Global Aerial Photogrammetry Software Market

Market Size in USD Billion

CAGR :

%

USD

2.42 Billion

USD

7.80 Billion

2025

2033

USD

2.42 Billion

USD

7.80 Billion

2025

2033

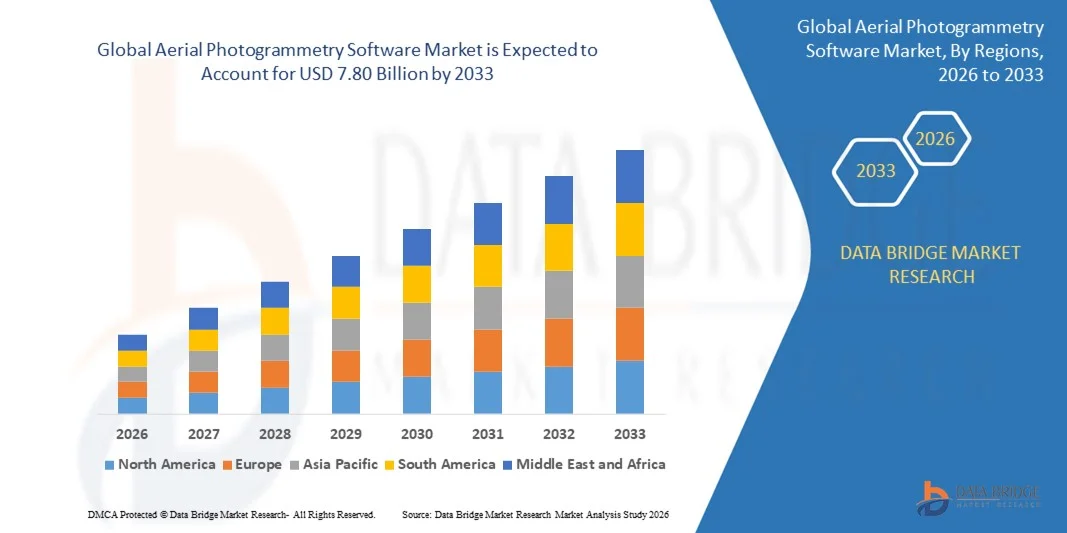

| 2026 –2033 | |

| USD 2.42 Billion | |

| USD 7.80 Billion | |

|

|

|

|

Aerial Photogrammetry Software Market Size

- The global aerial photogrammetry software market size was valued at USD 2.42 billion in 2025 and is expected to reach USD 7.80 billion by 2033, at a CAGR of 15.70% during the forecast period

- The market growth is largely fuelled by increasing adoption of drones and UAVs for mapping, surveying, and geospatial data collection

- Rising demand for high-accuracy topographic mapping, urban planning, and precision agriculture is further driving market expansion

Aerial Photogrammetry Software Market Analysis

- The market is witnessing strong growth as industries such as construction, mining, agriculture, and defense increasingly rely on aerial photogrammetry for accurate and timely geospatial information

- Advancements in drone technology, high-resolution cameras, and automated data processing tools are supporting wider adoption and improving the cost-effectiveness of aerial mapping solutions

- North America dominated the aerial photogrammetry software market with the largest revenue share in 2025, driven by the growing adoption of UAVs for surveying, mapping, and inspection across construction, agriculture, and mining sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global aerial photogrammetry software market, driven by increasing infrastructure development, rising adoption of advanced UAV technologies, and growing demand for precision agriculture and geospatial mapping

- The Multi Camera Photogrammetry segment held the largest market revenue share in 2025, driven by its ability to capture high-resolution, detailed images across large areas, ensuring precise mapping and 3D modeling. This style is widely used in construction, mining, and agriculture for accurate survey and monitoring purposes

Report Scope and Aerial Photogrammetry Software Market Segmentation

|

Attributes |

Aerial Photogrammetry Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aerial Photogrammetry Software Market Trends

Rise of Drone-Based Photogrammetry Solutions

- The growing adoption of drone-based photogrammetry is transforming the mapping and surveying landscape by enabling real-time, high-resolution aerial data collection. The mobility and speed of drones allow for immediate survey execution, particularly in large construction, mining, and agricultural sites, resulting in improved operational efficiency and reduced data collection costs. The integration of advanced sensors and GPS technology ensures precise measurements, enhancing the reliability of survey results and reducing the need for repeated field visits

- The high demand for rapid geospatial data in remote or hard-to-access regions is accelerating the adoption of lightweight drones equipped with advanced cameras and sensors. These solutions are particularly effective where traditional survey methods are time-consuming or resource-intensive, helping reduce project delays and improve accuracy. In addition, drones reduce human risk in hazardous terrain while enabling frequent updates on dynamic landscapes, supporting better decision-making for project managers and stakeholders

- The affordability and ease of use of modern drone-based photogrammetry systems are making them attractive for routine mapping and inspection tasks, leading to more frequent surveys and better-informed decision-making. Companies benefit from improved project planning without incurring excessive costs or logistical hurdles, which enhances overall operational efficiency. Software platforms with automated data processing capabilities further reduce labor requirements and accelerate analysis, creating cost and time efficiencies for end-users

- For instance, in 2023, several agricultural cooperatives in the U.S. reported improved crop monitoring and yield predictions after deploying drone-based photogrammetry solutions. These implementations allowed faster and more accurate land surveys, optimizing resource allocation and reducing operational expenses. The adoption of cloud-based photogrammetry platforms also enabled remote data access, collaboration between agronomists, and integration with precision agriculture tools for enhanced crop management

- While drone-based photogrammetry is accelerating survey efficiency and data accuracy, its impact depends on continued innovation, operator training, and software integration. Manufacturers must focus on localized product development, regulatory compliance, and workflow automation to fully capitalize on this growing demand. Expansion into new verticals, such as environmental monitoring, disaster management, and infrastructure inspection, further enhances market opportunities while promoting sustainable and technology-driven surveying practices

Aerial Photogrammetry Software Market Dynamics

Driver

Growing Demand for High-Accuracy Mapping and Surveying

- The increasing need for precise topographic mapping, urban planning, and infrastructure development is pushing governments, construction firms, and agriculture operators to adopt aerial photogrammetry solutions as a core data acquisition tool. High-resolution data enables accurate modeling, planning, and risk assessment. Integration with GIS and AI technologies also allows for predictive modeling and smarter decision-making, enhancing project outcomes and reducing operational inefficiencies

- Organizations are increasingly aware of the financial and operational risks associated with inaccurate mapping, including project delays, regulatory non-compliance, and resource misallocation. This awareness has led to more frequent use of drone-based photogrammetry across multiple industries. Timely and precise aerial data collection enables better allocation of resources, cost management, and proactive mitigation of potential project risks, ultimately improving ROI for businesses and public sector projects

- Public sector initiatives and international development programs have strengthened the adoption of photogrammetry software, offering subsidies, guidelines, and training to encourage usage. These frameworks support wider adoption and improved project execution efficiency. Moreover, these initiatives are fostering collaborations between technology providers, research institutions, and end-users, accelerating innovation in software features, sensor integration, and data analytics capabilities

- For instance, in 2022, the European Union implemented digital mapping programs for smart city projects, boosting demand for aerial photogrammetry software and UAV-based survey solutions. These programs emphasize sustainable urban planning, infrastructure monitoring, and efficient land-use management, creating opportunities for software providers to deliver integrated solutions that meet regulatory and operational requirements

- While growing demand and institutional support are driving the market, there is still a need to enhance software usability, reduce operational costs, and integrate photogrammetry solutions with GIS and AI tools to ensure sustained adoption. Developers are also focusing on improving interoperability, cloud storage solutions, and automated processing capabilities to make photogrammetry software accessible to smaller operators and new industry verticals

Restraint/Challenge

High Cost of Advanced Photogrammetry Software and Limited Technical Expertise

- The high price point of advanced aerial photogrammetry software, including 3D modeling, LiDAR integration, and cloud-based processing platforms, makes them inaccessible for small operators and underfunded organizations. Cost remains a major barrier to widespread adoption. Furthermore, recurring subscription fees for software updates and cloud storage can increase the total cost of ownership, limiting adoption among budget-conscious enterprises

- Many regions face a shortage of trained personnel capable of operating drones, managing software, and interpreting geospatial data. The absence of technical expertise and supporting infrastructure further limits the effective use of photogrammetry solutions. This talent gap is compounded in emerging economies where educational and certification programs for drone operations and geospatial analytics are limited or non-standardized, restricting the pace of market growth

- Market penetration is also restricted by regulatory barriers and limited access to airspace in certain regions, where drone flights require permits and compliance with strict aviation rules. These restrictions delay projects and reduce the efficiency of surveys. In addition, inconsistent enforcement of regulations across regions creates uncertainty for operators and adds administrative overhead, discouraging investment in advanced drone-based photogrammetry technologies

- For instance, in 2023, construction firms in Sub-Saharan Africa reported that over 60% of small-scale operators could not implement drone-based surveys due to software costs and lack of skilled personnel. The situation highlights the need for affordable, user-friendly solutions and training programs to bridge the skills gap and enable broader market adoption

- While photogrammetry technology continues to advance, solving cost and expertise challenges remains crucial. Market stakeholders must focus on affordable solutions, operator training, and scalable software platforms to unlock long-term market potential. In addition, partnerships with academic institutions, training centers, and government programs can help expand the skilled workforce, enabling wider adoption across industrial, agricultural, and infrastructure sectors

Aerial Photogrammetry Software Market Scope

The aerial photogrammetry software market is segmented on the basis of photogrammetry style, application, and end user.

- By Photogrammetry Style

On the basis of photogrammetry style, the aerial photogrammetry software market is segmented into Point-and-Shoot Photogrammetry, Multi Camera Photogrammetry, and Video-To-Photogrammetry. The Multi Camera Photogrammetry segment held the largest market revenue share in 2025, driven by its ability to capture high-resolution, detailed images across large areas, ensuring precise mapping and 3D modeling. This style is widely used in construction, mining, and agriculture for accurate survey and monitoring purposes.

The Video-To-Photogrammetry segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its capability to generate 3D models from video footage, reducing data acquisition time and simplifying the survey process. Video-based photogrammetry is particularly popular in infrastructure monitoring, traffic management, and cultural heritage documentation, offering cost-effective and efficient mapping solutions for dynamic environments.

- By Application

On the basis of application, the market is segmented into 3D Printing, Drones and Robots, Topographic Maps, Culture Heritage and Museum, Films and Games, Traffic Management, and Other Applications. The Drones and Robots segment held the largest share in 2025, fueled by the increasing use of UAVs for aerial surveys, inspection, and monitoring tasks across multiple industries.

The 3D Printing segment is expected to witness the fastest growth during the forecast period, driven by the rising demand for accurate 3D models for prototyping, design validation, and manufacturing purposes. Integration of photogrammetry data with 3D printing software is enabling faster production cycles and improved product quality.

- By End User

On the basis of end user, the market is segmented into Building and Construction, Automotive, Energy, Oil and Gas, Ship Building, and Others. The Building and Construction segment accounted for the largest market revenue share in 2025, attributed to the increasing need for accurate site surveys, progress monitoring, and urban planning.

The Energy and Oil & Gas segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the adoption of aerial photogrammetry software for pipeline inspection, site analysis, and infrastructure maintenance, which helps reduce operational risks and improve project efficiency.

Aerial Photogrammetry Software Market Regional Analysis

- North America dominated the aerial photogrammetry software market with the largest revenue share in 2025, driven by the growing adoption of UAVs for surveying, mapping, and inspection across construction, agriculture, and mining sectors

- Organizations in the region highly value the speed, accuracy, and cost-efficiency offered by aerial photogrammetry software for real-time data collection and 3D modeling, enhancing project planning and operational efficiency

- This widespread adoption is further supported by advanced technological infrastructure, high disposable incomes, and strong government support for smart city and infrastructure projects, establishing aerial photogrammetry software as a preferred solution for both commercial and public sector applications

U.S. Aerial Photogrammetry Software Market Insight

The U.S. aerial photogrammetry software market captured the largest revenue share in 2025 within North America, fueled by rapid adoption of drones and automated surveying solutions. Organizations are increasingly prioritizing accurate topographic mapping, infrastructure monitoring, and precision agriculture to reduce project delays and operational risks. The growing integration of photogrammetry software with GIS and AI tools, alongside government incentives for drone usage, further propels market growth.

Europe Aerial Photogrammetry Software Market Insight

The Europe aerial photogrammetry software market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent regulatory requirements for infrastructure planning, environmental monitoring, and urban development. Increased urbanization and demand for high-resolution geospatial data are fostering the adoption of photogrammetry software across construction, transportation, and energy sectors. European organizations also favor efficient and automated mapping solutions for cost reduction and project accuracy.

U.K. Aerial Photogrammetry Software Market Insight

The U.K. aerial photogrammetry software market is expected to witness significant growth from 2026 to 2033, driven by government initiatives for smart city development and digital mapping. The need for accurate and timely geospatial data, combined with rising interest in UAV-based surveying for agriculture, construction, and heritage conservation, is encouraging organizations to invest in photogrammetry solutions. Robust infrastructure and a growing technology adoption culture further support market expansion.

Germany Aerial Photogrammetry Software Market Insight

The Germany aerial photogrammetry software market is expected to witness rapid growth from 2026 to 2033, fueled by increasing industrial automation and technological innovation in surveying and mapping. Organizations are adopting photogrammetry software to improve precision in construction, energy, and transportation projects, while ensuring regulatory compliance. Germany’s emphasis on sustainable development and smart infrastructure projects is promoting the integration of aerial photogrammetry into routine operational workflows.

Asia-Pacific Aerial Photogrammetry Software Market Insight

The Asia-Pacific aerial photogrammetry software market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, technological advancements, and rising investments in infrastructure development across countries such as China, Japan, and India. The region’s expanding use of drones for construction, agriculture, and environmental monitoring, along with supportive government policies, is accelerating software adoption. Affordability, localized software solutions, and increasing skilled personnel are further boosting market growth.

Japan Aerial Photogrammetry Software Market Insight

The Japan aerial photogrammetry software market is expected to witness strong growth from 2026 to 2033 due to the country’s high-tech culture, rapid urbanization, and focus on precision in infrastructure and agriculture projects. Adoption of UAV-based surveys integrated with photogrammetry software is increasing for construction monitoring, disaster management, and heritage documentation. Japan’s aging workforce and demand for automated, efficient mapping solutions are further driving market expansion.

China Aerial Photogrammetry Software Market Insight

The China aerial photogrammetry software market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, urban development, and high drone adoption rates. China is investing heavily in smart city projects, precision agriculture, and infrastructure monitoring, making aerial photogrammetry software a critical tool for data acquisition. The availability of cost-effective solutions and strong domestic software providers is further propelling market growth.

Aerial Photogrammetry Software Market Share

The Aerial Photogrammetry Software industry is primarily led by well-established companies, including:

- Pix4D SA (Switzerland)

- 3Dflow SRL (Italy)

- Agisoft (Russia)

- Capturing Reality s.r.o. (Slovakia)

- nFrames (Germany)

- Vexcel Imaging GmbH (Austria)

- REDcatch GmbH (Germany)

- NUBIGON Inc. (U.S.)

- Linearis3D GmbH & Co.KG (Germany)

- Menci Software Srl (Italy)

- Photometrix Photogrammetry Software (Australia)

- Skyline Software Systems (U.S.)

- Racurs (Russia)

- SimActive Inc. (Canada)

- ICAROS (Germany)

- DroneDeploy (U.S.)

- PhotoModeler Technologies (Canada)

- Esri Global, Inc. (U.S.)

- Magnasoft (U.K.)

- Autodesk Inc. (U.S.)

- Trimble Inc. (U.S.)

- Hexagon AB (Sweden)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.