Global Aerospace And Defense Fuel Market

Market Size in USD Billion

CAGR :

%

USD

18.52 Billion

USD

26.54 Billion

2025

2033

USD

18.52 Billion

USD

26.54 Billion

2025

2033

| 2026 –2033 | |

| USD 18.52 Billion | |

| USD 26.54 Billion | |

|

|

|

|

Aerospace and Defense Fuel Market Size

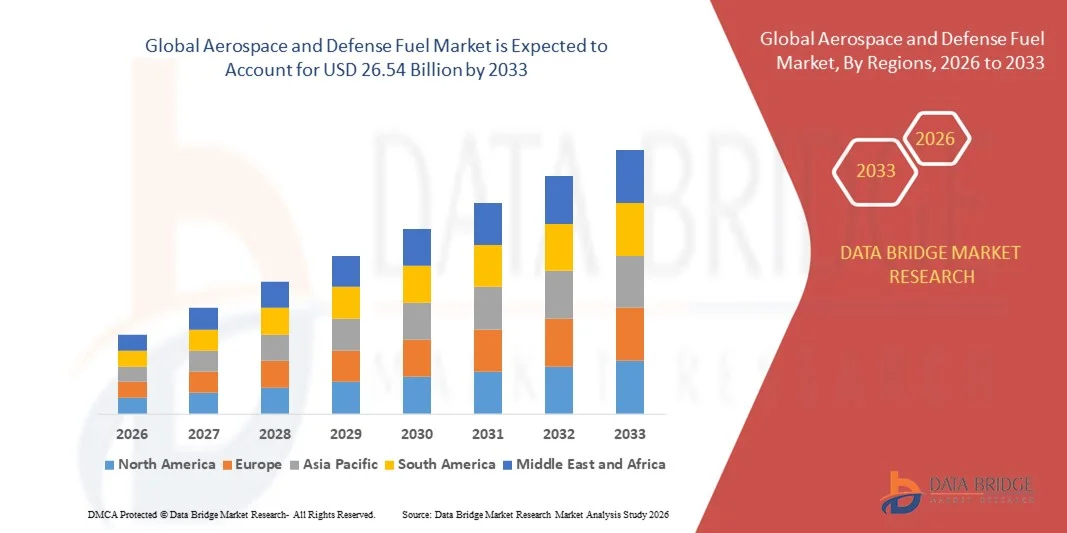

- The global aerospace and defense fuel market size was valued at USD 18.52 billion in 2025 and is expected to reach USD 26.54 billion by 2033, at a CAGR of 4.60% during the forecast period

- The market growth is largely fueled by the rising demand for efficient and high-performance fuels across commercial aviation and defense sectors, driven by the increasing number of aircraft operations and modernization of military fleets

- Furthermore, growing focus on sustainability and carbon reduction initiatives is promoting the adoption of alternative and bio-based aviation fuels. These converging factors are accelerating the uptake of advanced aerospace fuels, thereby significantly boosting the market's growth

Aerospace and Defense Fuel Market Analysis

- Aerospace and defense fuels, including jet fuel, aviation biofuels, and other high-energy fuels, are critical for ensuring operational efficiency, safety, and reliability in both civilian and military aviation

- The escalating demand for these fuels is primarily driven by the expansion of commercial aviation networks, modernization of defense fleets, regulatory mandates for cleaner fuels, and increasing investments in sustainable aviation fuel production and distribution

- North America dominated the aerospace and defense fuel market with a share of 42.4% in 2025, due to the high demand for military aircraft operations and commercial aviation fuel

- Asia-Pacific is expected to be the fastest growing region in the aerospace and defense fuel market during the forecast period due to rapid urbanization, expanding commercial aviation, and defense modernization in countries such as China, India, and Japan

- Aircrafts segment dominated the market with a market share of 51.7% in 2025, due to the increasing number of commercial and defense aircraft operations globally. Airlines and defense fleets heavily rely on high-quality fuel for long-haul flights, training missions, and operational readiness, emphasizing efficiency and safety standards. The segment benefits from extensive global refueling infrastructure and established logistics networks, ensuring uninterrupted supply chains and consistent performance for aviation fleets. The growing demand for air travel and modernization of military aircraft further reinforces the dominance of this segment in the market

Report Scope and Aerospace and Defense Fuel Market Segmentation

|

Attributes |

Aerospace and Defense Fuel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerospace and Defense Fuel Market Trends

Rising Adoption of Sustainable Aviation Fuels

- The aerospace and defense fuel market is witnessing a strong transition toward sustainable aviation fuels (SAFs) as part of ongoing global efforts to decarbonize air transport and military operations. Airlines and defense agencies are increasingly prioritizing SAFs to reduce greenhouse gas emissions and meet international carbon neutrality goals set by bodies such as ICAO and IATA

- For instance, in 2024, Boeing collaborated with Neste and the U.S. Air Force to test 100 percent sustainable aviation fuel blends for military and commercial aircraft. This initiative demonstrated the compatibility of SAFs with existing jet engines while also showcasing measurable reductions in lifecycle carbon emissions during high-performance operations

- Governments across key aviation markets such as the United States, the European Union, and Japan are introducing tax incentives and blending mandates to encourage SAF production and usage. These measures are supported by funding initiatives for biofuel refineries and hydrogen-based fuel technologies that align with ambitious net-zero emission policies

- Aerospace companies are strengthening their R&D capabilities to develop SAF-compatible engines, storage solutions, and fuel transport infrastructure. Companies such as Rolls-Royce and GE Aerospace are enhancing testing programs to certify engines for extended SAF use, ensuring safety and performance consistency across all operational conditions

- This trend is also fostering partnerships between fuel producers and defense organizations aimed at integrating low-carbon fuels into strategic supply chains. Collaborations are focusing on establishing domestic SAF production hubs and securing stable feedstock availability for long-term energy resilience

- As global aviation and defense sectors continue their shift toward sustainability, the adoption of SAFs represents a fundamental transformation in fuel strategy. This trend is expected to redefine performance standards, operational efficiency, and environmental accountability across the aerospace and defense landscape

Aerospace and Defense Fuel Market Dynamics

Driver

Growing Demand for High-Performance Fuels in Aviation and Defense

- The increasing demand for high-performance fuels in both aviation and defense sectors is a major driver shaping the market. The need for advanced fuels that offer superior energy density, stability under extreme conditions, and reduced environmental impact is growing in line with evolving operational requirements

- For instance, in 2024, ExxonMobil signed a supply agreement with the U.S. Navy to provide JP-5 and F-76 high-energy fuels for naval aviation and surface vessels. This partnership ensured reliable supply for critical missions while supporting the gradual inclusion of renewable fuel components in military operations

- Modern aircraft engines require fuels that maintain consistent combustion efficiency and thermal stability to achieve higher propulsion outputs and lower maintenance costs. Fuel manufacturers are investing heavily in refining technologies to produce cleaner, thermally stable formulations suitable for high-altitude and high-speed performance

- The rapid expansion of military exercises, global air transport networks, and the development of next-generation fighter jets and UAVs have further intensified the need for efficient fuel systems. These applications demand optimized formulations capable of delivering higher compression ratios and performance reliability in diverse operating environments

- The growing incorporation of hybrid propulsion and SAF-based blends in defense and commercial fleets indicates a significant market evolution. The convergence of performance requirements and sustainability goals is expected to propel ongoing innovation and secure future demand for advanced aviation and defense fuels

Restraint/Challenge

Crude Oil Price Volatility Impacting Production and Supply

- Fluctuating crude oil prices continue to pose a critical challenge for the aerospace and defense fuel market. The industry’s reliance on petroleum-based feedstocks makes it highly susceptible to variations in global crude markets, affecting production costs and fuel pricing stability

- For instance, during 2023 and 2024, significant crude oil price fluctuations driven by geopolitical tensions disrupted jet fuel supply chains, impacting major suppliers such as Shell Aviation and Chevron. These disruptions influenced airline operating costs and forced defense procurement agencies to reassess fuel sourcing strategies

- High price volatility hampers the consistent manufacturing of aviation-grade fuels, leading to increased budgetary pressure on both commercial carriers and defense ministries. Refiners face challenges in maintaining margins during downturns, while end-users struggle with unpredictable procurement costs throughout long-term contracts

- Uncertainties in oil supply and refining capacity further aggravate the situation by creating short-term bottlenecks and increasing logistics expenses. This situation also delays the transition toward alternative fuels as producers balance financial exposure and production priorities

- Long-term stability in fuel pricing and supply will depend on diversifying energy sources, expanding local refining capacities, and increasing SAF production. Establishing resilient supply chains and adopting flexible energy hedging mechanisms will be essential for mitigating the impact of crude oil volatility on aerospace and defense operations

Aerospace and Defense Fuel Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the aerospace and defense fuel market is segmented into Avgas, Avtur, rocket propellants, aviation biofuel, jet fuel, and CNG & LNG. The jet fuel segment dominated the market with the largest market revenue share in 2025, driven by its widespread use across commercial and military aircraft due to high energy density and established refueling infrastructure. Airlines and defense organizations often prioritize jet fuel for its reliability, efficiency, and compatibility with existing engine technologies. The segment also benefits from ongoing investments in refining technologies and infrastructure, ensuring consistent quality and availability to meet the growing demand in aviation operations. Furthermore, jet fuel’s versatility in supporting both civil and defense aviation applications reinforces its dominant market position.

The aviation biofuel segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing sustainability initiatives and government mandates to reduce carbon emissions. For instance, companies such as Neste and World Energy are expanding production and supply chains of sustainable aviation fuel to support airlines’ decarbonization goals. Aviation biofuels provide an eco-friendly alternative without significant engine modifications, attracting interest from commercial airlines and defense operators alike. The rising focus on environmental responsibility, coupled with technological advancements in feedstock processing, is expected to drive rapid adoption in the coming years.

- By Application

On the basis of application, the aerospace and defense fuel market is segmented into surveillance, aircrafts, and civil military. The aircraft segment held the largest market revenue share of 51.7% in 2025, driven by the increasing number of commercial and defense aircraft operations globally. Airlines and defense fleets heavily rely on high-quality fuel for long-haul flights, training missions, and operational readiness, emphasizing efficiency and safety standards. The segment benefits from extensive global refueling infrastructure and established logistics networks, ensuring uninterrupted supply chains and consistent performance for aviation fleets. The growing demand for air travel and modernization of military aircraft further reinforces the dominance of this segment in the market.

The surveillance segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by the rising deployment of unmanned aerial vehicles (UAVs) and reconnaissance systems for defense and commercial monitoring purposes. For instance, companies such as General Atomics and Northrop Grumman are increasingly integrating fuel-efficient power systems to extend UAV endurance and operational capabilities. Surveillance applications often require specialized fuels with high energy density and reliability to support long-duration missions, driving innovation and adoption of advanced fuel solutions. The expanding role of UAVs in intelligence, border monitoring, and disaster management is anticipated to propel significant growth in this segment.

Aerospace and Defense Fuel Market Regional Analysis

- North America dominated the aerospace and defense fuel market with the largest revenue share of 42.4% in 2025, driven by the high demand for military aircraft operations and commercial aviation fuel

- Consumers and defense organizations in the region prioritize fuel reliability, efficiency, and availability, ensuring uninterrupted operations for both civilian and defense fleets

- This widespread adoption is further supported by advanced infrastructure, strong logistics networks, and ongoing investments in fuel production and storage, establishing North America as a key hub for aerospace and defense fuel supply

U.S. Aerospace and Defense Fuel Market Insight

The U.S. aerospace and defense fuel market captured the largest revenue share in 2025 within North America, fueled by the significant presence of commercial airlines and military aviation fleets. Operators are increasingly focusing on fuel efficiency and reliability to optimize operational performance. The growing adoption of advanced aircraft requiring high-performance fuels and government initiatives supporting energy security further propel market growth. Moreover, technological advancements in fuel formulations and extensive refueling infrastructure are significantly contributing to market expansion.

Europe Aerospace and Defense Fuel Market Insight

The Europe aerospace and defense fuel market is projected to expand at a substantial CAGR during the forecast period, primarily driven by modernization of military fleets and the growing civil aviation sector. Strict environmental regulations and the shift towards sustainable aviation fuels are encouraging the adoption of advanced fuel types. Countries in Europe are emphasizing efficiency and eco-friendly alternatives to reduce carbon emissions. In addition, rising urban air mobility and increased cross-border defense collaborations are driving demand across the region.

U.K. Aerospace and Defense Fuel Market Insight

The U.K. aerospace and defense fuel market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the modernization of military aviation and increasing civil aviation operations. Government incentives for low-carbon fuels and strategic fuel stockpiling are supporting market expansion. The growing integration of sustainable aviation fuels and technological upgrades in fuel storage and distribution infrastructure is also stimulating growth in the U.K. market.

Germany Aerospace and Defense Fuel Market Insight

The Germany aerospace and defense fuel market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing defense modernization programs and adoption of aviation biofuels. Germany’s advanced infrastructure and focus on sustainability encourage the use of eco-friendly fuels in both civil and military aviation. Continuous innovation in fuel technology and efficient distribution networks further support market growth, aligning with the country’s energy and environmental objectives.

Asia-Pacific Aerospace and Defense Fuel Market Insight

The Asia-Pacific aerospace and defense fuel market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rapid urbanization, expanding commercial aviation, and defense modernization in countries such as China, India, and Japan. Rising air travel demand, along with government initiatives to enhance aviation infrastructure, is driving adoption of high-performance and sustainable fuels. The region is also emerging as a manufacturing hub for aviation fuel components, increasing affordability and accessibility for both civil and defense aviation.

Japan Aerospace and Defense Fuel Market Insight

The Japan aerospace and defense fuel market is gaining momentum due to the country’s advanced aerospace technology, focus on energy efficiency, and strategic military operations. The growing use of UAVs, commercial aircraft, and defense systems is increasing fuel demand. Integration of sustainable fuels and government-led initiatives to modernize aviation fleets are further accelerating market growth in Japan.

China Aerospace and Defense Fuel Market Insight

The China aerospace and defense fuel market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid expansion of civil aviation, strong defense modernization programs, and increasing fuel consumption efficiency requirements. China’s strategic investments in aviation infrastructure and domestic fuel production are bolstering the market. The adoption of sustainable aviation fuels, along with a large and growing airline fleet, are key factors driving the market in China.

Aerospace and Defense Fuel Market Share

The aerospace and defense fuel industry is primarily led by well-established companies, including:

- Naseba (U.A.E.)

- Chennai Petroleum Corporation Limited (India)

- Royal Dutch Shell Plc. (Netherlands)

- Chevron Corporation (U.S.)

- Reliance Industries Limited (India)

- Essar (India)

- Hindustan Petroleum Corporation Limited (India)

- BP p.l.c. (U.K.)

- Flightworx (U.A.E.)

- Repsol (Spain)

- Eaton (U.S.)

- Exxon Mobil Corporation (U.S.)

- Gazprom Neft PJSC (Russia)

- Skytanking Holding GmbH (Germany)

- Commercial Aviation Alternative Fuels Initiative (U.S.)

- TotalEnergies SE (France)

- LUKOIL (Russia)

- Indian Oil Corporation Ltd. (India)

- Bharat Oman Refineries Limited (India)

- China Petrochemical Corporation (China)

Latest Developments in Global Aerospace and Defense Fuel Market

- In June 2025, TotalEnergies announced plans to scale up production of sustainable aviation fuel (SAF) to over 500,000 tonnes annually by 2028, aiming to supply more than 10 % of its European jet fuel volumes. This strategic move strengthens its position in the aerospace and defense fuel market by accelerating the adoption of lower-carbon fuels, ensuring supply security, and aligning with tightening regulatory requirements, thereby reinforcing TotalEnergies as a key player in sustainable aviation fuel production

- In June 2025, TotalEnergies entered into a 15-year feedstock supply agreement for 60,000 tons per annum of used cooking oil to support its biorefineries converting waste oils into SAF and biodiesel. This development addresses a critical challenge in SAF production—consistent feedstock availability—thereby enhancing the scalability, cost-efficiency, and reliability of the aerospace and defense fuel supply chain

- In June 2025, Honeywell signed a Memorandum of Understanding with NTPC Green Energy in India to explore SAF production using captured CO₂ and green hydrogen, leveraging advanced refining technologies. This collaboration expands the geographic footprint of sustainable aviation fuels in the Asia-Pacific region, supports energy security and decarbonization goals, and demonstrates the increasing role of innovative partnerships in shaping the future of the aerospace and defense fuel market

- In February 2025, Honeywell signed an MoU with AM Green in India to assess the feasibility of producing SAF from ethanol, green methanol, and CO₂ feedstocks. This initiative broadens the innovation landscape for aerospace and defense fuels, exploring alternative pathways and feedstocks to strengthen the long-term supply base, improve market resilience, and support sustainability objectives within the sector

- In January 2025, Jet Aviation began supplying SAF at its Zurich fixed-base operation during the World Economic Forum, demonstrating operational availability for business and general aviation. This initiative boosts market acceptance of sustainable fuels within aerospace and defense applications by showing that SAF can be seamlessly integrated into VIP, charter, and support flight operations, thereby increasing adoption across niche aviation segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerospace And Defense Fuel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerospace And Defense Fuel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerospace And Defense Fuel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.