Global Aerostructures Market

Market Size in USD Billion

CAGR :

%

USD

41.23 Billion

USD

63.76 Billion

2025

2033

USD

41.23 Billion

USD

63.76 Billion

2025

2033

| 2026 –2033 | |

| USD 41.23 Billion | |

| USD 63.76 Billion | |

|

|

|

|

Aerostructures Market Size

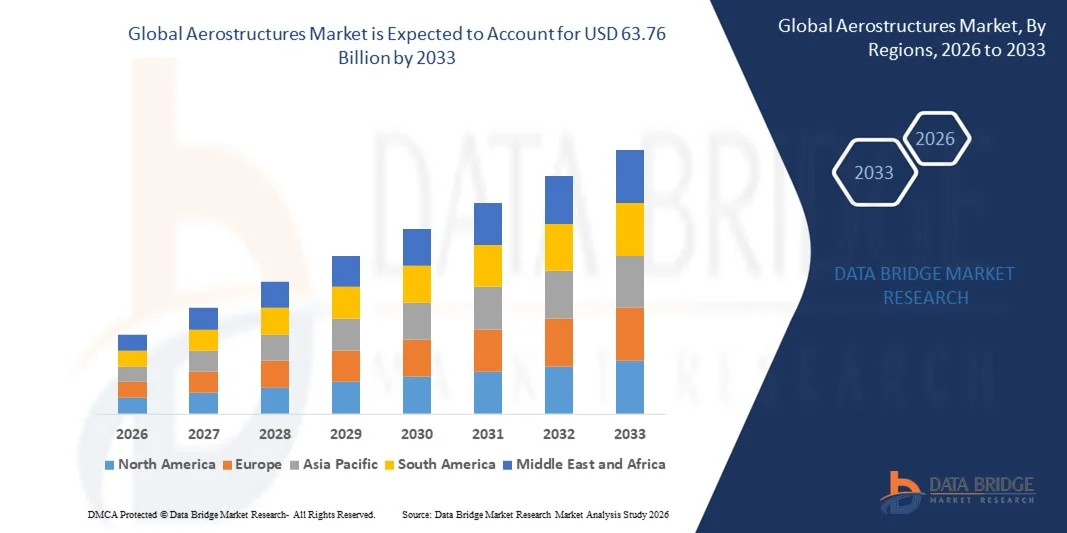

- The global aerostructures market size was valued at USD 41.23 billion in 2025 and is expected to reach USD 63.76 billion by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the increasing demand for fuel-efficient, lightweight, and technologically advanced aircraft, which is driving the adoption of innovative aerostructures and advanced materials such as composites and alloys

- Furthermore, rising investments by commercial and defense aircraft manufacturers in automated manufacturing, additive manufacturing, and digital design processes are enabling faster production cycles and higher precision. These converging factors are accelerating the adoption of advanced aerostructure solutions, thereby significantly boosting the industry's growth

Aerostructures Market Analysis

- Aerostructures, encompassing fuselage, wing, empennage, and other structural components, are critical for aircraft performance, safety, and efficiency. They are increasingly vital in both commercial and military aviation due to their role in reducing weight, improving fuel efficiency, and supporting next-generation aircraft designs

- The escalating demand for aerostructures is primarily fueled by growing commercial aircraft deliveries, modernization of military fleets, adoption of composite materials, and technological advancements in design and manufacturing processes. Increasing partnerships between OEMs and Tier‑1 suppliers further support market expansion and innovation in aerostructure solutions

- North America dominated the aerostructures market with a share of 34.5% in 2025, due to the presence of major aircraft manufacturers, rising defense spending, and growing commercial aviation demand

- Asia-Pacific is expected to be the fastest growing region in the aerostructures market during the forecast period due to rapid expansion of commercial aviation, rising defense budgets, and increasing aircraft deliveries in countries such as China, India, and Japan

- Fixed wing aircraft segment dominated the market with a market share of 70.5% in 2025, due to the global expansion of commercial aviation and increasing production of passenger and cargo aircraft. Fixed-wing platforms require advanced aerostructures for fuel efficiency, safety, and performance optimization. The segment’s dominance is also supported by innovations in lightweight materials, wing design, and fuselage architecture

Report Scope and Aerostructures Market Segmentation

|

Attributes |

Aerostructures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Aerostructures Market Trends

Rising Adoption of Lightweight Composite Materials in Aircraft Structures

- A major trend in the aerostructures market is the increasing adoption of lightweight composite materials such as carbon fiber-reinforced polymers in aircraft structures, driven by the growing demand for fuel-efficient and high-performance aircraft. These materials are reducing aircraft weight, enhancing structural durability, and enabling longer flight ranges while minimizing operational costs

- For instance, Boeing incorporates advanced composites in the 787 Dreamliner’s fuselage and wings, resulting in approximately 20% weight reduction compared to conventional aluminum structures. Such usage highlights the strategic importance of composites in modern aircraft design to achieve efficiency and environmental compliance

- Airbus is also expanding its use of composite materials in aircraft such as the A350 XWB, where carbon fiber components form a significant portion of the airframe, supporting lower fuel consumption and reduced carbon emissions. This reinforces the role of composites as enablers of next-generation, eco-friendly aviation solutions

- The trend is further strengthened by research initiatives and collaborations aimed at developing ultra-light, high-strength materials capable of withstanding extreme flight conditions. These efforts are positioning advanced composites as critical enablers of innovation in aerospace manufacturing

- Increasing demand from military and regional aviation segments is driving further adoption of lightweight materials, as these sectors prioritize performance, agility, and operational efficiency. This expansion is shaping design standards for new aircraft programs globally

- The market is witnessing strong interest in hybrid material solutions that combine composites with traditional metals to optimize structural integrity and cost-effectiveness. This rising adoption is reinforcing the strategic transition toward lightweight, high-performance aerostructures across the aerospace industry

Aerostructures Market Dynamics

Driver

Increasing Demand for Fuel-Efficient and Next-Generation Aircraft

- The demand for fuel-efficient aircraft is fueling growth in the aerostructures market, as manufacturers seek advanced materials and designs that reduce weight while improving performance. This trend is driven by rising fuel costs, stringent environmental regulations, and airline initiatives to lower carbon footprints

- For instance, Lockheed Martin integrates advanced composite materials in its F-35 fighter jets to enhance performance, reduce weight, and extend mission range. Such applications demonstrate how fuel efficiency and next-generation performance are shaping aerostructure design choices

- The growing commercial aviation sector, particularly in regions such as Asia-Pacific, is driving orders for aircraft equipped with optimized aerostructures that deliver improved efficiency. This is promoting innovation in materials engineering and structural design

- Aircraft modernization programs by major carriers are prompting retrofits and upgrades that incorporate lighter components, supporting both operational cost reduction and compliance with environmental standards. These initiatives reinforce market growth

- The trend toward unmanned aerial vehicles (UAVs) and electric aircraft is further encouraging the use of lightweight aerostructures capable of sustaining energy-efficient operation. This demand is influencing R&D investment and shaping the future of aircraft design

Restraint/Challenge

High Production Costs and Complex Manufacturing Processes

- The aerostructures market faces challenges due to the high costs associated with producing advanced components, which require specialized machinery, skilled labor, and rigorous quality control. These complexities can limit production scalability and increase unit costs

- For instance, Spirit AeroSystems employs precision automated manufacturing and composite layup techniques for commercial aircraft fuselage sections, which require significant capital investment and technical expertise. Such factors highlight the operational challenges of producing high-performance aerostructures

- Manufacturing lightweight composites involves stringent testing and certification standards to ensure safety and structural integrity, extending production timelines and elevating expenses. These requirements create barriers for smaller suppliers seeking to enter the market

- The reliance on rare or high-performance raw materials, such as carbon fiber and titanium alloys, introduces supply chain vulnerabilities and cost fluctuations. This impacts procurement planning and overall project economics

- The market continues to grapple with balancing the need for innovative, fuel-efficient structures with economic feasibility and competitive pricing. These constraints collectively shape investment strategies and influence adoption rates across aerospace programs

Aerostructures Market Scope

The market is segmented on the basis of component, material, platform, and end-use.

- By Component

On the basis of component, the aerostructures market is segmented into fuselage, empennage, flight control surfaces, wings, nose, nacelle and pylon, and others. The fuselage segment dominated the market with the largest revenue share in 2025, driven by its critical role in housing passengers, cargo, and essential aircraft systems. Aircraft manufacturers prioritize fuselage innovations to enhance structural integrity, reduce weight, and improve aerodynamics. The strong demand for fuselage components is further supported by rising air travel and the need for fuel-efficient aircraft designs. Its adaptability across commercial, defense, and regional aircraft contributes to sustained market dominance. The market sees continuous investment in advanced fuselage materials and design solutions to meet evolving safety and efficiency standards.

The wings segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by the growing demand for fuel-efficient, lightweight aircraft structures. Wings are essential for lift generation, and innovations such as composite wings and morphing wing technologies are driving adoption across commercial and regional aircraft. For instance, Boeing’s 787 Dreamliner and Airbus’ A350 feature advanced wing designs using lightweight materials to optimize performance. The integration of smart sensors and aerodynamic enhancements further accelerates the adoption of wing components. Rising production of narrow-body and wide-body aircraft is also contributing to this rapid growth trend.

- By Material

On the basis of material, the aerostructures market is segmented into composites, alloys, and metals. The composites segment dominated the market in 2025, driven by their superior strength-to-weight ratio and ability to improve fuel efficiency in modern aircraft. Aircraft manufacturers increasingly prefer composites for structural parts due to their corrosion resistance and ability to reduce overall maintenance costs. Composites also allow for innovative designs that optimize aerodynamics while meeting strict safety and performance standards. The segment benefits from ongoing R&D investments focused on developing next-generation high-performance composites. Rising adoption in both commercial and defense aircraft further reinforces its market dominance.

The alloys segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the continuous need for high-performance materials that balance weight and durability. For instance, aluminum-lithium alloys are increasingly used in Airbus and Boeing aircraft to reduce structural weight while maintaining mechanical strength. Alloys provide advantages in fatigue resistance and structural reliability, essential for both wings and fuselage sections. Their versatility across multiple aerostructure components contributes to steady growth. Growing aerospace production in emerging markets also supports the rapid adoption of alloy-based aerostructures.

- By Platform

On the basis of platform, the aerostructures market is segmented into fixed-wing aircraft and rotary-wing aircraft. The fixed-wing aircraft segment dominated the market with the largest share of 70.5% in 2025, driven by the global expansion of commercial aviation and increasing production of passenger and cargo aircraft. Fixed-wing platforms require advanced aerostructures for fuel efficiency, safety, and performance optimization. The segment’s dominance is also supported by innovations in lightweight materials, wing design, and fuselage architecture. Manufacturers continue to invest heavily in fixed-wing aerostructure production facilities to meet rising air travel demand. The increasing retrofit and modernization of older aircraft further bolster market leadership.

The rotary-wing aircraft segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising defense and emergency response applications. For instance, Bell Helicopter and Sikorsky have introduced lightweight rotorcraft designs with enhanced aerostructure components to improve maneuverability and payload capacity. Rotary-wing aerostructures are increasingly being optimized using composites and alloys to enhance performance under varying operational conditions. The growing adoption in search and rescue, medical evacuation, and urban air mobility also accelerates market expansion. Rising investment in advanced rotorcraft technologies supports rapid segment growth.

- By End-Use

On the basis of end-use, the aerostructures market is segmented into original equipment manufacturer (OEM) and aftermarket. The OEM segment dominated the market in 2025, driven by the production of new aircraft and the need for integrated, high-performance aerostructures. OEMs focus on lightweight materials, structural integrity, and fuel efficiency to meet stringent aviation regulations. The dominance is further supported by large-scale contracts with commercial and defense aircraft manufacturers. Continuous innovation in fuselage, wing, and empennage design enhances the segment’s market position. OEM demand is also influenced by rising global air travel and the expansion of commercial aircraft fleets.

The aftermarket segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing aircraft maintenance, repair, and overhaul (MRO) requirements. For instance, companies such as Lufthansa Technik and ST Engineering provide specialized aerostructure replacement and upgrade services to extend aircraft lifespan. The aftermarket segment benefits from the growing emphasis on fleet modernization and operational efficiency. Rising demand for structural retrofits and component replacements supports its rapid adoption. Increasing air traffic and aging aircraft fleets further drive aftermarket growth across regions.

Aerostructures Market Regional Analysis

- North America dominated the aerostructures market with the largest revenue share of 34.5% in 2025, driven by the presence of major aircraft manufacturers, rising defense spending, and growing commercial aviation demand

- Aerospace companies in the region prioritize lightweight, high-performance aerostructures to improve fuel efficiency and reduce operational costs, with significant investments in R&D for advanced materials and design innovations

- This widespread adoption is further supported by established aerospace supply chains, technological expertise, and government contracts, making North America a key market for both commercial and defense aerostructures

U.S. Aerostructures Market Insight

The U.S. aerostructures market captured the largest revenue share in 2025 within North America, driven by rising commercial aircraft production and significant defense procurement programs. U.S. manufacturers are increasingly investing in composite materials, automated assembly, and additive manufacturing to improve efficiency and reduce aircraft weight. The demand for narrow-body and wide-body aircraft is fueling the requirement for advanced fuselage, wing, and empennage components. In addition, collaborations between OEMs and Tier-1 suppliers, such as Boeing and Spirit AeroSystems, are accelerating technological advancements in aerostructures.

Europe Aerostructures Market Insight

The Europe aerostructures market is projected to grow at a significant CAGR during the forecast period, driven by strong commercial aircraft manufacturing and defense modernization programs. For instance, Airbus’s expansion in wing and fuselage component production is supporting market growth. The presence of advanced aerospace R&D centers and government-backed innovation initiatives encourages adoption of lightweight materials and next-generation aerostructures. The market is witnessing demand across commercial, regional, and military aircraft segments, with a focus on fuel efficiency and reduced environmental impact.

U.K. Aerostructures Market Insight

The U.K. aerostructures market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by government defense spending and aerospace sector investments. The country’s aerospace ecosystem emphasizes technological innovation, precision engineering, and sustainable manufacturing processes. Companies such as BAE Systems and GKN Aerospace are expanding production capabilities in composite and metallic aerostructures. In addition, collaborations with international aircraft OEMs are further enhancing expertise and boosting market demand.

Germany Aerostructures Market Insight

The Germany aerostructures market is expected to expand at a considerable CAGR during the forecast period, driven by strong engineering capabilities and advanced aerospace manufacturing infrastructure. For instance, Premium Aerotec’s focus on fuselage and wing components supports the country’s leadership in aerostructure innovation. German manufacturers emphasize precision, quality, and adoption of lightweight composite materials. The growth is supported across commercial and military aircraft segments, with sustainability and efficiency being key priorities for market players.

Asia-Pacific Aerostructures Market Insight

The Asia-Pacific aerostructures market is poised to grow at the fastest CAGR during 2026–2033, driven by rapid expansion of commercial aviation, rising defense budgets, and increasing aircraft deliveries in countries such as China, India, and Japan. The region is emerging as a hub for aerospace manufacturing, with local suppliers focusing on fuselage, wing, and empennage components. Rising urban air mobility initiatives and government support for aerospace technology development are accelerating market growth. Moreover, the availability of cost-competitive manufacturing and assembly capabilities is expanding adoption across commercial and military aircraft sectors.

Japan Aerostructures Market Insight

The Japan aerostructures market is gaining momentum due to the country’s advanced manufacturing technologies, focus on high-precision aerospace components, and growing commercial aircraft deliveries. Companies such as Mitsubishi Heavy Industries are investing in lightweight and high-strength aerostructures for domestic and international aircraft programs. The market emphasizes integration of automation, robotics, and advanced materials to enhance production efficiency. Rising defense modernization initiatives and collaborations with global OEMs are further fueling demand for aerostructures in Japan.

China Aerostructures Market Insight

The China aerostructures market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid growth of the commercial aviation sector and increasing domestic aircraft manufacturing programs. For instance, COMAC’s C919 program is boosting demand for advanced wing and fuselage components. The country benefits from supportive government policies, investments in aerospace infrastructure, and a growing pool of skilled workforce. Expansion of local suppliers and adoption of composite materials and automated manufacturing techniques are key factors driving market growth in China.

Aerostructures Market Share

The aerostructures industry is primarily led by well-established companies, including:

- AAR Corp (U.S.)

- Collins Aerospace (U.S.)

- RUAG Group (Switzerland)

- Saab AB (Sweden)

- Boeing (U.S.)

- Bombardier (Canada)

- Lockheed Martin Corporation (U.S.)

- Spirit AeroSystems, Inc (U.S.)

- STELIA Aerospace (France)

- Elbit Systems Ltd (Israel)

- GKN Aerospace Services Limited (U.K.)

- Premium AEROTEC (Germany)

- Leonardo S.p.A. (Italy)

- MITSUBISHI HEAVY INDUSTRIES, LTD (Japan)

- Kawasaki Heavy Industries, Ltd (Japan)

Latest Developments in Global Aerostructures Market

- In June 2025, JetZero selected Greensboro, North Carolina, for a USD 4.7 billion facility to manufacture its Z4 blended-wing aircraft. This development is set to significantly impact the aerostructures and advanced aircraft market by introducing highly fuel-efficient designs, offering up to 50% fuel-burn reduction compared with conventional aircraft. The investment underscores the growing demand for environmentally sustainable aviation solutions and positions JetZero as a key player in the emerging blended-wing and green aircraft segment, driving innovation across materials, aerostructures, and manufacturing technologies

- In May 2025, Vertical Aerospace and Honeywell expanded their partnership on the VX4 eVTOL project under a contract valued at USD 1 billion. This collaboration strengthens the electric vertical take-off and landing (eVTOL) aircraft market by accelerating production, certification, and technological development of urban air mobility solutions. The alliance is expected to enhance the adoption of advanced aerostructures, lightweight components, and integrated avionics systems, reinforcing both companies’ positions in the fast-growing sustainable air mobility segment

- In January 2024, Airbus SE entered into agreements with Mahindra Aerospace Structures Private Limited and Tata Advanced Systems Limited for the sourcing and production of components and assemblies for commercial aircraft models, including the A320neo, A330neo, and A350. This partnership expands Airbus’s global supply chain capabilities and is poised to increase production efficiency and component innovation. The collaboration boosts the aerostructures market in India by enhancing local manufacturing capacities, technology transfer, and integration of advanced materials, strengthening India’s role as a strategic aerospace hub

- In April 2023, Leonardo SpA announced a collaboration with Cisco Technology to develop innovative solutions for safer and more sustainable logistics and transportation systems. This alliance impacts the aerospace and aerostructures market by fostering digitalization, automation, and data-driven innovation across production and supply chain processes. The integration of smart technologies and sustainable practices supports long-term operational efficiency, positioning both companies to lead in connected and resilient aerospace infrastructure solutions

- In February 2023, Heart Aerospace, a Swedish electric aircraft manufacturer, was selected by Air New Zealand as a key partner for the renewal of its domestic Q300 fleet. This collaboration strengthens the electric aircraft segment within the regional aerostructures market by advancing the development and adoption of zero-emission aircraft. It underscores growing airline commitments to sustainability and accelerates the integration of lightweight materials, advanced aerostructures, and energy-efficient propulsion technologies, driving market evolution in electric and hybrid aviation solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.