Global Aerial Work Platform Market

Market Size in USD Billion

CAGR :

%

USD

21.53 Billion

USD

37.70 Billion

2025

2033

USD

21.53 Billion

USD

37.70 Billion

2025

2033

| 2026 –2033 | |

| USD 21.53 Billion | |

| USD 37.70 Billion | |

|

|

|

|

Aerial Work Platform Market Size

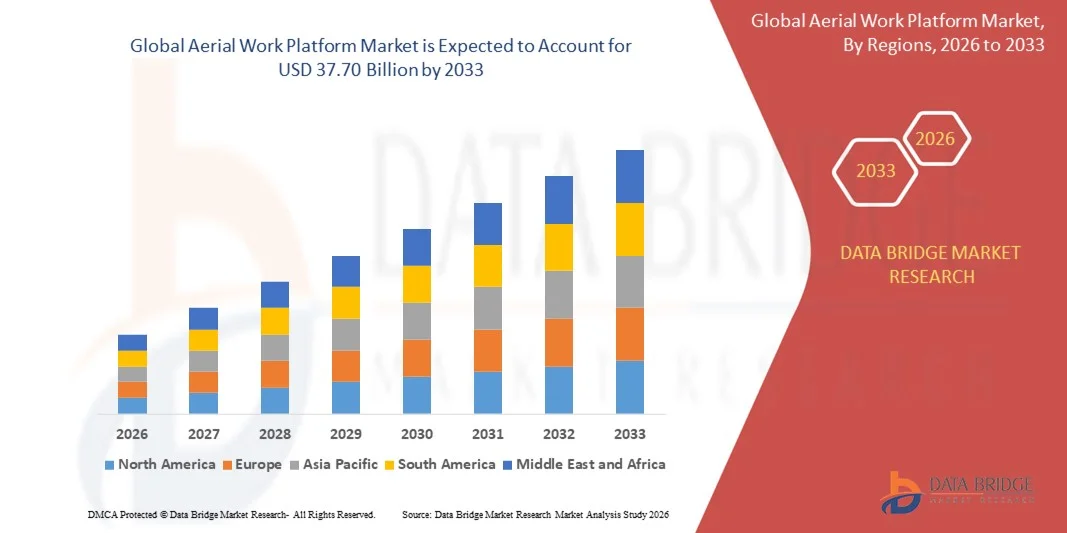

- The global aerial work platform market size was valued at USD 21.53 billion in 2025 and is expected to reach USD 37.70 billion by 2033, at a CAGR of 7.25% during the forecast period

- The market growth is largely fuelled by the increasing demand for construction and maintenance equipment, rising infrastructure development activities, and the growing adoption of automation and safety solutions in industrial and commercial sectors

- Technological advancements, such as electric and hybrid aerial work platforms, and the expansion of rental services are further supporting market growth

Aerial Work Platform Market Analysis

- The market is driven by the need for safe and efficient working-at-height solutions across construction, logistics, and maintenance industries

- Increasing government regulations and safety standards, along with urbanization and industrial expansion, are encouraging investments in advanced aerial work platforms

- North America dominated the aerial work platform market with the largest revenue share of 37.5% in 2025, driven by rising infrastructure development, industrial expansion, and the growing emphasis on workplace safety and efficiency

- Asia-Pacific region is expected to witness the highest growth rate in the global aerial work platform market, driven by rising industrialization, government infrastructure projects, increasing awareness of workplace safety, and growing investment in modern access solutions

- The Boom Lifts segment held the largest market revenue share in 2025, driven by their versatility, extended reach, and suitability for construction, maintenance, and industrial applications. Boom lifts offer high maneuverability and safety features, making them a preferred choice for large-scale projects and high-rise operations

Report Scope and Aerial Work Platform Market Segmentation

|

Attributes |

Aerial Work Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerial Work Platform Market Trends

Rising Demand for Safe and Efficient Working-At-Height Solutions

- The growing focus on workplace safety and operational efficiency is significantly shaping the aerial work platform market, as industries increasingly prefer equipment that ensures safe access at height. Aerial work platforms are gaining traction due to their ability to improve productivity, reduce risks, and meet regulatory safety standards without compromising operational efficiency. This trend strengthens their adoption across construction, industrial maintenance, and logistics sectors, encouraging manufacturers to innovate with new models and technologies that cater to evolving safety and efficiency requirements

- Increasing awareness around worker safety, regulatory compliance, and risk mitigation has accelerated the demand for aerial work platforms in construction, warehousing, and infrastructure projects. Organizations are actively seeking equipment that enhances operational safety and reliability, prompting manufacturers to develop platforms with advanced safety features and ergonomic designs

- Safety regulations and industry standards are influencing purchasing decisions, with companies emphasizing compliance, equipment certification, and operator training. These factors are helping brands differentiate their products in a competitive market and build trust among end-users, while also driving the adoption of automated, hybrid, and electric aerial work platforms

- For instance, in 2024, JLG in the U.S. and Genie in Germany expanded their product portfolios by introducing advanced electric and hybrid aerial work platforms with enhanced safety features and remote operation capabilities. These launches were introduced in response to rising demand for safe and efficient equipment, with deployment across construction, industrial, and maintenance projects

- While demand for aerial work platforms is growing, sustained market expansion depends on continuous R&D, cost-effective production, and maintaining functional performance and safety standards. Manufacturers are also focusing on improving scalability, operator training, and advanced control systems to enhance adoption in industrial and commercial sectors

Aerial Work Platform Market Dynamics

Driver

Growing Emphasis on Workplace Safety and Efficiency

- Rising industrial and construction activities are major drivers for the aerial work platform market. Companies are increasingly replacing manual or less safe methods with aerial work platforms to comply with safety regulations, enhance operational efficiency, and reduce workplace accidents. This trend is also pushing research into novel platform designs, automation features, and hybrid power options, supporting product diversification

- Expanding applications in construction, warehousing, logistics, maintenance, and utilities are influencing market growth. Aerial work platforms help improve accessibility, productivity, and safety, enabling companies to meet operational and regulatory expectations. The increasing use of automated and hybrid platforms globally further reinforces this trend

- Manufacturers are actively promoting advanced aerial work platforms through product innovation, marketing campaigns, and safety certifications. These efforts are supported by growing awareness of worker safety and operational efficiency, and they also encourage partnerships between platform providers and end-users to optimize deployment and reduce operational risks

- For instance, in 2023, Haulotte in France and Skyjack in Canada reported increased adoption of electric and hybrid aerial work platforms in construction and maintenance projects. This expansion followed rising regulatory compliance requirements and safety awareness, driving repeat purchases and operational efficiency. Both companies also highlighted automation and ergonomic features in marketing campaigns to strengthen brand recognition and trust

- Although rising safety and efficiency trends support growth, wider adoption depends on cost optimization, equipment availability, and scalable manufacturing processes. Investment in supply chain efficiency, operator training, and advanced safety technology will be critical for meeting global demand and maintaining competitive advantage

Restraint/Challenge

High Cost and Maintenance Requirements Compared to Conventional Access Methods

- The relatively higher cost of aerial work platforms compared to ladders or scaffolding remains a key challenge, limiting adoption among small-scale contractors and price-sensitive businesses. High purchase and maintenance costs, along with advanced safety features, contribute to elevated pricing. In addition, operational training and certification requirements can further affect cost-effectiveness and market penetration

- Awareness and training remain uneven, particularly in developing markets where safety regulations are less stringent. Limited understanding of functional benefits and proper usage restricts adoption across certain industries. This also leads to slower uptake in regions with minimal educational initiatives on workplace safety and aerial work platform operation

- Maintenance and logistical challenges also impact market growth, as aerial work platforms require regular servicing, adherence to safety standards, and proper storage. Complex handling, transportation, and operational requirements increase operational costs. Companies must invest in skilled operators, training programs, and maintenance infrastructure to ensure safe and efficient use

- For instance, in 2024, construction companies in India and Southeast Asia reported slower adoption of electric and hybrid aerial work platforms due to higher initial costs and limited awareness of operational advantages compared to conventional access methods. Additional barriers included operator training and maintenance requirements, which affected utilization and overall ROI

- Overcoming these challenges will require cost-efficient manufacturing, expanded training programs, and enhanced service networks. Collaboration with contractors, rental providers, and regulatory bodies can help unlock the long-term growth potential of the global aerial work platform market. Furthermore, developing cost-competitive models with advanced safety and operational features will be essential for widespread adoption

Aerial Work Platform Market Scope

The market is segmented on the basis of product, type, platform height, and application

- By Product

On the basis of product, the aerial work platform market is segmented into Boom Lifts, Scissor Lifts, Vertical Mast Lifts, and Personal Portable Lifts. The Boom Lifts segment held the largest market revenue share in 2025, driven by their versatility, extended reach, and suitability for construction, maintenance, and industrial applications. Boom lifts offer high maneuverability and safety features, making them a preferred choice for large-scale projects and high-rise operations.

The Scissor Lifts segment is expected to witness the fastest growth rate from 2026 to 2033, driven by their stability, compact design, and ease of use for indoor and outdoor maintenance tasks. Scissor lifts are particularly popular in warehousing, manufacturing, and facility management sectors, offering efficient vertical access and load handling capabilities.

- By Type

On the basis of type, the market is segmented into Electric and Engine-Powered. The Electric segment held the largest share in 2025 due to rising demand for eco-friendly, low-noise equipment suitable for indoor applications. Electric aerial work platforms are preferred for their energy efficiency, reduced emissions, and lower operating costs.

The Engine-Powered segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing construction and industrial activities in outdoor and rugged environments. Engine-powered platforms are favored for their higher load capacity, extended reach, and ability to operate in challenging terrain.

- By Platform Height

On the basis of platform height, the market is segmented into Below 10 Meters, 10 to 20 Meters, 20 to 25 Meters, and Above 25 Meters. The 10 to 20 Meters segment held the largest share in 2025, driven by its suitability for mid-rise construction, maintenance, and industrial operations. This height range balances accessibility, safety, and operational efficiency for various applications.

The Above 25 Meters segment is expected to witness the fastest growth rate from 2026 to 2033, driven by high-rise construction projects, infrastructure development, and growing demand for equipment that ensures safe access at greater heights.

- By Application

On the basis of application, the market is segmented into Rental, Construction & Mining, Government, Transportation & Logistics, and Utility. The Construction & Mining segment held the largest market share in 2025, fueled by increasing infrastructure projects, industrial expansion, and the need for safe, efficient working-at-height solutions.

The Rental segment is expected to witness the fastest growth from 2026 to 2033, driven by small and medium enterprises seeking cost-effective access solutions, flexible equipment deployment, and reduced capital expenditure. Rental services also enable operators to access advanced platforms with minimal upfront investment.

Aerial Work Platform Market Regional Analysis

- North America dominated the aerial work platform market with the largest revenue share of 37.5% in 2025, driven by rising infrastructure development, industrial expansion, and the growing emphasis on workplace safety and efficiency

- Consumers and businesses in the region highly value versatile, safe, and efficient aerial work platforms that enhance productivity and reduce risks in construction, maintenance, and logistics operations

- This widespread adoption is further supported by advanced manufacturing capabilities, high investment in industrial automation, and the availability of rental and leasing services, establishing aerial work platforms as a preferred solution for commercial, industrial, and government projects

U.S. Aerial Work Platform Market Insight

The U.S. aerial work platform market captured the largest revenue share in 2025 within North America, fueled by expanding construction, warehousing, and industrial maintenance activities. Companies are increasingly adopting electric and engine-powered platforms to improve operational efficiency while ensuring worker safety. The rising preference for rental and leasing services, combined with investment in advanced, high-reach platforms, further drives market growth. Moreover, the integration of safety automation, remote monitoring, and eco-friendly platform technologies is significantly contributing to the market's expansion.

Europe Aerial Work Platform Market Insight

The Europe aerial work platform market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict safety regulations, urbanization, and increasing infrastructure development. Growing demand for efficient access solutions in construction, industrial, and maintenance applications is fostering market adoption. European companies are also prioritizing electric and hybrid platforms to reduce emissions and meet energy efficiency targets. The region is witnessing significant growth across commercial, industrial, and government projects, with platforms being incorporated into both new construction and renovation projects.

U.K. Aerial Work Platform Market Insight

The U.K. aerial work platform market is expected to witness the fastest growth rate from 2026 to 2033, driven by the growing focus on workplace safety, industrial automation, and high-rise construction. In addition, the adoption of rental and leasing services is enabling small and medium enterprises to access advanced platforms without high upfront investment. The U.K.’s strong industrial and infrastructure development, alongside regulatory emphasis on safety standards, is expected to continue stimulating market growth.

Germany Aerial Work Platform Market Insight

The Germany aerial work platform market is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing awareness of workplace safety and demand for technologically advanced, eco-conscious equipment. Germany’s well-developed industrial infrastructure, combined with its focus on innovation and sustainability, promotes the adoption of electric and hybrid aerial work platforms, particularly in construction, logistics, and industrial maintenance. Integration with automation and safety monitoring systems is also becoming increasingly prevalent, aligning with local operational and regulatory expectations.

Asia-Pacific Aerial Work Platform Market Insight

The Asia-Pacific aerial work platform market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising industrial activities, and increasing investment in infrastructure development in countries such as China, Japan, and India. The region’s growing focus on workplace safety, supported by government initiatives promoting industrial automation, is driving adoption. Furthermore, as APAC emerges as a manufacturing hub for aerial work platforms, the affordability and accessibility of advanced platforms are expanding to a wider industrial and commercial user base.

Japan Aerial Work Platform Market Insight

The Japan aerial work platform market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced industrial automation, high urbanization, and demand for safe, efficient working-at-height solutions. The market places significant emphasis on safety, productivity, and eco-friendly equipment, and adoption is driven by industrial maintenance, construction, and logistics projects. Integration with automation, safety monitoring, and ergonomic features is fueling growth. Moreover, Japan's aging workforce is likely to spur demand for easier-to-use and safer aerial work platforms in industrial and commercial sectors.

China Aerial Work Platform Market Insight

The China aerial work platform market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s rapid industrialization, expanding construction activities, and increasing adoption of electric and hybrid platforms. China is one of the largest manufacturing hubs for aerial work platforms, supporting large-scale production and availability. Growing adoption in construction, industrial maintenance, and infrastructure projects, alongside government support for workplace safety and industrial automation, are key factors propelling market growth in China.

Aerial Work Platform Market Share

The Aerial Work Platform industry is primarily led by well-established companies, including:

• Terex Corporation (U.S.)

• JCB India (India)

• AICHI CORPORATION (Japan)

• HAULOTTE GROUP (France)

• Linamar Corporation (Canada)

• Hunan Sinoboom Intelligent Equipment Co., Ltd (China)

• Zhejiang Dingli Machinery Co., Ltd. (China)

• TADANO Ltd. (Japan)

• Oshkosh Corporation (U.S.)

• PALFINGER AG (Austria)

• IMER International SpA (Italy)

• MEC Aerial Work Platforms (U.S.)

• Mantall Heavy Industry Co., Ltd (China)

• Manitou Group (France)

• Noblelift Intelligent Equipment Co., Ltd. (China)

Latest Developments in Global Aerial Work Platform Market

- In May 2023, JCB unveiled two flexible boom aerial work platforms, the A45E and A45EH, featuring diesel/electric hybrid and battery-electric drivelines. These models improve operational efficiency, enhance operator access, and provide advanced monitoring capabilities, supporting safer and more productive work-at-height operations

- In February 2023, MEC Aerial Work Platforms launched the NANO10-XD, an all-electric scissor lift with a compact design and standard Xtra Deck, ideal for tight spaces such as 2x2 ceiling grids. The platform reduces environmental impact, extends duty cycles with lithium-ion batteries, and improves operational efficiency in sensitive applications

- In November 2022, CanLift Equipment Ltd. expanded its product portfolio by adding two rough terrain scissor lifts from XCMG, providing customers with greater flexibility in purchasing and rental options, enhancing market accessibility and adoption of rugged aerial platforms

- In October 2022, Genie introduced lithium-ion batteries for its GS E-Drive slab scissor lifts, improving durability, reducing noise levels, and offering eco-friendly operation, which supports adoption in indoor and noise-sensitive environments while strengthening the company’s competitive position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerial Work Platform Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerial Work Platform Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerial Work Platform Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.