Global Agentless Virtual Machine Backup And Recovery Market

Market Size in USD Billion

CAGR :

%

USD

2.35 Billion

USD

4.32 Billion

2025

2033

USD

2.35 Billion

USD

4.32 Billion

2025

2033

| 2026 –2033 | |

| USD 2.35 Billion | |

| USD 4.32 Billion | |

|

|

|

|

Global Agentless Virtual Machine Backup and Recovery Market Size

- The global Agentless Virtual Machine Backup and Recovery Market was valued at USD 2.35 billion in 2025 and is projected to reach USD 4.32 billion by 2033, expanding at a CAGR of 7.90% during the forecast period.

- Market expansion is primarily driven by the rapid growth of virtualized and cloud-native infrastructures, prompting organizations to adopt advanced, automated data-protection frameworks that minimize operational complexity and enhance backup efficiency.

- Additionally, increasing enterprise demand for secure, scalable, and easy-to-deploy backup solutions is positioning agentless technologies as the preferred choice for modern IT environments. These combined factors are accelerating adoption and substantially strengthening overall market growth.

Global Agentless Virtual Machine Backup and Recovery Market Analysis

- Agentless Virtual Machine Backup and Recovery solutions, providing automated, non-intrusive data protection for virtualized and cloud environments, are becoming essential components of modern IT infrastructures in both enterprise and SMB sectors due to their simplified deployment, reduced system overhead, and seamless integration with major virtualization platforms.

- The rising demand for agentless backup technologies is primarily driven by the accelerated adoption of cloud computing, growing cybersecurity concerns, and the increasing need for efficient, scalable, and low-maintenance data-protection frameworks across diverse industries.

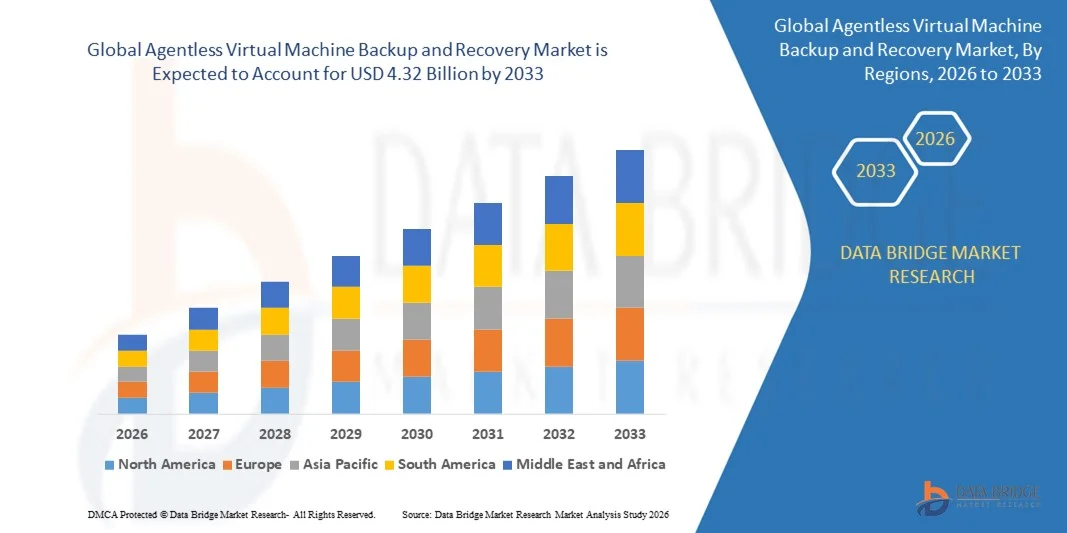

- North America dominated the Global Agentless Virtual Machine Backup and Recovery Market with the largest revenue share of 34% in 2025, supported by early virtualization adoption, strong enterprise IT spending, and the concentration of leading data-protection vendors, with the U.S. experiencing significant growth in agentless backup deployments driven by hybrid-cloud expansion and advanced automation capabilities.

- Asia-Pacific is expected to be the fastest growing region in the Global Agentless Virtual Machine Backup and Recovery Market during the forecast period due to rapid digital transformation, increasing cloud adoption, and rising investments in enterprise data-security infrastructure.

- The agentless segment dominated the market with the largest revenue share of 61.3% in 2025, driven by its simplified deployment, reduced operational overhead, and seamless compatibility with major hypervisors and cloud platforms.

Report Scope and Global Agentless Virtual Machine Backup and Recovery Market Segmentation

|

Attributes |

Agentless Virtual Machine Backup and Recovery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Veeam Software (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Global Agentless Virtual Machine Backup and Recovery Market Trends

Enhanced Efficiency Through AI-Driven Automation and Intelligent Orchestration

- A significant and accelerating trend in the Global Agentless Virtual Machine Backup and Recovery Market is the deepening integration of artificial intelligence (AI) and automation frameworks within cloud and virtualized environments. This convergence is greatly enhancing operational efficiency, reducing administrative workloads, and improving the reliability of enterprise data-protection systems.

- For Instance, leading platforms now integrate AI-based engines capable of automatically detecting new virtual machines across hybrid infrastructures, enabling instant policy assignment and ensuring continuous, agentless protection without manual configuration. Similarly, several enterprise-grade solutions leverage AI to optimize backup scheduling, resource allocation, and data-traffic routing across multi-cloud ecosystems.

- AI integration in backup and recovery solutions enables advanced features such as predictive analytics for identifying potential system failures, anomaly detection to flag unusual data-change patterns, and automated remediation workflows. Some modern platforms use AI to enhance ransomware detection capabilities and provide intelligent alerts when suspicious activity or abnormal backup behavior is detected.

- The seamless integration of backup systems with cloud orchestration platforms and virtualization management consoles facilitates centralized oversight of all data-protection activities. Through a unified interface, IT teams can monitor backup health, manage storage resources, and automate disaster-recovery processes across entire virtual environments.

- This trend toward more intelligent, automated, and interconnected backup ecosystems is reshaping enterprise expectations for data protection. Consequently, companies are developing AI-enabled agentless backup solutions with capabilities such as autonomous failover, smart tiering, and automated workload discovery.

- The demand for AI-driven, seamlessly integrated agentless backup technologies is growing rapidly across industries as organizations prioritize efficiency, security, and streamlined management within increasingly complex virtual and cloud-native IT environments.

Global Agentless Virtual Machine Backup and Recovery Market Dynamics

Driver

Growing Need Due to Rising Security Risks and Expanding Virtualization Adoption

- The rising frequency of cyberattacks, data breaches, and system failures—combined with the rapid expansion of virtualized and cloud-based infrastructures—is significantly driving the demand for agentless virtual machine backup and recovery solutions.

- For Instance, in 2025, several leading data-protection vendors announced enhancements to their agentless platforms, introducing advanced threat-detection analytics and automated workload-discovery features designed to safeguard expanding hybrid and multi-cloud deployments. Such innovations are expected to accelerate market growth over the forecast period.

- As enterprises become increasingly aware of evolving cybersecurity risks and the complexity of protecting large-scale virtual environments, agentless backup solutions offer features such as automated VM discovery, encrypted backup storage, anomaly detection, and real-time activity monitoring—providing a strong upgrade over legacy agent-based systems.

- Furthermore, the widespread adoption of cloud services, containerized workloads, and virtualization technologies is making agentless backup solutions an essential component of modern IT architectures, enabling seamless integration with hypervisors, cloud platforms, and orchestration tools.

- The demand for simplified management, reduced IT overhead, rapid deployment, and centralized policy control across hybrid environments is propelling adoption across sectors, from enterprises to SMBs. The trend toward automation-driven infrastructure management further contributes to market expansion.

Restraint/Challenge

Concerns Regarding Cybersecurity Vulnerabilities and High Implementation Costs

- Concerns surrounding cybersecurity risks in connected and cloud-dependent environments pose a significant challenge to wider adoption of agentless backup solutions. Because these platforms rely on network connectivity, APIs, and centralized management systems, they can be targeted by ransomware, unauthorized access attempts, or API-based exploits.

- For instance, high-profile reports of ransomware attacks infiltrating backup environments have made some organizations cautious about relying entirely on cloud-integrated or network-exposed backup systems.

- Addressing these cybersecurity concerns through robust encryption, zero-trust access controls, immutable backups, and continuous vulnerability patching is critical for building enterprise confidence. Vendors such as Veeam, Rubrik, and Cohesity emphasize advanced security layers and ransomware-resilient architectures to reassure customers.

- Additionally, the relatively high initial investment associated with deploying enterprise-grade agentless backup platforms—including storage costs, cloud resources, and subscription licenses—can be a barrier for cost-sensitive organizations, especially SMBs or organizations in developing regions.

- While cloud-based and subscription models are making solutions more accessible, the perception of high upfront and operational costs still hinders widespread adoption among organizations that do not yet recognize the long-term value of modern data-protection technologies.

- Overcoming these challenges through stronger security frameworks, customer education about best practices, and the development of more cost-efficient, scalable agentless backup offerings will be essential for sustained market growth.

Global Agentless Virtual Machine Backup and Recovery Market Scope

The agentless virtual machine backup and recovery market is segmented on the basis of type, organization size, deployment and vertical.

- By Type

On the basis of type, the Global Agentless Virtual Machine Backup and Recovery Market is segmented into agent-based and agentless solutions. The agentless segment dominated the market with the largest revenue share of 61.3% in 2025, driven by its simplified deployment, reduced operational overhead, and seamless compatibility with major hypervisors and cloud platforms. Organizations prefer agentless solutions due to the elimination of manual agent installation, faster implementation across large VM fleets, and minimized performance impact on host systems. Agentless technologies also integrate more efficiently with hybrid-cloud environments, offering automated workload discovery and centralized policy control.

The agent-based segment is expected to witness the fastest CAGR from 2026 to 2033, driven by adoption in highly regulated industries needing granular controls, legacy environment support, and advanced workload-level customization. Despite rising preference for agentless models, agent-based solutions remain relevant where deep OS-level interaction and high-security isolation are required.

- By Organization Size

On the basis of organization size, the market is segmented into large enterprises and small and medium-sized enterprises (SMEs). The large enterprise segment dominated the market with a 58.7% revenue share in 2025, supported by extensive virtualization infrastructure, higher data volumes, and the need for advanced, scalable backup systems. Large enterprises prioritize solutions that offer automated orchestration, multi-cloud compatibility, ransomware resilience, and seamless VM protection across geographically distributed data centers. Their greater IT budgets and complex workload environments further fuel adoption of AI-driven agentless backup platforms.

The SME segment is projected to register the fastest CAGR from 2026 to 2033, driven by the ongoing shift toward cloud-based and SaaS-driven backup models that reduce upfront investment. SMEs increasingly adopt agentless solutions due to their low maintenance requirements, ease of deployment, and subscription pricing flexibility, making enterprise-grade protection accessible to smaller IT teams.

- By Deployment

On the basis of deployment, the market is segmented into cloud and on-premise solutions. The cloud segment held the largest market share of 54.9% in 2025, driven by the accelerating migration to public and hybrid cloud environments, rising adoption of cloud-native applications, and the need for flexible, scalable backup capabilities. Cloud-based agentless solutions provide centralized management, rapid provisioning, cost-efficient storage options, and seamless integration with major cloud providers. Their ability to support multi-location deployments and enable automated disaster recovery further strengthens demand.

The on-premise segment is expected to witness the fastest CAGR from 2026 to 2033, primarily due to compliance-driven industries such as BFSI, government, and healthcare prioritizing local data control, strict regulatory requirements, and protected network environments. Organizations with legacy systems or restricted cloud usage continue to adopt on-premise agentless solutions enhanced with AI-based monitoring and immutable backup options.

- By Vertical

On the basis of vertical, the market spans several industries. The BFSI segment dominated the market with the largest share of 27.4% in 2025, driven by strict regulatory mandates, high-value transactional data, and the need for resilient protection against ransomware and operational downtime. BFSI organizations rely heavily on agentless backup solutions to secure virtualized core banking systems, customer data, and financial applications in hybrid-cloud environments.

The IT & Telecommunications segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rapid virtualization adoption, expansion of data centers, and the need to safeguard diverse workloads across multi-cloud infrastructures. Additionally, sectors like healthcare and government are increasing investments in secure agentless backup technologies to protect sensitive records, ensure compliance, and enhance operational continuity. Manufacturing and retail also contribute significantly, driven by growing digital transformation across supply chains and customer-facing systems.

Global Agentless Virtual Machine Backup and Recovery Market Regional Analysis

- North America dominated the Global Agentless Virtual Machine Backup and Recovery Market with the largest revenue share of 34% in 2025, driven by early adoption of virtualization technologies, high enterprise IT spending, and a strong presence of leading backup solution vendors.

- Organizations in the region prioritize reliable, scalable, and automated agentless backup solutions to protect critical workloads, ensure business continuity, and comply with stringent data-security and regulatory requirements.

- This widespread adoption is further supported by advanced IT infrastructure, high cloud adoption rates, and the increasing complexity of hybrid and multi-cloud environments, establishing agentless backup and recovery solutions as the preferred choice for large enterprises and SMBs across various sectors.

U.S. Agentless Virtual Machine Backup and Recovery Market Insight

The U.S. market captured the largest revenue share of 78% in 2025 within North America, driven by rapid virtualization adoption, high enterprise IT spending, and the increasing complexity of hybrid and multi-cloud environments. Organizations are prioritizing agentless backup solutions for automated data protection, ransomware resilience, and seamless integration with cloud platforms and hypervisors. The growing focus on business continuity, disaster recovery, and regulatory compliance further accelerates market growth. Moreover, enterprises are increasingly leveraging AI-enabled and automated backup solutions, enhancing operational efficiency and reducing administrative overhead.

Europe Agentless Virtual Machine Backup and Recovery Market Insight

The Europe market is projected to expand at a significant CAGR during the forecast period, supported by stringent data-protection regulations such as GDPR and the growing need for secure, efficient backup solutions across enterprises. Increasing cloud adoption, digital transformation initiatives, and awareness of ransomware threats are fostering agentless backup implementation. Organizations across sectors—including BFSI, healthcare, and government—are adopting these solutions to ensure compliance, data security, and operational continuity.

U.K. Agentless Virtual Machine Backup and Recovery Market Insight

The U.K. market is anticipated to grow at a notable CAGR, fueled by rising IT modernization, cloud adoption, and cybersecurity concerns. Enterprises are prioritizing agentless VM backup solutions for their ease of deployment, reduced maintenance overhead, and robust protection against cyber threats. The strong presence of IT service providers, cloud platforms, and virtualization infrastructure further supports adoption.

Germany Agentless Virtual Machine Backup and Recovery Market Insight

The Germany market is expected to expand at a considerable CAGR, driven by growing awareness of data-security best practices, compliance mandates, and technological advancements. German enterprises emphasize resilient, scalable, and efficient backup solutions to protect mission-critical workloads across on-premise and hybrid-cloud environments. The integration of AI-driven automation and predictive analytics in backup systems is also increasingly influencing adoption.

Asia-Pacific Agentless Virtual Machine Backup and Recovery Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 22% during 2026–2033, driven by digital transformation, rapid cloud adoption, and the expansion of virtualization in countries such as China, India, and Japan. Governments’ focus on smart city initiatives and enterprise digitization is accelerating adoption. Additionally, the rise of SMEs and large enterprises seeking scalable, low-maintenance, and cost-effective agentless backup solutions is fueling market growth.

Japan Agentless Virtual Machine Backup and Recovery Market Insight

The Japan market is gaining momentum due to advanced IT infrastructure, high enterprise virtualization penetration, and strong demand for automated, reliable backup systems. Organizations are adopting agentless solutions to protect critical workloads, ensure compliance, and optimize IT resource utilization. Integration with cloud-native and hybrid environments further drives adoption, while the focus on AI-enabled predictive analytics enhances operational efficiency.

China Agentless Virtual Machine Backup and Recovery Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid digitalization, cloud adoption, and large-scale enterprise virtualization. The increasing number of SMEs and large organizations seeking automated, scalable, and secure backup solutions is propelling growth. Additionally, the presence of domestic vendors and competitive pricing options enhances accessibility, while initiatives supporting data security and cloud infrastructure adoption strengthen market expansion.

Global Agentless Virtual Machine Backup and Recovery Market Share

The Agentless Virtual Machine Backup and Recovery industry is primarily led by well-established companies, including:

• Veeam Software (Switzerland)

• Rubrik Inc. (U.S.)

• Commvault Inc. (U.S.)

• Cohesity Inc. (U.S.)

• Nakivo Inc. (U.S.)

• Acronis International GmbH (Switzerland)

• Veritas Technologies LLC (U.S.)

• Dell Technologies (U.S.)

• IBM Corporation (U.S.)

• Arcserve (U.S.)

• Unitrends (U.S.)

• Barracuda Networks (U.S.)

• Zerto Ltd. (Israel)

• Micro Focus (U.K.)

• Vembu Technologies (India)

• Altaro Software (U.K.)

• StorageCraft Technology Corporation (U.S.)

• Huawei Technologies Co., Ltd. (China)

• Trend Micro Incorporated (Japan)

• Hitachi Vantara (Japan)

What are the Recent Developments in Global Agentless Virtual Machine Backup and Recovery Market?

- In April 2024, Veeam Software, a global leader in data-protection solutions, launched a strategic initiative in South Africa to provide advanced agentless VM backup and recovery solutions tailored for enterprises and SMBs. This initiative underscores the company’s commitment to delivering reliable, scalable, and automated backup systems that address the unique IT infrastructure needs of regional businesses while reinforcing Veeam’s position in the rapidly growing global market.

- In March 2024, Rubrik Inc., a U.S.-based cloud data-management company, introduced Rubrik Cloud Vault 2.0, specifically designed for mission-critical workloads in financial and healthcare sectors. The platform offers AI-driven automation, ransomware detection, and policy-based backup orchestration, highlighting Rubrik’s focus on enhancing data security and operational resilience for enterprise environments.

- In March 2024, Commvault Inc. successfully deployed the Bengaluru Smart Data Protection Project, aimed at safeguarding urban enterprise IT infrastructures through its advanced agentless backup and disaster recovery technologies. This initiative leverages automation, cloud integration, and AI analytics to strengthen operational continuity, emphasizing Commvault’s role in supporting resilient and secure data ecosystems.

- In February 2024, Nakivo Inc., a leading provider of VM and cloud backup solutions, announced a strategic partnership with Asia-Pacific SMB Cloud Consortium to expand its agentless backup offerings across emerging markets. The collaboration is designed to simplify deployment, enhance ransomware resilience, and improve operational efficiency, underscoring Nakivo’s commitment to innovation in enterprise data protection.

- In January 2024, Cohesity Inc., a U.S.-based data-management leader, launched the Cohesity Helios Agentless Backup Platform at the Global Cloud and Virtualization Expo 2024. The platform offers AI-driven insights, automated VM discovery, and cloud-native integration, enabling organizations to manage backups seamlessly across hybrid environments. This launch highlights Cohesity’s focus on providing secure, scalable, and intelligent data-protection solutions for modern enterprise infrastructures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.