Global Agricultural Soil Wetting Agents Market

Market Size in USD Million

CAGR :

%

USD

163.33 Million

USD

262.29 Million

2024

2032

USD

163.33 Million

USD

262.29 Million

2024

2032

| 2025 –2032 | |

| USD 163.33 Million | |

| USD 262.29 Million | |

|

|

|

|

Agricultural Soil Wetting Agents Market Size

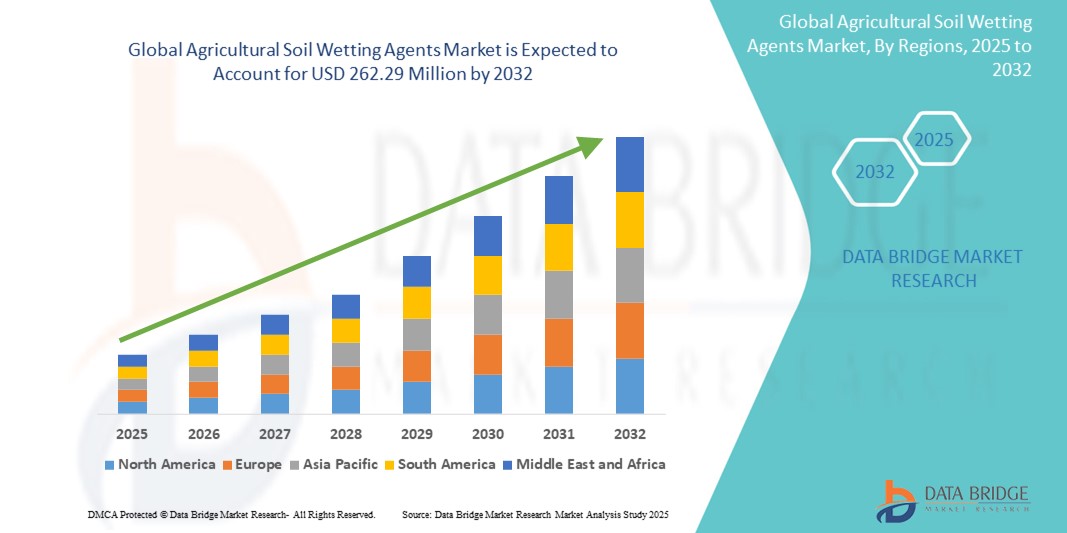

- The global agricultural soil wetting agents market size was valued at USD 163.33 million in 2024 and is expected to reach USD 262.29 million by 2032, at a CAGR of 6.10% during the forecast period

- The market growth is largely fuelled by the rising demand for efficient irrigation practices and enhanced crop yield across regions experiencing water scarcity

- Growing awareness among farmers regarding soil health and moisture retention is further contributing to the expansion of the agricultural soil wetting agents market

Agricultural Soil Wetting Agents Market Analysis

- Increasing global concerns over water conservation in agriculture have led to the adoption of soil wetting agents to improve water infiltration and retention in arid and semi-arid regions

- Countries such as India, Australia, and parts of Africa are driving demand as farmers seek sustainable solutions to optimize water usage and improve productivity in drought-prone soils

- North America dominated the agricultural soil wetting agents market with the largest revenue share in 2024, driven by increasing concerns over water conservation and rising demand for efficient irrigation practices across the region

- Asia-Pacific region is expected to witness the highest growth rate in the global Agricultural soil wetting agents market, driven by expanding agricultural activities, growing awareness regarding efficient water usage, and rising government initiatives focused on sustainable farming practices across countries such as India, China, and Australia

- The water-based segment dominated the market with the largest revenue share in 2024, owing to its ease of application, quick soil absorption, and compatibility with existing irrigation systems. These agents are widely used in both large-scale and small-scale farming operations due to their ability to promote efficient water infiltration in hydrophobic soils. Their non-toxic composition and ability to blend well with other agrochemicals also make them a preferred option across environmentally sensitive regions

Report Scope and Agricultural Soil Wetting Agents Market Segmentation

|

Attributes |

Agricultural Soil Wetting Agents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Adoption of Sustainable and Water-Efficient Farming Practices • Increasing Demand for High-Performance Soil Surfactants in Drought-Prone Regions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agricultural Soil Wetting Agents Market Trends

“Increasing Adoption of Sustainable Farming Practices Enhancing Soil Penetration Efficiency”

- Growing awareness around sustainable farming is encouraging the use of wetting agents that reduce water repellency and enhance soil hydration

- Farmers in arid regions are adopting wetting agents to ensure uniform water distribution and improved moisture retention in crops

- Eco-friendly, biodegradable formulations are gaining popularity to align with environmental standards and sustainability goals

- Integration of wetting agents in precision farming systems is improving resource efficiency and soil health

- For instance, in India’s Punjab region, wetting agents are increasingly used in wheat and rice fields to enhance water uptake amid declining groundwater levels

Agricultural Soil Wetting Agents Market Dynamics

Driver

“Growing Need for Water Conservation and Efficient Irrigation Management”

- Rising global water scarcity is pushing farmers to adopt solutions that maximize irrigation efficiency and minimize water waste

- Wetting agents help water infiltrate hydrophobic soils, allowing even moisture distribution in root zones

- Enhanced nutrient uptake and reduced irrigation frequency are leading to higher crop productivity and lower input costs

- Innovations in surfactant chemistry are driving the development of safer, soil-compatible wetting agent products

- For instance, Australian vineyards in South Australia are integrating wetting agents with drip irrigation to sustain yields during prolonged dry spells

Restraint/Challenge

“Lack of Awareness and Limited Access Among Small-Scale Farmers”

- Smallholder farmers in developing countries often lack knowledge of the benefits and applications of soil wetting agents

- High upfront costs discourage adoption, particularly in regions with limited access to subsidies or credit

- Poor distribution networks and weak agricultural extension services reduce product availability in rural areas

- Misconceptions about product safety and long-term effects hinder farmer confidence and usage

- For instance, in parts of sub-Saharan Africa, limited training and market presence have resulted in negligible adoption of soil wetting agents despite severe water stress

Agricultural Soil Wetting Agents Market Scope

The agricultural soil wetting agents market is segmented into four notable segments based on form, application, end-use product, and distribution channel.

• By Form

On the basis of form, the agricultural soil wetting agents market is segmented into water-based, solvent-based, powder-based, and granular. The water-based segment dominated the market with the largest revenue share in 2024, owing to its ease of application, quick soil absorption, and compatibility with existing irrigation systems. These agents are widely used in both large-scale and small-scale farming operations due to their ability to promote efficient water infiltration in hydrophobic soils. Their non-toxic composition and ability to blend well with other agrochemicals also make them a preferred option across environmentally sensitive regions.

The granular segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its longer shelf life, slow-release capabilities, and increasing use in turf and ornamental landscaping. Granular formulations are easy to store and transport, making them suitable for remote and large agricultural fields with limited access to liquid handling equipment.

• By Application

On the basis of application, the market is segmented into turf care and agriculture. The agriculture segment accounted for the largest revenue share in 2024, primarily due to the widespread adoption of wetting agents across crop fields to combat drought stress and improve water-use efficiency. Farmers are increasingly using wetting agents to maintain soil moisture during dry spells and optimize irrigation schedules.

Turf care is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand from golf courses, sports fields, and urban landscaping. Turf managers are adopting soil wetting agents to maintain consistent turf quality, especially under high foot traffic and limited rainfall conditions.

• By End-Use Product

On the basis of end-use product, the market is segmented into crop protection products and fertilizer. The crop protection products segment held the dominant revenue share in 2024, as wetting agents enhance the efficacy of herbicides, insecticides, and fungicides by improving their coverage and penetration in treated soils. These agents are often used as tank-mix adjuvants, helping improve chemical performance and crop protection outcomes.

The fertilizer segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for efficient nutrient delivery and moisture management. Wetting agents are being incorporated into granular and liquid fertilizers to enhance their mobility and uptake in dry or sandy soils.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into online channels, e-commerce, hypermarkets/supermarkets, and others. The hypermarkets/supermarkets segment captured the largest market share in 2024, backed by easy product accessibility, in-store product demonstrations, and wide consumer reach in urban areas. These retail outlets serve as a key platform for large-scale and small-scale growers to procure agricultural input products.

The online and e-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing digitalization of agri-input sales and the convenience of doorstep delivery. Enhanced digital infrastructure, combined with rising smartphone penetration among farmers, is significantly boosting online purchases of soil wetting agents, especially in developing regions.

Agricultural Soil Wetting Agents Market Regional Analysis

- North America dominated the agricultural soil wetting agents market with the largest revenue share in 2024, driven by increasing concerns over water conservation and rising demand for efficient irrigation practices across the region

- Farmers and turf managers are increasingly adopting wetting agents to improve water infiltration and optimize crop productivity, particularly in regions facing drought and soil hydrophobicity issues

- The widespread application of soil surfactants in golf courses, residential lawns, and high-value crops, supported by technological advancements and sustainability goals, continues to fuel market growth across the U.S. and Canada

U.S. Agricultural Soil Wetting Agents Market Insight

The U.S. agricultural soil wetting agents market accounted for the largest share in North America in 2024, supported by advanced agricultural practices and rising adoption of water-efficient farming technologies. Increasing pressure to enhance water use efficiency, particularly in arid regions such as California and Texas, is driving demand for surfactants in crop cultivation. In addition, the use of wetting agents in turf care applications such as golf courses, parks, and sports fields is contributing to sustained market growth, supported by government regulations encouraging sustainable land management.

Europe Agricultural Soil Wetting Agents Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness about soil health management and sustainable agriculture. EU regulations emphasizing the reduction of water usage and chemical input in farming are encouraging the use of wetting agents. Adoption is especially strong in Western Europe, where high-value crop production and turf management for recreational landscapes are prevalent. Manufacturers are also focusing on developing biodegradable and eco-friendly formulations that comply with regional environmental standards.

U.K. Agricultural Soil Wetting Agents Market Insight

The U.K. agricultural soil wetting agents market is expected to witness the fastest growth rate from 2025 to 2032, driven by climate variability and the need to improve water penetration in dry soils. Wetting agents are gaining traction among farmers for enhancing water distribution in cereal and vegetable crops. Moreover, increasing demand for well-maintained turf in residential, municipal, and sports infrastructure is fueling adoption. The U.K. government’s focus on sustainable land use and the integration of water-saving technologies into farming practices further accelerates market growth.

Germany Agricultural Soil Wetting Agents Market Insight

The Germany is expected to witness the fastest growth rate from 2025 to 2032, supported by its leadership in sustainable agriculture and precision farming. German farmers are increasingly integrating wetting agents with fertilizers and crop protection products to improve soil absorption and nutrient uptake. The market is also driven by the adoption of green technology in landscape management across public spaces. Strong awareness about environmental protection and resource efficiency aligns well with the expanding use of soil surfactants.

Asia-Pacific Agricultural Soil Wetting Agents Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding agricultural activities, population growth, and the rising need for food security. Countries such as China, India, and Australia are actively adopting wetting agents to combat drought, improve irrigation efficiency, and increase yields. Government support for modernizing irrigation systems and increasing awareness about the benefits of soil surfactants are also playing a pivotal role in market expansion.

China Agricultural Soil Wetting Agents Market Insight

The China accounted for the largest revenue share in the Asia-Pacific region in 2024, supported by large-scale agricultural operations and the government’s focus on modernizing rural farming infrastructure. The adoption of soil wetting agents is growing rapidly across the horticulture and turf care sectors, with increasing demand from golf courses, parks, and residential landscaping projects. In addition, rising investments in agricultural innovation and precision farming technologies are strengthening the outlook for the market.

Japan Agricultural Soil Wetting Agents Market Insight

The Japan agricultural soil wetting agents market is expected to grow at a steady CAGR during the forecast period, driven by the country’s emphasis on high-efficiency farming and sustainable resource management. Japanese agriculture, characterized by small but intensively managed plots, increasingly leverages wetting agents to enhance irrigation efficiency and optimize water usage in crops such as rice, fruits, and vegetables. Urban landscaping and turf maintenance—particularly in cities such as Tokyo and Osaka—also contribute to market demand, with soil surfactants used to maintain golf courses, parks, and public green spaces. In addition, Japan’s aging farmer population is encouraging the adoption of low-labor, high-efficiency agricultural inputs, further supporting the market growth of soil wetting agents.

Agricultural Soil Wetting Agents Market Share

The Agricultural Soil Wetting Agents industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Wilbur-Ellis Holdings, Inc. (U.S.)

- BrettYoung (Canada)

- Nufarm (Australia)

- Grow More Inc. (U.S.)

- Seasol (Australia)

- Milliken & Company (U.S.)

- ADS Agrotech Pvt. Ltd. (India)

- MD BIOCOALS PVT. LTD. (India)

- Geoponics Corp.(U.S.)

- Clariant (Switzerland)

- Evonik Industries (Germany)

- Croda International Plc (U.K.)

- Akzo Nobel N.V. (Netherlands)

- WinField United (U.S.)

- Momentive Performance Materials (U.S.)

- Interagro (UK) Ltd (U.K.)

- Helena Agri-Enterprises, LLC (U.S.)

- GarrCo Products, Inc. (U.S.)

- Adjuvants Plus (Canada)

- Solvay (Belgium)

- Huntsman International LLC (U.S.)

Latest Developments in Global Agricultural Soil Wetting Agents Market

- In July 2023, Precision Laboratories introduced Cascade Tre, an advanced formulation that combines the proven performance of Cascade with enhanced water use efficiency and turfgrass safety. Its versatile application rates enable turf managers to tailor their watering programs for optimal hydration and playability, ensuring a healthy and well-maintained turf

- In March 2023, Fernland launched the FloraTech range, featuring AquaPro, AquaSport, and AquaFirm—liquid wetting agents designed to refine watering practices. These products are engineered to improve watering efficiency, minimize disease risk, and sustain turf health year-round, offering effective solutions for maintaining quality playing surfaces

- In July 2022, Verano365 revealed plans to launch a new OMRI-listed variant of their acclaimed Cultivata wetting agent. This advanced liquid surfactant is known for its superior wetting capabilities in hydrophobic media. The upcoming OMRI-listed version highlights Verano365's dedication to providing eco-friendly, high-performance solutions for sustainable horticultural practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.