Global Aerospace Accumulator Market

Market Size in USD Billion

CAGR :

%

USD

9.89 Billion

USD

13.02 Billion

2025

2033

USD

9.89 Billion

USD

13.02 Billion

2025

2033

| 2026 –2033 | |

| USD 9.89 Billion | |

| USD 13.02 Billion | |

|

|

|

|

Aerospace Accumulator Market Size

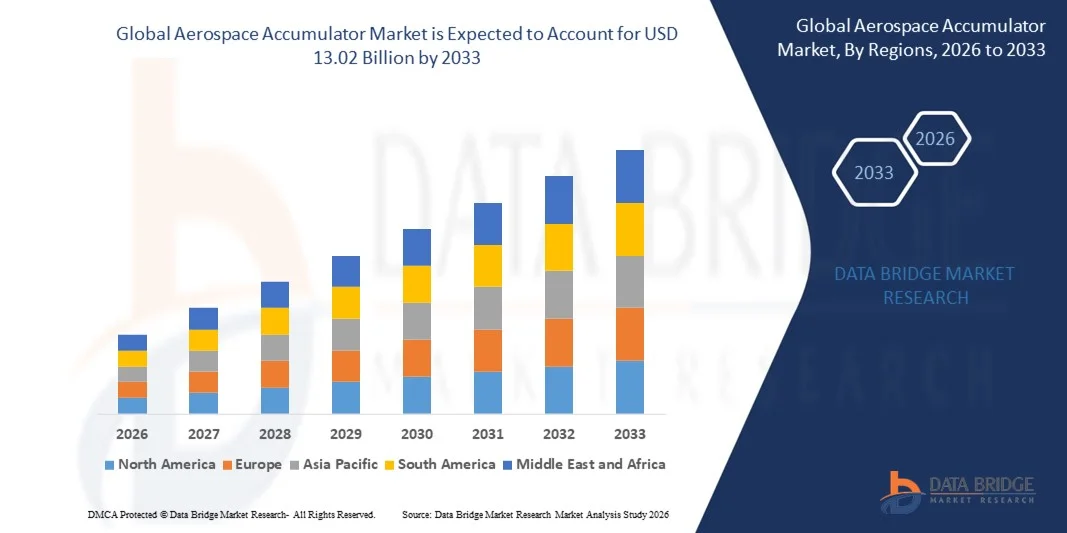

- The global aerospace accumulator market size was valued at USD 9.89 billion in 2025 and is expected to reach USD 13.02 billion by 2033, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by the rising demand for energy-efficient and high-performance hydraulic systems in commercial, regional, business, and military aircraft, driving the adoption of aerospace accumulators for pressure stabilization, energy storage, and shock absorption

- Furthermore, increasing aircraft production, fleet modernization programs, and stringent safety regulations are encouraging manufacturers and operators to integrate reliable accumulator solutions, thereby supporting the overall expansion of the aerospace accumulator market

Aerospace Accumulator Market Analysis

- Aerospace accumulators, including piston, bladder, and metal bellow types, are critical components in aircraft hydraulic systems, providing pressure maintenance, energy storage, and system protection in both commercial and defense aviation applications

- The growing focus on operational efficiency, system reliability, and reduced maintenance downtime is fueling the demand for accumulators, while technological advancements and lightweight materials are further enhancing their adoption across modern aircraft fleets

- North America dominated the aerospace accumulator market with a share of over 45% in 2025, due to increasing aircraft production, fleet expansion, and stringent safety and performance regulations

- Asia-Pacific is expected to be the fastest growing region in the aerospace accumulator market during the forecast period due to increasing aircraft production, fleet expansion, and modernization programs in countries such as China, Japan, and India

- Piston segment dominated the market with a market share of 47.5% in 2025, due to its proven reliability in maintaining stable hydraulic pressure and its compatibility with a wide range of aircraft hydraulic systems. Piston accumulators are favored for their durability under high-pressure conditions, low maintenance requirements, and predictable performance, making them a preferred choice for commercial and military aircraft

Report Scope and Aerospace Accumulator Market Segmentation

|

Attributes |

Aerospace Accumulator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aerospace Accumulator Market Trends

Adoption of Advanced Hydraulic Systems in Modern Aircraft

- A prominent trend in the aerospace accumulator market is the growing integration of advanced hydraulic systems in modern aircraft, driven by the need for enhanced energy efficiency, reliability, and safety in flight-critical operations. These systems enable smoother actuation of control surfaces, landing gear operations, and braking systems, positioning accumulators as essential components for contemporary aviation designs

- For instance, Parker Hannifin and Moog supply aerospace accumulators and hydraulic solutions widely implemented in commercial and military aircraft for precise motion control and system reliability. These products enhance operational efficiency and ensure consistent performance under high-pressure conditions

- The increasing complexity of aircraft systems is encouraging manufacturers to adopt accumulators that can provide rapid energy release, damping, and emergency power backup. This trend is contributing to the modernization of hydraulic subsystems across commercial jets, regional aircraft, and defense platforms

- There is rising emphasis on weight reduction and fuel efficiency, motivating the use of compact and high-performance accumulators capable of maintaining pressure stability while minimizing space and mass. This is driving design innovation and material advancements in accumulator technology

- The defense and military aviation sectors are increasingly integrating accumulators in mission-critical applications such as fighter jets and transport aircraft, where reliability and rapid response under extreme conditions are paramount. This is enhancing the strategic importance of aerospace accumulators across advanced aerial platforms

- The aerospace accumulator market continues to expand as aircraft manufacturers and OEMs focus on lifecycle optimization and system resilience. Accumulators are now viewed as indispensable elements in supporting both routine operations and emergency scenarios in modern aircraft

Aerospace Accumulator Market Dynamics

Driver

Rising Demand for Energy-Efficient and Reliable Aircraft Components

- The increasing focus on operational efficiency and sustainable aviation is driving demand for aerospace accumulators that contribute to energy savings, system reliability, and longer service life. Accumulators store and release hydraulic energy efficiently, helping optimize fuel consumption and reduce wear on mechanical components

- For instance, Eaton Corporation supplies high-performance aerospace accumulators used in commercial aircraft hydraulic systems to improve energy efficiency and operational reliability. These solutions help manufacturers meet stringent regulatory requirements for aircraft performance and safety

- The trend toward digital and automated flight systems is further increasing demand for accumulators capable of supporting precise control under dynamic conditions. These components ensure consistent pressure regulation and responsive actuation in modern flight control architectures

- The adoption of next-generation aircraft platforms with higher payload capacities and extended ranges requires accumulators that deliver consistent hydraulic support for heavier loads and complex systems. This is reinforcing their role as core enablers of aircraft performance

- In addition, airlines and aircraft OEMs are prioritizing maintenance reduction and system longevity, which strengthens demand for robust accumulators that can withstand repeated cycles and extreme conditions. This focus is encouraging continued innovation in accumulator materials, design, and performance

Restraint/Challenge

High Costs and Complexity of Integration

- The aerospace accumulator market faces challenges due to high manufacturing costs and the technical complexity of integrating accumulators into sophisticated hydraulic systems. Precision engineering, high-grade materials, and rigorous testing are essential to meet aerospace safety and performance standards, elevating overall system costs

- For instance, Moog’s aerospace accumulators require specialized fabrication and assembly techniques to achieve reliability in flight-critical applications. These intricate processes increase production time and operational expenses, limiting flexibility for cost reduction

- The integration of accumulators into modern aircraft involves balancing performance, weight, and space constraints, which adds design complexity and extends development timelines. These factors complicate adoption for retrofitting older aircraft platforms

- Manufacturers must also navigate regulatory certifications and compliance standards imposed by aviation authorities such as the FAA and EASA, which increases both technical and financial burden. Meeting these stringent requirements is essential to ensure safety and operational approval

- The market continues to experience limitations related to scaling high-performance accumulators for diverse aircraft models while maintaining cost-effectiveness. These constraints challenge OEMs and suppliers to optimize design, production, and integration strategies to satisfy growing demand while preserving reliability

Aerospace Accumulator Market Scope

The market is segmented on the basis of product, material, and aircraft.

- By Product

On the basis of product, the aerospace accumulator market is segmented into bladder, piston, and metal bellow types. The piston segment dominated the market with the largest revenue share of 47.5% in 2025, driven by its proven reliability in maintaining stable hydraulic pressure and its compatibility with a wide range of aircraft hydraulic systems. Piston accumulators are favored for their durability under high-pressure conditions, low maintenance requirements, and predictable performance, making them a preferred choice for commercial and military aircraft. The market also benefits from piston accumulators’ ability to support both energy storage and shock absorption functions, enhancing overall aircraft operational efficiency.

The bladder segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by increasing adoption in modern aircraft for lightweight, compact, and high-performance hydraulic systems. Bladder accumulators provide rapid response times, reduced leakage risks, and simplified maintenance, making them ideal for regional, business, and helicopter aircraft applications. Their flexibility in design and integration also allows manufacturers to optimize hydraulic circuits and meet stringent weight-saving requirements.

- By Material

On the basis of material, the aerospace accumulator market is segmented into steel and aluminum. The steel segment held the largest market share in 2025, driven by its high tensile strength, superior pressure-handling capabilities, and long service life under extreme operational conditions. Steel accumulators are commonly used in commercial and military aircraft due to their reliability in high-pressure hydraulic systems and proven performance in demanding flight environments. The segment also benefits from established manufacturing standards and certifications, which further strengthen its adoption across the aerospace industry.

The aluminum segment is expected to witness the fastest growth from 2026 to 2033, fueled by its lightweight characteristics, corrosion resistance, and suitability for modern fuel-efficient aircraft designs. Aluminum accumulators are increasingly integrated into regional and business aircraft to reduce overall weight, improve fuel efficiency, and support the development of advanced hydraulic architectures. The material’s adaptability allows manufacturers to design customized solutions for specific aircraft types and mission profiles.

- By Aircraft

On the basis of aircraft, the aerospace accumulator market is segmented into commercial, regional, business, helicopter, and military aircraft. The commercial aircraft segment dominated the market in 2025, driven by the high number of aircraft in service, the extensive use of hydraulic systems for flight control, landing gear, and braking operations, and the focus on operational safety and reliability. Commercial airlines prioritize accumulators that offer consistent performance, long lifecycle, and ease of maintenance to minimize downtime and operational costs. The segment also benefits from the integration of advanced hydraulic technologies to enhance passenger comfort and system efficiency.

The regional aircraft segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for short-haul and commuter flights, fleet expansion by regional airlines, and the adoption of lightweight and efficient hydraulic systems. Regional aircraft increasingly rely on bladder and aluminum accumulators for optimized performance, reduced maintenance, and compliance with stringent weight and space constraints. The segment’s growth is further supported by technological advancements in accumulator design that improve system responsiveness and energy efficiency.

Aerospace Accumulator Market Regional Analysis

- North America dominated the aerospace accumulator market with the largest revenue share of over 45% in 2025, driven by increasing aircraft production, fleet expansion, and stringent safety and performance regulations

- Aerospace operators and manufacturers in the region prioritize high-reliability hydraulic systems, where accumulators play a crucial role in energy storage, shock absorption, and system stabilization

- The region’s well-established aerospace infrastructure, high adoption of advanced technologies, and focus on operational efficiency support widespread adoption across commercial, military, and business aircraft

U.S. Aerospace Accumulator Market Insight

The U.S. aerospace accumulator market captured the largest revenue share in 2025 within North America, fueled by a robust aircraft manufacturing base and continuous modernization of commercial and defense fleets. Operators increasingly demand accumulators that enhance system reliability and reduce maintenance downtime. The growing integration of hydraulic systems with advanced flight control and energy management solutions further propels market growth. Moreover, the U.S. market benefits from leading accumulator manufacturers investing in innovative designs, advanced materials, and lightweight solutions to meet performance and regulatory standards.

Europe Aerospace Accumulator Market Insight

The Europe aerospace accumulator market is projected to expand at a substantial CAGR during the forecast period, driven by rising aircraft production, increasing fleet modernization, and stringent aviation safety regulations. European manufacturers emphasize high-performance hydraulic systems, and accumulators are integral to improving aircraft efficiency and reliability. The region is also witnessing adoption in regional, business, and military aircraft programs, with technological advancements and sustainability initiatives promoting the use of lightweight and high-durability accumulator solutions.

U.K. Aerospace Accumulator Market Insight

The U.K. aerospace accumulator market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s advanced aerospace manufacturing sector and increasing investments in civil and defense aviation. Accumulators are increasingly deployed to enhance hydraulic system performance, reduce system shocks, and ensure energy efficiency. The U.K.’s focus on innovation, combined with government support for aviation technology development, is expected to continue stimulating market growth.

Germany Aerospace Accumulator Market Insight

The Germany aerospace accumulator market is expected to expand at a considerable CAGR during the forecast period, fueled by strong aircraft manufacturing, research in advanced hydraulic technologies, and the need for high-performance systems in commercial and military aircraft. Germany’s emphasis on engineering excellence, system reliability, and safety compliance encourages the adoption of steel and piston-type accumulators. Integration of accumulators into energy-efficient and eco-friendly hydraulic architectures further strengthens market demand.

Asia-Pacific Aerospace Accumulator Market Insight

The Asia-Pacific aerospace accumulator market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing aircraft production, fleet expansion, and modernization programs in countries such as China, Japan, and India. The growing aerospace manufacturing capabilities, coupled with the rising adoption of hydraulic systems in commercial and regional aircraft, is driving market growth. In addition, government initiatives to support aerospace technology development and local production of components are improving accessibility and affordability of accumulators.

Japan Aerospace Accumulator Market Insight

The Japan aerospace accumulator market is gaining momentum due to the country’s advanced aviation technology, focus on energy-efficient aircraft, and adoption of modern hydraulic systems. Japanese manufacturers prioritize accumulators that provide precise pressure control, rapid response, and durability in commercial and regional aircraft. Moreover, the integration of accumulators with next-generation flight control and safety systems supports market expansion.

China Aerospace Accumulator Market Insight

The China aerospace accumulator market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid growth in commercial and regional aircraft production, fleet modernization, and strong government support for aerospace manufacturing. China is also emerging as a key hub for accumulator component manufacturing, boosting domestic supply and reducing costs. The increasing adoption of hydraulic systems in commercial, military, and regional aircraft, along with growing technological expertise, is significantly propelling the market in China.

Aerospace Accumulator Market Share

The aerospace accumulator industry is primarily led by well-established companies, including:

- PARKER HANNIFIN CORP (U.S.)

- Valcor Engineering Corporation (U.S.)

- Eaton (U.S.)

- Arkwin Industries, Inc. (U.S.)

- HYDAC (Germany)

- Bosch Rexroth AG (Germany)

- Triumph Group (U.S.)

- AMETEK, Inc. (U.S.)

- Technetics Group (U.S.)

- APPH (U.K.)

- LISI AEROSPACE (France)

- GIE Media, Inc. (U.S.)

- HYDRO SYSTEMS KG (Germany)

Latest Developments in Global Aerospace Accumulator Market

- In October 2025, Rolls-Royce signed an agreement with Bharat Forge to manufacture and supply fan blades for the Pearl 700 and Pearl 10X engines. This collaboration strengthens the aerospace supply chain and enhances Rolls-Royce’s engine production capacity. The deal also supports the company’s strategy to double India-based sourcing by 2030, which is expected to reduce costs, improve component availability, and boost the competitiveness of Rolls-Royce engines in the global market

- In July 2025, FDH Hardware, a division of FDH Aero, entered a supply agreement with MS Aerospace to provide fasteners for OEM and aftermarket customers worldwide. This agreement ensures a reliable supply of critical components across space, military, helicopter, commercial aircraft, missile, jet, and rocket engine platforms. The deal is expected to strengthen FDH Hardware’s presence in high-precision aerospace and defense markets and improve service continuity for operators globally

- In July 2025, HAECO and Liebherr-Aerospace entered a component maintenance agreement to support COMAC’s C909 and C919 programs. The partnership aims to deliver repair and overhaul services for hydraulic components, ensuring consistent safety and reliability as COMAC expands its fleet. This agreement enhances the aftermarket services segment, providing airlines and operators with trusted maintenance solutions that reduce downtime and operational risks

- In May 2025, GE Aerospace finalized a limited distribution agreement with United Aero Group (UAG) to distribute CT7/T700 engine parts and spares. The deal broadens access to genuine parts and maintenance solutions for CT7/T700 operators, improving service efficiency and reducing turnaround time. This expansion strengthens GE Aerospace’s aftermarket network and ensures better support for regional and military operators relying on these engine platforms

- In May 2024, Topcast entered a cooperation agreement with Apollo Aerospace Components to expand joint activities in aerospace and defense hardware. Under the partnership, Apollo will supply a wide range of U.S. and European specification items, including nuts, bolts, screws, rivets, bearings, seals, labels, and hydraulic fittings. This collaboration is expected to enhance supply chain reliability, expand market reach, and provide aerospace manufacturers with greater access to standardized, high-quality components

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.