Global Advanced Visualization Market

Market Size in USD Billion

CAGR :

%

USD

3.43 Billion

USD

7.86 Billion

2024

2032

USD

3.43 Billion

USD

7.86 Billion

2024

2032

| 2025 –2032 | |

| USD 3.43 Billion | |

| USD 7.86 Billion | |

|

|

|

|

Advanced Visualization Market Size

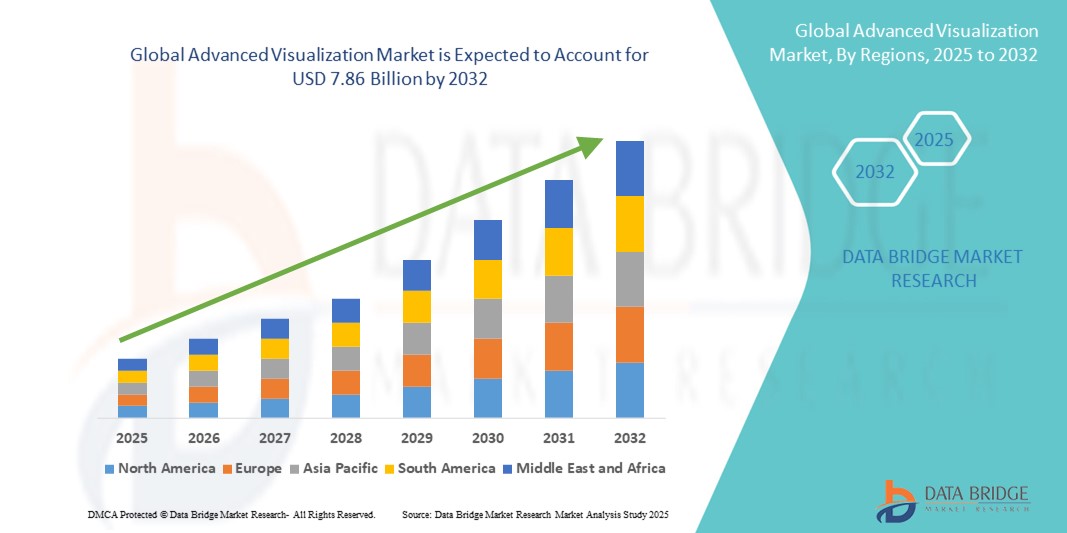

- The global advanced visualization market size was valued at USD 3.43 billion in 2024 and is expected to reach USD 7.86 billion by 2032, at a CAGR of 10.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced imaging modalities and the integration of sophisticated visualization software across healthcare facilities, research institutions, and diagnostic centers, leading to enhanced clinical decision-making and improved patient outcomes

- Furthermore, rising demand for accurate, high-resolution, and real-time imaging solutions for applications such as radiology, cardiology, neurology, and oncology is establishing advanced visualization systems as a critical component of modern medical diagnostics. These converging factors are accelerating the uptake of advanced visualization solutions, thereby significantly boosting the industry's growth

Advanced Visualization Market Analysis

- Advanced visualization systems, which provide enhanced medical imaging through advanced software and hardware solutions, are becoming indispensable tools in modern healthcare settings, including hospitals, diagnostic centers, and research institutes, due to their ability to deliver more accurate diagnostics, improved treatment planning, and real-time 3D/4D image analysis

- The rising demand for advanced visualization is primarily driven by the growing adoption of AI-integrated imaging technologies, increasing prevalence of chronic and lifestyle-related diseases, expanding use of multimodality imaging in diagnosis, and a global shift toward personalized medicine and minimally invasive procedures

- North America dominated the advanced visualization market with the largest revenue share of 40% in 2024, driven by advanced healthcare infrastructure, high healthcare spending, and favourable reimbursement policies. The U.S. market, in particular, benefits from early adoption of cutting-edge imaging technologies, wide deployment of AI-enhanced visualization systems, and strong R&D investments

- Asia-Pacific is expected to be the fastest-growing region in the advanced visualization market during the forecast period (2025–2032), with a projected CAGR of 13%. This growth is fueled by increased healthcare infrastructure investment, rising incidence of chronic and infectious diseases, expanding geriatric populations, and growing demand for diagnostic imaging in countries such as China, India, and Japan

- The hardware and software segment dominated the advanced visualization market with a market revenue share of 62.4% in 2024, driven by the increasing deployment of high-performance visualization workstations and advanced imaging software in healthcare facilities

Report Scope and Advanced Visualization Market Segmentation

|

Attributes |

Advanced Visualization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Advanced Visualization Market Trends

Enhanced Diagnostic Capabilities Through AI and Multimodal Integration

- A significant and accelerating trend in the global advanced visualization market is the deepening integration of artificial intelligence (AI) and machine learning algorithms with multimodality imaging platforms such as CT, MRI, PET, and ultrasound. This convergence is substantially improving diagnostic precision, workflow efficiency, and clinician decision-making

- For example, AI-powered advanced visualization software can automatically segment anatomical structures, highlight potential anomalies, and generate 3D reconstructions in real time, reducing analysis time and enhancing diagnostic accuracy. Leading solutions are also capable of integrating data from multiple imaging modalities into a unified interface for comprehensive patient assessment

- AI integration in advanced visualization platforms enables features such as automated lesion detection, predictive analytics for disease progression, and intelligent image post-processing. Some systems can learn from historical imaging data to improve future diagnostic accuracy and suggest optimized scan protocols based on patient history

- The seamless interoperability of advanced visualization solutions with hospital information systems (HIS), radiology information systems (RIS), and picture archiving and communication systems (PACS) facilitates centralized access to patient data, enabling radiologists and clinicians to collaborate more effectively across departments

- This trend toward more intelligent, intuitive, and interconnected imaging solutions is fundamentally reshaping the way healthcare providers approach diagnostics, particularly in oncology, cardiology, and neurology. Consequently, companies such as Siemens Healthineers, GE HealthCare, and Philips are investing heavily in AI-enabled advanced visualization platforms with real-time collaboration tools and cloud-based accessibility

- The demand for advanced visualization systems offering AI-driven analytics, multimodality integration, and enhanced interoperability is growing rapidly across hospitals, diagnostic imaging centers, and academic research institutions, as healthcare systems worldwide increasingly prioritize precision medicine and value-based care models

Advanced Visualization Market Dynamics

Driver

Growing Need Due to Rising Disease Burden and Demand for Accurate Diagnostics

- The rising prevalence of chronic diseases, coupled with the growing need for more accurate and detailed diagnostic imaging, is a major driver for the heightened demand for advanced visualization solutions

- For instance, in March 2024, Siemens Healthineers announced the launch of its new AI-powered syngo.via VB60 software, designed to enhance multi-modality imaging analysis and streamline diagnostic workflows. Such innovations are expected to drive the Advanced Visualization Market during the forecast period

- As healthcare providers increasingly focus on precision medicine and early disease detection, advanced visualization tools—offering high-quality 3D/4D imaging, AI integration, and real-time data processing—provide a significant improvement over traditional imaging systems

- Furthermore, the integration of advanced visualization software with PACS and cloud-based platforms enables seamless image sharing, remote collaboration, and faster clinical decision-making, making them indispensable in modern healthcare

- The adoption is also being propelled by the growing use of minimally invasive procedures and image-guided surgeries, where accurate 3D reconstructions and real-time visualization are critical. The rising penetration of AI-driven analytics and automated reporting features further supports market growth by improving diagnostic accuracy and operational efficiency

Restraint/Challenge

High Implementation Costs and Interoperability Issues

- The high initial cost associated with advanced visualization software, coupled with the expenses for necessary high-performance hardware infrastructure, poses a substantial challenge to its widespread adoption, particularly among small and mid-sized healthcare facilities with limited budgets. These solutions—especially premium AI-enabled visualization platforms—often demand significant upfront investments not only for software licensing but also for the acquisition and maintenance of powerful computing systems capable of processing complex imaging datasets efficiently

- For instance, multi-specialty hospitals aiming to implement enterprise-level advanced visualization solutions frequently encounter financial constraints when attempting to integrate these technologies with their existing, and often outdated, legacy imaging systems. This integration process may also require additional customization and technical support, further increasing overall expenditur

- Another significant challenge lies in the interoperability gap between diverse imaging modalities and vendor-specific platforms. In many cases, advanced visualization tools are not fully compatible with other systems within the healthcare network, leading to workflow inefficiencies, delays in diagnostic reporting, and the necessity for extensive training programs to help medical staff adapt to new processes

- Moreover, the successful utilization of these tools relies heavily on the availability of highly skilled radiologists, imaging specialists, and technicians. In developing regions, where healthcare workforce shortages are already prevalent, this skills gap becomes a considerable barrier to adoption, limiting the potential benefits of these technologies

- Addressing these challenges will require the adoption of flexible, cloud-based, subscription-pricing models that lower upfront investment barriers; the establishment of standardized interoperability protocols to ensure seamless data exchange across platforms; and the implementation of targeted training initiatives to enhance the technical competencies of healthcare professionals. Collectively, these measures will be critical in driving sustainable growth and ensuring broader accessibility to advanced visualization solutions worldwide

Advanced Visualization Market Scope

The market is segmented on the basis of products and services, type of solution, imaging modality, clinical application, and end-user.

- By Products and Services

On the basis of products and services, the advanced visualization market is segmented into hardware and software, and services. The hardware and software segment dominated the largest market revenue share of 62.4% in 2024, driven by the increasing deployment of high-performance visualization workstations and advanced imaging software in healthcare facilities. Continuous advancements in graphics processing and 3D/4D imaging capabilities have expanded the clinical use cases, supporting faster and more precise diagnostics.

The services segment is anticipated to witness the fastest growth rate with a CAGR of 9.8% from 2025 to 2032, propelled by the rising demand for training, technical support, and system integration. As healthcare providers adopt more complex imaging platforms, service providers play a crucial role in ensuring optimal usage and workflow efficiency.

- By Type of Solution

On the basis of type of solution, the advanced visualization market is segmented into enterprise-wide thin client-based solutions and standalone workstation-based solutions. The enterprise-wide thin client-based solutions segment held the largest market revenue share of 57.1% in 2024, attributed to their scalability, centralized data management, and cost-effectiveness for multi-site hospital networks. These solutions allow clinicians to access advanced visualization tools from multiple devices without heavy hardware requirements.

The standalone workstation-based solutions segment is expected to witness the fastest CAGR of 8.9% from 2025 to 2032, supported by the continued demand for high-performance, dedicated imaging systems in specialized departments. These solutions offer superior processing speeds and image quality, which are essential for complex or high-resolution imaging needs.

- By Imaging Modality

On the basis of imaging modality, the advanced visualization market is segmented into MRI, CT, PET, ultrasound, RT, nuclear medicine, and others. The CT segment captured the largest market revenue share of 34.8% in 2024, driven by its widespread use in oncology, cardiology, and emergency medicine, combined with advancements in multi-slice CT technology. The need for rapid, detailed imaging makes CT a primary modality for 3D visualization applications.

The MRI segment is projected to register the fastest growth with a CAGR of 9.5% from 2025 to 2032, owing to its superior soft tissue contrast and expanding role in neurological, musculoskeletal, and cardiovascular diagnostics. The integration of advanced visualization tools with MRI scans enhances diagnostic precision and supports surgical planning.

- By Clinical Application

On the basis of clinical application, the advanced visualization market is segmented into radiology/interventional radiology, cardiology, orthopedics, oncology, vascular, gastroenterology, neurology, and others. The radiology/interventional radiology segment accounted for the largest revenue share of 39.6% in 2024, reflecting the central role of imaging in disease diagnosis and treatment planning. Advanced visualization tools in radiology support efficient image interpretation, faster turnaround times, and improved patient outcomes.

The oncology segment is anticipated to witness the fastest CAGR of 10.2% from 2025 to 2032, driven by the rising prevalence of cancer and the critical need for precise tumor detection, staging, and treatment monitoring. Advanced visualization enables 3D tumor mapping, aiding in targeted therapies and minimally invasive procedures.

- By End-User

On the basis of end-user, the advanced visualization market is segmented into hospitals and surgical centers, imaging centers, academic and research centers, and others. The hospitals and surgical centers segment dominated the market revenue share with 54.3% in 2024, owing to the integration of advanced imaging systems into hospital workflows for a broad range of specialties. High patient volumes and the need for multidisciplinary collaboration make hospitals primary adopters of these technologies.

The imaging centers segment is expected to record the fastest CAGR of 9.6% from 2025 to 2032, fueled by the growing outsourcing of imaging services, the rise of standalone diagnostic centers, and the increasing demand for high-quality, rapid imaging services in outpatient settings.

Advanced Visualization Market Regional Analysis

- North America dominated the advanced visualization market with the largest revenue share of 40% in 2024, driven by advanced healthcare infrastructure, high healthcare expenditure, and favorable reimbursement frameworks that encourage the adoption of next-generation imaging technologies

- The region’s strong ecosystem of medical device manufacturers, healthcare IT companies, and research institutions enables rapid adoption of AI-enhanced visualization platforms, cloud-based diagnostic tools, and advanced 3D/4D imaging solutions

- The widespread implementation of these technologies is further supported by a skilled healthcare workforce, early integration of advanced visualization into diagnostic and surgical workflows, and robust investment in R&D aimed at enhancing diagnostic accuracy and patient outcomes

U.S. Advanced Visualization Market Insight

The U.S. advanced visualization market captured the largest revenue share of 56% in 2024 within North America, underpinned by the rapid deployment of cutting-edge imaging modalities, early adoption of AI-powered visualization software, and the integration of these solutions across radiology, cardiology, oncology, and neurology departments. The strong presence of leading industry players, combined with a highly digitalized healthcare system and increasing demand for precision diagnostics, continues to drive market expansion. Additionally, significant investments in telehealth-compatible imaging solutions and enterprise-level PACS/VNA integration are accelerating adoption in hospitals and specialty clinics.

Europe Advanced Visualization Market Insight

The Europe advanced visualization market is projected to expand at a substantial CAGR during the forecast period, driven by the growing need for accurate, real-time diagnostic capabilities, strict regulatory standards for imaging quality, and government-backed healthcare modernization programs. The adoption of advanced visualization tools in Europe is being fueled by the rising prevalence of chronic diseases, expansion of cross-border healthcare services, and strong emphasis on interoperability between imaging systems. These solutions are increasingly being integrated into surgical planning, oncology treatment monitoring, and cardiovascular diagnostics.

U.K. Advanced Visualization Market Insight

The U.K. advanced visualization market is anticipated to grow at a noteworthy CAGR, supported by the country’s commitment to healthcare digitalization, the expansion of NHS imaging capabilities, and the push towards precision medicine. Increasing demand for AI-assisted diagnostic tools and cloud-enabled visualization platforms is enhancing radiology workflows, reducing reporting times, and improving diagnostic accuracy.

Germany Advanced Visualization Market Insight

The Germany advanced visualization market is expected to witness significant growth during the forecast period, driven by the country’s strong healthcare infrastructure, focus on medical technology innovation, and emphasis on sustainable, energy-efficient imaging systems. German hospitals and research centers are adopting advanced visualization for complex surgical procedures, tumor detection, and minimally invasive interventions, often integrating these solutions with robotic surgery systems and AI-based decision support tools.

Asia-Pacific Advanced Visualization Market Insight

The Asia-Pacific advanced visualization market is expected to grow at the fastest CAGR of 13% between 2025 and 2032, driven by large-scale healthcare infrastructure investments, rapid urbanization, and rising demand for diagnostic imaging in emerging economies. Increasing incidences of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders are prompting greater adoption of high-resolution 3D and 4D visualization technologies. Government initiatives promoting AI in healthcare, coupled with rising healthcare expenditure in China, India, and Japan, are further propelling the market.

Japan Advanced Visualization Market Insight

The Japan advanced visualization market is expanding steadily due to the country’s strong emphasis on early disease detection, its rapidly aging population, and the government’s focus on digital health innovation. Hospitals are increasingly integrating advanced visualization software into MRI, CT, and PET systems, enabling improved accuracy in oncology, neurology, and orthopedic diagnostics.

China Advanced Visualization Market Insight

The China advanced visualization market accounted for the largest share of the Asia-Pacific Advanced Visualization market in 2024, supported by massive healthcare modernization programs, an expanding middle class, and the country’s leadership in medical device manufacturing. The rising prevalence of lifestyle-related diseases, coupled with the government’s push for AI-powered medical imaging under its “Healthy China 2030” initiative, is driving widespread adoption of advanced visualization systems across both urban and rural healthcare facilities.

Advanced Visualization Market Share

The Advanced Visualization industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- Canon Medical Systems Corporation (Japan)

- FUJIFILM Holdings Corporation (Japan)

- Terarecon, Inc. (U.S.)

- Agfa-Gevaert Group (Belgium)

- Ziosoft (U.S.)

- Pro Medicus, Ltd. (U.S.)

- General Electric Company (U.S.)

- Siemens Healthcare GmbH (Germany)

- Visage Imaging, Inc. (U.S.)

- Tempus AI (U.S.)

- Canon Medical Informatics, Inc. (U.S.)

- Carestream Health (U.S.)

Latest Developments in Global Advanced Visualization Market

- In March 2023, Philips showcased an AI-powered integrated diagnostic approach at the European Congress of Radiology (ECR). They highlighted smart imaging systems and informatics solutions that connect radiology, oncology, cardiology, and pathology to enhance diagnostic confidence and operational efficiency

- In November 2023, GE HealthCare accelerated AI integration in its enterprise imaging ecosystem by adding third-party, AI-enabled application orchestration to its True PACS and Centricity PACS platforms—strengthening its advanced visualization capabilities

- In November 2023, at RSNA, GE HealthCare also unveiled over 40 new innovations, including AI-enabled imaging technology solutions designed for more precise care, reinforcing the link between AI and next-gen visualization tools

- In November 2023, Philips AI Manager and Advanced Visualization Workspace were deployed at Vestre Viken Health Trust in Norway. This cloud-based, multi-vendor AI platform integrates third-party AI into advanced visualization workflows to aid radiologists with image processing and intelligent automation

- In November 2024, Konica Minolta Healthcare Americas launched Exa Enterprise, an enterprise imaging platform (PACS/RIS) powered by AWS, embedding advanced visualization capabilities natively

- In April 2025, Konica Minolta introduced the next-gen Exa Platform, now enhanced with advanced visualization tools via a new API layer built for strategic partner integration

- In February 2025, DeepHealth (RadNet) announced its strategic collaboration with ConcertAI’s TeraRecon to integrate TeraRecon’s advanced visualization into the DeepHealth OS Diagnostic Suite—creating a unified, cloud-native, AI-powered diagnostic workspace

- In June 2025, CIVIE unveiled RadPod, an AI-powered, on-demand radiology reading platform. It enables radiologists to interpret medical imaging scans remotely on their schedule, optimizing workflow flexibility and leveraging advanced visualization tools

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.