Global Agricultural Soil Stabilization Market

Market Size in USD Billion

CAGR :

%

USD

3.26 Billion

USD

4.74 Billion

2024

2032

USD

3.26 Billion

USD

4.74 Billion

2024

2032

| 2025 –2032 | |

| USD 3.26 Billion | |

| USD 4.74 Billion | |

|

|

|

|

What is the Global Agricultural Soil Stabilization Market Size and Growth Rate?

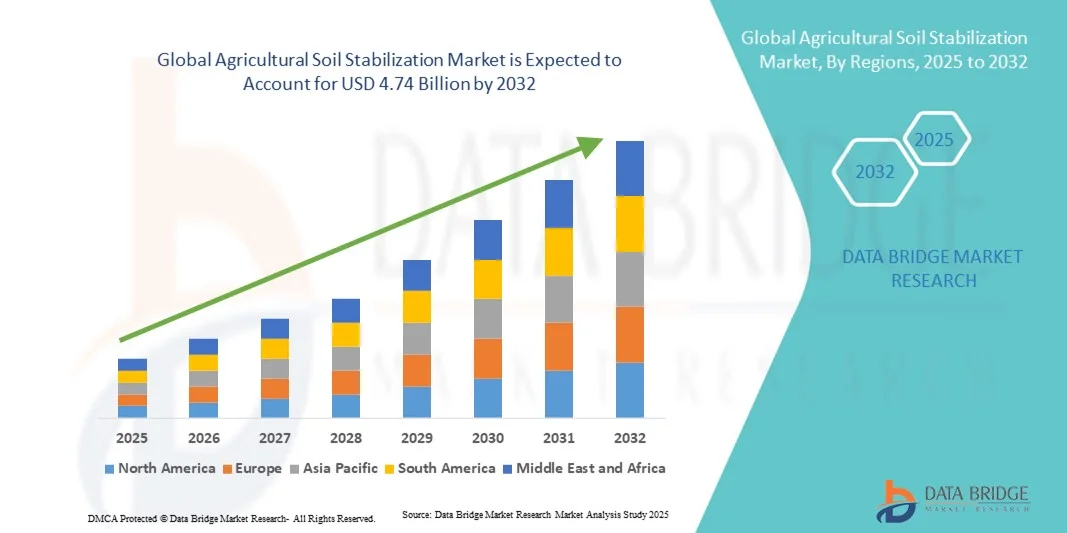

- The global agricultural soil stabilization market size was valued at USD 3.26 billion in 2024 and is expected to reach USD 4.74 billion by 2032, at a CAGR of 4.80% during the forecast period

- Growing number of construction and infrastructural activities, rapid urbanization across the globe, surging levels of investment by the government sector to develop dams, roadway network and other government institutes, increasing expansion of agricultural activities are some of the major and important factors which will such asly to boost the growth of the agricultural soil stabilization market

What are the Major Takeaways of Agricultural Soil Stabilization Market?

- Increasing number of technological research as well as development activities along with adoption of soil management which will further bring immense opportunities that will led to the growth of the agricultural soil stabilization market in the above mentioned projected timeframe

- High cost associated with the usages of stabilization equipment along with prevalence of established infrastructure in developed economies which will such asly to act as market restraints for the growth of the agricultural soil stabilization

- South America dominated the agricultural soil stabilization market with the largest revenue share of 39.5% in 2024, driven by the expanding agricultural sector, large-scale farming operations, and favorable government policies supporting sustainable soil management practices

- Asia-Pacific is poised to grow at the fastest CAGR of 7.3% during 2025–2032, driven by rapid urbanization, increasing agricultural mechanization, and rising investments in modern farming techniques in countries such as China, India, and Japan

- The chemical method segment dominated the market with the largest revenue share of 52% in 2024, driven by its superior efficiency in enhancing soil strength, reducing permeability, and controlling erosion across various soil types

Report Scope and Agricultural Soil Stabilization Market Segmentation

|

Attributes |

Agricultural Soil Stabilization Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agricultural Soil Stabilization Market?

Integration of Advanced Materials and Sustainable Techniques

- A significant and accelerating trend in the global agricultural soil stabilization market is the increasing adoption of advanced, eco-friendly materials and innovative stabilization techniques such as polymer-based binders, geosynthetics, and bio-enzymes. These solutions are enhancing soil durability, reducing maintenance costs, and improving long-term agricultural productivity

- For instance, companies such as Caterpillar and AB Volvo are introducing polymer-based stabilization systems for large-scale agricultural projects, enabling uniform soil compaction and better erosion control. Similarly, geotextile applications in soil stabilization are becoming mainstream for maintaining field integrity in flood-prone and highly irrigated zones

- Advanced stabilization techniques also allow precision control over soil moisture, compaction, and nutrient retention, which supports sustainable farming practices. For instance, polymer and enzyme-treated soils have shown higher load-bearing capacity and reduced runoff, benefiting crop yield and infrastructure longevity

- The seamless integration of these solutions with agricultural machinery and smart farming equipment facilitates centralized management of soil conditions, enhancing operational efficiency and resource utilization

- This trend toward environmentally conscious and technologically advanced soil stabilization methods is redefining user expectations for agricultural efficiency and sustainability. Companies such as Fayat Road Equipment are increasingly offering solutions that combine automation with material innovation to maximize performance

- The demand for innovative, eco-friendly, and high-performance Agricultural Soil Stabilization solutions is growing rapidly across both large-scale farms and commercial agricultural projects, as sustainability and productivity gains become critical decision drivers

What are the Key Drivers of Agricultural Soil Stabilization Market?

- Rising agricultural productivity demands and increasing government initiatives for sustainable land management are driving the adoption of advanced soil stabilization solutions

- For instance, in 2023, Global Road Technology International Holdings (HK) Limited announced initiatives to supply enzyme and polymer-based soil stabilization solutions to large-scale farmlands, expected to boost market growth significantly

- Soil stabilization improves soil structure, prevents erosion, enhances irrigation efficiency, and reduces long-term maintenance costs, making it an attractive solution for farms and agro-industrial projects

- The increasing mechanization of agriculture and adoption of smart farming equipment further support the need for stable and uniform soil conditions. Integration with precision agriculture systems enhances performance, providing actionable insights for soil management

- Accessibility to innovative stabilization materials, such as geosynthetics, polymers, and enzyme-based additives, alongside the trend toward sustainable and low-carbon farming practices, is fueling demand for Agricultural Soil Stabilization solutions in both emerging and developed markets

Which Factor is Challenging the Growth of the Agricultural Soil Stabilization Market?

- High initial investment costs for advanced soil stabilization technologies, including polymer binders, geosynthetics, and enzyme treatments, pose a significant barrier for small-scale farmers and budget-conscious agricultural operations

- For instance, high installation and material costs for polymer-based stabilization systems have limited adoption in developing regions, despite their long-term benefits

- In addition, the lack of technical expertise and awareness among farmers about the benefits and application methods of modern stabilization techniques can hinder adoption. Companies such as Soilworks, LLC and Aggrebind, Inc. emphasize training programs and field demonstrations to overcome these barriers

- Climate variability, unpredictable rainfall, and soil heterogeneity also present challenges in implementing standardized stabilization solutions across diverse agricultural zones

- While costs are gradually decreasing due to technological advancements and increased local manufacturing, perceived premium pricing and operational complexity can still limit widespread market penetration

- Addressing these challenges through government subsidies, farmer education programs, and the development of cost-effective, scalable solutions will be essential for sustaining market growth and adoption globally

How is the Agricultural Soil Stabilization Market Segmented?

The market is segmented on the basis of method, additives, application, and material.

- By Method

On the basis of method, the agricultural soil stabilization market is segmented into mechanical method and chemical method. The chemical method segment dominated the market with the largest revenue share of 52% in 2024, driven by its superior efficiency in enhancing soil strength, reducing permeability, and controlling erosion across various soil types. Chemical stabilization is widely preferred in large-scale agricultural projects due to its predictability, faster results, and adaptability to mechanized farming systems.

The mechanical method segment is expected to witness the fastest CAGR of 21% from 2025 to 2032, fueled by growing adoption in cost-sensitive projects and small-to-medium-scale farms where physical compaction and blending are more feasible. Mechanical stabilization also supports eco-friendly practices by reducing reliance on chemicals.

- By Additives

On the basis of additives, the market is segmented into polymers, mineral and stabilizing agents, and other additives. The mineral and stabilizing agents segment held the largest market revenue share of 48% in 2024, owing to their extensive use in improving soil compaction, pH balance, and nutrient retention.

Polymers are projected to witness the fastest CAGR from 2025 to 2032, driven by increasing adoption of biodegradable and environmentally safe polymers that enhance water retention, reduce erosion, and support sustainable farming practices.

- By Application

On the basis of application, the market is segmented into open-field application and greenhouse. Open-field application dominated with a market revenue share of 55% in 2024, as most large-scale agricultural lands and farmlands rely on soil stabilization to improve crop yield and irrigation efficiency.

Greenhouse applications are expected to witness the fastest CAGR of 20% from 2025 to 2032, due to the rising adoption of controlled-environment agriculture and precision farming techniques that require optimized soil conditions for high-value crops.

- By Material

On the basis of material, the market is segmented into cement, lime, bitumen, chemicals, electro-osmosis, grouting, geotextiles, and fabrics. Cement dominated the market with the largest revenue share of 42% in 2024, driven by its long-standing use, high availability, and strong performance in improving soil strength and load-bearing capacity.

Geotextiles and fabrics are expected to witness the fastest CAGR from 2025 to 2032, owing to their increasing application in erosion control, reinforcement, and sustainable soil stabilization practices across modern agricultural and infrastructure projects.

Which Region Holds the Largest Share of the Agricultural Soil Stabilization Market?

- South America dominated the agricultural soil stabilization market with the largest revenue share of 39.5% in 2024, driven by the expanding agricultural sector, large-scale farming operations, and favorable government policies supporting sustainable soil management practices

- Farmers and agribusinesses in the region highly value effective soil stabilization techniques to enhance crop yield, prevent erosion, and improve water retention, particularly in areas prone to heavy rainfall and soil degradation

- This widespread adoption is further supported by extensive arable land availability, increasing investment in modern farming equipment, and growing awareness of environmentally sustainable agricultural practices, positioning South America as a leading market for agricultural soil stabilization solutions

Brazil Agricultural Soil Stabilization Market Insight

The Brazilian market captured the largest revenue share of 68% in South America in 2024, fueled by government initiatives to enhance soil productivity and reduce land degradation. Farmers increasingly adopt chemical and mechanical stabilization methods to optimize crop output, particularly for soy, sugarcane, and coffee plantations. The integration of advanced soil stabilization techniques with precision agriculture technologies is also driving market expansion.

Argentina Agricultural Soil Stabilization Market Insight

The Argentina market is projected to grow steadily, driven by the adoption of polymers, lime, and mineral-based stabilizing agents to improve soil fertility and irrigation efficiency. Large-scale soybean and corn farms are increasingly implementing stabilization solutions to maintain soil structure and reduce nutrient loss.

Chile Agricultural Soil Stabilization Market Insight

The Chilean market is experiencing robust growth due to the adoption of chemical and mechanical soil stabilization methods in vineyards and fruit orchards. Government support for sustainable agriculture and erosion control measures is encouraging widespread usage.

Which Region is the Fastest Growing Region in the Agricultural Soil Stabilization Market?

Asia-Pacific is poised to grow at the fastest CAGR of 7.3% during 2025–2032, driven by rapid urbanization, increasing agricultural mechanization, and rising investments in modern farming techniques in countries such as China, India, and Japan. The region’s growing focus on sustainable agriculture, supported by government incentives and research initiatives, is accelerating the adoption of both chemical and mechanical soil stabilization methods. As APAC emerges as a manufacturing hub for soil stabilization additives and equipment, the affordability and accessibility of these solutions are expanding, enabling adoption across smallholder farms and large-scale commercial operations.

China Agricultural Soil Stabilization Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, driven by large-scale farmland management, increasing adoption of polymers and chemical stabilizers, and government-led soil conservation programs. Integration with modern irrigation and precision agriculture systems further fuels market expansion.

India Agricultural Soil Stabilization Market Insight

The Indian market is witnessing rapid growth due to rising awareness of soil degradation issues, government subsidies for soil improvement programs, and increased demand for high-yield crop production using sustainable stabilization techniques.

Japan Agricultural Soil Stabilization Market Insight

Japan is witnessing increasing adoption in greenhouse and intensive farming applications, leveraging geotextiles, polymers, and chemical stabilizers to maintain soil structure and productivity, particularly in regions with limited arable land.

Which are the Top Companies in Agricultural Soil Stabilization Market?

The agricultural soil stabilization industry is primarily led by well-established companies, including:

- Caterpillar (U.S.)

- AB Volvo (Sweden)

- Fayat Road Equipment (France)

- WIRTGEN GROUP (Germany)

- CARMEUSE (Belgium)

- Global Road Technology International Holdings (HK) Limited (Hong Kong)

- Soilworks, LLC (U.S.)

- Graymont Limited (Canada)

- SNF Holding Company (France)

- Aggrebind, Inc. (U.S.)

- IRRIDAN USA (U.S.)

- AltaCrete (Canada)

- Low & Bonar (U.K.)

- Tensar International Limited (U.K.)

- Boral Resources (Australia)

- Adelaide Brighton Cement Ltd. (Australia)

- Sibelco (Belgium)

- UBE INDUSTRIES, LTD. (Japan)

- Thrace Group (Greece)

- Lhoist (Belgium)

What are the Recent Developments in Global Agricultural Soil Stabilization Market?

- In September 2024, CEMEX acquired a majority stake in RC-Baustoffe Berlin GmbH & Co. KG, adding 400,000 tons of annual recycled-aggregate capacity to its Regenera line, strengthening its presence in the European soil stabilization market and enhancing sustainable construction solutions

- In May 2024, Heidelberg Materials signed an agreement to acquire ACE Group, Malaysia’s largest pulverized fly-ash supplier, enhancing circularity in Southeast Asia, which is expected to boost the company’s product offerings in eco-friendly soil stabilization solutions

- In October 2023, Standard Industries Company announced the acquisition of a majority stake in Panamint Valley Limestone, LLC (PVL), a leading producer of high-quality limestone products in California, expanding its geographic reach and strengthening its product portfolio in the soil stabilization market

- In January 2023, AggreBind Inc., a leading provider of product and dust control solutions, announced its expansion in India by establishing a local office, enabling closer access to the growing South American and Asian soil stabilization markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.