Global Aerospace Foam Market

Market Size in USD Billion

CAGR :

%

USD

8.17 Billion

USD

13.21 Billion

2024

2032

USD

8.17 Billion

USD

13.21 Billion

2024

2032

| 2025 –2032 | |

| USD 8.17 Billion | |

| USD 13.21 Billion | |

|

|

|

|

Aerospace Foam Market Size

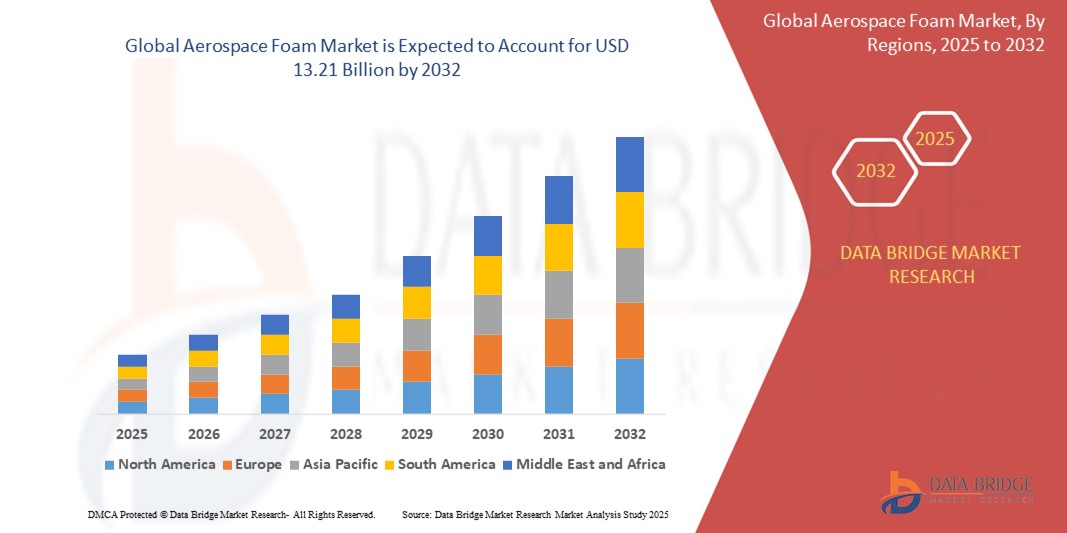

- The global aerospace foam market size was valued at USD 8.17 billion in 2024 and is expected to reach USD 13.21 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by increasing aircraft production and fleet modernization across commercial, general, and military aviation sectors, driving demand for lightweight, high-performance materials to enhance fuel efficiency and meet safety standards

- Furthermore, rising focus on passenger comfort, thermal insulation, and fire resistance is establishing aerospace foam as a critical material for cabin interiors and structural applications. These converging factors are accelerating the adoption of advanced foam solutions, thereby significantly boosting the industry's growth

Aerospace Foam Market Analysis

- Aerospace foams, used for insulation, cushioning, and structural applications in aircraft, are increasingly vital components in modern aviation due to their lightweight nature, high thermal resistance, and ability to meet stringent fire, smoke, and toxicity regulations

- The escalating demand for aerospace foams is primarily fueled by the growth in global air travel, rising aircraft production, and increasing emphasis on fuel efficiency and passenger comfort across commercial, military, and general aviation sectors

- North America dominated the aerospace foam market with a share of 38.35% in 2024, due to the strong presence of leading aerospace manufacturers and a robust aviation infrastructure

- Asia-Pacific is expected to be the fastest growing region in the aerospace foam market during the forecast period due to expanding air travel, fleet modernization programs, and the rising demand for lightweight materials

- PU foam segment dominated the market with a market share of 34.85% in 2024, due to its excellent cushioning properties, light weight, and cost-effectiveness. Widely used in aircraft seating and interior padding, PU foam helps reduce aircraft weight while enhancing passenger comfort and safety. Its compliance with fire, smoke, and toxicity (FST) standards makes it a preferred material for cabin applications

Report Scope and Aerospace Foam Market Segmentation

|

Attributes |

Aerospace Foam Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerospace Foam Market Trends

“Rising Development of Advanced Foam Technologies”

- A significant and accelerating trend in the global aerospace foam market is the increasing development of advanced foam technologies engineered for enhanced thermal resistance, reduced weight, and compliance with stringent flame, smoke, and toxicity (FST) standards in aviation

- For instance, manufacturers are innovating new formulations of polyurethane and polyimide foams that provide superior insulation and mechanical strength while contributing to overall aircraft weight reduction. Similarly, ceramic foams are gaining traction for their ability to withstand extreme temperatures in specialized aerospace applications

- These advanced foams are also being designed to meet new environmental and safety regulations, with materials offering greater recyclability and lower emissions during production. The integration of aerospace foams into next-generation aircraft structures further enables manufacturers to meet fuel efficiency and emission targets

- This trend towards highly functional, compliant, and environmentally sustainable foam materials is driving research and product innovation across the aerospace value chain. Companies are investing in R&D to develop specialty foams that offer multifunctionality, such as vibration damping, sound insulation, and high strength-to-weight ratios

- The demand for technologically advanced aerospace foams is growing rapidly as aircraft OEMs and airlines seek to improve operational efficiency, passenger comfort, and compliance with evolving global aviation standards

Aerospace Foam Market Dynamics

Driver

“Rising Demand for Lightweight Materials”

- The increasing emphasis on fuel efficiency and performance in both commercial and military aviation is a significant driver for the rising demand for lightweight materials such as aerospace foams

- For instance, aerospace foams help reduce overall aircraft weight, which directly impacts fuel consumption and emissions. Their application in cabin insulation, seating, and interior panels supports efforts to optimize payload capacity and operational efficiency

- As aircraft manufacturers prioritize the development of next-generation, energy-efficient planes, aerospace foams with high strength-to-weight ratios are becoming essential for maintaining structural integrity without compromising on performance or safety

- Moreover, the expanding global aircraft fleet and increasing air passenger traffic are intensifying the demand for efficient materials that can support higher production volumes without compromising on quality or performance. This growth is further bolstered by rising investments in aircraft modernization programs and next-generation aircraft manufacturing initiatives

- Furthermore, regulatory mandates regarding carbon emissions are encouraging the aviation industry to adopt lightweight and sustainable material alternatives, solidifying aerospace foams as a core material solution in aircraft design

Restraint/Challenge

“High Cost of Development”

- The high cost associated with the development and manufacturing of aerospace-grade foams poses a significant challenge to broader market expansion. These costs stem from the stringent testing, certification, and quality control processes required to meet aviation industry standards

- For instance, advanced foams that offer flame resistance, thermal insulation, and durability must undergo extensive validation, increasing both development time and expense. This limits market access for smaller players and can delay adoption in cost-sensitive segments

- Moreover, the raw materials and proprietary formulations required for high-performance aerospace foams often contribute to elevated production costs. These factors can make it difficult for manufacturers to balance performance demands with affordability

- In addition, fluctuations in raw material prices and supply chain disruptions can further escalate production costs, leading to reduced profit margins and price volatility in the market. These challenges are especially prominent in the case of high-performance specialty foams that rely on scarce or imported inputs

- Overcoming these challenges will require continued material innovation, process optimization, and collaboration across the aerospace supply chain to reduce cost barriers while maintaining high safety and performance benchmarks

Aerospace Foam Market Scope

The market is segmented on the basis of type, application, and end use.

• By Type

On the basis of type, the aerospace foam market is segmented into PU foam, PE foam, ceramic foam, melamine foam, metal foam, PI foam, PET foam, PVC foam, specialty high performance foam, and others. The PU foam segment held the largest market revenue share 34.85% in 2024, owing to its excellent cushioning properties, light weight, and cost-effectiveness. Widely used in aircraft seating and interior padding, PU foam helps reduce aircraft weight while enhancing passenger comfort and safety. Its compliance with fire, smoke, and toxicity (FST) standards makes it a preferred material for cabin applications.

The specialty high performance foam segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for advanced materials offering high thermal insulation, flame resistance, and mechanical strength. These foams are engineered for demanding aerospace environments, supporting innovation in lightweight structures and contributing to fuel efficiency and emission reduction goals in both commercial and defense aviation sectors.

• By Application

On the basis of application, the aerospace foam market is segmented into aircraft seats, aircraft floor carpets, flight deck pads, and overhead stow bins. The aircraft seats segment dominated the market revenue share in 2024 due to the large volume of foam used in passenger seating to ensure comfort, shock absorption, and thermal insulation. As airlines increasingly prioritize passenger experience, investments in advanced foam materials with ergonomic and safety attributes continue to grow.

The overhead stow bins segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the trend toward lighter cabin interiors that contribute to overall weight reduction. Foam materials used in stow bins must meet stringent FST and structural standards while offering design flexibility. The growing number of aircraft retrofits and rising passenger travel volumes are also fueling demand for upgraded and compliant interior components.

• By End Use

On the basis of end use, the aerospace foam market is segmented into general aviation, commercial aviation, and military aircraft. The commercial aviation segment accounted for the largest market revenue share in 2024, driven by increased global air travel, expansion of airline fleets, and rising focus on passenger safety and comfort. Commercial carriers prioritize lightweight, durable, and regulatory-compliant materials, propelling the demand for aerospace foam across seating, insulation, and paneling.

The military aircraft segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by rising defense budgets, modernization of air fleets, and the need for high-performance materials in tactical and transport aircraft. Foams used in military aviation must meet stricter durability, impact resistance, and thermal performance standards to operate under extreme conditions. This drives continuous material innovation and adoption across defense aerospace applications.

Aerospace Foam Market Regional Analysis

- North America dominated the aerospace foam market with the largest revenue share of 38.35% in 2024, driven by the strong presence of leading aerospace manufacturers and a robust aviation infrastructure

- The region's continued investment in military and commercial aircraft production supports sustained demand for advanced foam materials used in seating, insulation, and structural components

- This growth is further reinforced by high R&D activity, stringent safety regulations, and increased retrofitting and MRO operations focused on improving aircraft efficiency and cabin comfort

U.S. Aerospace Foam Market Insight

The U.S. aerospace foam market captured the largest revenue share in 2024 within North America, propelled by the country’s dominance in defense and commercial aircraft manufacturing. Major OEMs such as Boeing and Lockheed Martin contribute to significant foam consumption across various components. The nation’s focus on reducing aircraft weight for enhanced fuel efficiency and compliance with FAA safety standards fosters continuous innovation in foam materials. The U.S. also experiences rising demand for fire-retardant and eco-friendly foams in both new builds and fleet upgrades.

Europe Aerospace Foam Market Insight

The Europe aerospace foam market is projected to expand at a considerable CAGR during the forecast period, driven by strong emphasis on sustainable aviation and increased aircraft deliveries. European aerospace leaders are adopting lightweight and recyclable materials to align with EU emissions targets and fuel-saving initiatives. The region also benefits from the presence of Airbus and a wide supplier network, with growing demand for high-performance foams in cabin interiors and noise-reducing applications across civil and military aviation.

U.K. Aerospace Foam Market Insight

The U.K. aerospace foam market is expected to grow steadily during the forecast period, supported by government-backed aerospace R&D initiatives and a well-established aircraft interiors sector. With an increasing number of MRO activities and exports of lightweight aerospace components, the demand for specialized foams for insulation and seating continues to rise. The country’s focus on developing sustainable materials and circular economy practices further drives interest in recyclable and flame-resistant foam technologies.

Germany Aerospace Foam Market Insight

The Germany aerospace foam market is anticipated to witness significant growth, underpinned by the country's advanced manufacturing capabilities and engineering excellence. As a key supplier to Airbus and other European aerospace firms, Germany plays a vital role in the integration of lightweight, durable, and thermally efficient foams. The emphasis on innovation and adherence to strict fire and safety standards promote adoption in both civilian and defense aircraft segments.

Asia-Pacific Aerospace Foam Market Insight

The Asia-Pacific aerospace foam market is projected to grow at the fastest CAGR from 2025 to 2032, driven by expanding air travel, fleet modernization programs, and the rising demand for lightweight materials. Rapid industrialization in countries such as China, India, and Japan is supporting the development of indigenous aircraft and related supply chains. Government efforts to boost aviation infrastructure and domestic manufacturing further accelerate the adoption of aerospace foams for interior and structural applications.

Japan Aerospace Foam Market Insight

The Japan aerospace foam market is experiencing steady growth, supported by a mature aerospace ecosystem and ongoing development of passenger and defense aircraft. The country’s focus on energy-efficient and technologically advanced materials aligns with the use of specialty aerospace foams in thermal insulation, noise reduction, and seating. Japan’s commitment to quality, safety, and innovation is encouraging the adoption of high-performance foams in both OEM and aftermarket segments.

China Aerospace Foam Market Insight

The China aerospace foam market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to strong government investment in aviation and a rapidly growing domestic airline sector. China’s focus on developing its own commercial aircraft, such as the COMAC C919, is driving high demand for locally sourced foam materials. In addition, the country’s robust defense aviation segment and its role as a global supplier of aerospace components are contributing to increased consumption of advanced foams across various applications.

Aerospace Foam Market Share

The aerospace foam industry is primarily led by well-established companies, including:

- BASF (Germany)

- ARMACELL (Luxembourg)

- Boyd (U.S.)

- Evonik Industries AG (Germany)

- ERG Aerospace Corp. (U.S.)

- Zotefoams plc (U.K.)

- Solvay (Belgium)

- Fritz Nauer AG (Switzerland)

- UFP Technologies, Inc. (U.S.)

- NCFI Polyurethanes (U.S.)

- DuPont (U.S.)

- Recticel (Belgium)

- Rogers Corporation (U.S.)

- Huntsman International LLC (U.S.)

- Aerofoam Industries, LLC (U.S.)

- Technifab, Inc. (U.S.)

- Forest City Technologies, Inc. (U.S.)

- Greiner Foam International GmbH (Austria)

- SINFO, spol. s r.o.(Czech Republic)

- Airex AG (Switzerland)

Latest Developments in Global Aerospace Foam Market

- In September 2024, L&L Products launched its proprietary InsituCore foaming materials designed for lightweight composite manufacturing, which is expected to significantly impact the aerospace foam market by streamlining production processes and enabling the creation of net-shape parts with customized density and strength, thereby enhancing efficiency and design flexibility for aerospace manufacturers

- In March 2024, ERG Materials and Aerospace showcased its Duocel® foam—an ultra-light, rigid, and highly customizable open-cell foam—highlighting its potential in the aerospace sector for applications requiring tailored structural and thermal performance. This demonstration is anticipated to raise industry interest in high-performance, adaptable foam materials

- In May 2022, 3A Composites announced the acquisition of SOLVAY's TegraCore PPSU resin-based foam business, utilized across aerospace, marine, and rail sectors. This strategic move strengthens 3A Composites' portfolio, enhancing its offerings in high-performance materials and expanding its presence in key industries, ensuring continued innovation and support for diverse applications

- In March 2022, Evonik Industries AG unveiled plans for a significant investment in a state-of-the-art facility for manufacturing ROHACELL foams, integral core materials for sandwich composites. Positioned in Darmstadt, Germany, the new facility marks a substantial commitment to advancing aerospace, automotive, medical, and other sectors, catering to evolving industry demands and fostering technological progress

- In February 2020, Evonik’s introduction of ROHACELL foam cores for aerospace composites and automated production marked a key advancement, promoting greater use of lightweight core materials that support faster, more efficient manufacturing while meeting the stringent performance demands of aerospace applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerospace Foam Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerospace Foam Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerospace Foam Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.