Global Agricultural Implements Market

Market Size in USD Billion

CAGR :

%

USD

204.14 Billion

USD

315.68 Billion

2025

2033

USD

204.14 Billion

USD

315.68 Billion

2025

2033

| 2026 –2033 | |

| USD 204.14 Billion | |

| USD 315.68 Billion | |

|

|

|

|

Agricultural Implements Market Size

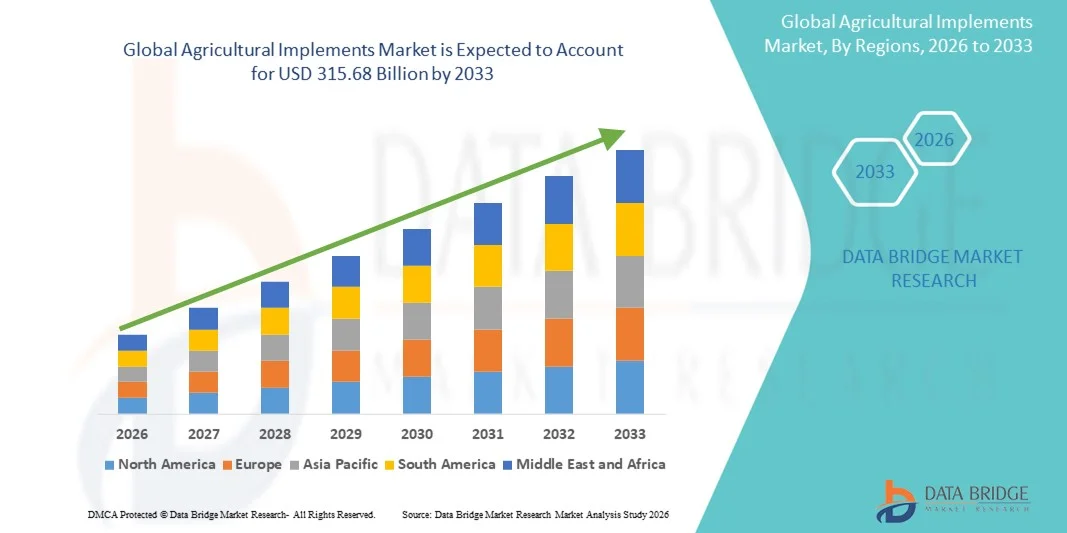

- The global agricultural implements market size was valued at USD 204.14 billion in 2025 and is expected to reach USD 315.68 billion by 2033, at a CAGR of 5.60% during the forecast period

- The market growth is largely fuelled by the rising mechanization of farming practices, technological advancements in precision agriculture, and increasing government support for modern agricultural equipment adoption

- Growing labor shortages in agriculture and the need for enhanced productivity are also propelling the demand for advanced implements such as tractors, harvesters, plows, and seed drills

Agricultural Implements Market Analysis

- The agricultural implements market is witnessing steady growth due to the shift from traditional manual farming to mechanized and efficient cultivation methods. The rising demand for high-yield crops and the growing emphasis on time-saving machinery are encouraging farmers to invest in advanced implements

- Manufacturers are increasingly focusing on automation, IoT integration, and energy-efficient machinery to cater to evolving agricultural needs and sustainability goals. The trend toward precision agriculture is also fostering demand for technologically enhanced implements that optimize resource utilization and crop output

- North America dominated the agricultural implements market with the largest revenue share in 2025, driven by the widespread mechanization of farming operations and the strong presence of leading agricultural machinery manufacturers

- Asia-Pacific region is expected to witness the highest growth rate in the global agricultural implements market, driven by expanding agricultural activities, technological advancements, and supportive government initiatives for farm mechanization

- The tractors segment held the largest market revenue share in 2025, driven by the growing mechanization of agriculture and the increasing demand for efficient land preparation and cultivation machinery. Tractors are widely used across both developed and developing economies due to their versatility, high power efficiency, and adaptability to various agricultural operations

Report Scope and Agricultural Implements Market Segmentation

|

Attributes |

Agricultural Implements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agricultural Implements Market Trends

Rising Adoption of Precision and Smart Farming Equipment

- The agricultural sector is rapidly shifting toward precision and smart farming technologies that optimize input use and enhance crop productivity. Farmers are increasingly adopting implements integrated with GPS, IoT sensors, and automation features to improve efficiency and reduce labor dependency. This trend is transforming conventional farming into a data-driven and technology-enabled practice, improving field management and operational accuracy across diverse crop types

- The growing need for real-time field monitoring and resource optimization is fueling demand for intelligent implements such as variable rate seeders, smart irrigation systems, and automated tractors. These tools enable farmers to make informed decisions, lower input costs, and achieve higher yields, especially in large-scale operations across developed economies. The expansion of connectivity solutions such as 5G and satellite-based systems is further enhancing the adoption of precision implements

- Precision farming adoption is supported by government subsidies, digital agriculture initiatives, and private investments in agritech startups. The integration of artificial intelligence and robotics into farm machinery is expected to further revolutionize field operations and maintenance practices. These technologies are enabling predictive analytics, autonomous navigation, and remote monitoring, improving productivity and reducing human error

- For instance, in 2024, several European nations implemented smart mechanization schemes to encourage the adoption of AI-based implements, resulting in increased productivity and reduced environmental impact through precision fertilizer and pesticide application. Such programs have also encouraged collaboration between technology providers and agricultural equipment manufacturers, enhancing innovation and market reach

- While the adoption of smart implements is gaining momentum, affordability and connectivity challenges in developing countries still limit large-scale implementation. Continued investment in cost-effective and adaptable technologies is necessary to expand the global precision farming footprint. The development of low-cost IoT devices and farmer training initiatives could further bridge the digital divide in agriculture

Agricultural Implements Market Dynamics

Driver

Mechanization of Agriculture and Labor Shortages in Developing Economies

- The growing mechanization of agriculture is a major driver of the agricultural implements market, as farmers seek to overcome challenges associated with manual labor shortages. Implements such as tractors, harvesters, and tillage equipment are increasingly replacing traditional tools, enhancing operational efficiency and crop output. This mechanization reduces dependence on seasonal labor and helps meet growing food demand efficiently

- Rising rural-to-urban migration and an aging farming population have further intensified the demand for mechanized solutions. Countries such as India, China, and Brazil are witnessing accelerated adoption of mid-range and compact equipment suitable for small and medium-sized farms. These machines are designed to optimize land preparation, planting, and harvesting in regions with fragmented landholding patterns

- Government-backed initiatives, including financial aid programs and farm mechanization missions, are promoting the purchase of modern implements. These efforts aim to boost agricultural productivity, reduce dependence on manual labor, and ensure food security in emerging economies. Public-private partnerships and agricultural cooperatives are also facilitating collective ownership of machinery to improve accessibility

- For instance, in 2023, India’s Ministry of Agriculture launched a national farm mechanization subsidy scheme to improve access to modern implements, leading to a noticeable increase in equipment sales across major states. Similar initiatives in Southeast Asia and Africa have encouraged local manufacturing and technology transfer to strengthen domestic capabilities

- While mechanization continues to drive market expansion, stakeholders must focus on localized manufacturing, skill development, and efficient service networks to ensure long-term adoption and sustainability. Creating awareness through demonstration programs and operator training can further enhance utilization rates and operational efficiency

Restraint/Challenge

High Equipment Costs and Limited Access to Financing for Small Farmers

- The high initial investment required for agricultural implements poses a major challenge, especially for smallholder and marginal farmers in developing countries. Implements such as harvesters, planters, and precision sprayers are often beyond the financial reach of these groups without external assistance or credit access. This cost barrier limits modernization and prolongs dependence on manual or outdated farming techniques

- Limited access to affordable financing and leasing options restricts adoption, particularly in rural regions with underdeveloped banking infrastructure. Many farmers still depend on traditional tools, resulting in lower efficiency and productivity compared to mechanized alternatives. Financial institutions often hesitate to lend to farmers due to perceived risks and lack of credit history

- Maintenance and repair costs further add to the financial burden, as spare parts and skilled service providers are often unavailable in remote areas. This creates downtime and affects equipment lifespan, deterring investment in advanced machinery. The absence of reliable after-sales services also reduces user confidence, impacting repeat purchases

- For instance, in 2024, agricultural cooperatives in Sub-Saharan Africa reported that less than 30% of small-scale farmers could access financing for new implements due to high interest rates and lack of collateral. Such constraints limit technology diffusion, particularly in regions dependent on rain-fed and subsistence farming

- To overcome these barriers, governments and manufacturers are promoting shared equipment models, rental programs, and low-cost innovation strategies that can enhance affordability and accelerate mechanization in developing regions. The establishment of rural machinery hubs and digital finance platforms is also improving accessibility and fostering inclusive growth

Agricultural Implements Market Scope

The market is segmented on the basis of product, application, automation, distributional channel, and business.

- By Product

On the basis of product, the agricultural implements market is segmented into tractors, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment, and others. The tractors segment held the largest market revenue share in 2025, driven by the growing mechanization of agriculture and the increasing demand for efficient land preparation and cultivation machinery. Tractors are widely used across both developed and developing economies due to their versatility, high power efficiency, and adaptability to various agricultural operations.

The harvesting equipment segment is expected to witness the fastest growth rate from 2026 to 2033, fuelled by rising labor shortages and the growing need for time-efficient harvesting solutions. The increasing use of combine harvesters and crop-specific machines is improving productivity and reducing post-harvest losses, particularly in large-scale and commercial farming operations.

- By Application

On the basis of application, the agricultural implements market is segmented into land development & seed bed preparation, sowing and planting, weed cultivation, plant protection, harvesting and threshing, and post-harvest and agro processing. The land development & seed bed preparation segment held the largest revenue share in 2025, supported by the critical need for efficient soil management and land preparation to enhance crop yield. Implements such as ploughs, harrows, and levellers are extensively used for optimizing soil fertility and seedbed uniformity.

The harvesting and threshing segment is projected to witness the fastest growth rate from 2026 to 2033 due to the rising emphasis on reducing crop wastage and improving harvesting efficiency. Mechanized harvesting tools are increasingly preferred over manual methods to meet growing food demand and minimize labor dependency.

- By Automation

On the basis of automation, the agricultural implements market is segmented into automatic, semi-automatic, and manual. The semi-automatic segment held the largest market share in 2025, driven by its balance between affordability and operational efficiency, especially in developing economies with mid-sized farms. These implements require minimal technical expertise and are widely adopted due to their reliability and cost-effectiveness.

The automatic segment is expected to register the fastest growth rate from 2026 to 2033, supported by the rapid adoption of smart farming technologies and precision agriculture. The integration of IoT, AI, and GPS-based automation in equipment is enhancing productivity and enabling data-driven farming practices.

- By Distributional Channel

On the basis of distributional channel, the agricultural implements market is segmented into B2C and B2B. The B2B segment held the largest market share in 2025, attributed to bulk purchases by large-scale farms, cooperatives, and institutional buyers. Manufacturers and distributors are increasingly focusing on long-term supply partnerships and aftersales contracts to strengthen their business relationships.

The B2C segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising penetration of e-commerce platforms and the growing awareness among small and individual farmers. The availability of financing options and doorstep delivery is further encouraging direct purchases of implements.

- By Business

On the basis of business, the agricultural implements market is segmented into original equipment manufacturers (OEMs) and aftersales. The OEMs segment held the largest revenue share in 2025, driven by strong demand for new machinery and ongoing technological advancements in the design and functionality of implements. Leading manufacturers are expanding their product portfolios and enhancing production capabilities to cater to global demand.

The aftersales segment is projected to witness the fastest growth rate from 2026 to 2033, supported by the increasing need for maintenance, spare parts, and equipment upgrades. The growth of service networks and digital maintenance platforms is helping improve operational uptime and customer satisfaction in the agricultural sector.

Agricultural Implements Market Regional Analysis

- North America dominated the agricultural implements market with the largest revenue share in 2025, driven by the widespread mechanization of farming operations and the strong presence of leading agricultural machinery manufacturers

- The region’s advanced technological infrastructure and high adoption of precision farming systems are further enhancing productivity and operational efficiency across large-scale farms

- Supportive government initiatives, availability of financing options, and the integration of smart technologies in agricultural equipment have contributed to North America’s dominance in the global agricultural implements market

U.S. Agricultural Implements Market Insight

The U.S. agricultural implements market captured the largest revenue share in 2025 within North America, driven by extensive adoption of advanced mechanization, automation, and precision farming technologies. American farmers are increasingly utilizing GPS-enabled tractors, autonomous machinery, and data-driven tools to optimize yield and resource use. Moreover, strong manufacturer presence, coupled with robust R&D investments and favorable agricultural policies, continues to support equipment modernization across the country. The emphasis on sustainability and efficiency in farming practices is also propelling growth in the U.S. agricultural implements market.

Europe Agricultural Implements Market Insight

The Europe agricultural implements market is expected to witness significant growth from 2026 to 2033, primarily driven by the region’s strong focus on sustainable agriculture and technological innovation. The European Union’s green farming initiatives and subsidies for mechanization are fostering the adoption of energy-efficient and eco-friendly implements. Growing labor shortages and rising demand for high-yield, low-input farming methods are accelerating the shift toward automation and smart machinery. Europe is also witnessing increased use of robotics and AI in field operations, enhancing precision and productivity.

U.K. Agricultural Implements Market Insight

The U.K. agricultural implements market is projected to witness robust growth from 2026 to 2033, supported by modernization efforts and the government’s focus on agricultural efficiency and sustainability. Farmers are increasingly adopting advanced machinery to mitigate labor challenges and improve productivity across key crop sectors. The integration of digital tools and precision farming technologies is transforming the U.K.’s agriculture landscape, while strong trade networks and local innovation continue to boost demand for smart agricultural equipment.

Germany Agricultural Implements Market Insight

The Germany agricultural implements market is expected to witness notable growth from 2026 to 2033, fueled by its strong engineering base, emphasis on innovation, and focus on environmentally responsible farming practices. German manufacturers are leading advancements in automation, robotics, and sensor-based agricultural machinery. The nation’s large-scale farms and cooperative models support rapid technology deployment, while sustainability-driven policies encourage the use of energy-efficient and low-emission equipment. This makes Germany one of the key innovation hubs in the global agricultural implements market.

Asia-Pacific Agricultural Implements Market Insight

The Asia-Pacific agricultural implements market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing mechanization, expanding agricultural output, and favorable government initiatives in countries such as China, India, and Japan. The rising population and demand for food security are pushing farmers toward advanced tools and machinery. Subsidies, credit access programs, and local manufacturing initiatives are further enhancing affordability and accessibility of implements in the region. Asia-Pacific’s emerging agritech ecosystem is also contributing to the adoption of precision and automated equipment.

Japan Agricultural Implements Market Insight

The Japan agricultural implements market is expected to witness steady growth from 2026 to 2033, driven by technological advancement, an aging farming population, and a national focus on smart agriculture. Farmers are increasingly adopting autonomous tractors, robotic harvesters, and AI-integrated systems to enhance efficiency and address labor shortages. Japan’s leadership in automation and its emphasis on compact, high-performance implements tailored for small farmlands are strengthening its market position.

China Agricultural Implements Market Insight

The China agricultural implements market accounted for the largest market revenue share in Asia-Pacific in 2025, owing to the government’s large-scale rural modernization programs and strong domestic manufacturing capabilities. Rapid urbanization, combined with increasing mechanization in both small and large farms, is driving equipment demand. China’s policies promoting smart agriculture, coupled with technological integration and export expansion, are boosting the production and adoption of modern implements. The availability of affordable, high-quality domestic machinery continues to reinforce China’s leadership in the regional market.

Agricultural Implements Market Share

The Agricultural Implements industry is primarily led by well-established companies, including:

• AGCO Corporation (U.S.)

• BIA (Belgium)

• Atespar (Turkey)

• APV GmbH (Austria)

• Bellota Agrisolutions (Spain)

• CLAAS KGaA mbH (Germany)

• CNH Industrial (U.K.)

• Escorts Limited (India)

• HORSCH (Germany)

• ISEKI & Co., Ltd. (Japan)

• JCB (U.K.)

• Deere & Company (U.S.)

• KLEVER Company (Russia)

• KRUKOWIAK (Poland)

• KUBOTA Corporation (Japan)

• KUHN SAS (France)

• Kverneland AS (Norway)

• LEMKEN GmbH & Co. KG (Germany)

• Mahindra & Mahindra Ltd. (India)

• Tractors and Farm Equipment Limited (India)

• Valmont Industries, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.