Global Agriculture Biologicals Testing Market

Market Size in USD Billion

CAGR :

%

USD

3.10 Billion

USD

5.86 Billion

2024

2032

USD

3.10 Billion

USD

5.86 Billion

2024

2032

| 2025 –2032 | |

| USD 3.10 Billion | |

| USD 5.86 Billion | |

|

|

|

|

Agriculture Biologicals Testing Market Size

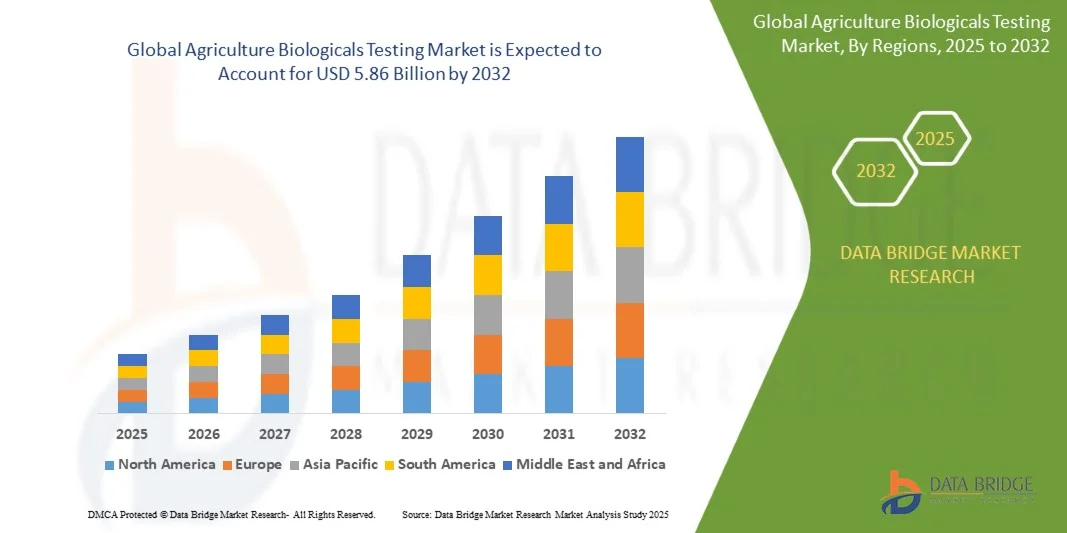

- The Agriculture Biologicals Testing Market size was valued at USD 3.1 billion in 2024 and is projected to reach USD 5.86 billion by 2032, expanding at a CAGR of 8.30% during the forecast period.

- The market growth is primarily driven by the increasing adoption of sustainable farming practices and the rising demand for organic food products, which are propelling the need for biological testing to ensure efficacy and safety.

- Additionally, advancements in biotechnology, supportive government initiatives promoting eco-friendly agriculture, and growing awareness among farmers about soil health and crop protection are accelerating the adoption of biological testing, thereby fostering robust market expansion.

Agriculture Biologicals Testing Market Analysis

- Agriculture biologicals testing, which involves evaluating biofertilizers, biopesticides, and biostimulants for quality, safety, and performance, is becoming an essential component of modern sustainable agriculture practices across both developed and developing regions due to its role in enhancing crop yield, soil health, and environmental safety.

- The growing demand for agriculture biologicals testing is primarily driven by the increasing adoption of organic farming, stringent regulatory requirements for biological inputs, and a global shift toward eco-friendly crop protection and nutrition solutions.

- North America dominated the Agriculture Biologicals Testing Market with the largest revenue share of 35.8% in 2024, supported by strong regulatory frameworks, advanced agricultural biotechnology infrastructure, and the presence of leading testing service providers, particularly in the U.S., where innovation and investments in sustainable agriculture are rapidly expanding.

- Asia-Pacific is expected to be the fastest-growing region in the Agriculture Biologicals Testing Market during the forecast period due to the increasing adoption of biological crop protection products, government support for organic farming, and rising awareness about sustainable agricultural practices.

- The biopesticides segment dominated the market with the largest revenue share of 43.2% in 2024, driven by the increasing demand for eco-friendly pest control solutions and stringent regulatory requirements for chemical pesticide alternatives.

Report Scope and Agriculture Biologicals Testing Market Segmentation

|

Attributes |

Agriculture Biologicals Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agriculture Biologicals Testing Market Trends

“Advancements in AI and Data-Driven Biological Testing”

- A significant and accelerating trend in the Agriculture Biologicals Testing Market is the growing integration of artificial intelligence (AI), machine learning (ML), and advanced data analytics to enhance the accuracy, speed, and reliability of biological product testing. This technological fusion is revolutionizing how biofertilizers, biopesticides, and biostimulants are evaluated for quality and efficacy.

- For instance, companies such as SGS and Eurofins Scientific are leveraging AI-powered platforms to analyze complex datasets from field trials and laboratory tests, enabling faster detection of microbial activity patterns and more precise predictions of product performance under diverse environmental conditions.

- AI integration in agricultural biologicals testing supports functions such as predictive modeling for crop responses, optimization of formulation stability, and identification of potential contaminants. Machine learning algorithms can also continuously improve testing accuracy by learning from historical data, thereby enhancing the reliability of regulatory submissions and product approvals.

- Furthermore, the use of automated systems and AI-driven analytics platforms allows laboratories to streamline workflows, minimize human error, and ensure consistent testing standards globally. These technologies facilitate real-time monitoring of test outcomes and generate actionable insights that help manufacturers refine biological formulations.

- This trend toward AI-enabled and data-centric biological testing is reshaping industry standards and expectations for product validation. As a result, leading players like Intertek Group and Bureau Veritas are investing heavily in digital transformation initiatives to strengthen their precision testing and reporting capabilities.

- The demand for advanced, AI-integrated testing solutions is expanding rapidly across both developed and emerging agricultural markets, as stakeholders increasingly prioritize efficiency, transparency, and scientific accuracy in biological product development and certification.

Agriculture Biologicals Testing Market Dynamics

Driver

“Growing Need Due to Rising Demand for Sustainable and Safe Agricultural Practices”

- The increasing global emphasis on sustainable farming, food safety, and environmental protection is a major driver behind the rising demand for agriculture biologicals testing. Farmers, regulators, and consumers alike are prioritizing eco-friendly crop inputs such as biopesticides, biofertilizers, and biostimulants, creating a strong need for reliable and standardized testing services.

- For instance, in March 2024, SGS S.A. announced the expansion of its biological testing capabilities in Europe, introducing advanced analytical tools to assess microbial efficacy and product stability. Such strategic initiatives by key market players are expected to drive market growth during the forecast period.

- As agricultural systems move toward reduced chemical dependency, biological testing ensures that new bio-based products meet safety, efficacy, and regulatory requirements before commercialization. This validation process builds trust among farmers and consumers by confirming product performance under diverse environmental conditions.

- Furthermore, the global shift toward organic farming and sustainable food production has positioned biological testing as an integral component of modern agriculture, enabling manufacturers to meet international quality and safety standards.

- The increasing awareness of soil health, environmental sustainability, and the benefits of biological alternatives is also encouraging investments in R&D and quality assurance programs. As a result, testing laboratories are adopting innovative biotechnological methods to enhance accuracy and efficiency in product evaluation.

Restraint/Challenge

“Regulatory Complexities and High Testing Costs”

- The complexity of regulatory frameworks across different regions presents a major challenge for the agriculture biologicals testing market. Each country maintains unique standards and registration procedures for biological products, which can delay market entry and increase compliance costs for manufacturers.

- For instance, obtaining approval for biopesticides in the European Union or the United States often requires extensive field testing and documentation, resulting in prolonged timelines and significant financial investments.

- Moreover, the high cost associated with advanced analytical tools, skilled personnel, and quality assurance infrastructure can limit accessibility to testing services, particularly for small and medium-sized bio-based product developers.

- Addressing these challenges requires harmonization of global regulatory standards, the development of cost-effective testing technologies, and increased collaboration between regulatory bodies and testing laboratories. Companies such as Eurofins Scientific and Intertek Group are actively working to streamline testing protocols and expand affordable service offerings to help manufacturers navigate complex regulatory landscapes.

- While technological progress and automation are gradually reducing testing expenses, the financial and procedural barriers continue to restrain faster market expansion. Overcoming these limitations through innovation, policy alignment, and industry partnerships will be crucial for ensuring consistent global growth of the agriculture biologicals testing sector.

Agriculture Biologicals Testing Market Scope

The global agricultural biologicals testing market is segmented on the basis of type, product and end user.

- By Type

On the basis of type, the Agriculture Biologicals Testing Market is segmented into biopesticides, biofertilizers, and biostimulants. The biopesticides segment dominated the market with the largest revenue share of 43.2% in 2024, driven by the increasing demand for eco-friendly pest control solutions and stringent regulatory requirements for chemical pesticide alternatives. Biopesticide testing ensures product safety, efficacy, and environmental compatibility, making it vital for market approval and farmer adoption. Testing services help verify microbial strains, stability, and field performance under different climatic conditions, supporting manufacturers in meeting global compliance standards.

The biostimulants segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing emphasis on soil health improvement, crop resilience, and nutrient efficiency. As biostimulants gain popularity in sustainable agriculture, rigorous testing for composition, performance, and compatibility is becoming essential to ensure consistent quality and regulatory acceptance.

- By Product

On the basis of product, the Agriculture Biologicals Testing Market is segmented into field support, analytical, and regulatory. The analytical segment dominated the market with the largest revenue share of 46.7% in 2024, owing to the rising need for precise laboratory analysis to assess microbial identity, potency, and formulation stability. Analytical testing provides critical insights into product efficacy and ensures adherence to quality and safety standards required by global authorities. The increasing complexity of biological formulations has further strengthened the demand for advanced analytical tools and techniques.

The regulatory segment is projected to witness the fastest CAGR from 2025 to 2032, driven by growing international efforts to standardize the approval and certification of agricultural biological products. Companies are investing heavily in regulatory testing to meet evolving compliance norms, minimize approval delays, and enhance product credibility across multiple regions.

- By End User

On the basis of end user, the Agriculture Biologicals Testing Market is segmented into biological product manufacturers, government agencies, and others. The biological product manufacturers segment held the largest revenue share of 52.4% in 2024, as these organizations rely heavily on third-party testing services for validation, quality assurance, and compliance certification of newly developed products. Manufacturers prioritize comprehensive testing to ensure product performance and safety before commercialization, supporting brand reputation and market entry.

The government agencies segment is anticipated to record the fastest CAGR from 2025 to 2032, driven by increasing regulatory oversight and government-led initiatives promoting sustainable and organic agriculture. National and regional agencies are increasingly funding biological testing programs and establishing dedicated facilities to ensure the reliability and traceability of agricultural biologicals, thereby reinforcing product integrity and consumer confidence.

Agriculture Biologicals Testing Market Regional Analysis

- North America dominated the Agriculture Biologicals Testing Market with the largest revenue share of 35.8% in 2024, driven by the rising adoption of sustainable farming practices, strict regulatory frameworks for biological inputs, and the growing demand for organic and residue-free food products.

- Farmers and manufacturers in the region place high importance on quality assurance, regulatory compliance, and product efficacy testing, leading to strong demand for advanced testing services. The presence of established market players such as SGS, Eurofins Scientific, and Intertek Group further supports innovation and accessibility in biological testing solutions.

- This robust market growth is also reinforced by high R&D investments, technological advancements in biotechnology, and supportive government initiatives promoting eco-friendly agriculture, positioning North America as a leading hub for agricultural biological product development and validation.

U.S. Agriculture Biologicals Testing Market Insight

The U.S. agriculture biologicals testing market captured the largest revenue share of 81% in 2024 within North America, driven by the rapid adoption of sustainable farming practices, organic food production, and advancements in biotechnology. Farmers and agribusinesses are increasingly focusing on the validation of biopesticides, biofertilizers, and biostimulants to ensure compliance with the U.S. Environmental Protection Agency (EPA) and USDA regulations. The presence of major testing and certification providers such as SGS, Eurofins Scientific, and Intertek Group supports market expansion. Moreover, the increasing emphasis on soil health and the reduction of chemical pesticide use are propelling demand for robust biological testing services across both research and commercial applications.

Europe Agriculture Biologicals Testing Market Insight

The Europe agriculture biologicals testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulatory standards, rising consumer preference for organic food, and the EU Green Deal’s focus on sustainable agriculture. European nations are investing in advanced biological testing infrastructure to ensure product safety, traceability, and compliance with EFSA (European Food Safety Authority) guidelines. The market is experiencing growth across the biopesticides and biofertilizers segments, as farmers adopt biological alternatives to synthetic agrochemicals. The growing emphasis on environmentally friendly and residue-free farming methods continues to foster strong demand for biological testing across both developed and developing European regions.

U.K. Agriculture Biologicals Testing Market Insight

The U.K. agriculture biologicals testing market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s transition toward sustainable and regenerative agricultural practices. Rising concerns over soil degradation and the impact of chemical inputs are encouraging farmers to adopt biological products, thereby increasing the need for standardized testing solutions. The U.K.’s proactive regulatory stance and investments in agricultural innovation further strengthen its market position. Additionally, the presence of academic research institutions and government-supported programs focused on bio-based product validation are expected to accelerate the sector’s growth.

Germany Agriculture Biologicals Testing Market Insight

The Germany agriculture biologicals testing market is expected to expand at a considerable CAGR during the forecast period, supported by technological innovation, precision agriculture adoption, and the nation’s strong emphasis on environmental sustainability. Germany’s advanced R&D ecosystem and close collaboration between universities, testing laboratories, and agricultural firms promote continuous improvements in biological product assessment. The growing demand for high-quality biopesticides and biostimulants in organic and conventional farming systems is boosting the market. Additionally, regulatory clarity and consumer awareness about sustainable food production are reinforcing testing demand across both domestic and export-oriented agricultural sectors.

Asia-Pacific Agriculture Biologicals Testing Market Insight

The Asia-Pacific agriculture biologicals testing market is poised to grow at the fastest CAGR of 24% during the forecast period of 2025 to 2032, driven by rapid agricultural modernization, increasing organic farming adoption, and government initiatives supporting sustainable crop protection. Countries such as China, Japan, and India are witnessing growing demand for certified biological inputs to improve productivity while minimizing environmental impact. Expanding research capabilities and collaborations between international testing organizations and regional laboratories are enhancing testing infrastructure. Furthermore, the rising awareness of food safety, coupled with the affordability of biological testing services, is making these solutions more accessible to small and medium-sized farmers across the region.

Japan Agriculture Biologicals Testing Market Insight

The Japan agriculture biologicals testing market is gaining momentum due to the nation’s technological sophistication, commitment to food safety, and emphasis on high-quality agricultural exports. Testing for biofertilizers, biopesticides, and biostimulants is becoming increasingly crucial as Japan advances its smart agriculture initiatives. Integration of AI and data analytics into testing processes is improving precision and reducing analysis time. Additionally, the government’s promotion of low-carbon and eco-friendly agriculture is driving partnerships between public research institutes and private laboratories to enhance product verification and compliance processes.

China Agriculture Biologicals Testing Market Insight

The China agriculture biologicals testing market accounted for the largest market revenue share in the Asia-Pacific region in 2024, fueled by rapid urbanization, government sustainability policies, and expanding domestic production of biological agricultural inputs. China’s focus on reducing chemical pesticide dependence and promoting green agriculture is driving strong demand for testing services to ensure product safety and regulatory compliance. Local manufacturers are increasingly partnering with international testing companies such as Bureau Veritas and Eurofins Scientific to meet global export standards. Additionally, as China continues to invest in rural modernization and agricultural digitalization, the biological testing sector is witnessing significant growth across both field and laboratory testing segments.

Agriculture Biologicals Testing Market Share

The Agriculture Biologicals Testing industry is primarily led by well-established companies, including:

- SGS SA (Switzerland)

- Bureau Veritas SA (France)

- Eurofins Scientific SE (Luxembourg)

- Intertek Group plc (U.K.)

- ALS Limited (Australia)

- BioTecnics (Spain)

- Microbac Laboratories, Inc. (U.S.)

- Agilent Technologies, Inc. (U.S.)

- SynTech Research Group (U.S.)

- Biotecnología Agroindustrial S.A. (Argentina)

- Anadiag Group (France)

- Biotree Group (China)

- Apal Agricultural Laboratory (Australia)

- Frontier Scientific Services, Inc. (U.S.)

- Jiangsu Rotam Biological Technology Co., Ltd. (China)

- CropG1 AgriBioTech Pvt. Ltd. (India)

- ICL Group Ltd. (Israel)

- Merieux NutriSciences Corporation (U.S.)

- Noack Group (Austria)

- Pace Analytical Services, LLC (U.S.)

What are the Recent Developments in Agriculture Biologicals Testing Market?

- In April 2023, Eurofins Scientific, a global leader in bioanalytical testing, launched a strategic initiative in South Africa aimed at strengthening the validation and safety of biopesticides and biofertilizers used in commercial and small-scale farming. This initiative emphasizes Eurofins’ commitment to providing high-quality, reliable biological testing solutions tailored to local regulatory standards and agricultural practices, reinforcing its position in the growing Agriculture Biologicals Testing Market.

- In March 2023, SGS, a Switzerland-based testing and certification company, introduced an advanced crop biostimulant testing protocol designed for large-scale agricultural producers and regulatory bodies. This development enables faster, more accurate assessment of product efficacy and compliance, highlighting SGS’ dedication to innovation and the safe, sustainable adoption of biological agricultural products.

- In March 2023, Intertek Group successfully deployed the China Green Agriculture Initiative, a project focused on improving urban and peri-urban farming safety through rigorous biological testing of pesticides, fertilizers, and biostimulants. The initiative demonstrates Intertek’s commitment to applying cutting-edge analytical methods to support sustainable and resilient agricultural systems, contributing to safer food supply chains.

- In February 2023, Bureau Veritas, a global leader in testing and inspection services, announced a strategic partnership with India’s National Centre for Organic Agriculture to establish standardized biological testing laboratories for farmers and agribusinesses. This collaboration aims to enhance product safety, quality assurance, and regulatory compliance, supporting the broader adoption of biological products in India.

- In January 2023, TÜV SÜD, a leading provider of testing, certification, and inspection services, unveiled a new integrated biofertilizer testing platform at the International Fertilizer Association Conference 2023. The platform offers end-to-end testing capabilities, allowing manufacturers and regulatory agencies to ensure product efficacy, safety, and compliance, reinforcing TÜV SÜD’s commitment to advancing the reliability of biological agricultural solutions globally.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.