Global Agriculture Biological Control Agents Market

Market Size in USD Billion

CAGR :

%

USD

14.75 Billion

USD

44.19 Billion

2025

2033

USD

14.75 Billion

USD

44.19 Billion

2025

2033

| 2026 –2033 | |

| USD 14.75 Billion | |

| USD 44.19 Billion | |

|

|

|

|

What is the Global Agriculture Biological Control Agents Market Size and Growth Rate?

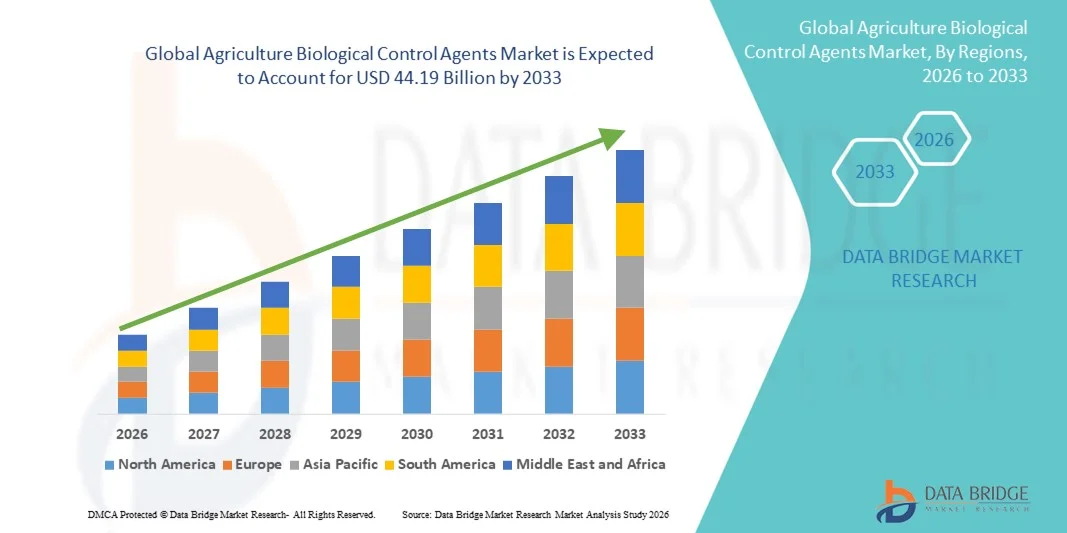

- The global agriculture biological control agents market size was valued at USD 14.75 billion in 2025 and is expected to reach USD 44.19 billion by 2033, at a CAGR of14.70% during the forecast period

- Major factors that are expected to boost the growth of the agriculture biological control agents market in the forecast period are the rise in the utilization of biological products over the chemical based crop protection products

What are the Major Takeaways of Agriculture Biological Control Agents Market?

- The rise in the need for the sustainable agricultural practices is further anticipated to propel the growth of the agriculture biological control agents market. Moreover, the rise in the knowledge concerning the damaging effects of chemical pesticides is further cushion the growth of the agriculture biological control agents market

- On the other hand, inadequate amount of shelf-life of biological control products is further projected to impede the growth of the agriculture biological control agents market

- Europe dominated the agriculture biological control agents market with an estimated 31.36% revenue share in 2025, driven by strong adoption of sustainable agriculture practices, strict regulations on chemical pesticides, and early integration of Integrated Pest Management (IPM) programs across the E.U

- Asia-Pacific is projected to register the fastest CAGR of around 8.36% from 2026 to 2033, driven by rising food demand, increasing pest resistance to chemical pesticides, and growing awareness of sustainable farming across China, India, Japan, Australia, and Southeast Asia

- The Bacteria segment dominated the market with an estimated 38.6% share in 2025, driven by widespread adoption of bacterial-based bioinsecticides and biofungicides such as Bacillus thuringiensis and Bacillus subtilis

Report Scope and Agriculture Biological Control Agents Market Segmentation

|

Attributes |

Agriculture Biological Control Agents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agriculture Biological Control Agents Market?

Increasing Shift Toward Sustainable, Target-Specific, and Microbial-Based Agriculture Biological Control Agents

- The agriculture biological control agents market is witnessing rising adoption of microbial agents, beneficial insects, and natural predators designed to control pests and diseases while reducing chemical pesticide dependence

- Manufacturers are increasingly developing strain-specific, high-efficacy biocontrol solutions with improved shelf life, field stability, and compatibility with integrated pest management (IPM) programs

- Growing demand for eco-friendly, residue-free, and organic-certified crop protection solutions is accelerating usage across fruits, vegetables, cereals, and high-value crops

- For instance, companies such as BASF, Bayer, Syngenta, Koppert, and Valent BioSciences are expanding their biological portfolios with microbial pesticides, beneficial insects, and biofungicides

- Increasing regulatory restrictions on synthetic pesticides and rising consumer preference for sustainable agriculture practices are accelerating the shift toward biological control agents

- As global farming moves toward sustainability and climate-resilient practices, agriculture biological control agents will remain critical for long-term crop protection, soil health, and biodiversity preservation

What are the Key Drivers of Agriculture Biological Control Agents Market?

- Rising demand for sustainable crop protection solutions due to growing concerns over chemical pesticide residues and environmental impact

- For instance, in 2024–2025, several leading players expanded investments in microbial R&D, fermentation technologies, and large-scale biocontrol production facilities

- Increasing adoption of organic farming, precision agriculture, and integrated pest management (IPM) across the U.S., Europe, and Asia-Pacific

- Advancements in microbial strain selection, formulation technologies, and delivery systems have improved efficacy, consistency, and ease of application

- Growing use of biological agents to combat pesticide resistance, soil degradation, and climate-induced pest pressure

- Supported by government incentives, regulatory approvals, and sustainability initiatives, the agriculture biological control agents market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Agriculture Biological Control Agents Market?

- Higher costs associated with R&D, formulation complexity, and cold-chain logistics compared to conventional chemical pesticides

- For instance, during 2024–2025, variability in raw material availability and fermentation scale-up challenges impacted production timelines for several manufacturers

- Inconsistent field performance influenced by climatic conditions, storage requirements, and application timing increases adoption complexity

- Limited farmer awareness in emerging markets regarding proper usage, benefits, and integration of biological control agents

- Competition from low-cost chemical pesticides and slower regulatory approvals in certain regions restrain market penetration

- To address these challenges, companies are focusing on cost-efficient formulations, farmer education programs, localized field trials, and improved distribution networks to expand global adoption of Agriculture Biological Control Agents

How is the Agriculture Biological Control Agents Market Segmented?

The market is segmented on the basis of product type, application, and crop type.

- By Product Type

On the basis of product type, the agriculture biological control agents market is segmented into Weed Killers, Parasitoids, Predators, Bacteria, Fungi, and Others. The Bacteria segment dominated the market with an estimated 38.6% share in 2025, driven by widespread adoption of bacterial-based bioinsecticides and biofungicides such as Bacillus thuringiensis and Bacillus subtilis. These products offer targeted pest control, high efficacy, and compatibility with organic farming practices. Strong regulatory support for microbial solutions and their ease of integration into IPM programs further strengthens adoption.

The Fungi segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising use of fungal biocontrol agents for soil-borne disease management, weed suppression, and resistance mitigation. Advancements in formulation stability and mass-production technologies are accelerating commercial deployment across diverse crop systems.

- By Application

On the basis of application, the market is segmented into Seed Treatment, Foliar Spray, Soil Treatment, and Others. The Foliar Spray segment held the largest market share of around 41.2% in 2025, as it remains the most widely used application method due to ease of use, rapid pest response, and suitability for high-value crops such as fruits and vegetables. Foliar-applied biologicals are extensively used for controlling insects and fungal diseases while minimizing residue concerns.

The Seed Treatment segment is projected to witness the fastest growth from 2026 to 2033, driven by increasing focus on early-stage crop protection, improved germination, and root health enhancement. Rising adoption of preventive crop protection strategies and growing availability of microbial seed coatings are supporting this trend.

- By Crop Type

On the basis of crop type, the agriculture biological control agents market is segmented into Grains, Fruits and Vegetables, and Others. The Fruits and Vegetables segment dominated the market with a 44.8% share in 2025, owing to high pest pressure, strict residue regulations, and strong demand for organic and sustainably produced food. Biological control agents are widely used in horticulture to maintain crop quality, yield, and export compliance.

The Grains segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by expanding acreage under sustainable farming, increasing adoption of IPM in cereals, and rising awareness of soil health preservation. Large-scale field trials and government-backed sustainability programs are further boosting adoption in grain crops.

Which Region Holds the Largest Share of the Agriculture Biological Control Agents Market?

- Europe dominated the agriculture biological control agents market with an estimated 31.36% revenue share in 2025, driven by strong adoption of sustainable agriculture practices, strict regulations on chemical pesticides, and early integration of Integrated Pest Management (IPM) programs across the E.U. High demand for residue-free crops, organic farming expansion, and government-backed sustainability initiatives continue to fuel adoption of biological control agents across cereals, fruits, and vegetables

- Leading European companies are actively investing in microbial R&D, formulation improvements, and large-scale commercialization of parasitoids, predators, bacteria, and fungi, strengthening the region’s leadership in eco-friendly crop protection solutions

- Strong regulatory frameworks, high farmer awareness, advanced agri-tech infrastructure, and continuous public–private investments further reinforce Europe’s dominant market position

Germany Agriculture Biological Control Agents Market Insight

Germany is a key contributor in Europe, supported by strong emphasis on organic farming, robust agricultural research institutions, and widespread adoption of biological crop protection products. Government incentives for reducing chemical pesticide usage and strong presence of biocontrol manufacturers drive steady market growth across field and horticultural crops.

France Agriculture Biological Control Agents Market Insight

France shows strong market performance due to extensive use of biological control in vineyards, fruits, and vegetables. National policies promoting agroecology, coupled with high adoption of beneficial insects and microbial solutions, continue to support market expansion.

Asia-Pacific Agriculture Biological Control Agents Market

Asia-Pacific is projected to register the fastest CAGR of around 8.36% from 2026 to 2033, driven by rising food demand, increasing pest resistance to chemical pesticides, and growing awareness of sustainable farming across China, India, Japan, Australia, and Southeast Asia. Rapid expansion of commercial agriculture, horticulture exports, and government-led initiatives promoting bio-inputs are accelerating adoption of biological control agents across major crop systems. Increasing investments in agri-biotechnology, local production capabilities, and farmer education programs further strengthen regional growth momentum

China Agriculture Biological Control Agents Market Insight

China is the largest contributor in Asia-Pacific, supported by large-scale agricultural production, strong government backing for green farming, and rising use of microbial pesticides to reduce chemical dependence. Domestic manufacturing and cost-effective solutions are boosting widespread adoption.

India Agriculture Biological Control Agents Market Insight

India is emerging as a high-growth market, driven by expanding organic farming, government schemes promoting biofertilizers and biopesticides, and increasing awareness among farmers. Rising demand for sustainable crop protection in grains, fruits, and vegetables is accelerating market penetration across the country.

Which are the Top Companies in Agriculture Biological Control Agents Market?

The agriculture biological control agents industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Valent BioSciences LLC (U.S.)

- Certis USA L.L.C. (U.S.)

- Marrone Bio Innovations, Inc. (U.S.)

- BioBest Group NV (Belgium)

- Syngenta AG (Switzerland)

- Corteva, Inc. (U.S.)

- Nufarm (Australia)

- United Phosphorus Ltd. (India)

- Bayer AG (Germany)

- Novozymes (Denmark)

- Koppert Biological Systems (Netherlands)

- Andermatt Biocontrol Suisse AG (Switzerland)

- Evogene (Israel)

- Lallemand, Inc. (Canada)

- Chr. Hansen Holding A/S (Denmark)

- Precision Laboratories, LLC (U.S.)

- Verdesian Life Sciences (U.S.)

- Isagro SpA (Italy)

- Symborg (Spain)

What are the Recent Developments in Global Agriculture Biological Control Agents Market?

- In August 2025, Bioline AgroSciences Ltd acquired Viridaxis SA, reinforcing its presence in the biological pest control space. This acquisition expands Bioline’s range of beneficial insects and strengthens its footprint in sustainable agriculture solutions across Europe, supporting long-term growth in eco-friendly crop protection

- In February 2025, PI Industries partnered with C-CAMP to accelerate innovation in biocontrol technologies for sustainable agriculture. Through funding support and technical mentorship for startups developing biological crop protection solutions, this initiative is expected to boost commercialization and innovation in the biocontrol ecosystem

- In January 2025, Koppert launched Limonica, a new predatory mite solution that combines two mite species to enhance pest control performance. Designed primarily for greenhouse crops, the product improves resilience and effectiveness against thrips and whiteflies, strengthening Koppert’s position in controlled-environment agriculture

- In March 2024, BW Fusion, Biodyne, and Agronomy 365 merged to create an integrated platform operating under the BW Fusion brand. This consolidation brings together capabilities in crop nutrition, environmental microbiology, and crop analytics, enabling the delivery of more comprehensive and sustainable biological solutions across the crop lifecycle

- In March 2024, Koppert Biological Systems and Biobest formed a strategic collaboration to jointly develop and distribute new predatory mites for greenhouse vegetable production in Europe and North America. By combining R&D expertise and distribution networks, the partnership addresses rising demand for advanced biological control solutions in protected cultivation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.