Global Aerogel Blanket Market

Market Size in USD Million

CAGR :

%

USD

384.77 Million

USD

1,863.70 Million

2024

2032

USD

384.77 Million

USD

1,863.70 Million

2024

2032

| 2025 –2032 | |

| USD 384.77 Million | |

| USD 1,863.70 Million | |

|

|

|

|

Aerogel Blanket Market Size

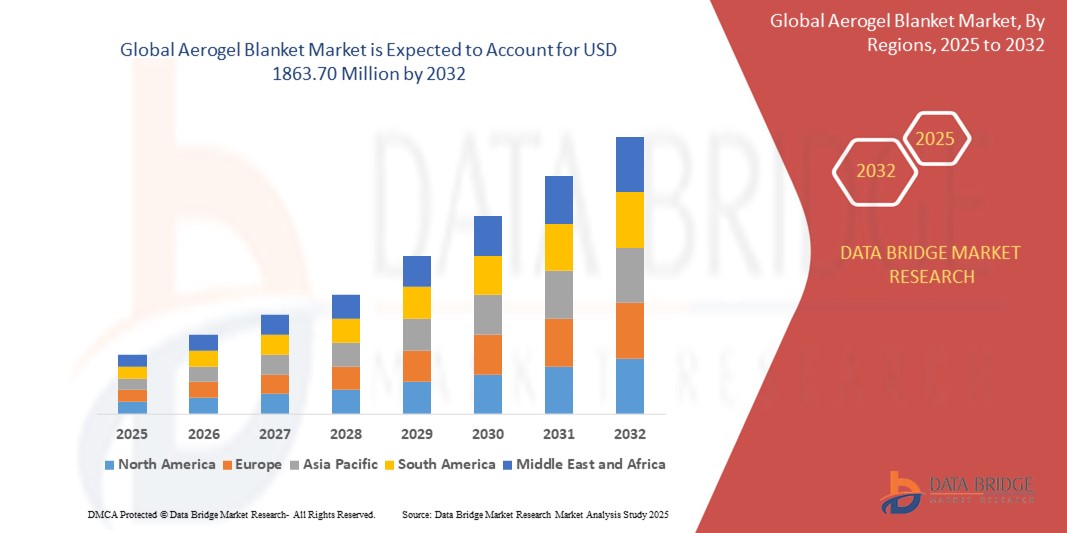

- The global aerogel blanket market size was valued at USD 384.77 million in 2024 and is expected to reach USD 1863.70 million by 2032, at a CAGR of 21.80% during the forecast period

- The market growth is primarily driven by increasing demand for high-performance insulation materials in industries such as oil and gas, construction, and aerospace, coupled with advancements in aerogel technology that enhance thermal efficiency and durability

- Rising awareness of energy conservation and the need for lightweight, eco-friendly insulation solutions are further propelling the adoption of aerogel blankets across residential and industrial applications

Aerogel Blanket Market Analysis

- Aerogel blankets, known for their superior thermal insulation, lightweight properties, and flexibility, are increasingly critical in applications requiring high-performance insulation, such as oil and gas pipelines, automotive components, and aerospace systems

- The demand for aerogel blankets is fueled by growing emphasis on energy efficiency, stringent environmental regulations, and the need for compact insulation solutions in space-constrained environments

- North America dominated the aerogel blanket market with the largest revenue share of 38.5% in 2024, driven by advanced industrial infrastructure, high adoption of innovative materials in construction and oil and gas sectors, and the presence of key market players

- The Middle East and Africa is expected to be the fastest-growing region during the forecast period, attributed to rapid industrialization, increasing energy sector investments, and growing construction activities in countries such as Saudi Arabia and the UAE

- The silica segment dominated the largest market revenue share of 66% in 2024, driven by its exceptional thermal insulation properties, high porosity, and low thermal conductivity, making it ideal for applications in oil and gas, construction, and aerospace. Its cost-effectiveness and versatility further solidify its dominance

Report Scope and Aerogel Blanket Market Segmentation

|

Attributes |

Aerogel Blanket Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerogel Blanket Market Trends

“Increasing Adoption of Energy-Efficient and Sustainable Insulation Solutions”

- The global aerogel blanket market is experiencing a significant trend toward the adoption of energy-efficient and sustainable insulation materials

- Aerogel blankets, known for their ultra-low thermal conductivity and lightweight properties, are increasingly utilized for their superior insulation capabilities compared to traditional materials such as fiberglass or foam

- These blankets are being integrated into applications requiring high-performance insulation, such as in aerospace for spacecraft thermal management, construction for energy-efficient buildings, and oil and gas for pipeline insulation

- Advanced manufacturing techniques, such as supercritical drying and nanotechnology, are enhancing the scalability and performance of aerogel blankets, making them more viable for widespread commercial use

- The push for sustainability is driving demand, as aerogel blankets contribute to reduced energy consumption and lower carbon footprints in industries such as construction and transportation

- For instance, companies are developing aerogel-based insulation solutions that improve energy efficiency in buildings, aligning with global regulations such as the EU’s Nearly Zero-Energy Buildings initiative

Aerogel Blanket Market Dynamics

Driver

“Growing Demand for Lightweight and High-Performance Insulation Materials”

- The rising need for lightweight, high-performance insulation in industries such as aerospace, automotive, and oil and gas is a major driver for the aerogel blanket market

- Aerogel blankets offer exceptional thermal insulation, high porosity, and low density, making them ideal for applications where space and weight savings are critical, such as insulating aircraft components or pipelines

- Government regulations promoting energy efficiency, particularly in North America and Europe, are accelerating the adoption of aerogel blankets in construction and industrial applications

- The expansion of 5G technology and IoT is enabling real-time monitoring and integration of aerogel blankets in smart infrastructure, enhancing their functionality in dynamic environments

- Major automakers and aerospace manufacturers are increasingly incorporating aerogel blankets as standard insulation solutions to meet stringent performance and sustainability standards

Restraint/Challenge

“High Production Costs and Complex Manufacturing Processes”

- The high cost of producing aerogel blankets, driven by complex manufacturing processes such as supercritical drying, remains a significant barrier to widespread adoption, particularly in cost-sensitive markets

- The integration of aerogel blankets into existing infrastructure or vehicles can be technically challenging and costly, limiting their use in retrofitting applications

- Environmental and safety concerns related to the production of aerogels, such as the handling of hazardous chemicals, pose challenges for manufacturers in complying with stringent regulations

- The high initial investment required for research, development, and scaling production facilities can deter smaller companies from entering the market, slowing overall market growth

- In addition, the niche nature of aerogel blankets and limited awareness in emerging markets such as parts of the Middle East and Africa can hinder market expansion despite their rapid growth potential in these regions

Aerogel Blanket market Scope

The market is segmented on the basis of material type, form, layer, application, and end-user.

- By Material Type

On the basis of material type, the global aerogel blanket market is segmented into silica, polymers, and carbon. The silica segment dominated the largest market revenue share of 66% in 2024, driven by its exceptional thermal insulation properties, high porosity, and low thermal conductivity, making it ideal for applications in oil and gas, construction, and aerospace. Its cost-effectiveness and versatility further solidify its dominance.

The carbon segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior mechanical strength, electrical conductivity, and thermal stability, particularly in energy storage and high-performance applications.

- By Form

On the basis of form, the global aerogel blanket market is segmented into blanket, particle, panel, and monolith. The blanket segment dominated the market with a revenue share of 65.4% in 2024, attributed to its flexibility, lightweight design, and high-performance thermal insulation properties, making it ideal for aerospace, oil and gas, and industrial applications.

The particle segment is anticipated to witness the fastest growth rate of 21.5% from 2025 to 2032, driven by its versatility, large surface area-to-volume ratio, and increasing use in insulation, catalysis, coatings, and composites across industries such as construction and defense.

- By Layer

On the basis of layer, the global aerogel blanket market is segmented into mono-layer and multi-layer. The multi-layer segment held the largest market revenue share of 60% in 2024, driven by its enhanced thermal insulation and durability, making it suitable for demanding applications such as oil and gas pipelines and cryogenic systems.

The mono-layer segment is expected to experience significant growth from 2025 to 2032, driven by its cost-effectiveness and increasing adoption in residential and commercial construction for energy-efficient insulation.

- By Application

On the basis of application, the global aerogel blanket market is segmented into oil and gas, automotive, cryogenic, performance coatings, and aerospace. The oil and gas segment accounted for the largest market revenue share of 61% in 2024, driven by the critical need for high-performance insulation in pipelines and equipment to reduce heat loss, enhance safety, and improve operational efficiency in harsh environments.

The automotive segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for lightweight, energy-efficient materials for thermal and acoustic insulation, particularly in electric vehicles (EVs) for battery thermal management.

- By End-User

On the basis of end-user, the global aerogel blanket market is segmented into refining industry, building and construction, households, pharmaceuticals, and transportation. The refining industry segment dominated the market with a revenue share of 55% in 2024, driven by the widespread use of aerogel blankets for insulating pipelines and equipment in oil refineries, where high thermal resistance and durability are essential.

The transportation segment is anticipated to witness rapid growth of 18.5% from 2025 to 2032, fueled by increasing adoption in aerospace and automotive industries for lightweight insulation solutions that enhance energy efficiency and performance.

Aerogel Blanket Market Regional Analysis

- North America dominated the aerogel blanket market with the largest revenue share of 38.5% in 2024, driven by advanced industrial infrastructure, high adoption of innovative materials in construction and oil and gas sectors, and the presence of key market players

- Consumers prioritize aerogel blankets for their superior thermal insulation, lightweight properties, and energy efficiency, particularly in regions with extreme climatic conditions

- Growth is supported by advancements in aerogel technology, including silica and polymer-based innovations, alongside increasing adoption in both industrial and commercial applications

U.S. Aerogel Blanket Market Insight

The U.S. aerogel blanket market captured the largest revenue share of 79.3% in 2024 within North America, fueled by strong demand in the oil and gas sector, where aerogel blankets are used for pipeline insulation, and in aerospace for lightweight thermal management. The trend toward energy-efficient building materials and increasing regulations promoting sustainability further boost market expansion. The integration of aerogel blankets in both OEM and aftermarket applications creates a diverse product ecosystem.

Europe Aerogel Blanket Market Insight

The Europe aerogel blanket market is expected to witness significant growth, supported by stringent energy efficiency regulations and a focus on sustainable building practices. Consumers seek blankets that provide exceptional thermal insulation while maintaining flexibility for various applications. Growth is prominent in both industrial insulation and construction projects, with countries such as Germany and the U.K. showing significant uptake due to rising environmental concerns and infrastructure development.

U.K. Aerogel Blanket Market Insight

The U.K. market for aerogel blankets is expected to witness rapid growth, driven by demand for energy-efficient insulation in urban and industrial settings. Increased awareness of aerogel’s thermal resistance and lightweight properties encourages adoption. Evolving regulations promoting energy conservation and sustainability influence consumer choices, balancing insulation performance with environmental compliance.

Germany Aerogel Blanket Market Insight

Germany is expected to witness rapid growth in the aerogel blanket market, attributed to its advanced industrial sector and high consumer focus on energy efficiency. German industries prefer technologically advanced silica-based aerogel blankets that reduce heat loss and contribute to lower energy consumption. The integration of these blankets in oil refineries, automotive manufacturing, and construction supports sustained market growth.

Asia-Pacific Aerogel Blanket Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding industrial and construction sectors in countries such as China, India, and Japan. Increasing awareness of energy efficiency, thermal insulation, and lightweight materials is boosting demand. Government initiatives promoting sustainable infrastructure and industrial advancements further encourage the use of advanced aerogel blankets.

Japan Aerogel Blanket Market Insight

Japan’s aerogel blanket market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced insulation solutions that enhance energy efficiency and safety. The presence of major aerospace and automotive manufacturers, along with the integration of aerogel blankets in OEM applications, accelerates market penetration. Rising interest in sustainable construction also contributes to growth.

China Aerogel Blanket Market Insight

China holds the largest share of the Asia-Pacific aerogel blanket market, propelled by rapid industrialization, increasing infrastructure development, and growing demand for energy-efficient insulation solutions. The country’s expanding construction sector and focus on sustainable manufacturing support the adoption of advanced aerogel blankets. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Middle East and Africa Aerogel Blanket Market Insight

The Middle East and Africa region is expected to be the fastest-growing market for aerogel blankets, driven by increased manufacturing capabilities and investments in industrial infrastructure. The demand for advanced insulation materials such as aerogel blankets is rising as countries in this region enhance their oil and gas, construction, and industrial sectors. The region’s focus on energy efficiency and sustainability further supports market growth.

Aerogel Blanket Market Share

The aerogel blanket industry is primarily led by well-established companies, including:

- Active Aerogels (Portugal)

- Aerogel Technologies, LLC (U.S.)

- Aspen Aerogels, Inc. (U.S.)

- BASF SE (Germany)

- Cabot Corporation (U.S.)

- Green Earth Aerogel Technologies (Spain)

- DuPont (U.S.)

- HUATAO GROUP LTD. (China)

- ENERSENS (France)

- Svenska Aerogel Holding AB (Sweden)

- Dow (U.S.)

- JIOS Aerogel Corporation (South Korea)

- PBM Insulations Pvt. Ltd. (India)

- Acoustiblok UK Limited (U.K.)

- ARMACELL (Luxembourg)

- Thermablok Aerogels Limited (U.K.)

What are the Recent Developments in Global Aerogel Blanket Market?

- In September 2024, Armacell introduced its next-generation aerogel technology with the launch of ArmaGel XG, a high-performance insulation solution designed for industrial and energy sectors. The new aerogel blanket, fully compliant with ASTM C1728, enhances thermal efficiency and expands Armacell’s existing ArmaGel portfolio. To meet growing global demand, the company announced plans to open a new manufacturing facility in Pune, India, by mid-2025, adding 1 million square meters per year of production capacity. This strategic investment reinforces Armacell’s commitment to innovation and sustainability in advanced insulation technologies.

- In September 2024, Armacell International S.A. acquired 100% ownership of its joint venture Armacell JIOS Aerogels Limited (AJA) by purchasing all shares held by JIOS Aerogel, a global leader in silica aerogel technology. This move transforms AJA into a wholly-owned subsidiary of Armacell, enabling the company to scale its aerogel production capabilities and strengthen its position in the energy and industrial insulation markets. AJA will continue operating under an evergreen license agreement with JIOS, allowing access to its patented aerogel powder production technology. The acquisition supports Armacell’s strategy to expand its advanced insulation portfolio

- In November 2023, JIOS Aerogel inaugurated its advanced manufacturing plant in Pioneer, Singapore, marking a major milestone in its expansion strategy. The facility serves as the primary production hub for the company’s flagship product, the Thermal Blade, a cutting-edge thermal and electrical insulation solution designed to be placed between EV battery cells. These ultra-thin silica aerogel components help mitigate thermal runaway risks, offering exceptional high-temperature protection and safety

- In June 2023, Aspen Aerogels, Inc. inaugurated a 59,000-square-foot engineering and rapid prototyping facility in Marlborough, Massachusetts, known as the Advanced Thermal Barrier Center (ATBC). This state-of-the-art site serves as the company’s hub for developing PyroThin thermal barriers, which are critical for enhancing the safety and performance of lithium-ion battery packs used in electric vehicles and energy storage systems. The facility supports real-time collaboration with global manufacturers and accelerates the commercialization of next-generation thermal runaway solutions, reinforcing Aspen’s leadership in thermal management and electrification technologies

- In May 2023, Cabot Corporation launched its ENTERA aerogel particles portfolio, designed to create ultra-thin thermal barriers for lithium-ion batteries used in electric vehicles. These aerogel particles offer exceptional thermal insulation, low density, and high thermal stability, making them ideal for mitigating thermal runaway risks. The ENTERA line includes three products—EV5200, EV5400, and EV5800—which can be formulated into blankets, pads, sheets, films, foams, and coatings. With over 90% air volume, ENTERA aerogels are up to 20 times lighter than traditional insulation materials, helping improve battery safety, energy efficiency, and vehicle range

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerogel Blanket Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerogel Blanket Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerogel Blanket Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.