Global Aerospace Lubricant Market

Market Size in USD Billion

CAGR :

%

USD

2.73 Billion

USD

4.38 Billion

2024

2032

USD

2.73 Billion

USD

4.38 Billion

2024

2032

| 2025 –2032 | |

| USD 2.73 Billion | |

| USD 4.38 Billion | |

|

|

|

|

Aerospace Lubricant Market Size

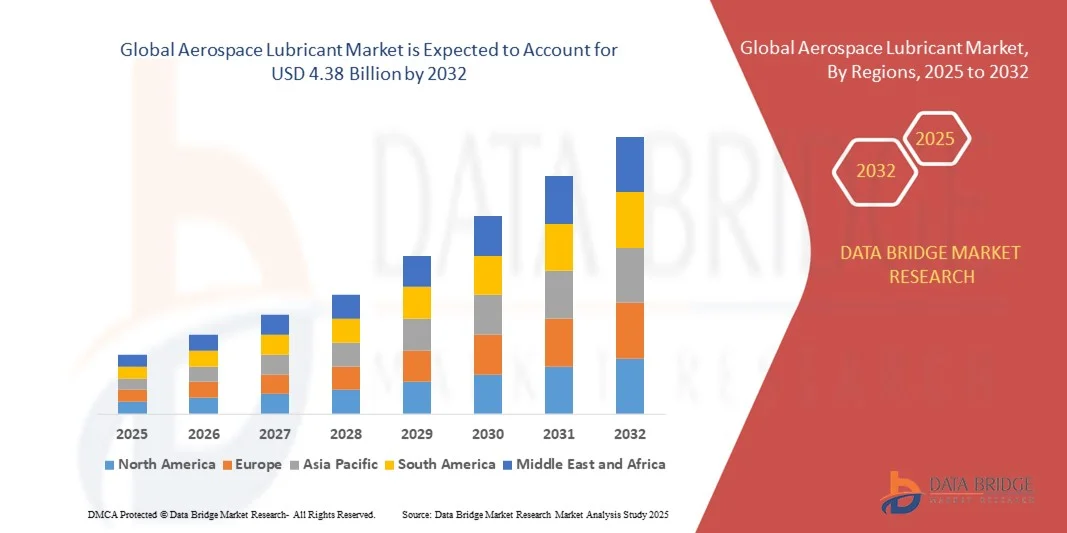

- The global aerospace lubricant market size was valued at USD 2.73 billion in 2024 and is expected to reach USD 4.38 billion by 2032, at a CAGR of 6.1% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance and sustainable lubricants across commercial, military, and general aviation sectors, driven by expanding aircraft fleets, rising MRO (maintenance, repair, and overhaul) activities, and the need for enhanced engine and hydraulic system efficiency

- Furthermore, growing emphasis on reducing environmental impact, adoption of synthetic and renewable-base lubricants, and stringent aviation regulations are encouraging the development and deployment of advanced aerospace lubricants. These converging factors are accelerating market expansion and positioning high-performance and sustainable lubricants as essential components in modern aircraft operations

Aerospace Lubricant Market Analysis

- Aerospace lubricants, including oils, greases, hydraulic fluids, and special additives, are increasingly critical for ensuring engine reliability, hydraulic system performance, landing gear operation, and airframe longevity in both commercial and defense aviation sectors due to extreme operating conditions and high safety standards

- The escalating demand for aerospace lubricants is primarily fueled by fleet expansion, modernization of military and commercial aircraft, stringent regulatory standards, and rising adoption of synthetic and bio-based lubricants for improved performance, reduced maintenance, and environmental sustainability

- Asia-Pacific dominated the aerospace lubricant market with a share of 62.9% in 2024, due to rapid expansion in commercial and military aviation, increasing aircraft fleet additions, and strong presence of aerospace manufacturing hubs

- North America is expected to be the fastest growing region in the aerospace lubricant market during the forecast period due to strong demand for aerospace lubricants in commercial airlines, defense fleets, and business aviation

- Gas turbine oil segment dominated the market with a market share of 42.4% in 2024, due to its critical role in ensuring optimal performance and thermal stability of aircraft engines. Gas turbine oils are essential for high-speed turbines and jet engines, providing effective lubrication under extreme temperatures and high rotational speeds. The segment’s dominance is also fueled by increasing commercial and military aviation activities, which demand high-performance lubricants to maintain engine reliability and safety standards

Report Scope and Aerospace Lubricant Market Segmentation

|

Attributes |

Aerospace Lubricant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Aerospace Lubricant Market Trends

Adoption of Sustainable and Synthetic Aerospace Lubricants

- The aerospace lubricant market is experiencing steady growth with increasing emphasis on sustainable and synthetic lubricant solutions that enhance aircraft performance while meeting stringent environmental regulations. The demand for advanced synthetic lubricants—such as polyalphaolefin (PAO) and ester-based oils—is rising due to their superior thermal stability, oxidation resistance, and extended service life compared to traditional mineral-based products

- For instance, ExxonMobil Corporation has developed next-generation synthetic turbine and hydraulic fluids designed to reduce carbon footprint while maintaining optimal performance under extreme temperature conditions. This innovation reflects the aerospace industry’s ongoing transition toward high-performance, eco-compliant lubrication solutions supporting both operational efficiency and sustainability objectives

- Sustainable aerospace lubricants are gaining momentum as aircraft manufacturers and maintenance providers pursue carbon-reduction targets and life-cycle optimization. The use of bio-based additives and low-toxicity synthetic formulations ensures lower environmental impact without compromising safety or material compatibility

- In addition, the increasing integration of lightweight materials and advanced composites in aircraft design has driven the need for specialized lubricants that provide high load-bearing capacity and low friction. These products are engineered to minimize volatility and improve efficiency under high stress and fluctuating pressure conditions

- The industry’s focus on circular economy principles is also encouraging development of recyclable packaging, closed-loop oil recovery systems, and eco-friendly maintenance solutions. Collaboration between lubricant suppliers and aerospace OEMs is fostering innovation in long-life formulations that support extended maintenance intervals and reduced waste generation

- As aerospace sustainability initiatives deepen and flight operations grow more complex, the adoption of synthetic and environmentally friendly lubricants is expected to accelerate. These developments are setting new performance and regulatory benchmarks, positioning advanced lubricants as critical enablers of next-generation aviation performance and reliability

Aerospace Lubricant Market Dynamics

Driver

Growing Global Aircraft Fleets and MRO Activities

- The steady expansion of global aircraft fleets and the increasing frequency of maintenance, repair, and overhaul (MRO) activities are major drivers of the aerospace lubricant market. Rising air travel demand and fleet modernization efforts by commercial and defense sectors are generating sustained lubricant consumption across engines, hydraulic systems, and gear assemblies

- For instance, Shell Aviation has expanded its AeroShell range to cater to the growing base of commercial jets and regional aircraft, providing high-performance turbine oils and greases tailored to varying climatic and operational conditions. The company’s expansion reflects increasing global MRO requirements amid surging post-pandemic flight operations

- Aircraft operators prioritize lubricants that ensure long service intervals, minimize wear, and enhance fuel efficiency to reduce operational costs. As airlines and defense agencies extend aircraft lifecycles, the use of advanced lubricants becomes essential for maintaining optimal performance and regulatory compliance under diverse flight environments

- In addition, the growing number of aging aircraft in service is accelerating demand for high-quality lubricants required during frequent maintenance cycles. The integration of digital monitoring and predictive maintenance systems is further enhancing lubricant management efficiency across the aerospace ecosystem

- With global passenger and cargo fleets expected to continue expanding through the next decade, the correlation between aviation growth and lubricant demand remains strong. As a result, MRO service providers and lubricant manufacturers are collaborating closely to develop tailored formulations that extend component life and support operational reliability worldwide

Restraint/Challenge

High Cost of Advanced Lubricants

- The high cost of advanced aerospace lubricants poses a restraint to market growth, particularly among smaller fleet operators and regional maintenance providers. Synthetic lubricants, while providing superior performance, involve costly production processes and specialized raw materials that contribute to higher unit prices compared to conventional mineral-based oils

- For instance, NYCO SAS and Eastman Chemical Company have noted that the synthesis of high-grade ester- and PAO-based lubricants requires advanced refining and testing, resulting in premium pricing structures. This financial burden can limit adoption in budget-constrained aerospace operations where cost control is a priority

- In addition, R&D investments associated with developing lubricants that meet evolving thermal, oxidative, and environmental performance standards add to overall production expenses. Certification and qualification processes mandated by aviation authorities such as SAE and ASTM further extend timelines and increase compliance costs for suppliers

- The volatility of raw material prices and limited supplier competition in synthetic base-stock markets also contribute to pricing instability. These factors collectively hinder small and regional operators from fully transitioning to advanced lubricant solutions despite their long-term operational benefits

- Manufacturers are increasingly focusing on cost-optimized blends, bulk supply agreements, and performance-based service contracts to mitigate pricing barriers. As production scalability improves and sustainable supply chains mature, the long-term adoption of advanced aerospace lubricants is expected to expand steadily across both commercial and defense aviation sectors globally

Aerospace Lubricant Market Scope

The market is segmented on the basis of product, type, material type, components, application, and platform.

- By Product

On the basis of product, the aerospace lubricant market is segmented into grease, special additives & lubricants, gas turbine oil, piston engine oil, hydraulic fluid, and others. The gas turbine oil segment dominated the market with the largest revenue share of 42.4% in 2024, driven by its critical role in ensuring optimal performance and thermal stability of aircraft engines. Gas turbine oils are essential for high-speed turbines and jet engines, providing effective lubrication under extreme temperatures and high rotational speeds. The segment’s dominance is also fueled by increasing commercial and military aviation activities, which demand high-performance lubricants to maintain engine reliability and safety standards.

The hydraulic fluid segment is anticipated to witness the fastest growth rate from 2025 to 2032, owing to the rising adoption in landing gear, flight control, and auxiliary hydraulic systems. Advanced hydraulic fluids provide enhanced thermal stability, corrosion protection, and longer operational life, making them indispensable for modern aircraft. Growth is also supported by the ongoing development of more fuel-efficient and automated aircraft systems, which rely heavily on advanced hydraulic solutions.

- By Type

On the basis of type, the aerospace lubricant market is segmented into Group I, Group II, Group III, and Group IV. The Group III segment dominated the market in 2024 due to its high purity, excellent thermal stability, and ability to meet stringent aviation industry standards. These synthetic and highly refined oils enhance engine efficiency, reduce maintenance costs, and provide superior oxidation and deposit control, making them a preferred choice among commercial and military operators.

The Group IV segment is expected to witness the fastest growth during the forecast period, driven by the increasing need for fully synthetic lubricants capable of withstanding extreme temperatures and high-pressure operating conditions. Group IV oils offer superior wear protection, longer service life, and compatibility with advanced turbine engines, positioning them as an attractive option for next-generation aerospace applications.

- By Material Type

On the basis of material type, the market is segmented into mineral-based and synthetic lubricants. Synthetic lubricants dominated the market in 2024, owing to their superior thermal stability, longer service intervals, and enhanced performance under extreme operating conditions. They are widely preferred in high-performance engines and critical aircraft systems where reliability and durability are paramount.

Mineral-based lubricants are expected to witness the fastest growth from 2025 to 2032, supported by cost-effectiveness and ongoing improvements in additive technologies. These lubricants are increasingly used in less critical systems and older aircraft platforms, where performance demands are moderate but operational efficiency and maintenance cost savings remain important considerations.

- By Components

On the basis of components, the aerospace lubricant market is segmented into engine, landing gear, hydraulic system, airframes, and others. The engine component segment dominated the market in 2024, driven by the critical need for high-performance lubrication in turbine and piston engines. Engine lubricants help maintain operational efficiency, reduce wear and tear, and enhance the lifespan of aircraft engines operating under extreme temperatures and high loads.

The hydraulic system segment is projected to witness the fastest growth over the forecast period, fueled by the increasing complexity and automation of modern aircraft hydraulic systems. Advanced lubricants used in hydraulic components ensure smooth operation, corrosion resistance, and system reliability, supporting safer and more efficient flight operations.

- By Application

On the basis of application, the aerospace lubricant market is segmented into hydraulic systems, engine, landing gear, airframe, and others. The engine application segment dominated in 2024 due to the high demand for reliable lubrication in turbine and piston engines, which are critical for flight safety and performance. The segment benefits from stringent regulatory standards and the growing fleet of commercial and military aircraft.

Hydraulic system applications are expected to witness the fastest growth from 2025 to 2032, driven by the increasing use of advanced hydraulic controls in landing gear, flight control surfaces, and auxiliary systems. Growth is further supported by the demand for higher efficiency, reduced maintenance, and longer service life in both commercial and defense aviation.

- By Platform

On the basis of platform, the aerospace lubricant market is segmented into commercial aviation, military aviation, and business & general aviation. The commercial aviation segment dominated the market in 2024, driven by the expanding airline fleets worldwide and the increasing number of long-haul flights that demand high-performance lubrication for fuel efficiency and engine reliability.

Military aviation is expected to witness the fastest growth during the forecast period, fueled by modernization programs, new aircraft procurement, and the requirement for high-performance lubricants capable of operating in extreme environments. The growth is also supported by the adoption of advanced turbine engines and high-speed aircraft in defense fleets globally.

Aerospace Lubricant Market Regional Analysis

- Asia-Pacific dominated the aerospace lubricant market with the largest revenue share of 62.9% in 2024, driven by rapid expansion in commercial and military aviation, increasing aircraft fleet additions, and strong presence of aerospace manufacturing hubs

- The region’s cost-effective manufacturing ecosystem, rising investments in advanced aerospace technologies, and growing maintenance, repair, and overhaul (MRO) activities are accelerating market growth

- Availability of skilled workforce, supportive government aviation policies, and rapid industrialization across developing economies are contributing to higher consumption of aerospace lubricants across engine, hydraulic, and airframe systems

China Aerospace Lubricant Market Insight

China held the largest share in the Asia-Pacific aerospace lubricant market in 2024, owing to its status as a global leader in commercial aircraft production and active defense aviation programs. The country’s strong industrial base, government incentives for aerospace manufacturing, and increasing MRO activities are major growth drivers. Demand is further supported by ongoing investments in advanced lubricants for turbine engines, hydraulic systems, and airframe components.

India Aerospace Lubricant Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly expanding commercial aviation sector, modernization of military aircraft, and increasing MRO facilities. Initiatives such as "Make in India" and rising investments in defense and aerospace infrastructure are strengthening demand for high-performance lubricants. Growth is also driven by increasing domestic aircraft manufacturing and rising exports of aviation components.

Europe Aerospace Lubricant Market Insight

The Europe aerospace lubricant market is expanding steadily, supported by a strong aerospace manufacturing base, stringent quality standards, and growing focus on sustainable and high-performance lubricants. The region emphasizes environmental compliance, precision engineering, and advanced formulations, particularly in commercial and defense aviation. Increasing use of synthetic lubricants in engines and hydraulic systems is further enhancing market growth.

Germany Aerospace Lubricant Market Insight

Germany’s aerospace lubricant market is driven by its leadership in aircraft engine manufacturing, strong defense aviation programs, and well-established MRO services. The country’s R&D networks and partnerships between industry and academic institutions foster innovation in lubricant formulations for engines, landing gear, and hydraulic systems. Demand is particularly strong for high-performance and synthetic lubricants supporting commercial and military aviation fleets.

U.K. Aerospace Lubricant Market Insight

The U.K. market is supported by a mature aerospace and defense sector, increasing investments in aircraft MRO, and efforts to localize high-performance lubricant production. Focus on R&D, industry-academic collaboration, and adoption of advanced synthetic lubricants for engines, hydraulic systems, and airframes are driving growth in both commercial and defense aviation segments.

North America Aerospace Lubricant Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by strong demand for aerospace lubricants in commercial airlines, defense fleets, and business aviation. Advancements in turbine engines, hydraulic systems, and fuel-efficient aircraft technologies are boosting demand. Rising reshoring of aerospace manufacturing and collaboration between lubricant producers and aircraft OEMs are supporting regional growth.

U.S. Aerospace Lubricant Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its expansive commercial and military aviation industries, strong R&D infrastructure, and significant investment in synthetic and specialty lubricants. The country’s focus on performance, reliability, and regulatory compliance encourages adoption of high-performance lubricants across engines, landing gear, and hydraulic systems. Presence of major aerospace OEMs and a mature MRO network solidify the U.S.’s leading position in the region.

Aerospace Lubricant Market Share

The aerospace lubricant industry is primarily led by well-established companies, including:

- ROCOL (U.K.)

- Whitmore Manufacturing LLC (U.S.)

- BP p.l.c. (U.K.)

- Royal Dutch Shell (Netherlands)

- Quaker Chemical Corporation d/b/a Quaker Houghton (U.S.)

- Phillips 66 Company (U.S.)

- Petrobras (Brazil)

- Aerospace Lubricants, Inc. (U.S.)

- TotalEnergies SE (France)

- China Petroleum & Chemical Corporation (China)

- The Chemours Company (U.S.)

- Inox Lubricants (India)

- Eastman Chemical Company (U.S.)

- NYCO (France)

- LANXESS (Germany)

- FUCHS (Germany)

- Chevron Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

Latest Developments in Global Aerospace Lubricant Market

- In July 2023, Shell Aircraft introduced a lifecycle sustainability concept for aircraft lubricants under its AeroShell brand. This initiative provides a comprehensive range of aerospace oils and lubricants designed to improve operational efficiency and reduce environmental impact. The launch strengthens Shell’s position in the aerospace lubricant market by aligning with growing demand for sustainable and high-performance lubricants, helping airlines and MRO providers meet evolving regulatory and sustainability standards

- In February 2023, Neste launched a new line of lubricants called Neste ReNewTM across Finland, Sweden, the Baltic nations, and Poland. The product combines refined or renewable base oils with premium additives to create environmentally conscious lubricants. This launch positions Neste as a key player in the sustainable aerospace lubricant market, offering clients solutions that reduce dependence on crude-oil-based products while supporting the shift toward greener aviation operations

- In July 2022, ExxonMobil Lubricants Pvt. Ltd. promoted next-generation high-technology lubricants for passenger vehicles that comply with India’s BS-VI emission standards. While focused on ground vehicles, this development reflects the company’s broader commitment to high-performance, low-emission lubricants, indirectly enhancing brand credibility and technological expertise in aerospace lubricants, especially in regions demanding stringent environmental compliance

- In March 2022, TotalEnergies SE commenced production at its Normandy platform, boosting sustainable aviation fuel (biojet) output from two existing plants, the Audale plant and La Mayde biorefinery. This strategic move supports the aerospace lubricant and fuel market by providing compatible biojet options that meet regulatory mandates, such as the French legislation requiring a minimum of 1% sustainable aviation fuel, positioning TotalEnergies as a significant contributor to sustainable aviation operations

- In April 2021, the U.S. government announced a $25 billion investment in airport infrastructure as part of the American Infrastructure program launched by President Joe Biden. This massive investment is expected to expand airport capacity, modernize facilities, and support increased aviation activity. The development underpins North America’s dominance in the aerospace and aerospace lubricants market, as growing airport infrastructure and aviation operations directly drive demand for high-performance lubricants across engines, hydraulic systems, and airframe components

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Aerospace Lubricant Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Aerospace Lubricant Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Aerospace Lubricant Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.