Global Agricultural Biofungicides Market

Market Size in USD Billion

CAGR :

%

USD

3.58 Billion

USD

11.83 Billion

2025

2033

USD

3.58 Billion

USD

11.83 Billion

2025

2033

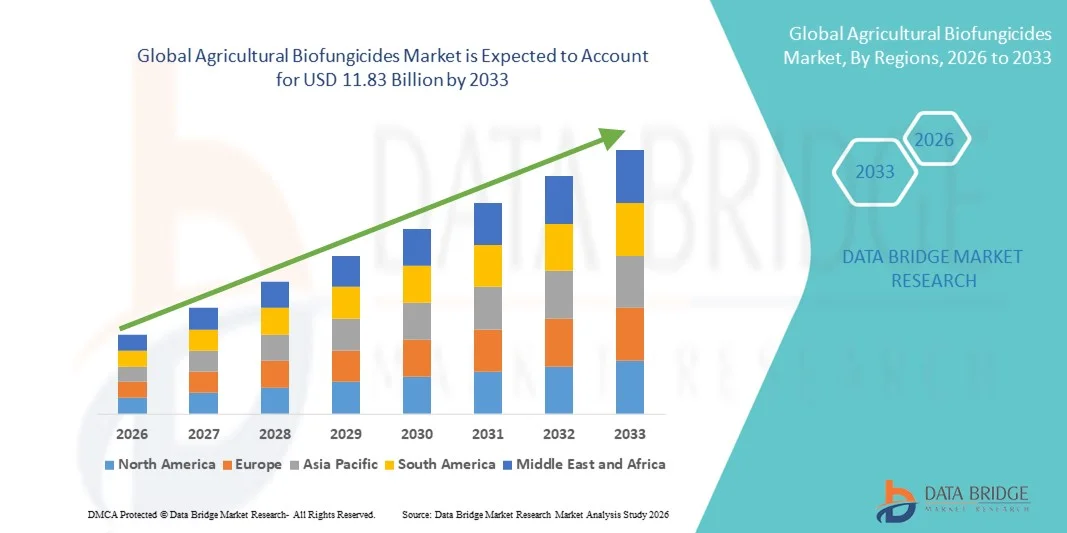

| 2026 –2033 | |

| USD 3.58 Billion | |

| USD 11.83 Billion | |

|

|

|

|

What is the Global Agricultural Biofungicides Market Size and Growth Rate?

- The global agricultural biofungicides market size was valued at USD 3.58 billion in 2025 and is expected to reach USD 11.83 billion by 2033, at a CAGR of 16.10% during the forecast period

- The rise in the preference towards organic food products among consumers across the globe acts as one of the major factors driving the growth of agricultural biofungicides market

- The rise in awareness among farmers about the benefits of adopting biofungicides, and increase in regulatory pressures and harmful effects related with the use of synthetic plant protectants accelerate the market growth

What are the Major Takeaways of Agricultural Biofungicides Market?

- The increase in in preference for organic products to encourage the adoption of biological products, and rise in in emphasis on integrated pest management solutions further influence the market

- Additionally, surge in investments and intervention of digital farming and precision farming practices, rise in usage of various forms of biofungicides in ranches and private farms, and rise in concerns regarding environment positively affect the agricultural biofungicides market

- North America dominated the Agricultural Biofungicides market with a 39.8% revenue share in 2025, driven by strong adoption of organic farming practices, increasing regulatory restrictions on synthetic fungicides, and rising consumer demand for residue-free food products across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.32% from 2026 to 2033, driven by expanding agricultural production, rising food security concerns, and increasing awareness regarding sustainable farming practices across China, India, Japan, South Korea, and Southeast Asia

- The Microbial Species segment dominated the market with a 68.4% share in 2025, driven by high efficacy, targeted action, and strong compatibility with integrated pest management (IPM) programs

Report Scope and Agricultural Biofungicides Market Segmentation

|

Attributes |

Agricultural Biofungicides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agricultural Biofungicides Market?

Rising Adoption of Sustainable, Microbial-Based, and Residue-Free Crop Protection Solutions

- The agricultural biofungicides market is witnessing strong growth in microbial and plant-based formulations derived from beneficial bacteria, fungi, and botanical extracts, supporting sustainable farming practices

- Manufacturers are introducing broad-spectrum biofungicides with improved shelf life, enhanced field stability, and compatibility with integrated pest management (IPM) programs

- Growing demand for residue-free food products and stricter regulations on synthetic chemical fungicides are accelerating the shift toward biological alternatives

- For instance, companies such as BASF SE, Bayer AG, Corteva, Inc., and Syngenta AG are expanding their biological crop protection portfolios through R&D and strategic partnerships

- Increasing organic farming acreage and adoption of regenerative agriculture practices further support market expansion

- As sustainability and environmental safety become central to agricultural policies, Agricultural Biofungicides will play a vital role in long-term crop protection strategies

What are the Key Drivers of Agricultural Biofungicides Market?

- Rising consumer demand for organic, chemical-free, and sustainably grown food products across global markets

- For instance, in 2025, leading agrochemical companies expanded production of microbial biofungicides to meet growing adoption in fruits, vegetables, cereals, and specialty crops

- Stringent regulatory restrictions on synthetic fungicides in Europe and North America are encouraging farmers to adopt biological alternatives

- Increasing awareness among farmers regarding soil health, resistance management, and long-term crop productivity strengthens biofungicide usage

- Advancements in fermentation technology, formulation techniques, and microbial strain development improve product effectiveness and shelf stability

- Supported by government incentives, organic certification programs, and sustainable agriculture initiatives, the Agricultural Biofungicides market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Agricultural Biofungicides Market?

- Limited field persistence and variable performance under extreme climatic conditions may restrict widespread adoption

- For instance, during 2024–2025, inconsistent efficacy results in certain regions highlighted the need for improved formulation stability and farmer training

- Higher production costs compared to some conventional fungicides can limit price competitiveness in cost-sensitive markets

- Shorter shelf life and storage sensitivity of microbial products create supply chain and distribution challenges

- Limited awareness and technical knowledge among small-scale farmers slow market penetration in emerging economies

- To address these challenges, companies are focusing on advanced formulation technologies, farmer education programs, strategic collaborations, and expanded distribution networks to enhance global adoption of Agricultural Biofungicides

How is the Agricultural Biofungicides Market Segmented?

The market is segmented on the basis of type, form, species, application, and crop types.

- By Type

On the basis of type, the agricultural biofungicides market is segmented into Microbial Species and Botanical. The Microbial Species segment dominated the market with a 68.4% share in 2025, driven by high efficacy, targeted action, and strong compatibility with integrated pest management (IPM) programs. Microbial biofungicides, derived from beneficial bacteria and fungi, are widely adopted for controlling soil-borne and foliar diseases while improving soil health. Their ability to enhance plant growth and resistance makes them highly preferred among organic and conventional farmers.

The Botanical segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing demand for plant-extract-based solutions, minimal environmental impact, and expanding adoption in organic farming systems.

- By Form

On the basis of form, the market is segmented into Wettable Powder, Aqueous Solution, and Granules. The Wettable Powder segment dominated the market with a 44.7% share in 2025, owing to its longer shelf life, ease of storage, cost-effectiveness, and suitability for large-scale agricultural spraying. Farmers prefer wettable powders for their stability and compatibility with conventional spraying equipment.

The Aqueous Solution segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by ease of application, uniform distribution, and increasing use in precision agriculture practices.

- By Species

On the basis of species, the agricultural biofungicides market is segmented into Bacillus, Trichoderma, Pseudomonas, Streptomyces, and Other Species. The Bacillus segment dominated the market with a 36.9% share in 2025, supported by its strong antifungal properties, spore-forming stability, and broad-spectrum disease control across multiple crops.

The Trichoderma segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption for soil treatment, root disease management, and plant growth promotion benefits.

- By Application

On the basis of application, the market is segmented into Foliar Spray, Soil Treatment, Seed Treatment, and Other Modes of Application. The Foliar Spray segment dominated the market with a 40.3% share in 2025, as it allows direct application to infected plant surfaces, ensuring rapid disease control and preventive protection.

The Seed Treatment segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing emphasis on early-stage crop protection, improved germination rates, and sustainable disease prevention strategies.

- By Crop Type

On the basis of crop type, the agricultural biofungicides market is segmented into Fruits and Vegetables, Cereals and Grains, Oilseeds and Pulses, Turf, and Ornamentals. The Fruits and Vegetables segment dominated the market with a 38.5% share in 2025, due to high susceptibility to fungal infections and strong demand for residue-free produce in domestic and export markets

The Cereals and Grains segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising global food demand, expansion of sustainable farming practices, and increasing bio-based crop protection adoption.

Which Region Holds the Largest Share of the Agricultural Biofungicides Market?

- North America dominated the Agricultural Biofungicides market with a 39.8% revenue share in 2025, driven by strong adoption of organic farming practices, increasing regulatory restrictions on synthetic fungicides, and rising consumer demand for residue-free food products across the U.S. and Canada

- Leading agrochemical and biological solution providers in North America are expanding microbial product portfolios, investing in advanced fermentation technologies, and strengthening distribution networks to support sustainable crop protection strategies

- Strong presence of large-scale commercial farms, well-established agricultural extension systems, and government support for sustainable agriculture further reinforce regional market leadership

U.S. Agricultural Biofungicides Market Insight

The U.S. is the largest contributor in North America, supported by expanding organic acreage, increasing adoption of integrated pest management (IPM) practices, and growing awareness of soil health improvement. Strong R&D capabilities and presence of major biological crop protection companies accelerate product innovation and commercialization.

Canada Agricultural Biofungicides Market Insight

Canada contributes significantly to regional growth, driven by rising demand for sustainable crop protection in cereals, pulses, and oilseeds. Government-backed environmental initiatives and increasing focus on reducing chemical pesticide usage strengthen adoption of biofungicides.

Asia-Pacific Agricultural Biofungicides Market

Asia-Pacific is projected to register the fastest CAGR of 10.32% from 2026 to 2033, driven by expanding agricultural production, rising food security concerns, and increasing awareness regarding sustainable farming practices across China, India, Japan, South Korea, and Southeast Asia. Rapid growth in horticulture, fruits and vegetables cultivation, and export-oriented farming is accelerating demand for residue-free crop protection solutions. Government subsidies, organic certification programs, and growing investments in agricultural biotechnology further support market expansion

China Agricultural Biofungicides Market Insight

China is the largest contributor in Asia-Pacific due to strong agricultural output, government initiatives promoting green agriculture, and increasing restrictions on chemical fungicides. Expanding domestic production capacity enhances market penetration.

India Agricultural Biofungicides Market Insight

India is emerging as a high-growth market supported by rising organic farming adoption, government schemes encouraging biological inputs, and growing awareness among smallholder farmers.

Japan Agricultural Biofungicides Market Insight

Japan shows steady growth driven by stringent food safety standards and increasing demand for high-quality, residue-free produce.

South Korea Agricultural Biofungicides Market Insight

South Korea contributes steadily due to modernization of farming practices, adoption of eco-friendly inputs, and growing focus on sustainable agricultural productivity.

Which are the Top Companies in Agricultural Biofungicides Market?

The agricultural biofungicides industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- Corteva, Inc. (U.S.)

- Syngenta AG (Switzerland)

- FMC Corporation (U.S.)

- UPL Ltd. (India)

- Sumitomo Chemical Co., Ltd. (Japan)

- Nippon Soda Co., Ltd. (Japan)

- ADAMA Agricultural Solutions Ltd. (Israel)

- Nissan Chemical Corporation (Japan)

- Marrone Bio Innovations, Inc. (U.S.)

- Koppert Biological Systems (Netherlands)

- Bioworks, Inc. (U.S.)

- STK Bio-ag Technologies (Israel)

- Verdesian Life Sciences (U.S.)

- Seipasa S.A. (Spain)

- Ishihara Sangyo Kaisha, Ltd. (Japan)

What are the Recent Developments in Global Agricultural Biofungicides Market?

- In November 2025, the U.S. Environmental Protection Agency (EPA) issued a proposed registration decision for Biotalys’ EVOCA, a protein-based biofungicide developed to combat fungal pathogens including botrytis and powdery mildew in fruits and vegetables, with its active ingredient exempted from residue tolerance limits, reinforcing its strong safety profile and strengthening regulatory support for next-generation biological crop protection solutions

- In July 2025, UPL Corp Australia unveiled Thiopron at WineTech 2025 as a biofungicide specifically formulated for grapevines to control powdery mildew and other fungal diseases, positioning it as a sustainable alternative to conventional fungicides and reinforcing UPL’s commitment to expanding its biological portfolio in line with global sustainability trends

- In October 2024, Certis Biologicals (Mitsui) expanded its North American portfolio with the launch of a new wettable powder biofungicide designed to enhance shelf life and tank-mix compatibility, gaining strong traction among greenhouse vegetable and specialty fruit growers and strengthening its leadership in residue-free biological solutions

- In May 2024, UPL Limited introduced a Trichoderma-based seed treatment biofungicide across Asia-Pacific to improve germination, root development, and early-stage fungal protection in cereals and pulses, supporting sustainable agriculture initiatives and reinforcing UPL’s expansion in green crop protection technologies across emerging markets

- In February 2024, Bayer AG secured EU registration for a new microbial biofungicide containing multiple Bacillus strains aimed at managing powdery mildew and botrytis in grapes and vegetables, aligning with Farm-to-Fork pesticide reduction goals and strengthening Bayer’s sustainable crop protection pipeline in Europe

- In January 2024, Certis Biologicals announced the launch of Convergence, a multi-strain microbial biofungicide formulated for corn, soybeans, and peanuts, delivering broad-spectrum disease control and reinforcing its strategic focus on sustainable and integrated crop protection solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.