, more reliable testing in advanced nodes

- Demand for such high-precision, AI-integrated probe cards is accelerating in both logic and memory testing, driven by the growing complexity of devices and the increasing push for shorter time-to-market in consumer electronics, automotive, and high-performance computing sectors

What are the Key Drivers of Advanced Probe Card Market?

- The rapid growth of the semiconductor industry, driven by surging demand for advanced consumer electronics, 5G devices, electric vehicles, and AI-enabled systems, is a primary driver of the advanced probe card market

- For instance, in March 2024, FormFactor announced advancements in MEMS-based probe card technologies designed for next-generation logic and DRAM devices, enabling improved contact accuracy and reduced cost per test

- As semiconductor devices become smaller, faster, and more complex, the need for precise, reliable, and cost-effective wafer-level testing solutions has intensified, positioning advanced probe cards as a critical component in manufacturing

- Furthermore, the rise in outsourced semiconductor assembly and test (OSAT) services is expanding the customer base for probe card suppliers, as more fabless companies rely on external partners for high-volume testing

- The ability of modern probe cards to support multi-site and parallel testing, reduce downtime through modular designs, and integrate with smart factory infrastructure is increasing their adoption across the industry

- In addition, the growing focus on reducing production costs, improving yields, and accelerating time-to-market is pushing chipmakers to invest in advanced probe card solutions that deliver higher efficiency without compromising test quality

Which Factor is Challenging the Growth of the Advanced Probe Card Market?

- The high cost of advanced probe cards, especially those designed for cutting-edge nodes below 7nm, remains a significant challenge for market adoption, particularly among smaller fabs and OSAT providers

- Complex manufacturing processes, precision engineering requirements, and the need for specialized materials contribute to elevated production costs, making it harder for price-sensitive customers to upgrade to newer technologies

- For instance, probe cards for advanced 3D NAND and high-bandwidth memory (HBM) testing can cost significantly more than conventional products, limiting their penetration in low-margin production environments

- Another major challenge is the wear and tear of probe tips, which leads to shorter lifespans and higher maintenance costs, especially when testing advanced wafers with delicate structures

- In addition, fluctuations in semiconductor demand cycles can impact probe card orders, as companies often delay capital-intensive testing equipment investments during downturns

- Overcoming these challenges will require innovations in cost-effective probe card designs, adoption of longer-lasting materials, and greater emphasis on modular, easily replaceable components to extend product life. Suppliers that can balance advanced performance with affordability are such asly to gain a competitive edge in the coming years

How is the Advanced Probe Card Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Technology

On the basis of technology, the advanced probe card market is segmented into MEMS, Cantilever, and Vertical. The MEMS segment dominated the advanced probe card market with the largest market revenue share of 49.6% in 2024, driven by its high precision, scalability, and suitability for testing advanced semiconductor devices with smaller node sizes. MEMS probe cards are preferred for their ability to handle high-frequency applications, deliver consistent contact force, and reduce damage to delicate wafers, making them the go-to choice for leading semiconductor manufacturers.

The Vertical segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by its increasing adoption in advanced packaging and 3D IC testing. Vertical probe cards provide high pin counts, better planarity, and support for complex testing environments, meeting the demands of next-generation semiconductor designs. Their growing use in heterogeneous integration and advanced logic applications also contributes to their rising popularity.

- By Application

On the basis of application, the advanced probe card market is segmented into Foundry and Logic, DRAM, Flash, and Other Applications. The Foundry and Logic segment accounted for the largest market revenue share of 54.3% in 2024, driven by the surge in production of advanced logic devices, AI chips, and processors for high-performance computing. This segment benefits from the continuous demand for cutting-edge semiconductor nodes, high-density integration, and rigorous testing requirements to ensure device reliability.

The DRAM segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the growing demand for high-capacity and high-speed memory in data centers, smartphones, and AI-driven applications. Increased investments in DRAM production and the development of next-generation DDR standards are boosting the adoption of specialized probe cards in this segment.

Which Region Holds the Largest Share of the Advanced Probe Card Market?

- Asia-Pacific dominated the advanced probe card market with the largest revenue share of 44.2% in 2024, driven by rapid growth in the semiconductor industry, technological advancements, and the presence of major foundries in countries such as Taiwan, South Korea, Japan, and China

- The region benefits from a robust electronics manufacturing ecosystem, strong government support for digitalization, and increasing demand for advanced testing solutions in logic, memory, and high-performance computing applications

- Rising investments in AI, 5G, and IoT, coupled with the proliferation of consumer electronics, are fueling the adoption of advanced probe cards across both established semiconductor hubs and emerging markets in the region

China Advanced Probe Card Market Insight

China advanced probe card market captured the largest revenue share of 37% in 2024 within Asia-Pacific, supported by its position as a global leader in electronics production and semiconductor packaging. The country’s strong domestic manufacturing base, combined with government-backed initiatives to advance semiconductor self-sufficiency, is accelerating adoption. Demand is further driven by local foundries expanding capacity for advanced nodes, as well as a focus on cost-effective yet high-precision testing solutions.

Japan Advanced Probe Card Market Insight

The Japan advanced probe card market is expected to grow steadily, driven by the country’s expertise in precision engineering and high-reliability electronics. Japan’s semiconductor industry is focusing on advanced memory, automotive chips, and 3D packaging, all of which require sophisticated testing solutions. Strong R&D capabilities and demand for high-pin-count probe cards are contributing to market expansion, particularly among leading semiconductor device manufacturers.

South Korea Advanced Probe Card Market Insight

The South Korea advanced probe card market is poised for robust growth, backed by its leadership in DRAM and NAND flash manufacturing. Major chipmakers in the country are investing heavily in next-generation memory production, driving the need for advanced, high-throughput probe cards. The focus on high-volume production and rapid time-to-market is accelerating the adoption of vertical and MEMS probe card technologies.

Which Region is the Fastest Growing Region in the Advanced Probe Card Market?

North America advanced probe card market is projected to grow at the fastest CAGR of 11.8% during 2025–2032, driven by increased investment in semiconductor R&D, the expansion of advanced packaging facilities, and the region’s leadership in AI, high-performance computing, and data center infrastructure. The U.S. is seeing strong demand from both logic and advanced memory testing, supported by government incentives for domestic chip production under initiatives such as the CHIPS and Science Act.

U.S. Advanced Probe Card Market Insight

The U.S. advanced probe card market held the largest share of 84% in 2024 within North America, propelled by the presence of leading semiconductor equipment manufacturers and design houses. Strong collaborations between fabless companies, foundries, and test solution providers are driving adoption. The growing focus on onshore manufacturing and the testing of next-generation chip architectures is further supporting market expansion.

Canada Advanced Probe Card Market Insight

The Canada advanced probe card market is gaining traction, supported by niche semiconductor R&D, photonics development, and integration with AI-driven testing systems. The country’s focus on collaborative research with U.S.-based semiconductor firms is fostering adoption of advanced probe card technologies for specialized applications.

Which are the Top Companies in Advanced Probe Card Market?

The advanced probe card industry is primarily led by well-established companies, including:

- FormFactor Ltd (U.S.)

- Feinmetall GmbH (Germany)

- SV Probe (Taiwan)

- Microfriend Inc. (Taiwan)

- Japan Electronic Materials Corporation (Japan)

- RIKA DENSHI CO., LTD. (Japan)

- Precision Test Tech.Co., Ltd. (Taiwan)

- MPI Corporation (Taiwan)

- MICRONICS JAPAN CO., LTD. (Japan)

- TSE Co, Ltd. (Japan)

What are the Recent Developments in Global Advanced Probe Card Market?

- In May 2024, FormFactor once again received recognition in TechInsights’ customer satisfaction survey, highlighting its strong position in the semiconductor industry. The survey evaluates global semiconductor suppliers based on customer service, product performance, and overall performance, and FormFactor has now been honored for eleven consecutive years as a leading supplier of Test Subsystems, particularly in probe card manufacturing. This consistent recognition reinforces the company’s reputation for excellence and reliability in the industry

- In May 2024, MJC Europe GmbH, a subsidiary of Micronics Japan Co., Ltd., relocated to a new office in Munich to strengthen its sales opportunities for probe cards and test sockets tailored for logic chips, especially targeting the automotive sector in Europe. The strategic move places the company closer to Europe’s key semiconductor hubs, enabling enhanced collaboration and market reach. This relocation is expected to drive stronger business growth and customer engagement within the region

- In April 2024, FormFactor introduced an innovative presentation, COMPASS, showcasing methods to optimize CCC in probe cards and the progression toward an Unburnable Probe. The session explored probe card design strategies aimed at achieving CCC levels above 2.5A at 80-µm minimum pitch, incorporating advanced probe designs and architectural improvements for high-stress environments. This initiative highlights FormFactor’s continuous innovation in enhancing probe card performance and durability

- In January 2024, Samsung inaugurated a new U.S.-based R&D laboratory dedicated to developing next-generation 3D-DRAM within its Device Solutions America (DSA) division. The facility will focus on advanced DRAM architecture to reinforce Samsung’s leadership in the global 3D memory chip market. This expansion strengthens Samsung’s competitive edge in cutting-edge memory technologies

- In September 2023, Jenoptik announced the launch of the UFO Probe Vertical, extending its range of wafer-level testing solutions for photonic integrated circuits (PICs). Based on Jenoptik’s proprietary UFO Probe technology, the vertical version offers enhanced precision and efficiency in testing. This development underscores Jenoptik’s commitment to advancing photonics testing capabilities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.