Global Agricultural Commodity Market

Market Size in USD Billion

CAGR :

%

USD

1,600.00 Billion

USD

2,124.40 Billion

2025

2033

USD

1,600.00 Billion

USD

2,124.40 Billion

2025

2033

| 2026 –2033 | |

| USD 1,600.00 Billion | |

| USD 2,124.40 Billion | |

|

|

|

|

Agricultural Commodity Market Size

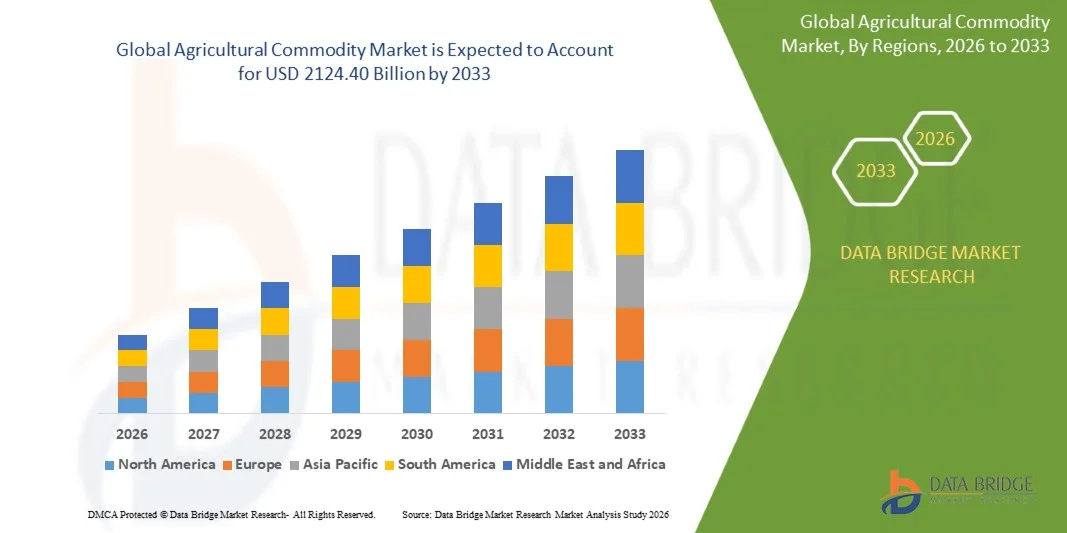

- The global agricultural commodity market size was valued at USD 1600 billion in 2025 and is expected to reach USD 2124.40 billion by 2033, at a CAGR of 3.20% during the forecast period

- The market growth is largely driven by rising global food demand, expanding population levels, and increasing consumption of staple crops and soft commodities across both developed and emerging economies

- Furthermore, advancements in agricultural practices, improved supply chain infrastructure, and the growing integration of digital trading platforms are enhancing market efficiency and price transparency, thereby accelerating agricultural commodity trade and overall market expansion

Agricultural Commodity Market Analysis

- Agricultural commodities refer to primary farm-based products such as grains, oilseeds, soft commodities, and fibers that are produced, traded, and consumed globally as essential inputs for food, feed, textile, and biofuel industries

- The growing demand for agricultural commodities is primarily supported by increasing food processing activities, rising livestock feed requirements, and expanding international trade, reinforcing the market’s critical role in global economic and food security systems

- North America dominated the agricultural commodity market with a share of 32.30% in 2025, due to large-scale commercial farming, advanced agricultural practices, and strong export demand for grains and oilseeds

- Asia-Pacific is expected to be the fastest growing region in the agricultural commodity market during the forecast period due to rapid population growth, rising food consumption, and expanding agricultural trade

- Corn segment dominated the market with a market share of 38.5% in 2025, due to its extensive use across food processing, animal feed, and biofuel production. Corn benefits from high global production volumes, strong government support in key producing regions, and consistent demand from ethanol manufacturers. Its price transparency and active participation in global commodity exchanges further strengthen its dominance

Report Scope and Agricultural Commodity Market Segmentation

|

Attributes |

Agricultural Commodity Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agricultural Commodity Market Trends

“Rising Adoption of Digital Agricultural Commodity Trading Platforms”

- A prominent trend in the agricultural commodity market is the increasing adoption of digital trading platforms that enable transparent price discovery, faster transactions, and improved market access for producers and buyers. These platforms are transforming traditional commodity trading by integrating real-time data, analytics, and digital contracts across global agricultural supply chains

- For instance, platforms operated by organizations such as CME Group and Intercontinental Exchange facilitate digital trading of agricultural commodities including corn, wheat, and soybeans, allowing participants to manage risk and execute trades with greater efficiency. These platforms enhance market transparency and support informed decision-making across volatile commodity environments

- The use of digital platforms is expanding among large agribusiness firms as they seek streamlined procurement and distribution of agricultural commodities. This shift supports improved coordination between farmers, traders, and processors while reducing dependency on manual trading processes

- Small and medium-scale farmers are increasingly gaining access to broader markets through digital commodity exchanges and agri-tech platforms. This trend is improving price realization and reducing the influence of intermediaries in agricultural commodity transactions

- The integration of data analytics and forecasting tools within digital trading platforms is supporting better supply-demand assessment and inventory planning. This capability is strengthening risk management practices and improving market responsiveness to changing conditions

- The growing reliance on digital trading solutions is reinforcing the modernization of agricultural commodity markets worldwide. This transition is positioning digital platforms as essential infrastructure for efficient, transparent, and scalable agricultural commodity trading systems

Agricultural Commodity Market Dynamics

Driver

“Increasing Global Food Demand and Population Growth”

- Rising global population levels and changing dietary patterns are driving sustained demand for agricultural commodities across cereals, oilseeds, and soft commodities. This demand is intensifying production, trade, and investment activities throughout global agricultural value chains

- For instance, organizations such as Archer Daniels Midland and Cargill play a major role in sourcing, processing, and distributing large volumes of agricultural commodities to meet growing global food requirements. Their extensive supply networks support consistent availability of staple commodities across international markets

- Urbanization and income growth in emerging economies are increasing consumption of food products that rely heavily on agricultural raw materials. This is expanding demand for grains, edible oils, and feed crops used in livestock production

- Governments and international agencies are strengthening food security initiatives to ensure stable agricultural commodity supplies for expanding populations. These efforts are supporting increased cultivation, trade facilitation, and storage capacity development

- The continuous growth in global food requirements is reinforcing this driver as a core force shaping agricultural commodity market expansion. Population growth remains a long-term factor influencing production planning, pricing, and trade dynamics across the sector

Restraint/Challenge

“Price Volatility Due to Climate and Geopolitical Uncertainties”

- The agricultural commodity market faces significant challenges from price volatility caused by unpredictable climate conditions and geopolitical disruptions. Extreme weather events and trade policy shifts create uncertainty in supply levels and pricing stability across key commodities

- For instance, organizations such as the Food and Agriculture Organization of the United Nations have reported sharp price fluctuations in global grain markets linked to droughts, floods, and regional conflicts affecting major producing regions. These disruptions impact availability and increase volatility for producers and buyers

- Climate-related risks such as changing rainfall patterns and temperature extremes are affecting crop yields and production consistency. This variability makes long-term pricing and supply forecasting more complex for market participants

- Geopolitical tensions and export restrictions imposed by producing countries can disrupt international agricultural commodity flows. Such actions create sudden supply shortages and trigger price spikes in global markets

- The ongoing exposure to climate and geopolitical uncertainties continues to restrain market stability and predictability. Managing price volatility remains a critical challenge influencing risk management strategies and overall confidence in agricultural commodity markets

Agricultural Commodity Market Scope

The market is segmented on the basis of product, trading, and end user.

• By Product

On the basis of product, the agricultural commodity market is segmented into soybeans, corn, wheat, rice, cocoa, coffee, cotton, spices, and other products. The corn segment dominated the largest market revenue share of 38.5% in 2025, driven by its extensive use across food processing, animal feed, and biofuel production. Corn benefits from high global production volumes, strong government support in key producing regions, and consistent demand from ethanol manufacturers. Its price transparency and active participation in global commodity exchanges further strengthen its dominance. In addition, corn’s role as a raw material for starches, sweeteners, and industrial derivatives supports steady trade volumes. The availability of advanced farming technologies and high-yield seed varieties also contributes to sustained supply stability.

The soybeans segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for plant-based proteins and edible oils. Soybeans are increasingly used in food products, livestock feed, and biodiesel, expanding their application base. Growing health awareness and the shift toward vegetarian and vegan diets are boosting soybean consumption globally. Trade expansion in emerging economies and favorable export demand further support rapid growth. Continuous improvements in soybean processing and crushing capacity also enhance market momentum.

• By Trading

On the basis of trading, the agricultural commodity market is segmented into online and offline channels. The offline segment accounted for the largest market revenue share in 2025, supported by the traditional dominance of physical commodity exchanges, brokers, and wholesale trading networks. Many large-scale buyers and producers rely on established offline channels for bulk transactions, quality inspection, and price negotiation. Offline trading offers better risk assessment through personal relationships and on-ground verification. It also remains preferred in regions with limited digital infrastructure. Regulatory familiarity and long-standing trading practices further reinforce its dominance.

The online trading segment is expected to grow at the fastest rate during the forecast period, driven by increasing digitalization of commodity exchanges and trading platforms. Online channels offer greater price transparency, faster execution, and broader market access for buyers and sellers. The adoption of real-time data analytics and digital contracts enhances trading efficiency. Small and medium participants benefit from reduced transaction costs and easier market entry. Growing internet penetration and fintech integration are accelerating this shift.

• By End User

On the basis of end user, the agricultural commodity market is segmented into business to business and business to consumer. The business to business segment dominated the market in 2025, owing to large-volume procurement by food processors, exporters, manufacturers, and institutional buyers. B2B transactions form the backbone of global agricultural trade, supporting supply chains across food, textile, and energy industries. Long-term contracts and bulk purchasing provide pricing stability and predictable demand. Strong logistics networks and established supplier relationships further drive this segment. Industrial-scale consumption ensures consistent trade flows.

The business to consumer segment is projected to witness the fastest growth from 2026 to 2033, supported by the expansion of direct-to-consumer platforms and branded agricultural products. Consumers increasingly prefer traceable, packaged, and quality-certified commodities. E-commerce platforms and modern retail channels enable producers to directly reach end users. Rising disposable income and awareness of product origin support this trend. The shift toward premium and specialty agricultural products further accelerates growth.

Agricultural Commodity Market Regional Analysis

- North America dominated the agricultural commodity market with the largest revenue share of 32.30% in 2025, driven by large-scale commercial farming, advanced agricultural practices, and strong export demand for grains and oilseeds

- The region benefits from well-established commodity exchanges, efficient logistics infrastructure, and high adoption of mechanized and precision agriculture

- Stable government support programs, extensive storage facilities, and strong participation of agribusiness corporations further reinforce North America’s leading position across global agricultural trade

U.S. Agricultural Commodity Market Insight

The U.S. agricultural commodity market accounted for the largest revenue share within North America in 2025, supported by high production of corn, soybeans, and wheat. The country’s dominance is driven by advanced farming technologies, strong export competitiveness, and active futures trading on major commodity exchanges. Robust domestic demand from food processing, biofuel, and livestock feed industries further strengthens market performance. Continuous innovation in crop yield optimization and supply chain efficiency continues to support long-term growth.

Europe Agricultural Commodity Market Insight

The Europe agricultural commodity market is projected to grow at a steady CAGR during the forecast period, driven by rising demand for sustainably sourced and high-quality agricultural products. Strong regulatory frameworks, emphasis on food security, and increasing adoption of modern farming techniques support market expansion. Cross-border trade within the region and consistent consumption of cereals, dairy-related feed crops, and specialty commodities contribute to stable growth.

U.K. Agricultural Commodity Market Insight

The U.K. agricultural commodity market is anticipated to expand at a moderate CAGR, supported by steady demand for grains, oilseeds, and imported soft commodities such as coffee and cocoa. The country’s reliance on structured import channels and commodity trading hubs supports market activity. Growing focus on supply chain transparency and food quality standards continues to shape trading dynamics.

Germany Agricultural Commodity Market Insight

The Germany agricultural commodity market is expected to register consistent growth during the forecast period, driven by strong demand from food processing, brewing, and livestock feed industries. Germany’s emphasis on efficiency, sustainable farming, and well-organized distribution networks supports stable commodity flows. The country also plays a key role in intra-European agricultural trade.

Asia-Pacific Agricultural Commodity Market Insight

The Asia-Pacific agricultural commodity market is expected to grow at the fastest CAGR from 2026 to 2033, driven by rapid population growth, rising food consumption, and expanding agricultural trade. Increasing urbanization and income growth are boosting demand for staple crops and soft commodities. The region’s growing role as both a major producer and consumer of agricultural commodities supports accelerated market expansion.

China Agricultural Commodity Market Insight

The China agricultural commodity market held the largest revenue share in Asia Pacific in 2025, driven by high domestic consumption of rice, corn, wheat, and soybeans. Strong government focus on food security, large-scale imports, and modernization of agricultural supply chains support market growth. China’s extensive processing capacity and expanding livestock sector continue to drive demand.

Japan Agricultural Commodity Market Insight

The Japan agricultural commodity market is experiencing steady growth due to consistent demand for imported grains, oilseeds, and soft commodities. Limited arable land and high dependence on imports shape market dynamics. Strong quality standards, stable consumption patterns, and efficient logistics infrastructure support sustained commodity trade across the country.

Agricultural Commodity Market Share

The agricultural commodity industry is primarily led by well-established companies, including:

- Barry Callebaut (Switzerland)

- Marubeni Corporation (Japan)

- CHS Inc. (U.S.)

- Olam International Limited (Singapore)

- Grupo Bimbo (Mexico)

- Gunvor Group (Switzerland)

- Adecoagro S.A. (Luxembourg)

- Cargill Inc. (U.S.)

- Itochu Corporation (Japan)

- Viterra Ltd. (Canada)

- Fresh Del Monte Produce Inc. (U.S.)

- Sucafina S.A. (Switzerland)

- COFCO International (China)

- Richardson International Ltd. (Canada)

- Smithfield Foods Inc. (U.S.)

- Nidera B.V. (Netherlands)

- Wilmar International Limited (Singapore)

- Glencore plc (Switzerland)

- Devex S.A. (Argentina)

- Oetker Group (Germany)

- Bunge Limited (U.S.)

- BrasilAgro (Brazil)

- Archer Daniels Midland Company (U.S.)

- Ecom Agroindustrial Corp. (Switzerland)

- Louis Dreyfus Company B.V. (Netherlands)

Latest Developments in Global Agricultural Commodity Market

- In October 2025, India expanded the National Agriculture Market (e-NAM) platform by incorporating nine additional agricultural commodities, significantly strengthening digital market integration across multiple states. This expansion improved nationwide price discovery by reducing regional price disparities and increasing real-time visibility of commodity prices. It also enhanced farmer participation by enabling access to a wider buyer base, leading to improved farm-gate realizations. For traders and processors, the move supported higher transaction volumes and smoother inter-state commodity flows, reinforcing organized agricultural trade in India

- In September 2025, Bunge Global SA completed the acquisition of selected soy-related assets from International Flavors & Fragrances (IFF), expanding its footprint in soy protein and lecithin processing. This development strengthened Bunge’s downstream presence in value-added agricultural commodities, allowing greater control over processing and supply chains. The acquisition supported rising demand for plant-based food ingredients and industrial soy applications. It also enhanced Bunge’s ability to capture higher margins while stabilizing raw soybean procurement

- In July 2025, Bartlett finalized its acquisition of Ceres Global Ag Corp., significantly expanding grain storage, handling, and merchandising capacity across the U.S. and Canada. This acquisition improved logistical efficiency and reduced bottlenecks in grain movement, particularly for wheat and corn. Enhanced infrastructure supported faster turnaround times and more reliable supply to domestic and export markets. The move strengthened Bartlett’s competitive position in North American agricultural commodity trading

- In June 2025, DeHaat acquired AgriCentral from Olam Agri, integrating a large base of smallholder farmers into its digital agriculture ecosystem. This development improved farmer access to market prices, input advisory, and demand forecasting tools. By strengthening digital linkages between farmers and buyers, the acquisition supported more structured commodity aggregation and reduced reliance on informal trading channels. It also contributed to improved supply predictability for key crops in the Indian agricultural commodity market

- In April 2025, Kumiai Chemical Industry Co., Ltd., in partnership with Valent U.S.A. LLC, progressed the commercialization of Effeeda herbicide for rice cultivation in the U.S. This product development supported better weed control and yield stability for rice farmers. Improved crop productivity contributed to more consistent rice supply levels, which is critical for price stability in rice trading. The advancement indirectly reinforced the reliability of rice as a core agricultural commodity in both domestic and international markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.