Global Aerogels Market

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

2.93 Billion

2024

2032

USD

1.38 Billion

USD

2.93 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.93 Billion | |

|

|

|

|

Aerogel Market Size

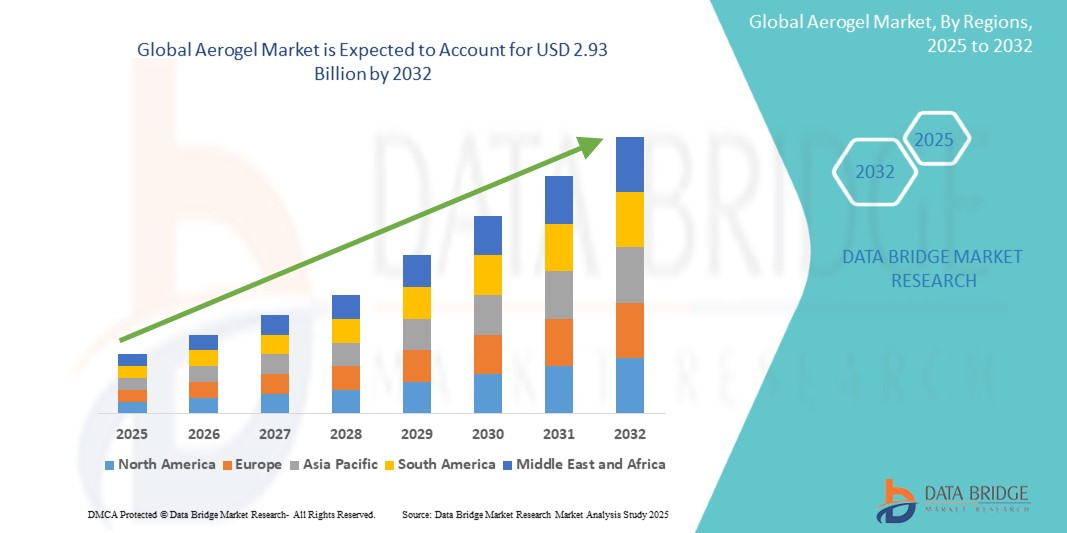

- The global Aerogel market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 2.93 billion by 2032, at a CAGR of 9.85% during the forecast period

- This growth is driven by factors such rising insulation demand, energy efficiency regulations, and increasing adoption in aerospace and construction

Aerogel Market Analysis

- Aerogels are highly porous, lightweight materials known for their exceptional thermal insulation, low density, and high surface area, making them ideal for applications across oil & gas, construction, automotive, and aerospace industries

- The demand for aerogels is significantly driven by increasing emphasis on energy efficiency, environmental regulations, and the growing adoption of sustainable insulation materials

- North America is expected to dominate the global aerogel market due to the presence of major manufacturers, technological advancements, and strong demand from aerospace and oil & gas sectors

- Asia-Pacific is expected to be the fastest growing region in the aerogel market during the forecast period due to rapid industrialization, infrastructure development, and rising energy demands

- The oil & gas segment is expected to dominate the market with a substantial share due to the increasing need for thermal insulation in pipelines and offshore installations, where aerogels offer unmatched performance under extreme conditions

Report Scope and Aerogel Market Segmentation

|

Attributes |

Aerogel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

Infosets In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerogel Market Trends

Increasing Demand for Energy-Efficient Insulation Materials

- One prominent trend driving growth in the aerogel market is the increasing adoption of energy-efficient insulation materials in construction and industrial applications

- Aerogels, with ultra-low thermal conductivity and lightweight properties, are replacing traditional insulation in energy-intensive industries like oil & gas, construction, and automotive

- For instance, Cabot Corporation’s aerogel products are used in pipeline insulation to minimize energy loss while ensuring high durability in harsh environments.

- This shift aligns with rising demand for sustainable and eco-friendly materials, as aerogels are recyclable and support green construction goals. Governments worldwide are encouraging energy-efficient building designs, further accelerating aerogel integration and positioning it as a key material in the global sustainability movement

Aerogel Market Dynamics

Driver

Rising Adoption in Aerospace

- The adoption of aerogels in the aerospace industry is rising due to their lightweight structure, high durability, and exceptional thermal insulation properties

- As aircraft and spacecraft face extreme temperature variations, aerogels offer critical protection by minimizing heat transfer without adding significant weight

- This is especially important as the aerospace sector focuses on improving fuel efficiency and reducing emissions by incorporating advanced, lightweight materials

For instance

- NASA utilizes silica aerogels in Mars rovers and other space missions to insulate key components from extreme thermal conditions. Similarly, commercial aircraft manufacturers use aerogels in cabin insulation to reduce aircraft weight and enhance energy efficiency

- Consequently, the growing emphasis on performance optimization and environmental sustainability in aerospace is significantly driving the demand for aerogels

Opportunity

Advancements in Nanotechnology

- Recent innovations in nanotechnology have significantly improved aerogel production, leading to reduced manufacturing costs and enhanced mechanical and thermal properties

- Nanotech-driven advancements have enabled the creation of flexible and durable aerogels, broadening their application scope across industries such as construction, automotive, and healthcare

- These breakthroughs allow for the integration of aerogels in next-generation energy-efficient buildings and electric vehicle battery insulation due to their superior insulation and strength

For instance

- Researchers have developed silica aerogels with improved mechanical resilience and thermal efficiency, making them suitable for use in sustainable architecture and advanced automotive systems. Reduced production costs have also made aerogels more accessible in emerging markets, driving global adoption

- As a result, nanotechnology is creating lucrative opportunities by making high-performance aerogels more affordable and versatile, positioning them as a sustainable solution across multiple high-growth sectors

Restraint/Challenge

Manufacturing Scalability

- The scalability of aerogel manufacturing poses a significant challenge for market growth, particularly due to the complexity and cost of production processes

- Aerogels require intricate production methods, such as supercritical drying, which are expensive and difficult to implement at a mass-production scale while maintaining material performance

- This technological and operational complexity makes it challenging for manufacturers to meet rising demand without driving up costs or compromising product quality

For instance

- Current aerogel production demands specialized equipment and highly controlled environments, limiting the ability of manufacturers to expand output efficiently. As a result, large-scale adoption across industries such as construction and automotive remains constrained by high production costs and technical barriers

- Consequently, these manufacturing limitations hinder widespread aerogel adoption and slow the market’s potential growth, particularly in cost-sensitive or emerging market sectors.

Aerogel Market Scope

The market is segmented on the basis type, processing, application, and end use

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By Processing |

|

|

By Application

|

|

|

By End Use |

|

In 2025, the silica surgery is projected to dominate the market with a largest share in type segment

The silica segment is expected to dominate the aerogel market with the largest share in 2025 due to its superior thermal insulation properties, high surface area, and widespread application across industries such as oil & gas, construction, and aerospace. As the most established and commercially viable form of aerogel, silica-based products benefit from proven performance and scalability. Additionally, ongoing innovations and cost optimization in silica aerogel manufacturing further solidify its leading position in the global market

The blanket is expected to account for the largest share during the forecast period in form segment

In 2025, the blanket segment is expected to dominate the market with the largest market share 61.15% due to its high demand and versatile application in thermal insulation across industries such as oil & gas, construction, and industrial processing. Aerogel blankets offer excellent flexibility, ease of installation, and superior thermal performance, making them the preferred choice for energy conservation. As industries increasingly prioritize energy efficiency and emission reduction, the adoption of aerogel blankets continues to rise, solidifying their position as the leading form in the aerogel market

Aerogel Market Regional Analysis

North America Holds the Largest Share in the Aerogel Market

- North America dominates the aerogel market, driven by advanced manufacturing capabilities, strong demand from aerospace, construction, and oil & gas industries, and the presence of key market players

- The U.S. holds a significant share due to its technological leadership, high adoption of energy-efficient insulation materials, and strong industrial base. The country also benefits from increased investment in green building projects and infrastructure development

- The availability of government incentives and strong regulatory frameworks that promote energy efficiency further strengthens the market. Additionally, the growing adoption of aerogels for advanced applications like aerospace insulation and energy storage is boosting demand in the region

- Increased focus on sustainable materials and the need for high-performance materials in industries like automotive and construction are driving aerogel market growth in North America

Asia-Pacific is Projected to Register the Highest CAGR in the Aerogel Market

- The Asia-Pacific region is expected to witness the highest growth rate in the aerogel market, driven by rapid industrialization, expanding construction activities, and rising energy efficiency awareness

- Countries such as China, India, and Japan are emerging as key markets for aerogel applications, particularly in construction, automotive, and energy sectors. The increasing demand for energy-efficient insulation materials is a key driver in these regions

- Japan, with its focus on high-tech industries and energy-efficient solutions, continues to lead in the adoption of advanced materials, including aerogels, for automotive and aerospace applications

- China and India, with their fast-growing populations and booming infrastructure sectors, are seeing increased demand for sustainable and cost-effective insulation materials, further contributing to the growth of the aerogel market. The government’s focus on green building projects and the rise of industrial automation also foster the adoption of aerogels in the region

Aerogel Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cabot Corporation (U.S.)

- Aspen Aerogel Inc. (U.S.)

- Svenska Aerogel AB (Sweden)

- American Aerogel Corporation (U.S.)

- JIOS Aerogel (South Korea)

- Active Aerogels (Portugal), Enersens (France

- Green Earth Aerogel Technologies (U.S.)

- DuPont (U.S.)

- Dow (U.S.)

- TAASI Corporation (U.S.)

- Airglass AB (Sweden), Acoustiblok UK Ltd. (U.K.),

- BASF (U.S.)

Latest Developments in Global Aerogel Market

- In November 2023, JIOS Aerogel (JIOS) inaugurated a state-of-the-art manufacturing facility in Pioneer, Singapore. This new plant is focused on producing advanced aerogel-based technologies aimed at improving the safety and performance of electric vehicle (EV) batteries. The company’s initiative highlights its commitment to enhancing the durability and efficiency of EVs by incorporating cutting-edge aerogel solutions to optimize thermal insulation and energy storage systems in batteries

- In March 2023, Fibenol partnered with Aerogel-it to develop a bio-aerogel derived from lignin, a natural polymer produced by Fibenol through direct biomass processing. This collaboration seeks to explore sustainable aerogel solutions with enhanced properties. The bio-aerogel aims to offer superior thermal insulation while being eco-friendly, aligning with increasing demand for greener, renewable materials in various industries, especially for applications such as insulation and energy-efficient products

- In February 2023, Svenska Aerogel entered into a strategic partnership with a leading producer in the process industry to enhance the utilization of Quartzene, its patented aerogel-based material. The agreement includes a pilot phase where Svenska Aerogel will supply 30 tons of Quartzene annually, demonstrating the material’s potential in industrial applications. Quartzene is designed to improve thermal insulation and energy efficiency in a variety of sectors, ranging from construction to manufacturing

- In April 2022, Alkegen introduced AlkeGel, an innovative proprietary material designed for electric vehicle (EV) and battery fire protection, as well as other industrial temperature control applications. AlkeGel boasts extremely high thermal conductivity and minimal dust, providing superior insulation properties compared to traditional materials. This cutting-edge aerogel solution significantly reduces insulation thickness while enhancing thermal performance, making it ideal for EV batteries, fire protection, and high-temperature industrial applications

- In August 2020, Armacell launched ArmaGel DT, a flexible aerogel blanket designed for dual-temperature and cryogenic applications. This next-generation material offers exceptional thermal insulation performance while maintaining flexibility, making it suitable for both high and low-temperature environments. ArmaGel DT is ideal for industries requiring reliable insulation in challenging conditions, such as in the transport and storage of cryogenic gases or the insulation of industrial equipment exposed to fluctuating temperatures

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.