Global Agricultural Films Market

Market Size in USD Billion

CAGR :

%

USD

11.95 Billion

USD

19.49 Billion

2025

2033

USD

11.95 Billion

USD

19.49 Billion

2025

2033

| 2026 –2033 | |

| USD 11.95 Billion | |

| USD 19.49 Billion | |

|

|

|

|

Global Agricultural Films Market Size

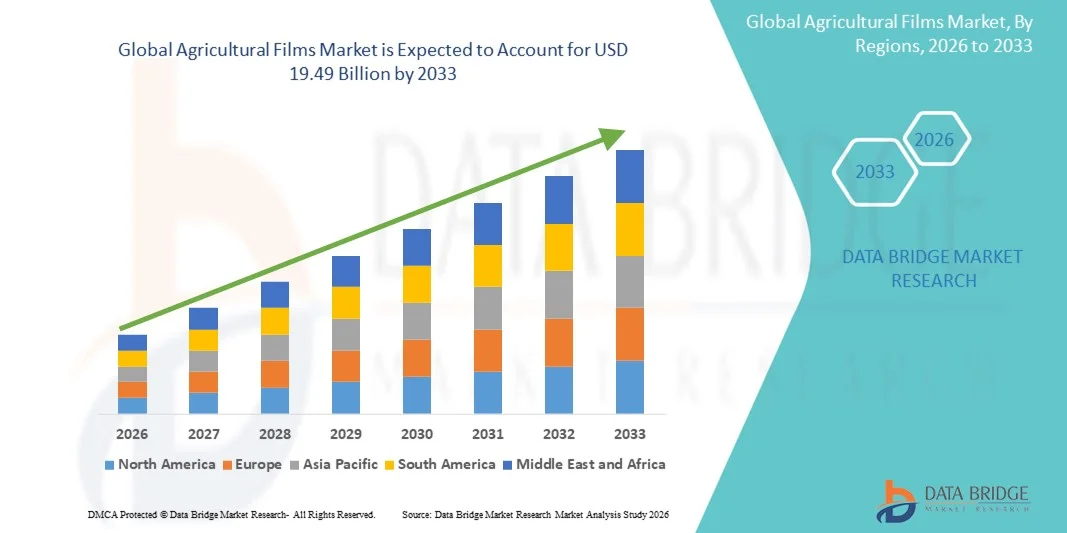

- The global Agricultural Films Market size was valued at USD 11.95 billion in 2025 and is expected to reach USD 19.49 billion by 2033, at a CAGR of 6.30% during the forecast period.

- The market growth is largely fueled by the increasing demand for enhanced crop yield and sustainable farming practices, driving the adoption of innovative agricultural films such as mulching, greenhouse, and silage films.

- Furthermore, advancements in biodegradable and UV-resistant film technologies, along with government initiatives supporting modern farming techniques, are promoting widespread use of agricultural films. These converging factors are accelerating market expansion, thereby significantly boosting the industry's growth.

Global Agricultural Films Market Analysis

- Agricultural films, including mulching, greenhouse, and silage films, are increasingly vital components of modern farming practices in both open-field and protected cultivation due to their ability to enhance crop yield, improve resource efficiency, and protect against environmental stressors.

- The escalating demand for agricultural films is primarily fueled by the adoption of advanced farming techniques, the growing focus on sustainable agriculture, and the need for higher productivity to meet the rising global food demand.

- Asia-Pacific dominated the Global Agricultural Films Market with the largest revenue share of 34.6% in 2025, characterized by the adoption of modern farming practices, high investment in agricultural technology, and a strong presence of key industry players, with the U.S. witnessing substantial growth in greenhouse and mulching film usage driven by innovations in biodegradable and UV-resistant materials.

- Europe is expected to be the fastest-growing region in the Global Agricultural Films Market during the forecast period due to increasing agricultural mechanization, government initiatives supporting modern farming, and rising demand for high-quality food products.

- The LLDPE segment dominated the market with the largest revenue share of 38.7% in 2025, driven by its excellent tensile strength, flexibility, and durability, making it ideal for greenhouse covers, mulching, and silage applications.

Report Scope and Global Agricultural Films Market Segmentation

|

Attributes |

Agricultural Films Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Berry Global Group (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Agricultural Films Market Trends

Enhanced Efficiency Through Smart and Sustainable Film Technologies

- A significant and accelerating trend in the global Agricultural Films Market is the deepening integration of advanced materials and smart farming technologies, including biodegradable films, UV-resistant coatings, and precision agriculture solutions. This combination is significantly enhancing crop yield, resource efficiency, and sustainability in modern farming practices.

- For instance, biodegradable mulching films not only reduce plastic waste but also naturally decompose into the soil, improving long-term soil health. Similarly, UV-resistant greenhouse films protect crops from excessive sunlight while maintaining optimal growing conditions.

- Integration with precision agriculture technologies enables features such as monitoring soil moisture, temperature, and crop growth to optimize the use of agricultural films. For example, some smart greenhouse systems use sensors and AI algorithms to control film shading, ventilation, and irrigation automatically, improving crop quality and reducing resource consumption.

- The seamless combination of agricultural films with modern farming systems facilitates centralized and efficient farm management. Through sensor-driven and automated processes, farmers can manage film application alongside irrigation, fertilization, and climate control, creating a more productive and sustainable agricultural ecosystem.

- This trend towards more intelligent, eco-friendly, and high-performance agricultural films is fundamentally reshaping expectations for modern farming. Consequently, companies such as Berry Global and Novamont are developing films with enhanced durability, biodegradability, and compatibility with precision farming technologies.

- The demand for agricultural films that offer smart, sustainable, and efficiency-enhancing features is growing rapidly across both commercial farms and small-scale operations, as farmers increasingly prioritize crop yield, environmental sustainability, and cost-effective farming solutions.

Global Agricultural Films Market Dynamics

Driver

Growing Need Due to Increasing Food Demand and Sustainable Farming Practices

- The rising global demand for food, coupled with the accelerating adoption of modern and sustainable farming techniques, is a significant driver for the heightened demand for agricultural films.

- For instance, in 2025, Novamont launched an advanced biodegradable mulching film designed to improve crop yield while reducing environmental impact. Such innovations by key companies are expected to drive the agricultural films market growth during the forecast period.

- As farmers face challenges such as water scarcity, climate variability, and soil degradation, agricultural films offer advanced features such as moisture retention, weed suppression, temperature regulation, and protection from pests, providing a compelling upgrade over traditional farming methods.

- Furthermore, the growing popularity of precision agriculture and smart farming technologies is making high-performance films an integral component of these systems, offering compatibility with automated irrigation, sensors, and climate control solutions.

- The ability to increase crop productivity, reduce resource consumption, and optimize farm operations are key factors propelling the adoption of agricultural films across both large-scale commercial farms and smallholder operations. Government incentives for sustainable agriculture and the trend towards eco-friendly farming solutions further contribute to market growth.

Restraint/Challenge

Concerns Regarding Environmental Impact and High Initial Costs

- Concerns surrounding the environmental impact of conventional plastic agricultural films pose a significant challenge to broader market adoption. Non-biodegradable films can accumulate in soil, leading to pollution and disposal issues.

- For instance, reports highlighting microplastic residues in agricultural lands have made some farmers hesitant to adopt traditional films, preferring biodegradable alternatives despite their higher cost.

- Addressing these environmental concerns through biodegradable, recyclable, and eco-friendly films is crucial for building farmer confidence. Companies such as Berry Global and BASF SE emphasize their sustainable product offerings and eco-certifications in marketing to reassure potential buyers. Additionally, the relatively high initial cost of advanced films, including UV-resistant, biodegradable, and sensor-integrated options, can be a barrier for price-sensitive farmers, particularly in developing regions or small-scale operations.

- While prices are gradually decreasing and government subsidies are encouraging adoption, the perceived premium for advanced agricultural films can still hinder widespread use, especially for those who do not immediately see the long-term benefits.

- Overcoming these challenges through sustainable product innovation, farmer education on environmental and productivity benefits, and the development of more cost-effective film solutions will be vital for sustained market growth.

Global Agricultural Films Market Scope

The agricultural films market is segmented on the basis of type and application.

- By Type

On the basis of type, the Global Agricultural Films Market is segmented into Linear Low-Density Polyethylene (LLDPE), Low-Density Polyethylene (LDPE), Reclaim, Ethylene-Vinyl Acetate (EVA), High-Density Polyethylene (HDPE), and Others. The LLDPE segment dominated the market with the largest revenue share of 38.7% in 2025, driven by its excellent tensile strength, flexibility, and durability, making it ideal for greenhouse covers, mulching, and silage applications. LLDPE films also provide superior light diffusion and resistance to tearing, contributing to improved crop yields and farm productivity. The market sees strong demand for LLDPE due to its adaptability to both open-field and protected cultivation systems, as well as compatibility with biodegradable and UV-resistant coatings.

The EVA segment is anticipated to witness the fastest growth rate of 22.5% from 2026 to 2033, fueled by increasing adoption in high-value crops and specialized greenhouse applications. EVA films offer superior clarity, elasticity, and thermal insulation properties, making them highly suitable for modern horticulture and precision farming.

- By Application

On the basis of application, the Global Agricultural Films Market is segmented into Greenhouse Film, Mulching Film, and Silage Film. The Mulching Film segment accounted for the largest market revenue share of 42.3% in 2025, driven by its widespread use in moisture retention, weed control, soil temperature regulation, and enhanced crop yield across diverse crops such as vegetables, fruits, and cash crops. Mulching films are increasingly adopted in both open-field and high-tech farming, as they support sustainable agriculture practices while reducing irrigation requirements.

The Greenhouse Film segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, fueled by rising greenhouse farming activities, demand for year-round crop production, and advancements in UV-resistant, anti-drip, and light-diffusing films. Greenhouse films improve microclimatic conditions, extend growing seasons, and enhance productivity for high-value crops, driving their rapid adoption in both developed and emerging markets.

Global Agricultural Films Market Regional Analysis

- Asia-Pacific dominated the Global Agricultural Films Market with the largest revenue share of 34.6% in 2025, driven by the early adoption of modern farming practices, high investment in agricultural technology, and strong government support for sustainable agriculture.

- Farmers and commercial growers in the region highly value the efficiency, durability, and crop protection offered by agricultural films such as LLDPE and mulching films, which enhance yield, reduce water consumption, and improve soil health.

- This widespread adoption is further supported by advanced greenhouse farming, precision agriculture technologies, and a strong presence of key industry players, establishing high-performance agricultural films as an essential solution for both large-scale commercial farms and specialized horticulture operations.

U.S. Agricultural Films Market Insight

The U.S. agricultural films market captured the largest revenue share of 38% in 2025 within North America, driven by the widespread adoption of modern farming practices and advanced greenhouse technologies. Farmers increasingly prioritize high-performance films such as LLDPE and EVA for crop protection, yield enhancement, and moisture conservation. The growing use of precision agriculture, combined with government subsidies for sustainable farming, further propels the agricultural films industry. Additionally, integration with smart irrigation and climate-control systems is significantly contributing to market expansion.

Europe Agricultural Films Market Insight

The Europe agricultural films market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict environmental regulations and the need for sustainable farming practices. Increased adoption of greenhouses, mulching, and silage films, along with advanced farming techniques, is fostering market growth. European farmers value high-quality, UV-resistant films that enhance crop productivity while reducing resource usage, particularly in commercial horticulture and high-value crop cultivation.

U.K. Agricultural Films Market Insight

The U.K. agricultural films market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the rising focus on sustainable agriculture and high-value horticulture. Concerns regarding soil health, crop yield optimization, and efficient water usage are encouraging the adoption of biodegradable, UV-resistant, and high-performance films. The country’s advanced agricultural infrastructure and government initiatives promoting eco-friendly practices continue to stimulate market growth.

Germany Agricultural Films Market Insight

The Germany agricultural films market is expected to expand at a considerable CAGR during the forecast period, driven by increasing awareness of sustainable farming practices and precision agriculture. Farmers in Germany prioritize advanced films for greenhouses, mulching, and silage, which improve crop protection and resource efficiency. Strong emphasis on innovation, environmental sustainability, and quality standards supports the adoption of technologically advanced agricultural films across commercial and specialized farms.

Asia-Pacific Agricultural Films Market Insight

The Asia-Pacific agricultural films market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising urbanization, increasing disposable incomes, and technological adoption in countries such as China, Japan, and India. The growing demand for greenhouse farming, high-value crops, and precision agriculture, supported by government initiatives, is driving the adoption of agricultural films. Additionally, APAC’s role as a manufacturing hub for advanced agricultural film materials is improving affordability and accessibility across the region.

Japan Agricultural Films Market Insight

The Japan agricultural films market is gaining momentum due to the country’s advanced farming technologies, high-value crop cultivation, and the growing adoption of greenhouse and mulching films. Japanese farmers prioritize films with superior light diffusion, thermal insulation, and durability, which enhance crop productivity. Additionally, the integration of films with smart farming practices and climate-control systems is fueling market growth in both commercial and small-scale operations.

China Agricultural Films Market Insight

The China agricultural films market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a growing population, and increasing demand for food security. The widespread adoption of greenhouse farming, mulching, and silage films supports higher crop yields and improved efficiency. Government initiatives promoting sustainable agriculture, coupled with strong domestic production capabilities, affordable high-quality films, and rising awareness among farmers, are key factors propelling the market in China.

Global Agricultural Films Market Share

The Agricultural Films industry is primarily led by well-established companies, including:

• Berry Global Group (U.S.)

• Uflex Ltd. (India)

• Toray Industries, Inc. (Japan)

• Innovia Films (U.K.)

• ExxonMobil Chemical (U.S.)

• BASF SE (Germany)

• Novamont S.p.A. (Italy)

• Mitsui Chemicals, Inc. (Japan)

• Dupont de Nemours, Inc. (U.S.)

• Futamura Group (Japan)

• RPC Group (U.K.)

• Clopay Plastic Products (U.S.)

• Jindal Poly Films Ltd. (India)

• Solvay S.A. (Belgium)

• Tekni-Plex, Inc. (U.S.)

• Asahi Kasei Corporation (Japan)

• Sealed Air Corporation (U.S.)

• Mondi Group (Austria)

• Polyplex Corporation Ltd. (India)

• Kaneka Corporation (Japan)

What are the Recent Developments in Global Agricultural Films Market?

- In April 2024, Berry Global Group, a global leader in engineered materials, launched a strategic initiative in South Africa aimed at promoting sustainable agricultural practices through its advanced greenhouse and mulching films. This initiative underscores the company’s dedication to delivering high-quality, durable films tailored to local farming conditions. By leveraging global expertise and cutting-edge product innovations, Berry Global is addressing regional agricultural challenges while reinforcing its position in the rapidly growing Global Agricultural Films Market.

- In March 2024, Uflex Ltd., a leading Indian polymer and packaging company, introduced a new range of biodegradable mulching films designed specifically for high-value crops and greenhouse cultivation. The innovative films aim to improve soil moisture retention, reduce plastic waste, and enhance crop yields, highlighting Uflex’s commitment to sustainable and technologically advanced agricultural solutions.

- In March 2024, Toray Industries, Inc. successfully deployed advanced EVA greenhouse films across multiple horticulture projects in Japan, aimed at improving crop quality and energy efficiency in controlled environments. The initiative demonstrates Toray’s focus on innovation and its contribution to the development of sustainable, high-performance agricultural films in both commercial and residential farming sectors.

- In February 2024, Innovia Films, a leader in specialty films, announced a strategic partnership with the European Association of Horticultural Producers to create a marketplace for high-performance mulching and silage films. This collaboration is designed to enhance efficiency, sustainability, and accessibility for farmers, highlighting Innovia’s commitment to improving operational effectiveness and advancing modern farming practices.

- In January 2024, ExxonMobil Chemical unveiled its new LLDPE-based greenhouse and mulching films at the Agritechnica 2024 Expo. These advanced films offer enhanced UV resistance, tear strength, and light diffusion, enabling farmers to optimize crop growth while reducing environmental impact. The launch reflects ExxonMobil’s dedication to integrating advanced polymer technology into agriculture, providing growers with reliable and high-performing solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.