Global Aerospace And Defense Materials Market

Market Size in USD Billion

CAGR :

%

USD

33.28 Billion

USD

53.85 Billion

2024

2032

USD

33.28 Billion

USD

53.85 Billion

2024

2032

| 2025 –2032 | |

| USD 33.28 Billion | |

| USD 53.85 Billion | |

|

|

|

|

Aerospace and Defense Materials Market Size

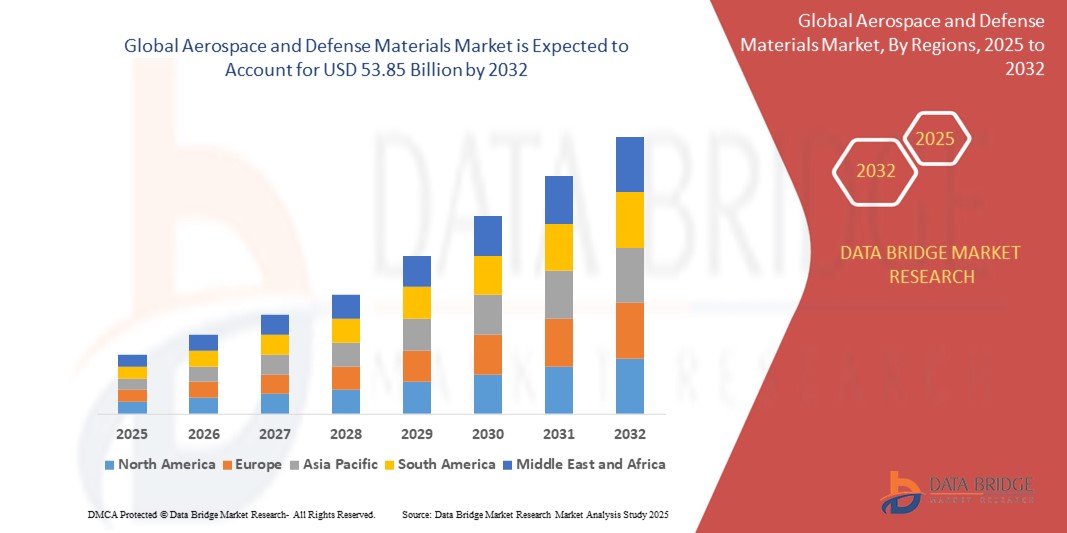

- The global aerospace and defense materials market size was valued at USD 33.28 billion in 2024 and is expected to reach USD 53.85 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fuelled by the rising demand for lightweight and high-performance materials to improve fuel efficiency, durability, and performance in next-generation aircraft and defense systems

- Increasing investments in aerospace innovations, growing defense budgets, and the expansion of commercial aviation fleets are further contributing to the market expansion

Aerospace and Defense Materials Market Analysis

- Growing adoption of advanced composites and titanium alloys for manufacturing airframes, engines, and structural components is transforming the materials landscape across both commercial and military sectors

- Strategic collaborations between material providers and aerospace OEMs are accelerating innovation in lightweight and sustainable materials, enhancing operational efficiency and reducing environmental impact

- North America dominated the aerospace and defense materials market with the largest revenue share of 37.46% in 2024, driven by robust investments in defense modernization and the expansion of commercial aircraft fleets

- Asia-Pacific region is expected to witness the highest growth rate in the global aerospace and defense materials market, driven by increasing defense budgets, expanding commercial aviation fleets, and significant investments in aerospace manufacturing infrastructure in countries such as China, India, and Japan

- The aluminium alloys segment held the largest market revenue share in 2024, driven by their lightweight nature, high strength-to-weight ratio, and excellent corrosion resistance. Aluminium alloys remain a material of choice for manufacturing fuselage and wing structures due to their cost-effectiveness and ease of fabrication. The segment benefits from widespread use across commercial and military aircraft due to their long-standing reliability and support for fuel efficiency improvements

Report Scope and Aerospace and Defense Materials Market Segmentation

|

Attributes |

Aerospace and Defense Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Lightweight and Fuel-Efficient Aircraft Materials • Increasing Defense Expenditure on Advanced Combat and Surveillance Systems |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerospace and Defense Materials Market Trends

“Growing Use of Composite Materials for Weight Reduction and Fuel Efficiency”

- Aerospace manufacturers are increasingly adopting carbon fiber-reinforced polymers and ceramic matrix composites to reduce aircraft weight and enhance fuel efficiency

- Lightweight composites can lower fuel consumption by up to 20%, making them more cost-effective over the aircraft’s lifecycle

- Composites offer additional benefits such as corrosion resistance and fatigue strength, which reduces maintenance and increases service life

- The military sector is leveraging composites in stealth technology due to their radar-absorbing properties

- Composite usage is rapidly expanding across both new aircraft programs and retrofitting of older fleets

- For instance, the Boeing 787 Dreamliner uses over 50% composite materials by weight to improve fuel efficiency and reduce emissions

Aerospace and Defense Materials Market Dynamics

Driver

“Increased Global Demand for Air Travel and Military Modernization”

- Rapid growth in global air traffic, especially in the Asia-Pacific region, is prompting increased aircraft production and material demand

- Governments are ramping up defense spending to modernize fleets with high-performance, lightweight, and durable materials

- Advanced materials such as titanium alloys and composites are essential for manufacturing next-generation aircraft and drones

- The need to meet stricter emissions regulations in commercial aviation is boosting demand for lighter, fuel-efficient materials

- OEMs are expanding production to fulfill large aircraft backlogs and defense contracts

- For instance, India’s domestic air passenger traffic reached 152 million in 2023, pushing carriers to order hundreds of fuel-efficient aircraft

Restraint/Challenge

“High Costs and Complex Manufacturing Processes of Advanced Materials”

- High production costs of advanced materials such as titanium and carbon composites limit their accessibility for smaller manufacturers

- Specialized equipment and skilled labor required for processing these materials result in longer production cycles and increased operational expenses

- Material waste during manufacturing processes further increases costs, especially in carbon fiber production

- Strict quality control standards and certification requirements in aerospace extend development timelines

- Cost pressures and fluctuating raw material prices challenge the supply chain, especially for non-recurring orders

- For instance, titanium’s high cost has restricted its widespread use in commercial aviation, prompting companies to explore hybrid material options

Aerospace and Defense Materials Market Scope

The market is segmented on the basis of product, application, and end-use.

• By Product

On the basis of product, the aerospace and defense materials market is segmented into aluminium alloys, composites, heat-resistant alloys, plastics and polymers, super alloys, ceramics, steel, nanocomposites, graphene, and others. The aluminium alloys segment held the largest market revenue share in 2024, driven by their lightweight nature, high strength-to-weight ratio, and excellent corrosion resistance. Aluminium alloys remain a material of choice for manufacturing fuselage and wing structures due to their cost-effectiveness and ease of fabrication. The segment benefits from widespread use across commercial and military aircraft due to their long-standing reliability and support for fuel efficiency improvements.

The composites segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to their superior weight reduction capabilities, fatigue resistance, and versatility in shaping. Composites are increasingly being used in advanced aircraft programs and space exploration vehicles. Their application across airframes, rotor blades, and interior components is growing rapidly due to the demand for materials that support both fuel economy and aerodynamic performance.

• By Application

On the basis of application, the aerospace and defense materials market is segmented into aircraft structural frames/aerostructure, propulsion systems, components, cabin interiors, satellite, construction and insulation components, and others. The aircraft structural frames/aerostructure segment dominated the market with the largest revenue share in 2024, owing to the extensive use of high-strength materials in building critical load-bearing components. Increasing demand for lighter and more durable structural elements to enhance fuel efficiency and payload capacity is driving growth in this segment.

The propulsion systems segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising investments in advanced engines and thrusters for both commercial and defense applications. The use of heat-resistant alloys and super alloys in turbines and engine cores is gaining traction due to their ability to withstand extreme thermal and mechanical stress in next-generation propulsion systems.

• By End-Use

On the basis of end-use, the aerospace and defense materials market is segmented into commercial, military, business and general aviation, and others. The commercial segment held the highest market revenue share in 2024, supported by increasing aircraft deliveries, growing passenger air travel, and stringent emission norms pushing for lighter, fuel-efficient materials. Major OEMs are increasingly adopting advanced materials to meet evolving environmental and economic performance goals.

The military segment is expected to witness the fastest growth rate from 2025 to 2032, driven by heightened defense budgets and modernization initiatives worldwide. Strategic defense programs are fueling the demand for advanced materials in fighter jets, unmanned aerial vehicles (UAVs), and space defense technologies, where strength, stealth, and durability are critical performance metrics.

Aerospace and Defense Materials Market Regional Analysis

- North America dominated the aerospace and defense materials market with the largest revenue share of 37.46% in 2024, driven by robust investments in defense modernization and the expansion of commercial aircraft fleets

- The region’s well-established aerospace manufacturing ecosystem, including major players such as Boeing and Lockheed Martin, significantly supports the consumption of high-performance materials for both structural and propulsion components

- Ongoing innovation in lightweight and sustainable materials, alongside rising R&D spending, continues to solidify North America’s leadership in the market

U.S. Aerospace and Defense Materials Market Insight

The U.S. aerospace and defense materials market accounted for the majority share in North America in 2024, propelled by a surge in defense procurement and increasing demand for commercial aircraft production. The country’s ongoing military upgrades, including next-generation fighter jets and satellite systems, are stimulating the adoption of advanced composites and alloys. In addition, the U.S. space exploration sector, with projects led by NASA and private players such as SpaceX, contributes to growing demand for high-strength, lightweight materials suited for extreme environments.

Europe Aerospace and Defense Materials Market Insight

The Europe aerospace and defense materials market is expected to witness the fastest growth rate from 2025 to 2032, supported by collaborative defense initiatives and increased aircraft manufacturing activity. Countries such as France, Germany, and the U.K. are investing in military aircraft and space missions, driving material innovation and demand. Furthermore, the European Union’s commitment to sustainable aviation fuels and lightweight materials is boosting the use of composites and thermoplastics. The region also emphasizes localization and strategic autonomy, which supports growth in domestic material production.

U.K. Aerospace and Defense Materials Market Insight

The U.K. aerospace and defense materials market is expected to witness the fastest growth rate from 2025 to 2032, driven by the government’s increasing defense budget and focus on indigenous aircraft programs such as the Future Combat Air System (FCAS). The growing collaboration with NATO and European partners is also spurring investment in cutting-edge materials that enhance aircraft efficiency and survivability. In addition, the U.K.’s emphasis on clean aviation and materials research is expected to encourage innovation in carbon composites and sustainable alternatives.

Germany Aerospace and Defense Materials Market Insight

The Germany’s aerospace and defense materials market is expected to witness the fastest growth rate from 2025 to 2032, due to rising investment in civil aviation, defense upgrades, and advanced manufacturing. The country’s involvement in European defense projects, such as the Eurofighter and military helicopters, boosts the demand for specialized materials, particularly heat-resistant alloys and composites. Germany’s strong industrial base and leadership in engineering innovation provide a favorable environment for the development and deployment of new-generation aerospace materials.

Asia-Pacific Aerospace and Defense Materials Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate from 2025 to 2032of 2025 to 2032, led by expanding commercial aviation and rising defense spending in countries such as China, India, and Japan. Increasing urbanization, air travel demand, and domestic aircraft manufacturing programs are driving material consumption. Moreover, regional governments are investing in space exploration and satellite development, further supporting the market. The shift toward self-reliance in defense production, particularly in India and China, enhances the regional demand for aerospace-grade materials.

Japan Aerospace and Defense Materials Market Insight

The Japan's aerospace and defense materials market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s growing space missions, defense upgrades, and participation in global commercial aviation. Japan’s Ministry of Defense continues to prioritize stealth technologies and high-performance materials for next-gen aircraft. In addition, domestic aerospace manufacturers are investing in R&D to develop lightweight composites and ceramics suited for space and defense applications. Japan’s emphasis on precision and quality standards aligns well with the demand for durable and high-performance materials.

China Aerospace and Defense Materials Market Insight

The China dominated the Asia-Pacific aerospace and defense materials market in 2024, driven by the country’s aggressive investment in indigenous aircraft development and rapid expansion of its space program. The increasing production of aircraft such as the COMAC C919, as well as the modernization of the People’s Liberation Army (PLA), is significantly fueling the demand for advanced materials. The Chinese government’s focus on reducing dependency on foreign materials and enhancing its domestic supply chain is also a key growth driver in the market.

Aerospace and Defense Materials Market Share

The Aerospace and Defense Materials industry is primarily led by well-established companies, including:

- Hindalco - Almex Aerospace Limited (India)

- Tata Advanced Systems Limited (India)

- MATERION CORPORATION (U.S.)

- PARK AEROSPACE CORP. (U.S.)

- TEIJIN LIMITED. (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- 3M (U.S.)

- Huntsman International LLC. (U.S.)

- Safran (France)

- Arkema (France)

- Solvay (Belgium)

- Rogers Corporation (U.S.)

- Alcoa Corporation (U.S.)

- Arconic (U.S.)

- Hexcel Corporation (U.S.)

- Constellium (Netherlands)

- AMG (Netherlands)

- SGL Carbon (Germany)

- DuPont (U.S.)

- SABIC (Saudi Arabia)

Latest Developments in Global Aerospace and Defense Materials Market

- In July 2023, Safran Helicopter Engines and Hindustan Aeronautics Limited (HAL) formed a joint venture in Bangalore, India, to design, produce, and support helicopter engines for India's naval helicopter programs. This partnership marks India's inaugural initiative in engine design and manufacturing, supporting the nation's defense technology self-reliance vision and strengthening the aerospace strategic roadmap between India and France. Leveraging HAL's manufacturing expertise and Safran's turboshaft engine design, the collaboration aims to explore new aviation business opportunities

- In June 2023, Teijin Carbon announced its commitment to the aerospace industry by offering lightweight, durable solutions through a comprehensive approach integrating high-performance materials and advanced manufacturing technologies. Utilizing Teijin’s Tenax Carbon Fibers, the company is revolutionizing aerospace with high-performance components tailored to aircraft manufacturers' specific needs. This initiative aims to deliver customized solutions that enhance aircraft performance and efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerospace And Defense Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerospace And Defense Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerospace And Defense Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.