Global Aeroponics Market

Market Size in USD Billion

CAGR :

%

USD

2.85 Billion

USD

6.03 Billion

2025

2033

USD

2.85 Billion

USD

6.03 Billion

2025

2033

| 2026 –2033 | |

| USD 2.85 Billion | |

| USD 6.03 Billion | |

|

|

|

|

Aeroponics Market Size

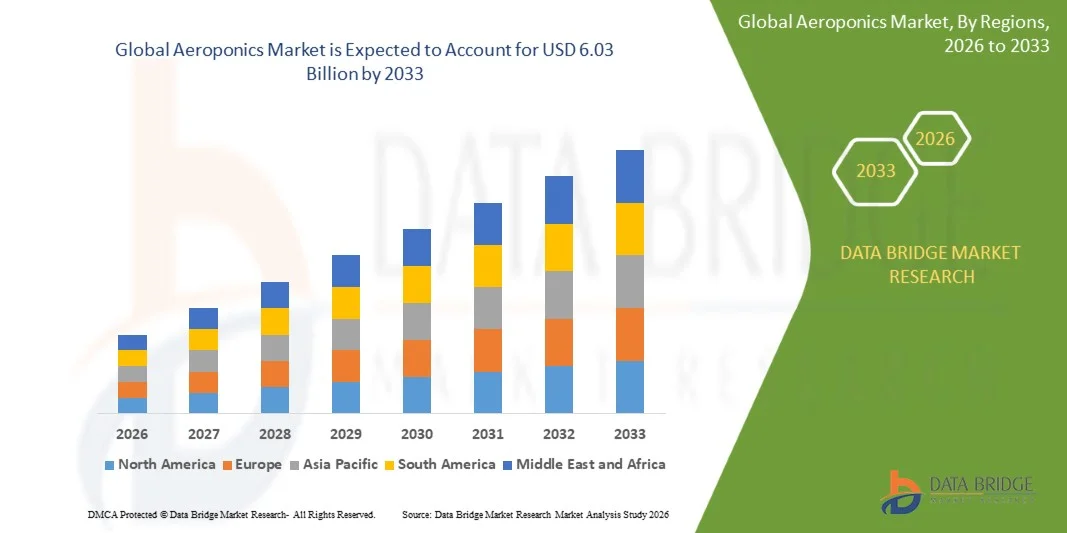

- The global aeroponics market size was valued at USD 2.85 billion in 2025 and is expected to reach USD 6.03 billion by 2033, at a CAGR of 9.80% during the forecast period

- The market growth is largely fuelled by the increasing adoption of soilless cultivation methods in urban farming, rising demand for fresh and pesticide-free produce, and advancements in aeroponic systems that enhance crop yield and resource efficiency

- Growing awareness about sustainable agriculture and water conservation is also driving market expansion

Aeroponics Market Analysis

- The market is witnessing significant innovation in aeroponic technologies, including automated nutrient delivery and climate control systems, which improve efficiency and reduce labor costs

- The increasing urban population and limited arable land are pushing farmers and enterprises to adopt aeroponics for high-density, year-round crop production

- North America dominated the aeroponics market with the largest revenue share of 38.5% in 2025, driven by the increasing adoption of controlled environment agriculture and vertical farming, as well as growing awareness of sustainable farming practices

- Asia-Pacific region is expected to witness the highest growth rate in the global aeroponics market, driven by rapid urbanization, government support for smart agriculture, and increasing investments in indoor and vertical farming solutions

- The Vegetables and Herbs segment held the largest market revenue share in 2025, driven by the high demand for fresh, pesticide-free leafy greens and culinary herbs in urban and commercial farming setups. Vegetables and herbs grown in aeroponic systems benefit from faster growth cycles and higher yields, making them highly attractive for both vertical farming and controlled environment agriculture

Report Scope and Aeroponics Market Segmentation

|

Attributes |

Aeroponics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aeroponics Market Trends

“Rise of High-Efficiency Soilless Farming Systems”

- The adoption of high-efficiency aeroponic systems is transforming modern agriculture by enabling faster growth rates and higher crop yields in controlled environments. These systems reduce water and nutrient consumption while allowing precise management of plant growth conditions, which is especially valuable in urban and resource-constrained areas. Farmers can grow multiple crop cycles per year, maximizing output from limited space and resources

- The increasing demand for fresh, pesticide-free, and year-round produce is accelerating the deployment of aeroponic vertical farms and modular growth units. Such systems are particularly attractive in regions with limited arable land or harsh climatic conditions, supporting sustainable food production. Urban centers and remote areas benefit from locally grown crops, reducing supply chain dependencies and food transport emissions

- Technological advancements, including automated nutrient delivery, LED lighting optimization, and IoT-enabled monitoring, are making aeroponic setups easier to manage and more cost-effective. This encourages adoption among commercial growers and research institutions alike. Integration with data analytics allows growers to optimize growth conditions and minimize resource waste, improving overall operational efficiency

- For instance, in 2024, several urban farming startups in Singapore implemented fully automated aeroponic towers, achieving up to 40% faster growth for leafy greens compared to traditional hydroponics. The success of these initiatives highlights the potential for scalability and improved resource efficiency. Such real-world applications are inspiring further investments in smart vertical farming systems globally

- While high-efficiency aeroponics is driving market expansion, its impact depends on continued technological innovation, affordability, and farmer education. Manufacturers and agritech providers must focus on localized solutions and training programs to maximize adoption and long-term benefits. Awareness campaigns and pilot projects can help farmers understand operational advantages and return on investment, fostering wider acceptance

Aeroponics Market Dynamics

Driver

“Increasing Water Scarcity and Need for Sustainable Agriculture”

- Rising concerns over water scarcity and soil degradation are encouraging growers to adopt aeroponics as a water-efficient, sustainable farming method. These systems use up to 90% less water than conventional soil-based agriculture while maintaining high yields. This also helps conserve critical freshwater resources and supports climate-resilient farming practices

- Governments and environmental agencies are promoting soilless cultivation methods through subsidies, grants, and awareness campaigns, boosting adoption among both commercial and urban farmers. Such policy support reduces the initial financial burden on growers and incentivizes innovation in precision agriculture technologies. Public-private partnerships are also helping implement large-scale aeroponic projects

- Farmers are recognizing the economic advantages of aeroponics, including faster crop cycles, higher productivity, and reduced dependency on pesticides, which enhances profitability and product quality. The ability to grow crops year-round enables farmers to meet consistent market demand and stabilize income streams. The reduction in chemical usage also aligns with the rising consumer preference for organic and safe food

- For instance, in 2023, urban farms in California expanded aeroponic operations following state-led initiatives promoting water-efficient technologies, resulting in higher production with significantly lower water consumption. The positive outcomes encouraged neighboring farms to adopt similar systems, demonstrating replicability and scalability. Government-backed pilot programs continue to drive technology awareness and adoption rates

- While sustainability concerns and supportive policies are driving growth, effective implementation requires upfront investment in equipment, training, and maintenance, which remains a focus for stakeholders. Continuous monitoring and technical support are essential to ensure consistent crop quality, minimize operational risks, and optimize system performance

Restraint/Challenge

“High Initial Investment and Technical Complexity”

- The high capital expenditure required for aeroponic systems, including infrastructure, nutrient delivery systems, and environmental controls, limits adoption among small-scale farmers and emerging markets. Many growers are hesitant to invest without clear ROI projections or financial assistance. This can slow market penetration, especially in developing regions

- The complexity of managing nutrient solutions, pH levels, and lighting conditions requires technical knowledge and skilled personnel, which may be lacking in certain regions. Incorrect management can reduce crop yield and quality, discouraging growers from adopting advanced systems. Training programs and expert guidance are critical for overcoming these technical barriers

- Maintenance costs, system calibration, and potential technical failures also pose challenges, particularly for decentralized or rural operations with limited access to service support. Continuous monitoring, periodic repairs, and replacement of sensitive components add to operational expenses. Without proper technical backup, system downtime can significantly impact productivity

- For instance, in 2023, several smallholder farms in India reported reluctance to adopt aeroponics due to high equipment costs and the need for specialized technical training. This highlights the importance of offering affordable, modular solutions and local technical support networks to encourage adoption. Demonstration farms and knowledge-sharing platforms are proving effective in bridging these gaps

- While the technology offers significant advantages, overcoming cost and knowledge barriers is essential for broader adoption, prompting manufacturers to develop more affordable, user-friendly, and modular solutions. The market is witnessing innovation in low-cost aeroponic kits, plug-and-play units, and remote monitoring tools, which are gradually expanding access to smaller farms and emerging markets

Aeroponics Market Scope

The market is segmented on the basis of crop type, end-use, and cultivation method

• By Crop Type

On the basis of crop type, the aeroponics market is segmented into Fruits, Vegetables and Herbs, and Others. The Vegetables and Herbs segment held the largest market revenue share in 2025, driven by the high demand for fresh, pesticide-free leafy greens and culinary herbs in urban and commercial farming setups. Vegetables and herbs grown in aeroponic systems benefit from faster growth cycles and higher yields, making them highly attractive for both vertical farming and controlled environment agriculture.

The Fruits segment is expected to witness the fastest growth rate from 2026 to 2033, driven by innovations in aeroponic systems that support small fruit cultivation such as strawberries and cherry tomatoes. These systems allow precise nutrient and water delivery, enabling high-quality fruit production in limited spaces and urban environments.

• By End-Use

On the basis of end-use, the aeroponics market is segmented into Commercial and Residential. The Commercial segment held the largest market revenue share in 2025, driven by large-scale urban farms, vertical farming startups, and institutional growers aiming to meet the rising demand for fresh produce. Commercial growers benefit from the scalability, automation, and resource efficiency offered by modern aeroponic systems.

The Residential segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the increasing interest of urban consumers in home gardening and self-sufficient food production. Compact and user-friendly aeroponic kits are gaining popularity among residential users for growing herbs, microgreens, and small vegetables indoors.

• By Cultivation Method

On the basis of cultivation method, the aeroponics market is segmented into Outdoor and Indoor. The Indoor segment held the largest market revenue share in 2025, driven by the growth of vertical farming, controlled environment agriculture, and urban farming initiatives. Indoor aeroponics allows year-round crop production with precise control over light, humidity, and nutrients, improving productivity and quality.

The Outdoor segment is expected to witness the fastest growth rate from 2026 to 2033, supported by the adoption of hybrid aeroponic systems in greenhouses and open-air setups. These systems are being increasingly used in regions with favorable climates to cultivate high-value crops while conserving water and reducing reliance on soil-based agriculture.

Aeroponics Market Regional Analysis

- North America dominated the aeroponics market with the largest revenue share of 38.5% in 2025, driven by the increasing adoption of controlled environment agriculture and vertical farming, as well as growing awareness of sustainable farming practices

- Farmers and commercial growers in the region are leveraging aeroponic systems for higher crop yields, water efficiency, and year-round production, particularly in urban centers and regions with limited arable land

- The widespread adoption is further supported by high investment in agritech, a technologically skilled workforce, and government initiatives promoting soilless farming, establishing aeroponics as a preferred solution for both commercial and research applications

U.S. Aeroponics Market Insight

The U.S. aeroponics market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of vertical farming and smart agriculture technologies. Commercial growers and startups are increasingly prioritizing high-efficiency, resource-saving systems to meet the demand for fresh, pesticide-free produce. The integration of IoT, automated nutrient delivery, and climate-controlled environments further supports market expansion, enabling precise crop management and higher productivity.

Europe Aeroponics Market Insight

The Europe aeroponics market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by sustainable agriculture initiatives, limited farmland, and increasing urbanization. Countries such as Germany, France, and the Netherlands are adopting aeroponic systems in commercial greenhouses and vertical farms to improve efficiency and reduce water consumption. Growing government support for climate-resilient agriculture and urban farming projects is further propelling market adoption.

U.K. Aeroponics Market Insight

The U.K. aeroponics market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising interest in home and urban farming, as well as a focus on reducing food imports. The increasing trend of indoor farming and vertical gardens, along with concerns over sustainability and food safety, encourages both commercial growers and households to adopt aeroponic solutions.

Germany Aeroponics Market Insight

The Germany aeroponics market is expected to witness the fastest growth rate from 2026 to 2033, fueled by technological advancements, strong agritech infrastructure, and sustainability-focused policies. German farmers and research institutions are increasingly integrating aeroponics with smart monitoring and automated systems to maximize yield while minimizing resource consumption. The country’s emphasis on innovation and eco-friendly farming supports steady market growth.

Asia-Pacific Aeroponics Market Insight

The Asia-Pacific aeroponics market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising food demand, and government initiatives promoting smart agriculture in countries such as China, Japan, and India. The region’s increasing focus on water-efficient farming and high-value crop production is supporting the adoption of aeroponic systems in commercial farms and urban vertical farms.

Japan Aeroponics Market Insight

The Japan aeroponics market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high population density, limited arable land, and strong inclination toward technological innovation. Indoor and vertical aeroponic farms are increasingly used to cultivate vegetables and herbs year-round. Integration with IoT and automated nutrient systems is driving productivity and attracting both commercial and research-focused users.

China Aeroponics Market Insight

The China aeroponics market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and increasing demand for fresh, safe produce. Smart vertical farms and commercial aeroponic operations are expanding to meet urban food requirements. Supportive government policies, domestic manufacturing of aeroponic systems, and rising investments in agritech are key factors driving market growth.

Aeroponics Market Share

The Aeroponics industry is primarily led by well-established companies, including:

- AeroFarms (U.S.)

- LettUs Grow (U.K.)

- Living Greens Farm (U.S.)

- Altius Farms (U.S.)

- CleanGreenss Solutions (Switzerland)

- Aponic International (U.K.)

- Aeriz (U.S.)

- City Greens (India)

- Innovation Agritech Group (U.K.)

- Freight Farms (U.S.)

Latest Developments in Global Aeroponics Market

- In October 2024, LettUs Grow, an indoor farming technology provider, launched its latest Aeroponic Rolling Bench at the Heath Farm Aeroponic Innovation Centre in Bristol, U.K. The product integrates ultrasonic aeroponic irrigation with industry standards, enabling large-scale indoor growers to enhance productivity and exceed annual yield targets. This development strengthens LettUs Grow’s position in the European aeroponics market and promotes the adoption of advanced soilless farming technologies

- In April 2024, LettUs Grow partnered with Innovative Growers Equipment to introduce ultrasonic aeroponics to greenhouse growers across the U.S. and Canada. The collaboration aims to expand the reach of efficient indoor farming solutions, improving crop yields, resource efficiency, and operational scalability for North American growers

- In February 2024, LettUs Grow announced a global partnership program to extend the distribution of its ultrasonic aeroponic technology. This initiative is designed to accelerate market penetration, increase technology accessibility, and support the growth of high-efficiency indoor farming worldwide

- In January 2023, CleanGreens Solutions S.A., a Swiss agro-tech company, signed a contract with Midiflore to deploy a 3,500-square-meter aeroponic project using the GREENOVA system. The project allows Midiflore to locally produce aromatic herbs, reduce imports, and enhance supply chain efficiency, supporting sustainable agriculture in the region

- In March 2022, Living Greens Farm, one of the largest indoor vertical aeroponic farms in the U.S., invested USD 70 million to establish a 200,000-square-foot facility for farming, processing, and packaging. The farm incorporates smart automation for transplanting, seeding, and harvesting, significantly increasing operational efficiency, productivity, and market competitiveness in the North American aeroponics sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.