Global Agricultural Activator Adjuvants Market

Market Size in USD Billion

CAGR :

%

USD

2.87 Billion

USD

4.27 Billion

2025

2033

USD

2.87 Billion

USD

4.27 Billion

2025

2033

| 2026 –2033 | |

| USD 2.87 Billion | |

| USD 4.27 Billion | |

|

|

|

|

Global Agricultural Activator Adjuvants Market Size

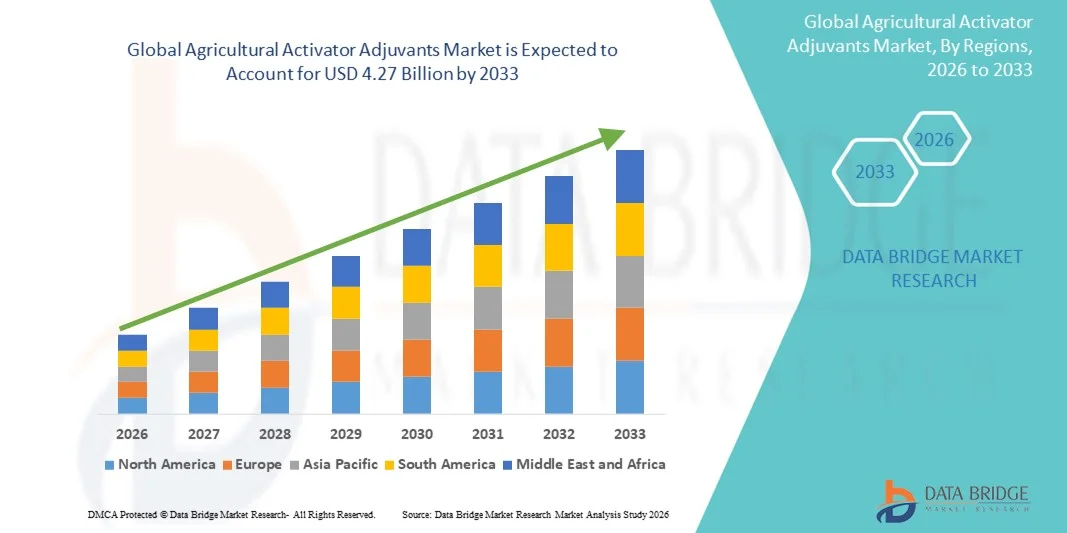

- The global Agricultural Activator Adjuvants Market size was valued at USD 2.87 billion in 2025 and is expected to reach USD 4.27 billion by 2033, at a CAGR of 5.10% during the forecast period.

- The market growth is largely driven by the increasing adoption of advanced farming practices and precision agriculture technologies, which enhance crop yield, nutrient absorption, and pesticide efficiency.

- Furthermore, rising demand for sustainable agricultural solutions and environmentally friendly crop protection methods is encouraging the use of activator adjuvants, which optimize the performance of agrochemicals. These factors are collectively accelerating market expansion, thereby significantly boosting the industry's growth.

Global Agricultural Activator Adjuvants Market Analysis

- Agricultural activator adjuvants, enhancing the efficiency and performance of pesticides and fertilizers, are increasingly vital components of modern crop protection and nutrient management strategies in both large-scale and smallholder farming due to their ability to improve spray coverage, absorption, and overall crop yield.

- The escalating demand for agricultural activator adjuvants is primarily fueled by the adoption of precision agriculture technologies, increasing emphasis on sustainable farming practices, and the need for cost-effective solutions that maximize the efficiency of agrochemical applications.

- North America dominated the Global Agricultural Activator Adjuvants Market with the largest revenue share of 32.2% in 2025, characterized by advanced farming practices, high adoption of precision agriculture tools, and a strong presence of leading agrochemical companies, with the U.S. experiencing substantial growth in activator adjuvant usage due to innovations in formulation technologies and regulatory support for sustainable agriculture.

- Asia-Pacific is expected to be the fastest-growing region in the Global Agricultural Activator Adjuvants Market during the forecast period due to increasing agricultural modernization, rising adoption of high-yield crops, and growing investments in farm mechanization and crop protection solutions.

- The cereals and grains segment dominated the market with the largest revenue share of 38.5% in 2025, driven by the extensive cultivation of wheat, rice, and maize globally, which necessitates the use of adjuvants to improve the efficacy of herbicides and fertilizers.

Report Scope and Global Agricultural Activator Adjuvants Market Segmentation

|

Attributes |

Agricultural Activator Adjuvants Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• BASF SE (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Agricultural Activator Adjuvants Market Trends

Enhanced Efficiency Through Precision Agriculture and AI Integration

- A significant and accelerating trend in the global Agricultural Activator Adjuvants Market is the deepening integration with precision agriculture technologies and artificial intelligence (AI) systems. This fusion of technologies is significantly enhancing crop management efficiency and agrochemical application precision.

- For instance, AI-powered spraying systems can optimize the use of adjuvants by adjusting dosage, droplet size, and spray patterns in real time, reducing waste and improving crop coverage. Similarly, smart sensors and drones can monitor crop health and guide adjuvant application to areas with the greatest need, enhancing overall yield.

- AI integration in agricultural systems enables features such as predictive modeling for pest and disease outbreaks, suggesting optimal adjuvant combinations, and providing intelligent alerts on crop stress. For example, some advanced systems analyze environmental and soil data to recommend precise adjuvant formulations, improving nutrient absorption and pesticide effectiveness.

- The seamless integration of adjuvants with digital farm management platforms allows centralized control over crop protection and nutrient optimization. Through a single interface, farmers can monitor field conditions, adjust adjuvant application rates, and integrate other agrochemical inputs for a fully automated crop management process.

- This trend towards more intelligent, data-driven, and interconnected agricultural solutions is fundamentally reshaping farmer expectations for crop protection efficiency. Consequently, companies such as BASF, Corteva, and Syngenta are developing AI-enabled adjuvants and application technologies that optimize performance while reducing environmental impact.

- The demand for agricultural activator adjuvants integrated with AI and precision farming tools is growing rapidly across both large-scale commercial farms and emerging agricultural markets, as farmers increasingly prioritize efficiency, sustainability, and high crop yield.

Global Agricultural Activator Adjuvants Market Dynamics

Driver

Growing Need Due to Rising Demand for Sustainable and Efficient Crop Protection

- The increasing need for higher crop yields, coupled with growing emphasis on sustainable farming practices, is a significant driver for the heightened demand for agricultural activator adjuvants.

- For instance, in 2025, Syngenta announced the launch of advanced adjuvant formulations designed to improve pesticide efficacy while minimizing environmental impact. Such innovations by key companies are expected to drive growth in the activator adjuvants market over the forecast period.

- As farmers face challenges such as pest resistance, variable weather conditions, and soil nutrient deficiencies, activator adjuvants enhance the effectiveness of herbicides, pesticides, and fertilizers, providing a compelling upgrade over traditional agricultural inputs.

- Furthermore, the growing adoption of precision agriculture technologies and smart farming solutions is making activator adjuvants an integral component of modern crop management systems, enabling optimized application, reduced chemical waste, and improved crop health.

- The efficiency improvements offered by activator adjuvants—such as better spray coverage, increased absorption, and enhanced nutrient uptake—are key factors propelling their adoption in both large-scale commercial farms and smallholder operations. The trend toward integrated farm management practices and the increasing availability of cost-effective, user-friendly adjuvant products further contribute to market growth.

Restraint/Challenge

Concerns Regarding Environmental Impact and Regulatory Compliance

- Concerns surrounding the potential environmental impact of agrochemical use, including certain activator adjuvants, pose a significant challenge to broader market penetration. Regulatory restrictions and stricter environmental standards in key regions can limit the types and formulations of adjuvants that can be used, raising compliance burdens for farmers and manufacturers.

- For instance, reports of chemical runoff and soil contamination have made some farmers hesitant to adopt new adjuvant products, particularly in regions with strict environmental regulations.

- Addressing these concerns through the development of eco-friendly, biodegradable, and non-toxic adjuvants, along with compliance with regulatory guidelines, is crucial for building trust among farmers. Companies such as BASF, Corteva, and UPL emphasize sustainable formulations and adherence to local regulations to reassure potential buyers.

- Additionally, the relatively high cost of premium adjuvant formulations compared to traditional additives can be a barrier to adoption for price-sensitive farmers, particularly in developing regions or for small-scale operations. While basic adjuvants are widely affordable, advanced products offering enhanced efficacy or precision application features often carry a higher price.

- Overcoming these challenges through the development of cost-effective, environmentally safe adjuvants, farmer education programs on sustainable usage, and incentives for adopting advanced formulations will be vital for sustained market growth.

Global Agricultural Activator Adjuvants Market Scope

Agricultural activator adjuvants market is segmented on the basis of crop type, formulation, adoption stage and application.

- By Crop Type

On the basis of crop type, the Global Agricultural Activator Adjuvants Market is segmented into cereals and grains, oilseeds and pulses, fruits and vegetables, and others. The cereals and grains segment dominated the market with the largest revenue share of 38.5% in 2025, driven by the extensive cultivation of wheat, rice, and maize globally, which necessitates the use of adjuvants to improve the efficacy of herbicides and fertilizers. Farmers prioritize adjuvants in these crops to enhance spray coverage, nutrient uptake, and overall yield.

The fruits and vegetables segment is expected to witness the fastest CAGR of 21.3% from 2026 to 2033, owing to the rising demand for high-value crops, adoption of precision agriculture, and the need for optimized agrochemical performance in horticulture. The growing consumer preference for quality produce and minimal chemical residues further fuels the adoption of activator adjuvants in this segment.

- By Formulation

On the basis of formulation, the Global Agricultural Activator Adjuvants Market is segmented into suspension concentrate (SC) and emulsifiable concentrate (EC). The suspension concentrate segment held the largest market revenue share of 45.2% in 2025, due to its stability, ease of mixing with water, and compatibility with a wide range of pesticides and fertilizers. SC formulations enhance spray coverage and reduce drift, making them highly preferred by commercial farmers and large-scale operations.

The emulsifiable concentrate segment is anticipated to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by its superior solubility in oil-based pesticides and effectiveness in improving foliar absorption. EC formulations are increasingly used in regions practicing intensive crop protection, especially for high-value horticultural and specialty crops where precision application and efficiency are critical.

- By Adoption Stage

On the basis of adoption stage, the Global Agricultural Activator Adjuvants Market is segmented into in-formulation and tank-mix. The in-formulation segment dominated the market with a revenue share of 52.4% in 2025, as it involves the direct incorporation of adjuvants during pesticide or fertilizer formulation, ensuring consistent performance and ease of use for end-users. Major agrochemical manufacturers prefer this stage to provide ready-to-use products with optimized efficacy.

The tank-mix segment is expected to witness the fastest CAGR of 20.6% from 2026 to 2033, driven by the growing flexibility it offers farmers to mix adjuvants with multiple agrochemicals on-site. Tank-mix adoption is increasingly popular among smallholder farmers and commercial growers seeking cost-effective, customizable solutions for targeted crop protection.

- By Application

On the basis of application, the Global Agricultural Activator Adjuvants Market is segmented into insecticides, fungicides, herbicides, and others. The herbicides segment dominated the market with the largest revenue share of 41.7% in 2025, owing to the extensive use of adjuvants to improve weed control efficiency in major row crops such as cereals and oilseeds. Adjuvants enhance spray retention, absorption, and overall herbicide performance, reducing chemical wastage and environmental impact.

The fungicides segment is anticipated to witness the fastest CAGR of 22.1% from 2026 to 2033, driven by increasing incidences of fungal diseases due to climate change and higher adoption of horticultural crops. Effective fungicide applications with adjuvants are critical to prevent crop losses, maintain quality, and meet rising consumer demand for fresh produce.

Global Agricultural Activator Adjuvants Market Regional Analysis

- North America dominated the Global Agricultural Activator Adjuvants Market with the largest revenue share of 32.2% in 2025, driven by the widespread adoption of advanced farming practices and precision agriculture technologies.

- Farmers and agribusinesses in the region prioritize the use of activator adjuvants to enhance the efficiency of pesticides and fertilizers, improve crop yields, and reduce chemical waste, reflecting a strong focus on sustainable and cost-effective agriculture.

- This widespread adoption is further supported by high technological penetration, government initiatives promoting efficient crop protection, and the presence of leading agrochemical companies offering innovative adjuvant solutions, establishing North America as a key market for advanced agricultural inputs across both large-scale commercial farms and smaller operations.

U.S. Agricultural Activator Adjuvants Market Insight

The U.S. agricultural activator adjuvants market captured the largest revenue share of 81% in 2025 within North America, driven by the rapid adoption of precision agriculture technologies and the increasing focus on sustainable crop protection. Farmers are prioritizing adjuvants to enhance the efficiency of pesticides and fertilizers, improve nutrient uptake, and maximize yields. The growing preference for advanced application methods, including drone- and sensor-assisted spraying, further propels market growth. Moreover, the integration of digital farm management platforms is enabling farmers to optimize adjuvant usage, reduce chemical waste, and improve operational efficiency, contributing significantly to market expansion.

Europe Agricultural Activator Adjuvants Market Insight

The Europe agricultural activator adjuvants market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by strict regulations on agrochemical use and the increasing need for efficient, sustainable crop protection. Rising adoption of precision farming, coupled with growing awareness of environmental sustainability, is fostering the uptake of adjuvants. European farmers are incorporating activator adjuvants into cereals, oilseeds, and horticultural crops to optimize chemical efficiency while minimizing environmental impact, supporting growth across both commercial and smallholder operations.

U.K. Agricultural Activator Adjuvants Market Insight

The U.K. agricultural activator adjuvants market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the adoption of modern farming practices and government initiatives promoting sustainable agriculture. Increasing demand for higher crop yields and efficient agrochemical application encourages the use of adjuvants. The country’s well-established agricultural research infrastructure and robust distribution networks for agrochemicals support market expansion, especially in cereal, vegetable, and oilseed cultivation.

Germany Agricultural Activator Adjuvants Market Insight

The Germany agricultural activator adjuvants market is expected to expand at a considerable CAGR during the forecast period, driven by the emphasis on sustainable farming, technological innovation, and efficient crop protection solutions. German farmers increasingly adopt activator adjuvants to enhance pesticide and fertilizer performance while adhering to strict environmental regulations. Integration with precision agriculture tools, such as GPS-guided spraying and real-time crop monitoring systems, is further boosting market adoption, particularly for high-value crops and intensive cultivation practices.

Asia-Pacific Agricultural Activator Adjuvants Market Insight

The Asia-Pacific agricultural activator adjuvants market is poised to grow at the fastest CAGR of 24% during the forecast period of 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and modernization of agricultural practices in countries such as China, India, and Japan. The increasing adoption of mechanized farming and precision agriculture technologies is driving demand for activator adjuvants. Furthermore, government initiatives promoting sustainable crop protection and increased awareness of high-yield farming practices are enabling broader adoption across cereals, fruits, vegetables, and oilseeds.

Japan Agricultural Activator Adjuvants Market Insight

The Japan agricultural activator adjuvants market is gaining momentum due to the country’s highly mechanized farming sector, aging farmer population, and focus on maximizing crop efficiency. The adoption of activator adjuvants is driven by the need to reduce labor-intensive operations and improve pesticide and nutrient uptake in rice, fruits, and vegetables. Integration with precision agriculture technologies, such as drone spraying and IoT-enabled crop monitoring systems, is fueling growth in both residential and commercial farming sectors.

China Agricultural Activator Adjuvants Market Insight

The China agricultural activator adjuvants market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s rapid urbanization, expanding agricultural output, and rising adoption of modern farming technologies. Activator adjuvants are increasingly used in cereals, fruits, vegetables, and oilseeds to optimize the efficacy of fertilizers and pesticides. Government programs promoting sustainable agriculture, the push for higher crop yields, and the presence of strong domestic agrochemical manufacturers are key factors driving market growth in China.

Global Agricultural Activator Adjuvants Market Share

The Agricultural Activator Adjuvants industry is primarily led by well-established companies, including:

• BASF SE (Germany)

• Corteva Agriscience (U.S.)

• Syngenta AG (Switzerland)

• UPL Limited (India)

• ADAMA Agricultural Solutions (Israel)

• Bayer CropScience (Germany)

• Helm AG (Germany)

• FMC Corporation (U.S.)

• Nufarm Limited (Australia)

• Sumitomo Chemical Co., Ltd. (Japan)

• Arysta LifeScience (Japan)

• WinField Solutions (U.S.)

• Marrone Bio Innovations (U.S.)

• Mitsui Chemicals Agro, Inc. (Japan)

• Isagro S.p.A. (Italy)

• Gujarat Narmada Valley Fertilizers & Chemicals (India)

• Sino-Agri International (China)

• ADI Agrochemicals (U.S.)

• Rotam Agrochemical Co., Ltd. (China)

• Cheminova A/S (Denmark)

What are the Recent Developments in Global Agricultural Activator Adjuvants Market?

- In April 2024, BASF SE, a global leader in crop protection and agricultural solutions, launched a new line of advanced activator adjuvants in South Africa aimed at improving pesticide efficiency and nutrient uptake in cereals and vegetables. This initiative underscores BASF’s commitment to delivering innovative, environmentally responsible crop protection solutions tailored to regional farming challenges, while strengthening its presence in the rapidly growing global Agricultural Activator Adjuvants Market.

- In March 2024, Corteva Agriscience, a leading U.S.-based agricultural company, introduced an advanced tank-mix adjuvant specifically designed for high-value horticultural crops. The new formulation enhances the performance of herbicides and fungicides, improving absorption and reducing chemical wastage. This development highlights Corteva’s dedication to innovation in crop protection technologies that maximize yield and efficiency for commercial growers.

- In March 2024, Syngenta AG successfully implemented a precision farming project in Bengaluru, India, integrating AI-enabled activator adjuvants with smart spraying systems to optimize fertilizer and pesticide application. This initiative demonstrates Syngenta’s commitment to leveraging advanced technologies to enhance crop productivity and sustainability, contributing to safer, more efficient farming practices.

- In February 2024, UPL Limited, a leading agrochemical company, announced a strategic partnership with the Indian Council of Agricultural Research (ICAR) to promote the adoption of advanced adjuvants among smallholder farmers. The collaboration focuses on improving agrochemical performance and reducing environmental impact, underscoring UPL’s dedication to innovation and operational efficiency in the agricultural sector.

- In January 2024, Helena Chemical Company unveiled a new suspension concentrate (SC) adjuvant at the Global AgriTech Expo 2024. The product enhances foliar absorption and spray retention for a wide range of herbicides and fungicides. Helena’s latest offering highlights the company’s focus on integrating cutting-edge technology into crop protection solutions, enabling farmers to achieve higher yields while minimizing chemical usage and environmental impact.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.