Global Aerospace Adhesive Sealants Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

2.31 Billion

2024

2032

USD

1.60 Billion

USD

2.31 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 2.31 Billion | |

|

|

|

|

Aerospace Adhesive - Sealants Market Size

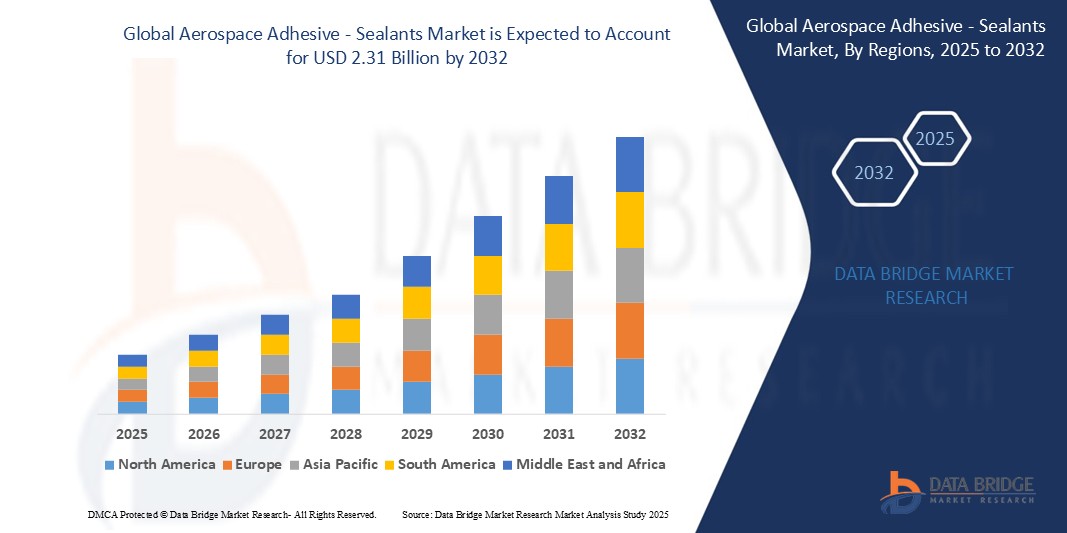

- The global aerospace adhesive - sealants market size was valued at USD 1.60 billion in 2024 and is expected to reach USD 2.31 billion by 2032, at a CAGR of 4.70% during the forecast period

- The market growth is largely fueled by the increasing demand for lightweight and fuel-efficient aircraft, which necessitates the use of advanced adhesives and sealants for structural integrity while reducing overall weight

- Rising aircraft production rates across commercial, military, and general aviation sectors are driving the consumption of adhesives and sealants in both original equipment manufacturing (OEM) and maintenance, repair, and overhaul (MRO) activities

- Technological advancements in adhesive and sealant formulations, including enhanced temperature resistance, chemical compatibility, and durability, are expanding their applications in critical aerospace components and systems

Aerospace Adhesive - Sealants Market Analysis

- The increasing demand for lightweight aircraft is a central factor propelling the aerospace adhesive and sealant market in the current market, as lighter planes require advanced bonding solutions for composite materials, directly impacting fuel efficiency which is a major concern for the airline industry

- The heightened use of carbon fiber reinforced polymers in modern aircraft necessitates high-performance adhesives and sealants to ensure structural integrity and reduce overall weight, demonstrating the market's responsiveness to the aerospace industry's focus on fuel economy and reduced emissions in the current market

- North America dominated the aerospace adhesive - sealants market with the largest revenue share of 47.18% in 2024, driven by strong aerospace manufacturing capabilities, rising defense expenditure, and growing MRO activities

- Asia-Pacific is expected to be the fastest growing region in the aerospace adhesive - sealants market during the forecast period due to rapid urbanization, rising disposable income, and increasing air travel are major drivers. APAC is emerging as a major aerospace manufacturing and MRO hubsss

- The commercial aviation segment dominated the aerospace adhesive - sealants market with largest share of 64.13% in 2024, driven by increasing air passenger traffic and the need for new aircraft deliveries worldwide. Adhesive-sealant usage in cabin interiors, fuselage structures, and engines is a major contributor to this segment

Report Scope and Aerospace Adhesive - Sealants Market Segmentation

|

Attributes |

Aerospace Adhesive - Sealants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aerospace Adhesive - Sealants Market Trends

“Increasing Adoption of Lightweighting Initiatives in Aircraft Manufacturing”

- A significant market trend in the current aerospace adhesive and sealant sector is the increasing adoption of lightweighting initiatives in aircraft manufacturing

- This trend is driven by the continuous pressure to enhance fuel efficiency and reduce emissions in the aviation industry

- For instance, the growing utilization of composite materials such as carbon fiber in aircraft structures necessitates advanced adhesive and sealant technologies for effective bonding

- These specialized adhesives and sealants contribute to the overall reduction in aircraft weight without compromising structural integrity

- In conclusion, consequently, the demand for high-performance, lightweight adhesive and sealant solutions is on the rise in the current aerospace market

Aerospace Adhesive - Sealants Market Dynamics

Driver

“Stringent Environmental Regulations Fueling Demand for Sustainable Adhesive Solutions”

- Growing environmental regulations are a key driver for the aerospace adhesive and sealant market, pushing for reduced VOC emissions and improved fuel efficiency

- This regulatory pressure is spurring innovation in eco-friendly formulations such as water-based and solvent-free adhesives, for instance, many manufacturers are now offering low-VOC sealants for cabin interiors

- Aerospace companies are actively adopting these greener alternatives to meet compliance and enhance their sustainability image, for instance, airlines are increasingly choosing adhesives with better lifecycle assessments

- This shift towards sustainable solutions is fundamentally changing material selection in the aerospace sector, creating opportunities for environmentally conscious suppliers

- Ultimately, the pursuit of a greener aerospace industry is significantly boosting the demand for and development of sustainable adhesive and sealant technologies

Restraint/Challenge

“Rising Concerns Regarding Long-Term Performance and Reliability in Extreme Aerospace Conditions”

- Ensuring consistent long-term performance and reliability in extreme aerospace conditions poses a significant challenge for the adhesive and sealant market

- Aircraft endure severe temperature swings, from freezing high altitudes to hot runways, alongside mechanical stresses and chemical exposure, for instance, sealants in fuel tanks must resist constant contact with jet fuel

- Maintaining bond integrity is crucial for aircraft safety and operation, as failures can lead to structural issues or leaks, for instance, adhesives used in wing assembly must withstand immense aerodynamic forces

- The aerospace industry employs exceptionally rigorous testing involving prolonged exposure to harsh conditions to qualify materials such as adhesives and sealants, for instance, vibration tests simulate in-flight conditions for extended periods

- Developing formulations that endure decades of such demanding environments necessitates continuous research, strict quality control, and robust application methods, representing a persistent restraint requiring ongoing innovation and thorough validation

Aerospace Adhesive - Sealants Market Scope

The market is segmented on the basis of product, resins, technology, aircraft, aisle type, user, and end user.

- By Product

On the basis of type, the aerospace adhesive - sealants market is segmented into adhesives and sealants. The adhesives segment dominated the largest market revenue share of 43.2% in 2024, driven by its critical role in bonding lightweight composite materials and improving fuel efficiency. the increasing use of structural adhesives for load-bearing applications in both commercial and military aircraft is further boosting demand. adhesives also contribute to reduced aircraft weight, leading to better fuel economy and lower emissions.

The sealants segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising demand for corrosion-resistant, flexible sealing materials in aircraft assembly and maintenance. these are essential in sealing joints and preventing fluid leakage, especially in fuel tanks and fuselage components. the growing need for longer-lasting and high-temperature-resistant materials in extreme aviation environments is propelling this segment.

- By Resins

On the basis of resins, the aerospace adhesive - sealants market is segmented into epoxy, polyurethane, silicone, and others. The epoxy segment accounts for the largest market share in 2024 with share of 40.08%, due to its strong mechanical properties, thermal resistance, and widespread usage in structural bonding. epoxies are preferred for their high strength-to-weight ratio, making them ideal for primary aircraft structures.

The polyurethane segment is expected to witness rapid growth, owing to its superior flexibility, durability, and resistance to environmental stress. polyurethane-based adhesives and sealants are increasingly used in interior applications and exterior panel bonding, supporting their growing popularity across various aircraft types.

- By Aircraft

On the basis of aircraft, the aerospace adhesive - sealants market is segmented into small wide, large wide, medium wide, and others. the large wide-body aircraft segment dominates the market revenue share in 2024, driven by higher production of long-haul aircraft and demand for fuel-efficient wide-body models. these aircraft require extensive bonding and sealing applications due to their complex structures.

The medium wide-body aircraft segment is projected to grow significantly over the forecast period, fueled by increased air travel demand and airline fleet modernization programs. these aircraft balance capacity and range, leading to high usage of advanced adhesive-sealant systems to support safety and performance.

- By Aisle type

On the basis of aisle type, the aerospace adhesive - sealants market is segmented into single aisle and multiple aisle. The single-aisle segment captures the largest market share in 2024, propelled by strong demand from low-cost carriers and short-to-medium haul routes. their higher production rates and global popularity increase adhesive-sealant consumption per unit.

The multiple aisle segment is expected to exhibit steady growth, supported by increasing deliveries of long-range aircraft and the need for advanced bonding solutions in large, complex structures. these aircraft require greater material durability and sealing precision, promoting market expansion.

- By User

On the basis of user, the aerospace adhesive - sealants market is segmented into OEM and aftermarket. the OEM segment holds the largest share in 2024, driven by rising aircraft production and demand for lightweight, integrated bonding solutions at the assembly stage. OEMS increasingly use adhesives and sealants to replace traditional mechanical fasteners, optimizing structural integrity.

The aftermarket segment is projected to grow rapidly, driven by the growing need for MRO (maintenance, repair, and overhaul) services across aging fleets. airlines are investing in sealant and adhesive upgrades to enhance aircraft life cycles and reduce maintenance costs, boosting demand in this segment.

- By End Use

On the basis of end use, the aerospace adhesive - sealants market is segmented into commercial, military, general aviation, space, and others. The commercial aviation segment dominates the market with share of 64.13% in 2024, driven by increasing air passenger traffic and the need for new aircraft deliveries worldwide. adhesive-sealant usage in cabin interiors, fuselage structures, and engines is a major contributor to this segment.

The military segment is expected to witness robust growth, supported by defense modernization initiatives and the rising demand for durable bonding materials in combat and cargo aircraft. these applications require high-performance adhesives that withstand extreme environmental conditions and mechanical stress.

Aerospace Adhesive - Sealants Market Regional Analysis

- North America dominated the aerospace adhesive - sealants market with the largest revenue share of 47.18% in 2024, driven by strong aerospace manufacturing capabilities, rising defense expenditure, and growing MRO activities

- The region is home to leading aerospace OEMs such as Boeing and Lockheed Martin, which drive consistent demand for high-performance adhesive and sealant solutions. The growing emphasis on lightweight materials and fuel-efficient aircraft further fuels adoption across both commercial and military aviation sectors

- The increasing investments in aircraft maintenance, repair, and overhaul (MRO) services are expanding the use of advanced bonding technologies. Regulatory support for low-emission, sustainable products is also encouraging the shift toward eco-friendly adhesive-sealant formulations in North America

U.S. Aerospace Adhesive - Sealants Market Insight

The U.S. Dominated the north American market with an 81% revenue share in 2024, driven by strong aerospace manufacturing and MRO demand. Rising integration of advanced materials and lightweight bonding technologies fuels market growth. The presence of major aerospace OEMS and defense contractors boosts adoption. Increasing use of composite components in aircraft construction supports adhesive-sealant usage. Government focus on defense modernization enhances demand. Technological advancements in adhesive formulations also contribute. Environmental compliance and sustainability trends are influencing product development.

Europe Aerospace Adhesive - Sealants Market Insight

The European market is set to grow at a solid CAGR, supported by strict performance standards and growing demand for durable, lightweight bonding solutions. Increased aircraft production and a focus on fuel efficiency drive adoption. Germany, France, and the U.K. Are leading in aerospace innovation and manufacturing. Demand spans both commercial and defense sectors. Sustainability and eco-friendly product use are gaining traction. Adhesive-sealants are increasingly used in interior, structural, and exterior applications. Refurbishment and retrofitting projects further propel market expansion.

U.K. Aerospace Adhesive - Sealants Market Insight

The U.K. Market is projected to grow significantly, supported by expanding aircraft fleet and aerospace R&D investment. Strong presence of global aerospace manufacturers fosters market demand. Lightweight bonding solutions are favored in aircraft assembly and maintenance. Market growth is also driven by focus on fuel efficiency and emission control. Increasing MRO activities and export opportunities boost adhesive-sealants usage. The push for sustainable manufacturing practices supports the adoption of eco-conscious products. Integration of advanced composite materials enhances adhesive demand.

Germany Aerospace Adhesive - Sealants Market Insight

Germany’s aerospace adhesive - sealants market is growing steadily due to its strong engineering base and innovation-driven manufacturing sector. Increased focus on energy efficiency and lightweight aircraft components is a key growth factor. German aerospace companies prioritize high-performance, durable bonding technologies. The market is aligned with EU environmental directives encouraging low-emission products. Aircraft modernization and retrofitting projects further support adhesive-sealant usage. Automation and digitization trends are also shaping product development. Export-oriented aerospace production enhances market dynamics.

Asia-Pacific Aerospace Adhesive - Sealants Market Insight

The Asia-pacific region is set to register the fastest CAGR of over 24% in 2024, led by China, Japan, and India. Rapid urbanization, rising disposable income, and increasing air travel are major drivers. APAC is emerging as a major aerospace manufacturing and MRO hub. Governments are supporting aviation growth through infrastructure development and digitalization. Affordable product availability and growing domestic production support wider adoption. Increasing aircraft deliveries and defense spending further enhance market prospects. The trend toward lightweight, fuel-efficient aircraft favors adhesive-sealants.

Japan Aerospace Adhesive - Sealants Market Insight

Japan’s market is expanding due to its focus on innovation, aerospace technology, and manufacturing excellence. Demand is driven by lightweight and durable bonding materials for commercial and defense aviation. Strong integration of adhesive-sealants with advanced components and automation technologies is observed. Aircraft modernization and maintenance needs are rising. Government support for aerospace R&D boosts product demand. Eco-friendly and high-performance products are gaining preference. The growing elderly population also influences aviation safety and material standards.

China Aerospace Adhesive - Sealants Market Insight

China led the Asia-pacific market in revenue share in 2024, driven by a rapidly growing aerospace sector and increased aircraft production. The expanding middle class and strong government support for aviation fuel market growth. Domestic manufacturers are enhancing the supply of cost-effective, high-quality adhesives. The push for smart manufacturing and smart cities supports technology adoption. High demand across commercial, military, and general aviation segments fuels usage. Investments in new aircraft programs and infrastructure bolster market development.

Aerospace Adhesive - Sealants Market Share

The aerospace adhesive - sealants industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Beacon Adhesives, Inc. (U.S.)

- Bostik (France)

- Chemetall (Germany)

- Delo (Germany)

- DuPont (U.S.)

- Dow (U.S.)

- Flamemaster Corp. (U.S.)

- Dymax (U.S.)

- General Sealants (U.S.)

- H.B Fuller Company (U.S.)

- Henkel AG & Co. KGaA (Germany)

- Hernon Manufacturing (U.S.)

- Permabond (U.K.)

- Permatex (Subsidiary of ITW) (U.S.)

- PPG Industries Inc. (U.S.)

- SIKA (Switzerland)

- Solvay (Belgium)

- Alchemie Ltd. (U.K.)

- Hylomar Products (U.K.)

Latest Developments in Global Aerospace Adhesive - Sealants Market

- In August 2024, H.B Fuller acquired H.S.Butyl Limited, the world’s largest of adhesives company announced that it has acquired HS Butyl Limited (HS Butyl), the largest distributor and manufacturer of premium butyl tapes in the UK. These tapes offer robust, long-lasting, watertight seals for a range of applications in the infrastructure, automotive, and renewable energy sectors. This acquisition strengthened and expanded position in the global specialty construction tapes market

- In May 2024, Henkel AG & Co. KGaA showcased sustainable product innovations at Drupa 2024, highlighting advancements in eco-friendly packaging and printing solutions. By presenting sustainable innovations, Henkel reinforced its position as a leader in eco-friendly solutions, attracting environmentally conscious customers and strengthening its market presence in the packaging and printing industries

- In June 2024, recent advancements in nano-based adhesive bonding involve adding nanoparticles to adhesives, enhancing their strength, flexibility, and durability. This improvement boosts adhesion and performance, particularly in aerospace. For aerospace applications, these enhanced adhesives offer greater strength and durability, leading to more reliable components and cost-effective manufacturing

- In February 2021, Researchers at Oak Ridge National Laboratory, supported by the DOE’s Building Technologies Office, have created ASHA-Elastomer, a self-healing adhesive that autonomously repairs itself and maintains strong adhesion in tough conditions. This smart adhesive innovation benefits companies by extending material lifespans and cutting maintenance requirements. In aerospace applications, it translates to more durable and reliable adhesives and sealants, enhancing performance and reducing costs in high-demand environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.