Global Agricultural Micronutrients Market

Market Size in USD Billion

CAGR :

%

USD

6.39 Billion

USD

13.03 Billion

2024

2032

USD

6.39 Billion

USD

13.03 Billion

2024

2032

| 2025 –2032 | |

| USD 6.39 Billion | |

| USD 13.03 Billion | |

|

|

|

|

Agriculture Micronutrients Market Size

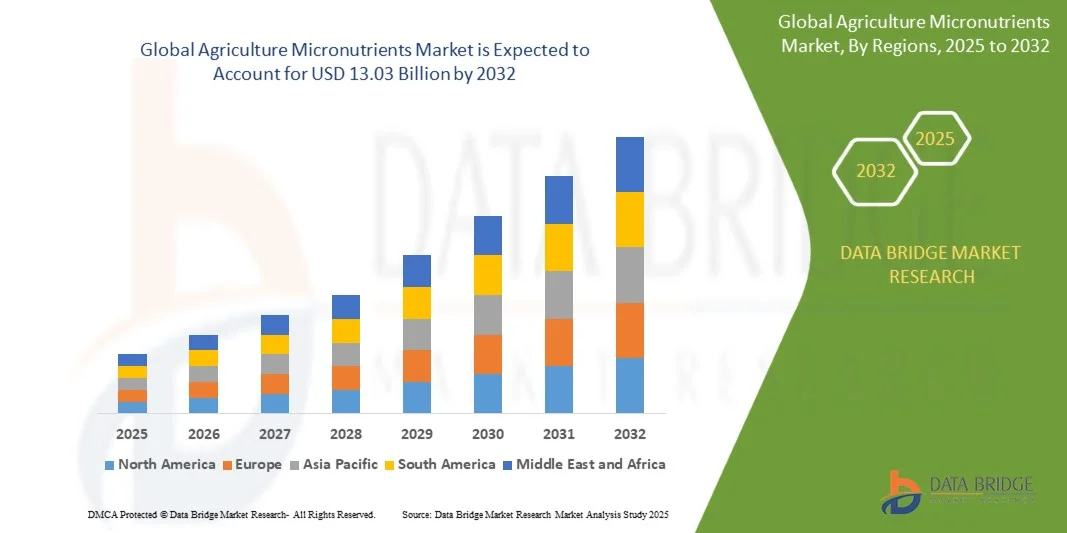

- The global agriculture micronutrients market was valued at USD 6.39 billion in 2024 and is expected to reach USD 13.03 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.30%, primarily driven by escalating global demand for increased and higher-quality food production

- This growth is driven by growing population and shifting dietary habits

Agriculture Micronutrients Market Analysis

- Agriculture micronutrients have gained widespread popularity due to the rising need for high crop yields, growing soil nutrient deficiencies, and an increasing focus on sustainable farming. These essential elements play a crucial role in improving plant growth, enhancing soil fertility, and boosting crop productivity

- The market is primarily driven by the expansion of precision agriculture, growing awareness among farmers, and advancements in micronutrient formulations. In addition, government initiatives promoting the adoption of fortified fertilizers are further accelerating market growth

- Asia-Pacific dominates the agriculture micronutrients market due to its large agricultural sector, high population-dependent farming, and increasing adoption of advanced fertilizers to combat soil nutrient deficiencies

- For instance, in India and China, farmers are increasingly using micronutrient-enriched fertilizers to enhance crop productivity and counteract soil depletion, contributing to sustained market expansion

- Globally, agriculture micronutrients remain essential in modern farming, with key innovations such as slow-release formulations, nano-based fertilizers, and customized nutrient blends driving industry transformation and supporting the shift toward sustainable agriculture

Report Scope and Agriculture Micronutrients Market Segmentation

|

Attributes |

Agriculture Micronutrients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Agriculture Micronutrients Market Trends

“Rising Adoption of Chelated Micronutrients in Precision Farming”

- The increasing integration of precision farming techniques is driving demand for chelated micronutrients, which offer higher nutrient absorption and efficient crop uptake

- Farmers are shifting towards chelated formulations due to their enhanced solubility, ability to prevent nutrient leaching, and improved plant bioavailability

- The growing need for high-yield crop production and sustainable agriculture practices is further accelerating the adoption of chelated micronutrients worldwide

For instance

- In September 2023, the European Commission introduced incentives for farmers adopting chelated micronutrients, promoting sustainable farming and higher crop efficiency

- In June 2023, Yara International launched a new line of chelated micronutrient fertilizers, designed to optimize nutrient uptake in diverse soil conditions

- In April 2022, the China Agricultural Ministry reported a 15% increase in the use of chelated micronutrients, particularly in high-value crops such as fruits and vegetables

- As precision agriculture continues to expand, the demand for chelated micronutrients will rise, ensuring better crop productivity, efficient nutrient utilization, and sustainable soil management

Agriculture Micronutrients Market Dynamics

Driver

“Growing Soil Nutrient Deficiency Driving Demand for Agriculture Micronutrients”

- The increasing depletion of essential soil nutrients due to intensive farming practices is a major driver of the agriculture micronutrients market

- Farmers are adopting micronutrient-enriched fertilizers to replenish deficient soils, improve crop yields, and maintain soil health for sustainable agriculture

- Governments and agricultural organizations are promoting the use of micronutrients to combat soil degradation and enhance food security

For instance

- In July 2023, the Food and Agriculture Organization (FAO) reported that over 30% of global agricultural soils suffer from micronutrient deficiencies, urging increased use of fortified fertilizers

- In March 2023, the Indian Ministry of Agriculture launched a subsidy program to promote the use of micronutrient-based fertilizers, addressing soil deficiencies in key agricultural regions

- In October 2022, the U.S. Department of Agriculture (USDA) introduced grants for farmers adopting micronutrient-enriched soil management practices to improve productivity

- As soil depletion continues to impact global agricultural output, the demand for agriculture micronutrients is expected to grow significantly, ensuring higher crop yields and long-term soil sustainability

Opportunity

“Expanding Use of Micronutrients in Organic and Sustainable Farming”

- The growing shift toward organic farming is creating significant demand for micronutrient-based fertilizers, as farmers seek natural soil enrichment solutions

- Governments worldwide are promoting sustainable agriculture through subsidies and incentives, encouraging the use of micronutrient-enriched bio fertilizers

- The rising consumer preference for chemical-free, organic produce is further driving the adoption of micronutrient-based fertilizers in certified organic farming

For instance,

- In October 2023, the U.S. Department of Agriculture (USDA) announced a USD 500 million investment to support organic farming practices, including micronutrient-based soil enrichment programs

- In August 2023, India's Ministry of Agriculture launched an initiative to expand organic farming zones, promoting the use of bio-based micronutrients to enhance soil fertility and crop yield

- In March 2022, European Union policymakers introduced regulations supporting the adoption of micronutrient-fortified bio fertilizers, aiming to reduce chemical fertilizer dependency by 2030

- With the global push for sustainable agriculture, micronutrient-based fertilizers will witness increasing adoption, ensuring enhanced soil health, higher crop productivity, and long-term agricultural sustainability

Restraint/Challenge

“Fluctuating Raw Material Prices and Supply Chain Disruptions”

- The agriculture micronutrients market is facing challenges due to fluctuating raw material prices, affecting the cost-effectiveness of micronutrient fertilizers

- Supply chain disruptions, caused by geopolitical tensions and trade restrictions, have led to inconsistent availability of key micronutrients such as zinc, boron, and iron

- Farmers in developing regions struggle with high costs and limited access to quality micronutrient fertilizers, impacting crop yield and soil health

For instance,

- In January 2024, the World Bank reported a 15% surge in zinc and boron prices, driven by global mining restrictions and increased demand from the agriculture and industrial sectors

- In November 2023, China, a major producer of agricultural micronutrients, restricted exports of key fertilizers, causing global supply shortages and price hikes

- In May 2022, the Russia-Ukraine conflict disrupted fertilizer trade routes, leading to higher transportation costs and reduced availability of micronutrient fertilizers in Europe and Asia

- Unless alternative sourcing strategies and local production initiatives are strengthened, the agriculture micronutrients Market may continue to face price volatility, supply chain uncertainties, and accessibility challenges

Agriculture Micronutrients Market Scope

The market is segmented on the basis of type, crop type, form, and mode of application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Crop Type |

|

|

By Form |

|

|

By Mode of Application |

|

Agriculture Micronutrients Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Agriculture Micronutrients Market”

- Asia-Pacific holds the largest market share in the global agriculture micronutrients market, driven by expanding agricultural activities, increasing soil deficiencies, and the rising adoption of high-yield farming techniques

- China, India, and Japan lead the region due to their growing demand for food production, government initiatives for soil health improvement, and expanding use of micronutrient-enriched fertilizers

- The availability of advanced soil testing technologies and a growing focus on sustainable farming practices have further fueled market expansion

- In addition, the rising need for high-quality crops, increasing awareness among farmers, and expanding agrochemical distribution networks contribute to the growth of agriculture micronutrients across Asia-Pacific

“North America is projected to register the Highest Growth Rate”

- North America is expected to witness the highest growth rate in the agriculture micronutrients market, driven by rising adoption of precision farming, growing awareness of soil nutrient deficiencies, and increasing demand for high-yield crops

- The U.S. and Canada are emerging as key markets due to technological advancements in fertilizer application, strong government support for sustainable agriculture, and the expanding presence of agrochemical companies

- The U.S. leads the region in micronutrient adoption, with a growing emphasis on soil testing and customized nutrient management solutions to enhance crop productivity

- Canada is experiencing strong market growth due to expanding organic farming practices, rising demand for fortified fertilizers, and supportive agricultural policies promoting sustainable farming

- The rising use of chelated micronutrients, investments in research for advanced formulations, and expanding distribution networks further contribute to the strong market expansion across North America

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- CHR. Hansen A/S (Denmark)

- Lallemand Inc. (Canada)

- Novus International Inc. (U.S.)

- DSM (Netherlands)

- BASF (Germany)

- Alltech (U.S.)

- ADM (U.S.)

- Charoen Pokphand Foods PCL (Thailand)

- Associated British Foods plc (U.K.)

- Cargill Incorporated (U.S.)

- UPSIDE Foods (U.S.)

- MosaMeat (Netherlands)

- Integriculture Inc. (Japan)

- Aleph Farms (Israel)

- Finless Foods Inc. (U.S.)

- AVANTMEATS (China)

- Balletic Inc. (U.S.)

Latest Developments in Global Agriculture Micronutrients Market

- In October 2021, Grupa Azoty introduced its 2021-2030 strategy, with Green Azoty as the flagship initiative. This project aimed at decarbonization and lowering carbon emissions by implementing R&D projects aligned with the European Green Deal. The company's research and development efforts would focus on climate neutrality goals and new formulations enriched with micronutrients derived from waste streams

- In April 2021, Compass Minerals announced a definitive agreement with Koch Agronomic Service (LLP) Koch, a subsidiary of Koch Industries, to sell its North American micronutrient assets for approximately USD 60.25 million

- In March 2021, The Mosaic Company and Sound Agriculture revealed their strategic collaboration to introduce innovative nutrient-efficient fertilizer products. These products were designed to enhance crop yields and improve soil health using a unique combination of bio-inspired chemistry and essential micronutrients

- In March 2021, Coromandel International Limited launched GroShakti Plus, a new fertilizer formulated for cereals, pulses, oilseeds, and various fruits and vegetables. The fertilizer was developed to enhance root development through phosphorus and improve plant resistance with zinc

- In January 2021, Commoditag expanded its plant nutrition segment by introducing products from its new supplier, DeltaAg. The newly added products featured a variety of stage-specific formulas and micronutrient solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL AGRICULTURE MICRONUTRIENTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL AGRICULTURE MICRONUTRIENTS MARKETSIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 DEMAND AND SUPPLY-SIDE VARIABLES

2.2.8 TOP TO BOTTOM ANALYSIS

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 VALUE CHAIN ANALYSIS

5.2 SUPPLY CHAIN ANALYSIS

5.3 IMPORT-EXPORT ANALYSIS

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 BARGAINING POWER OF SUPPLIERS

5.4.2 BARGAINING POWER OF BUYERS/CONSUMERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTE PRODUCTS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 RAW MATERIAL SOURCING ANALYSIS

5.6 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

5.7 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

5.8 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.9 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

5.1 SHOPPING BEHAVIOUR AND DYNAMICS

5.10.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.10.2 RESEARCH

5.10.3 IMPULSIVE

5.10.4 ADVERTISEMENT

5.11 PROMOTIONAL ACTIVITIES

5.12 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

5.13 NEW PRODUCT LAUNCH STRATEGY

5.13.1 NUMBER OF NEW PRODUCT LAUNCH

5.13.1.1. LLINE EXTENSTION

5.13.1.2. NNEW PACKAGING

5.13.1.3. RRE-LAUNCHED

5.13.1.4. NNEW FORMULATION

5.14 CONSUMER LEVEL TRENDS

5.15 MEETING CONSUMER REQUIREMENT

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING INDEX (PRICE AT B2B END & PRICES AT FOB)

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET, BY MICRONUTRIENT TYPE

11.1 OVERVIEW

11.2 ZINC

11.3 COPPER

11.4 MANGANESE

11.5 CHLORINE

11.6 MOLYBDENUM

11.7 BORON

11.8 IRON

11.9 OTHERS

12 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET, BY MODE OF APPLICATION

12.1 OVERVIEW

12.2 SOIL

12.3 FOLIAR

12.4 FERTIGATION

12.5 OTHERS (IF ANY)

13 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET, BY CATEGORY

13.1 OVERVIEW

13.2 CHELATED

13.3 NON-CHELATED

14 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET, BY CROP TYPE

14.1 OVERVIEW

14.2 OIL SEEDS

14.2.1 OIL SEEDS, BY TYPE

14.2.1.1. SOYBEAN

14.2.1.2. SUNFLOWER

14.2.1.3. CORN

14.2.1.4. PEANUT

14.2.1.5. COTTONSEED

14.2.1.6. FLAXSEED

14.2.1.7. OTHERS

14.2.2 OIL SEEDS, BY MICRONUTRIENT TYPE

14.2.2.1. ZINC

14.2.2.2. COPPER

14.2.2.3. MANGANESE

14.2.2.4. CHLORINE

14.2.2.5. MOLYBDENUM

14.2.2.6. BORON

14.2.2.7. IRON

14.2.2.8. OTHERS

14.3 PULSES

14.3.1 PULSES, BY TYPE

14.3.1.1. BLACK BEANS

14.3.1.2. PEAS

14.3.1.3. CHICKPEAS

14.3.1.4. OTHERS

14.3.2 PULSES, BY MICRONUTRIENT TYPE

14.3.2.1. ZINC

14.3.2.2. COPPER

14.3.2.3. MANGANESE

14.3.2.4. CHLORINE

14.3.2.5. MOLYBDENUM

14.3.2.6. BORON

14.3.2.7. IRON

14.3.2.8. OTHERS

14.4 CEREALS & GRAINS

14.4.1 CERELAS & GRAINS, BY TYPE

14.4.1.1. RICE

14.4.1.2. WHEAT

14.4.1.3. BARLEY

14.4.1.4. MILLET

14.4.1.5. OAT

14.4.1.6. SORGHUM

14.4.1.7. RYE

14.4.1.8. OTHERS

14.4.2 OCEREALS & GRAINS, BY MICRONUTRIENT TYPE

14.4.2.1. ZINC

14.4.2.2. COPPER

14.4.2.3. MANGANESE

14.4.2.4. CHLORINE

14.4.2.5. MOLYBDENUM

14.4.2.6. BORON

14.4.2.7. IRON

14.4.2.8. OTHERS

14.5 FRUITS

14.5.1 FRUITS, BY TYPE

14.5.1.1. APPLE & PEARS

14.5.1.2. CITRUS FRUITS

14.5.1.3. TROPICAL FRUITS

14.5.1.4. BERRIES

14.5.1.5. MELONS

14.5.1.6. OTHERS

14.5.2 FRUITS, BY MICRONUTRIENT TYPE

14.5.2.1. ZINC

14.5.2.2. COPPER

14.5.2.3. MANGANESE

14.5.2.4. CHLORINE

14.5.2.5. MOLYBDENUM

14.5.2.6. BORON

14.5.2.7. IRON

14.5.2.8. OTHERS

14.6 VEGETABLES

14.6.1 VEGETABLES, BY TYPE

14.6.1.1. LEAFY GREENS

14.6.1.2. CRUCIFEROUS VEGETABLES

14.6.1.3. MARROW VEGATBALES

14.6.1.4. ROOT VEGETABLES

14.6.1.5. ONION

14.6.1.6. GRALIC

14.6.1.7. OTHERS

14.6.2 VEGETABLES, BY MICRONUTRIENT TYPE

14.6.2.1. ZINC

14.6.2.2. COPPER

14.6.2.3. MANGANESE

14.6.2.4. CHLORINE

14.6.2.5. MOLYBDENUM

14.6.2.6. BORON

14.6.2.7. IRON

14.6.2.8. OTHERS

14.7 HORTICULTURE

14.7.1 HORTICULTURE, BY MICRONUTRIENT TYPE

14.7.1.1. ZINC

14.7.1.2. COPPER

14.7.1.3. MANGANESE

14.7.1.4. CHLORINE

14.7.1.5. MOLYBDENUM

14.7.1.6. BORON

14.7.1.7. IRON

14.7.1.8. OTHERS

14.8 TURN & ORNAMENTS

14.8.1 TURF & ORNAMENTS, BY MICRONUTRIENT TYPE

14.8.1.1. ZINC

14.8.1.2. COPPER

14.8.1.3. MANGANESE

14.8.1.4. CHLORINE

14.8.1.5. MOLYBDENUM

14.8.1.6. BORON

14.8.1.7. IRON

14.8.1.8. OTHERS

15 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS & PARTNERSHIP

15.8 REGULATORY CHANGES

16 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET, BY GEOGRAPHY

16.1 OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

16.2 NORTH AMERICA

16.2.1 U.S.

16.2.2 CANADA

16.2.3 MEXICO

16.3 EUROPE

16.3.1 GERMANY

16.3.2 U.K.

16.3.3 ITALY

16.3.4 FRANCE

16.3.5 SPAIN

16.3.6 SWITZERLAND

16.3.7 NETHERLANDS

16.3.8 BELGIUM

16.3.9 RUSSIA

16.3.10 TURKEY

16.3.11 REST OF EUROPE

16.4 ASIA-PACIFIC

16.4.1 JAPAN

16.4.2 CHINA

16.4.3 SOUTH KOREA

16.4.4 INDIA

16.4.5 AUSTRALIA

16.4.6 SINGAPORE

16.4.7 THAILAND

16.4.8 INDONESIA

16.4.9 MALAYSIA

16.4.10 PHILIPPINES

16.4.11 REST OF ASIA-PACIFIC

16.5 SOUTH AMERICA

16.5.1 BRAZIL

16.5.2 ARGENTINA

16.5.3 REST OF SOUTH AMERICA

16.6 MIDDLE EAST AND AFRICA

16.6.1 SOUTH AFRICA

16.6.2 UAE

16.6.3 SAUDI ARABIA

16.6.4 KUWAIT

16.6.5 REST OF MIDDLE EAST AND AFRICA

17 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET, SWOT & DBMR ANALYSIS

18 GLOBAL AGRICULTURE MICRONUTRIENTS MARKET, COMPANY PROFILE

18.1 BASF SE

18.1.1 COMPANY OVERVIEW

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHICAL PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

19 AKZONOBEL (NOURYON)

19.1.1 COMPANY OVERVIEW

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHICAL PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 NUTRIEN LTD.

19.2.1 COMPANY OVERVIEW

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHICAL PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 NUFARM

19.3.1 COMPANY OVERVIEW

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHICAL PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 YARA INTERNATIONAL ASA

19.4.1 COMPANY OVERVIEW

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHICAL PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 COROMANDEL INTERNATIONAL LTD

19.5.1 COMPANY OVERVIEW

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHICAL PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 LAND O LAKES

19.6.1 COMPANY OVERVIEW

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHICAL PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENTS

19.7 HELENA CHEMICAL COMPANY

19.7.1 COMPANY OVERVIEW

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHICAL PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENTS

19.8 THE MOSAIC COMPANY

19.8.1 COMPANY OVERVIEW

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHICAL PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENTS

19.9 HAIFA GROUP

19.9.1 COMPANY OVERVIEW

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHICAL PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENTS

19.1 SAPEC S.A.

19.10.1 COMPANY OVERVIEW

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHICAL PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENTS

19.11 COMPASS MINERALS INTERNATIONAL

19.11.1 COMPANY OVERVIEW

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHICAL PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENTS

19.12 VALAGRO

19.12.1 COMPANY OVERVIEW

19.12.2 REVENUE ANALYSIS

19.12.3 GEOGRAPHICAL PRESENCE

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENTS

19.13 ZUARI AGROCHEMICALS LTD

19.13.1 COMPANY OVERVIEW

19.13.2 REVENUE ANALYSIS

19.13.3 GEOGRAPHICAL PRESENCE

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENTS

19.14 STOLLER ENTERPRISES INC

19.14.1 COMPANY OVERVIEW

19.14.2 REVENUE ANALYSIS

19.14.3 GEOGRAPHICAL PRESENCE

19.14.4 PRODUCT PORTFOLIO

19.14.5 RECENT DEVELOPMENTS

19.15 BALCHEM

19.15.1 COMPANY OVERVIEW

19.15.2 REVENUE ANALYSIS

19.15.3 GEOGRAPHICAL PRESENCE

19.15.4 PRODUCT PORTFOLIO

19.15.5 RECENT DEVELOPMENTS

19.16 ATP NUTRITION

19.16.1 COMPANY OVERVIEW

19.16.2 REVENUE ANALYSIS

19.16.3 GEOGRAPHICAL PRESENCE

19.16.4 PRODUCT PORTFOLIO

19.16.5 RECENT DEVELOPMENTS

19.17 BAICOR LC

19.17.1 COMPANY OVERVIEW

19.17.2 REVENUE ANALYSIS

19.17.3 GEOGRAPHICAL PRESENCE

19.17.4 PRODUCT PORTFOLIO

19.17.5 RECENT DEVELOPMENTS

19.18 CORTEVA INC

19.18.1 COMPANY OVERVIEW

19.18.2 REVENUE ANALYSIS

19.18.3 GEOGRAPHICAL PRESENCE

19.18.4 PRODUCT PORTFOLIO

19.18.5 RECENT DEVELOPMENTS

19.19 BMS MICRO-NUTRIENTS NV

19.19.1 COMPANY OVERVIEW

19.19.2 REVENUE ANALYSIS

19.19.3 GEOGRAPHICAL PRESENCE

19.19.4 PRODUCT PORTFOLIO

19.19.5 RECENT DEVELOPMENTS

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 RELATED REPORTS

21 CONCLUSION

22 QUESTIONNAIRE

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Agricultural Micronutrients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Agricultural Micronutrients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Agricultural Micronutrients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.