Global Aerospace Composites Market

Market Size in USD Billion

CAGR :

%

USD

29.09 Billion

USD

61.69 Billion

2024

2032

USD

29.09 Billion

USD

61.69 Billion

2024

2032

| 2025 –2032 | |

| USD 29.09 Billion | |

| USD 61.69 Billion | |

|

|

|

|

Aerospace Composites Market Size

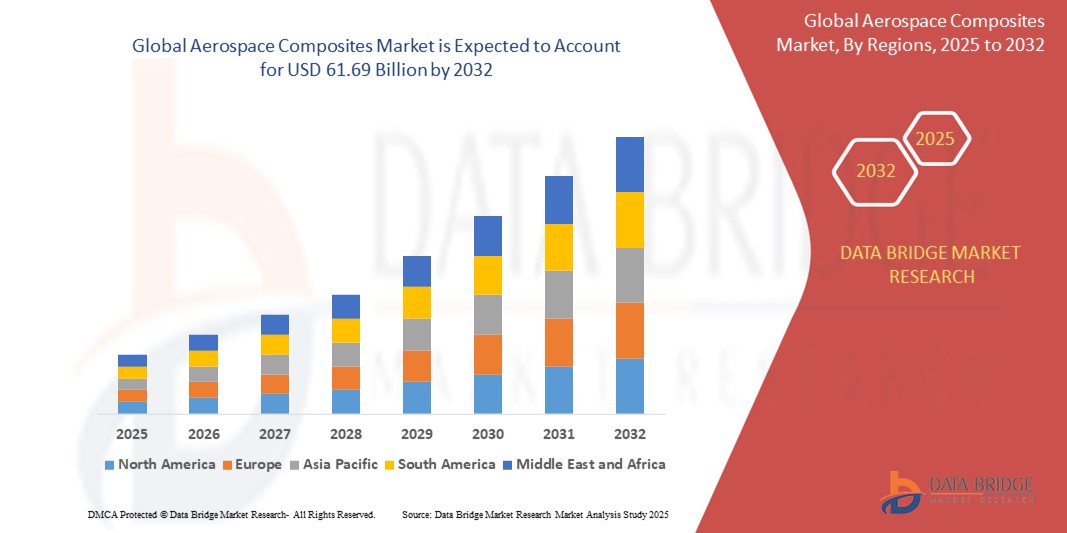

- The global aerospace composites market size was valued at USD 29.09 billion in 2024 and is expected to reach USD 61.69 billion by 2032, at a CAGR of 9.85% during the forecast period

- This growth is driven by factors such as increasing demand for lightweight and fuel-efficient materials in aerospace manufacturing, rising adoption of advanced composite materials to improve aircraft performance, and ongoing industrial expansion in emerging economies supporting aviation growth

Aerospace Composites Market Analysis

- Aerospace composites are critical materials used across various aerospace applications including commercial aircraft, military jets, helicopters, and space vehicles, providing lightweight, high-strength, and corrosion-resistant properties

- The demand for aerospace composites is significantly driven by the need for fuel efficiency, stringent emission regulations, and the push toward lightweight materials to enhance aircraft performance and reduce operating costs

- North America dominates the global aerospace composites market, accounting for approximately 41.91% of the market share in 2024. This dominance is attributed to the presence of leading aerospace manufacturers, advanced research and development capabilities, and government initiatives supporting aerospace innovation

- Asia-Pacific is the fastest growing region in the global aerospace composites market, driven by rapid industrialization, expanding aerospace manufacturing capabilities, and increasing investments in commercial and defense aviation sectors

- The carbon fiber composites segment is projected to dominate the global aerospace composites market, holding approximately 45% of the total market share. This dominance is due to carbon fiber’s superior strength-to-weight ratio, excellent fatigue resistance, and increasing adoption in commercial and military aircraft manufacturing

Report Scope and Aerospace Composites Market Segmentation

|

Attributes |

Aerospace Composites Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerospace Composites Market Trends

“Advancements in Lightweight Materials & Integration of Smart Manufacturing Technologies”

- A key trend in the global aerospace composites market is the growing use of advanced lightweight composite materials such as carbon fiber reinforced polymers (CFRP) and thermoplastic composites to improve fuel efficiency and reduce aircraft weight

- These materials, combined with smart manufacturing technologies like automation, additive manufacturing, and real-time quality monitoring, are enhancing production precision, reducing waste, and accelerating aircraft assembly processes, thereby improving overall aerospace performance and sustainability

- For instance, In March 2024, Hexcel Corporation expanded its range of high-performance aerospace carbon fiber composites designed for next-generation commercial aircraft, supporting both lighter and stronger airframe structures

- These innovations are driving higher adoption of aerospace composites, enabling manufacturers to meet stringent emission standards, reduce operational costs, and improve aircraft lifecycle performance, ultimately transforming the aerospace industry toward more sustainable and efficient operations

Aerospace Composites Market Dynamics

Driver

“Rising Demand from Expanding Aerospace and Defense Sectors”

- The rapid growth of the aerospace and defense industries worldwide, driven by increasing air travel, defense modernization, and demand for fuel-efficient aircraft, is significantly boosting the adoption of advanced aerospace composites

- As emerging economies invest heavily in expanding their aerospace infrastructure and fleets, the need for lightweight, durable, and high-performance composite materials continues to rise to enhance aircraft efficiency and safety

- Aerospace manufacturers are also focusing on developing tailored composite solutions that meet stringent industry standards for weight reduction, strength, and thermal resistance, helping to improve overall aircraft performance and reduce emissions

For instance,

- In January 2024, Toray Industries announced a contract to supply advanced carbon fiber prepregs for the next generation of commercial aircraft to a leading aerospace manufacturer, reinforcing lightweight construction and fuel efficiency

- Driven by increasing aircraft production and stringent environmental regulations, the global aerospace composites market is experiencing steady growth, especially in regions with expanding commercial aviation and defense capabilities

Opportunity

“Expansion of Recyclable and Sustainable Composite Materials”

- Growing environmental concerns and stricter regulations are driving aerospace manufacturers to explore recyclable and bio-based composite materials to reduce the carbon footprint of aircraft manufacturing and disposal

- Advances in sustainable composites, such as thermoplastic resins and natural fiber reinforcements, offer potential for lighter, eco-friendly alternatives without compromising performance and durability

- The ability to recycle aerospace composites at end-of-life stages and reduce reliance on virgin materials is expected to open new market segments and strengthen sustainability commitments in the aerospace industry

For instance,

- In April 2024, Solvay launched a new line of recyclable aerospace-grade composites designed to reduce environmental impact while maintaining structural integrity, gaining rapid interest among major aircraft manufacturers

- The integration toward sustainable materials adoption represents a promising opportunity for companies to innovate and differentiate their product portfolios while aligning with global sustainability goals

Restraint/Challenge

“High Initial Investment and Manufacturing Complexity”

- The aerospace composites market faces significant challenges due to the high initial investment required for advanced composite materials and the specialized manufacturing processes involved

- The production of aerospace-grade composites demands costly raw materials, sophisticated equipment, and skilled labor, leading to elevated capital expenditure that can be prohibitive, especially for small and medium-sized manufacturers

- In addition, operating costs related to quality control, curing processes, and compliance with stringent aerospace safety standards add financial and technical burdens on manufacturers

For instance,

- In March 2024, a market analysis report by McKinsey & Company emphasized that emerging aerospace manufacturers in developing regions struggle with the high costs of integrating advanced composite technologies, limiting their competitiveness

- These cost-related challenges may slow the adoption of new composite materials and advanced manufacturing techniques, potentially hindering market expansion and innovation in certain regions

Aerospace Composites Market Scope

The market is segmented on the basis of resin, fiber type, matrix type, application, and aircraft type.

|

Segmentation |

Sub-Segmentation |

|

By Resin |

|

|

By Fiber Type |

|

|

By Matrix Type |

|

|

By Application |

|

|

By Manufacturing Process |

|

|

By Aircraft Type |

|

In 2025, the carbon fiber composites segment is projected to dominate the industrial boilers market with the largest share in the fiber type segment.

The carbon fiber composites segment is expected to hold approximately 45% of the total market share. This dominance is attributed to carbon fiber’s superior strength-to-weight ratio, excellent fatigue resistance, and ability to significantly reduce aircraft weight, leading to improved fuel efficiency and lower emissions. Carbon fiber composites offer high performance and durability, making them the preferred choice for commercial and military aerospace applications. In addition, increasing investments in advanced composite manufacturing technologies and expanding use in new aircraft programs further drive the adoption of carbon fiber composites globally.

The thermoplastic segment is expected to account for the largest share during the forecast period in resin segments

The thermoplastic segment is projected to dominate the aerospace composites market with a market share of 57.3% in 2025. This dominance is due to thermoplastic composites’ excellent impact resistance, recyclability, and faster processing compared to thermoset composites. Thermoplastic materials offer advantages such as enhanced durability, repairability, and design flexibility, making them increasingly preferred in aerospace manufacturing. The growing demand for lightweight, sustainable materials and advances in thermoplastic composite technologies are driving this segment’s strong market position.

Aerospace Composites Market Regional Analysis

“North America Holds the Largest Share in the Aerospace Composites Market”

- North America dominates the global aerospace composites market, accounting for approximately 41.91% of the market share in 2024.

- The U.S. holds a significant share of approximately 35.5% in the North American aerospace composites market. This is driven by its strong aerospace manufacturing presence, rising demand for lightweight and fuel-efficient aircraft, and ongoing technological advancements in composite materials

- Well-established aerospace infrastructure, substantial R&D investments by major aerospace companies, and government support for innovation further strengthen the market in the region

- Additionally, increasing focus on reducing carbon emissions and improving aircraft performance is driving the adoption of advanced composites across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Aerospace Composites Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the aerospace composites market, driven by rapid industrialization, expanding aerospace manufacturing capabilities, and increasing demand for lightweight, fuel-efficient aircraft

- Countries such as China, India, and Japan are emerging as key markets due to their growing aerospace sectors, rising investments in defense and commercial aviation, and focus on advanced material technologies

- China, with its expanding aircraft production and strong government support for the aerospace industry, is driving significant demand for aerospace composites, emphasizing innovation and sustainability

- India, with increasing aircraft manufacturing and maintenance activities, supported by government initiatives and private sector investments, is rapidly adopting aerospace composites to meet performance and efficiency goals

Aerospace Composites Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- dsm-firmenich (Netherlands)

- TEIJIN LIMITED (Japan)

- TORAY INDUSTRIES, INC. (Japan)

- Honeywell International Inc. (U.S.)

- DuPont (U.S.)

- Solvay (Belgium)

- Gurit Services AG (Switzerland)

- Morgan Advanced Materials plc (U.K.)

- Southern States, llc (U.S.)

- Barrday Inc. (Canada)

- Plastic Reinforcement Fabrics Ltd (U.K.)

- Gaffco Ballistics (U.S.)

- M Cubed Technologies (U.S.)

- Roihu Inc. (Finland)

- MKU Limited (India)

- ArmorSource, LLC. (U.S.)

- Elmon (Turkey)

- JPS Composite Materials (U.S.)

- ITT INC. (U.S.)

Latest Developments in Global Aerospace Composites Market

- In March 2024, Hexcel Corporation and Arkema formed a strategic partnership to advance high-performance thermoplastic composite structures. The collaboration led to the development of an innovative demonstrator, designed and manufactured using HexPly thermoplastic tapes. This breakthrough was achieved within the HAICOPAS collaborative project, which focuses on optimizing composite tape production, automated deposition processes, and in-situ welding technologies. The project aims to enhance cost efficiency and production rates, making thermoplastic composites a viable alternative to traditional metallic materials in aerospace applications

- In January 2024, Materion Beryllium & Composites, a subsidiary of Materion Corporation, entered into a strategic partnership with Liquidmetal Technologies Inc. As a member of the Certified Liquidmetal Partners Program, Materion will leverage its alloy production technologies alongside Liquidmetal and other partners to deliver high-quality products and support services to customers. This collaboration aims to enhance material innovation, particularly in medical, military, consumer, and industrial applications, by utilizing Liquidmetal’s proprietary amorphous metal alloys for superior strength, durability, and corrosion resistance

- In August 2023, Spirit AeroSystems, Inc. and Oak Ridge National Laboratory entered into a strategic agreement to advance high-temperature in-situ process monitoring techniques and predictive modeling capabilities for microstructure-based performance and certification of carbon and ceramic composites as well as additively manufactured alloys. This collaboration aims to enhance manufacturing efficiency and material performance in commercial, defense, and space aerostructure markets. Additionally, research teams will explore thermal protection systems for aerospace platforms, focusing on materials that withstand extreme heat and harsh environments

- In July 2023, NASA awarded an $800,000 Phase II Small Business Technology Transfer (STTR) contract to AnalySwift LLC, a U.S.-based firm, to develop the Design Tool for Advanced Tailorable Composites (DATC). This tool aims to enhance simulation capabilities for next-generation aerospace structures, including hybrid wing bodies, space launch vehicles, and space habitats. DATC integrates advanced composite modeling techniques to optimize lightweight, high-performance materials for aerospace applications. The project is expected to conclude with the tool’s official launch by 202

- In December 2022, Velocity Composites, a leading supplier of aerospace composite material kits, entered the U.S. aerospace market through a five-year partnership agreement with GKN Aerospace. This collaboration is expected to generate over $100 million in revenue, supporting high-performance composite structures across military, civil, and business jet programs. To facilitate this expansion, Velocity established its first advanced manufacturing facility in Alabama, integrating proprietary digital technology and cleanroom-standard production to enhance efficiency and sustainability in aerospace manufacturing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerospace Composites Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerospace Composites Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerospace Composites Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.