Global Aero Structure Equipment Market

Market Size in USD Billion

CAGR :

%

USD

13.73 Billion

USD

27.36 Billion

2024

2032

USD

13.73 Billion

USD

27.36 Billion

2024

2032

| 2025 –2032 | |

| USD 13.73 Billion | |

| USD 27.36 Billion | |

|

|

|

|

Aero Structure Equipment Market Size

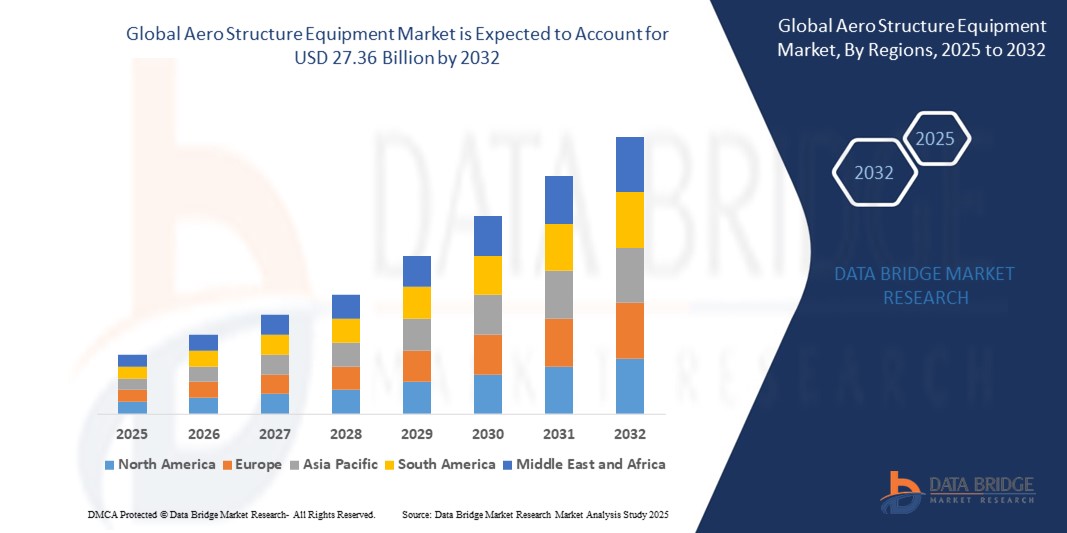

- The global aero structure equipment market size was valued at USD 13.73 billion in 2024 and is expected to reach USD 27.36 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is primarily driven by increasing demand for advanced aircraft manufacturing technologies, rising global air traffic, and the adoption of lightweight composite materials in aerospace production

- In addition, the push for fuel-efficient aircraft, coupled with advancements in automation and Industry 4.0 technologies, is accelerating the adoption of aero structure equipment, significantly boosting the industry’s growth

Aero Structure Equipment Market Analysis

- Aero structure equipment, encompassing advanced machinery and tools for manufacturing aircraft structures, is increasingly critical in the aerospace industry due to its role in enhancing production efficiency, precision, and scalability in both commercial and military applications

- The growing demand for aero structure equipment is fueled by the rising production of next-generation aircraft, increasing defense budgets, and the need for lightweight, durable materials to meet stringent environmental and performance standards

- North America dominated the aero structure equipment market with the largest revenue share of 42.5% in 2024, driven by the presence of major aerospace manufacturers, high investment in R&D, and advanced technological infrastructure, particularly in the U.S., where demand for commercial and military aircraft production is strong

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rapid growth in aerospace manufacturing, increasing defense spending, and expanding air travel in countries such as China and India

- The Automated Production System segment dominated the largest market revenue share of 38.5% in 2024, driven by its critical role in enhancing manufacturing efficiency through robotics, AI, and advanced automation technologies

Report Scope and Aero Structure Equipment Market Segmentation

|

Attributes |

Aero Structure Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aero Structure Equipment Market Trends

“Increasing Integration of AI and Advanced Automation”

- The global aero structure equipment market is experiencing a significant trend toward the integration of Artificial Intelligence (AI) and advanced automation technologies

- These technologies enable enhanced precision, efficiency, and quality control in the manufacturing and assembly of aircraft structures, providing deeper insights into production processes and equipment performance

- AI-driven systems allow for predictive maintenance of manufacturing equipment, identifying potential issues before they cause production delays or costly downtime

- For instance, several aerospace manufacturers are adopting AI-powered platforms to optimize automated production systems, such as fastening and composite systems, to improve manufacturing speed and reduce errors

- This trend is enhancing the efficiency of aero structure equipment, making it more appealing to original equipment manufacturers (OEMs) and maintenance, repair, and overhaul (MRO) providers

- AI algorithms can analyze vast datasets from production lines, including equipment performance, material usage, and assembly accuracy, to optimize processes and reduce waste

Aero Structure Equipment Market Dynamics

Driver

“Rising Demand for Lightweight and Fuel-Efficient Aircraft”

- The increasing demand for lightweight, fuel-efficient aircraft, driven by rising fuel costs and environmental regulations, is a major driver for the global aero structure equipment market

- Aero structure equipment, such as composite systems and automated assembly systems, enables the production of advanced components such as wings, fuselages, and empennages made from lightweight composite materials

- Government mandates and industry standards, particularly in regions such as Europe and North America, are pushing for greener aviation solutions, further boosting the adoption of advanced aero structure equipment

- The proliferation of advanced manufacturing technologies and high-speed connectivity is enabling faster and more precise production processes, supporting the development of next-generation aircraft.

- Major aircraft manufacturers are increasingly incorporating automated production and fastening systems as standard solutions to meet the demand for high-performance, eco-friendly aircraft

Restraint/Challenge

“High Cost of Implementation and Supply Chain Complexities”

- The significant initial investment required for advanced aero structure equipment, such as automated production systems, composite systems, and robotic assembly lines, poses a major barrier to adoption, particularly for smaller manufacturers in emerging markets

- Integrating sophisticated equipment into existing production facilities can be complex and costly, requiring specialized expertise and infrastructure upgrades

- In addition, supply chain complexities and material availability issues, particularly for high-quality composites and alloys, present challenges for manufacturers, leading to potential delays and cost overruns

- The highly regulated nature of the aerospace industry, with strict compliance requirements across different countries, further complicates the deployment of aero structure equipment, increasing operational costs

- These factors can deter smaller players and limit market expansion in regions with limited aerospace infrastructure or cost sensitivity

Aero Structure Equipment market Scope

The market is segmented on the basis of equipment type, aircraft body type, and type.

- By Equipment Type

On the basis of equipment type, the Global Aero Structure Equipment Market is segmented into Automated Production System, Fastening Systems, Composite Systems, Automated Assembly Systems, Stations/Lines, Conveyor System, Small Tools, and Service Offering. The Automated Production System segment dominated the largest market revenue share of 38.5% in 2024, driven by its critical role in enhancing manufacturing efficiency through robotics, AI, and advanced automation technologies. These systems reduce human error and optimize production workflows, meeting the aerospace industry's demand for high-volume, high-precision manufacturing.

The Composite Systems segment is expected to witness the fastest growth rate of 8.7% from 2025 to 2032, propelled by the increasing adoption of lightweight composite materials such as carbon fiber reinforced polymers (CFRPs) in aircraft manufacturing. These materials, used extensively in aircraft such as Boeing’s 787 Dreamliner, contribute to significant weight reduction and improved fuel efficiency, aligning with sustainability goals and stricter environmental regulations.

- By Aircraft Body Type

On the basis of aircraft body type, the Global Aero Structure Equipment Market is segmented into Small Body Aircraft Aero Structure Equipment, Wide Body Aircraft Aero Structure Equipment, Very Large Body Aircraft Aero Structure Equipment, and Regional Aircraft Aero Structure Equipment. The Wide Body Aircraft Aero Structure Equipment segment dominated the market with a revenue share of 42.0% in 2024, driven by the growing demand for long-haul commercial aircraft, such as the Boeing 787 and Airbus A350, which require advanced aero structure equipment for their complex fuselage and wing assemblies.

The Regional Aircraft Aero Structure Equipment segment is anticipated to experience the fastest growth rate of 9.2% from 2025 to 2032, fueled by increasing demand for regional jets in emerging markets, particularly in Asia-Pacific. The expansion of regional air travel and fleet modernization initiatives are driving the need for specialized equipment tailored to smaller aircraft.

- By Type

On the basis of type, the Global Aero Structure Equipment Market is segmented into Commercial and Military. The Commercial segment held the largest market revenue share of 68.5% in 2024, attributed to the global surge in air passenger traffic, fleet expansion, and the replacement of older aircraft with fuel-efficient models. The rise in air travel demand, particularly in emerging economies, and the adoption of advanced manufacturing technologies further bolster this segment.

The Military segment is expected to witness rapid growth of 8.5% from 2025 to 2032, driven by increasing defense budgets and modernization programs worldwide. The demand for advanced aero structure equipment for fighter jets, transport planes, and unmanned aerial vehicles (UAVs) is fueled by the need for stealth, agility, and mission-specific capabilities.

Aero Structure Equipment Market Regional Analysis

- North America dominated the aero structure equipment market with the largest revenue share of 42.5% in 2024, driven by the presence of major aerospace manufacturers, high investment in R&D, and advanced technological infrastructure, particularly in the U.S., where demand for commercial and military aircraft production is strong

- Consumers and manufacturers prioritize advanced equipment for precision manufacturing, lightweight materials, and automation to enhance aircraft performance and fuel efficiency, particularly in regions with high aerospace innovation

- Growth is supported by technological advancements in automated production systems, composite manufacturing, and increasing demand in both commercial and military aircraft segments

U.S. Aero Structure Equipment Market Insight

The U.S. aero structure equipment market captured the largest revenue share of 83.1% in 2024 within North America, fueled by strong demand for advanced manufacturing technologies and the presence of leading aerospace OEMs. The trend towards automation, including robotics and composite systems, supports efficient production. Increasing defense budgets and the need for fuel-efficient aircraft further drive market expansion, with both OEM and aftermarket segments contributing to growth.

Europe Aero Structure Equipment Market Insight

The Europe aero structure equipment market is expected to witness significant growth, supported by a strong emphasis on sustainable aviation and advanced manufacturing. Countries such as Germany and France lead due to their established aerospace sectors and focus on lightweight composite materials. The adoption of automated assembly systems and stringent environmental regulations drive demand for innovative equipment in both new aircraft production and retrofit projects.

U.K. Aero Structure Equipment Market Insight

The U.K. market for aero structure equipment is expected to experience rapid growth, driven by increasing demand for automated production systems and composite manufacturing in aerospace applications. The focus on fuel efficiency, advanced materials, and compliance with safety regulations encourages adoption. The U.K.’s aerospace innovation ecosystem and retrofit programs for existing aircraft fleets further bolster market growth

Germany Aero Structure Equipment Market Insight

Germany is expected to witness a high growth rate in the aero structure equipment market, attributed to its advanced aerospace manufacturing sector and emphasis on precision and efficiency. German manufacturers prioritize equipment such as fastening systems and composite systems to support lightweight aircraft designs. The integration of these technologies in premium aircraft and aftermarket services sustains market expansion.

Asia-Pacific Aero Structure Equipment Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding aerospace production and rising investments in countries such as China, India, and Japan. Increasing demand for commercial and military aircraft, coupled with advancements in automation and composite materials, boosts market growth. Government initiatives promoting aviation infrastructure and sustainability further encourage the adoption of advanced aero structure equipment.

Japan Aero Structure Equipment Market Insight

Japan’s aero structure equipment market is expected to witness rapid growth due to strong consumer and manufacturer preference for high-quality, technologically advanced equipment that enhances aircraft performance and safety. The presence of major aerospace manufacturers and the integration of automated systems in OEM production accelerate market penetration. Growing interest in aftermarket upgrades also contributes to market expansion.

China Aero Structure Equipment Market Insight

China holds the largest share of the Asia-Pacific aero structure equipment market, propelled by rapid growth in aerospace manufacturing, increasing aircraft demand, and strong domestic production capabilities. The focus on lightweight materials, such as composites, and automation technologies supports market growth. Rising defense budgets and the expansion of commercial aviation further enhance the adoption of advanced aero structure equipment.

Aero Structure Equipment Market Share

The aero structure equipment industry is primarily led by well-established companies, including:

- KUKA AG (Germany)

- M Torres Diseños Industriales SAU (Spain)

- LISI AEROSPACE (SAS) (France)

- Triumph Group (U.S.)

- Broetje-Automation GmbH (Germany)

- ARITEX CADING SAU (Spain)

- Electroimpact Inc. (U.S.)

- Sener - Grupo Sener (Spain)

- REEL International (France)

- Ascent Aerospace, LLC (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Spirit AeroSystems, Inc. (U.S.)

- RTX (U.S.)

- Boeing (U.S.)

- AIRBUS (France)

- Lockheed Martin Corporation (U.S.)

- Bombardier (Canada)

- Collins Aerospace (U.S.)

- Thales (France)

What are the Recent Developments in Global Aero Structure Equipment Market?

- In October 2024, Broetje-Automation GmbH introduced its next-generation automated riveting system, reinforcing its dedication to innovation in aerospace manufacturing. This advanced solution is designed to improve precision, accelerate production timelines, and reduce operational costs through high-efficiency automation. Featuring a flexible, modular design and a 10 axis positioner, the system supports diverse aircraft structures, including fuselage and wing panels. Its integration of electric end-effectors and automated fastener feeding systems enables streamlined assembly processes. This launch reflects Broetje-Automation’s commitment to shaping the “Factory of the Future” with cutting-edge technologies for structural assembly

- In September 2024, Syensqo unveiled AeroPaste® 1003, a new grade of its epoxy-based structural paste adhesives tailored for aerospace applications. This two-part, room-temperature adhesive is engineered for high-rate assembly, structural bonding of metallic and composite components, and repair tasks. Its compatibility with out-of-autoclave processes and automated manufacturing systems enhances production efficiency. AeroPaste 1003 offers film-such as performance, high-temperature strength, and controlled flow properties for easy dispensing. This innovation reflects Syensqo’s commitment to advancing material science and supporting industrialization in aerospace sectors such as advanced air mobility, commercial aviation, and defense

- In June 2024, Ascent Aerospace LLC strategically acquired a specialized tooling company to strengthen its position in the aero structure equipment sector. This move was aimed at expanding its product portfolio and enhancing its manufacturing capabilities to better serve the evolving demands of the aerospace industry. By integrating advanced tooling expertise, Ascent Aerospace seeks to deliver more comprehensive solutions to its clients, improve operational efficiency, and support innovation in aircraft assembly and automation. The acquisition underscores the company’s commitment to growth and its proactive approach to meeting future challenges in aerospace engineering and production

- In April 2023, Solvay and GKN Aerospace renewed their long-standing collaboration to advance the use of thermoplastic composite (TPC) materials in aerospace structures. Building on successful joint projects since 2017, the renewed agreement focuses on developing next-generation TPC materials and high-rate manufacturing processes for commercial aviation and advanced air mobility. This partnership highlights a shared commitment to lightweight, durable solutions that enhance aircraft performance and sustainability. Solvay remains a preferred supplier of TPC materials to GKN Aerospace, reinforcing their joint leadership in thermoplastic innovation for primary structural applications

- In January 2023, Electroimpact Inc. introduced a cutting-edge automated drilling system tailored for composite aircraft components, marking a significant step forward in aerospace manufacturing. Developed in collaboration with FANUC and Lübbering, the ADUbot system automates the traditionally manual task of drilling thousands of precision holes in airframes. Designed for high accuracy and rapid cycle times, it supports mobile deployment and integration with existing drill jigs. This innovation reflects the industry's growing emphasis on automation to enhance efficiency, reduce labor dependency, and maintain stringent quality standards in handling advanced composite materials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.