Global Agriculture Equipment Market

Market Size in USD Billion

CAGR :

%

USD

218.45 Billion

USD

414.63 Billion

2024

2032

USD

218.45 Billion

USD

414.63 Billion

2024

2032

| 2025 –2032 | |

| USD 218.45 Billion | |

| USD 414.63 Billion | |

|

|

|

|

Agriculture Equipment Market Size

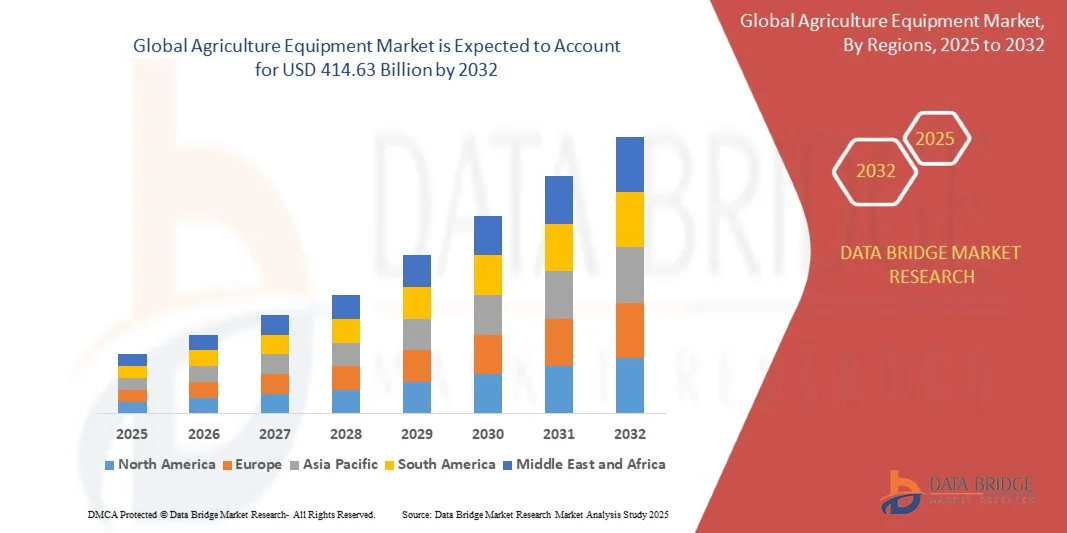

- The global agriculture equipment market size was valued at USD 218.45 billion in 2024 and is expected to reach USD 414.63 billion by 2032, at a CAGR of 8.34% during the forecast period

- The market growth is largely fuelled by the increasing adoption of mechanized farming practices, rising demand for high-efficiency and precision agriculture equipment, and government initiatives supporting modern farming technologies

- Growing global population and the need for higher crop yields are driving investments in tractors, harvesters, and irrigation systems, which enhance productivity and reduce labor dependency

Agriculture Equipment Market Analysis

- Increasing focus on precision agriculture and sustainable farming practices is shaping the development of advanced equipment designed to optimize resource use and reduce environmental impact

- Rising investments by private and public sectors, along with expanding agricultural land under mechanization in emerging economies, are contributing to significant market growth

- Asia-Pacific dominated the agriculture equipment market with the largest revenue share of 37.7% in 2024, driven by rapid adoption of mechanized farming, precision agriculture technologies, and government initiatives supporting modern agricultural practices

- North America region is expected to witness the highest growth rate in the global agriculture equipment market, driven by technological advancements, favorable government initiatives, and increasing farm consolidation requiring large-scale and automated equipment

- The tractors segment held the largest market revenue share in 2024, driven by their extensive use in plowing, planting, and irrigation activities across large and small-scale farms. Tractors offer enhanced operational efficiency, reduced labor dependency, and compatibility with various attachments, making them a preferred choice among farmers globally

Report Scope and Agriculture Equipment Market Segmentation

|

Attributes |

Agriculture Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agriculture Equipment Market Trends

“Increasing Adoption of Smart and Precision Farming Equipment”

- The growing shift toward smart and precision agriculture equipment is transforming the farming landscape by enabling real-time monitoring, automated operations, and data-driven decision-making. These technologies allow farmers to optimize resource usage, increase crop yield, and reduce operational costs, thereby enhancing overall farm productivity. In addition, they provide actionable insights through IoT and AI integration, helping farmers make precise decisions on irrigation, fertilization, and crop protection

- Rising demand for automated machinery in remote and under-resourced regions is accelerating the adoption of drones, GPS-enabled tractors, and robotic harvesters. These tools are particularly effective where manual labor is limited or inefficient, helping reduce crop losses and improve farming efficiency. Government initiatives, agritech partnerships, and affordable leasing programs further boost adoption, allowing small and medium-scale farms to integrate advanced technology without significant capital expenditure

- The affordability and ease of use of modern agricultural equipment are making them attractive for small and medium-scale farms, leading to broader adoption. Farmers benefit from efficient machinery that reduces labor dependency while ensuring precision and sustainability in operations. In addition, equipment manufacturers are offering modular, low-maintenance solutions that require minimal training, expanding market reach across emerging economies

- For instance, in 2023, several farms in India and Brazil reported increased productivity and reduced resource wastage after implementing GPS-guided tractors and automated irrigation systems, driving market acceptance and encouraging further investments. These success stories have motivated regional governments and cooperatives to subsidize and promote modern agricultural equipment, further boosting adoption

- While smart and precision farming equipment are accelerating operational efficiency and sustainability, their impact depends on continuous innovation, training, and financing options. Manufacturers must focus on durable, cost-effective, and application-specific solutions to fully capitalize on growing market demand. In addition, after-sales support, software updates, and data-driven services are becoming critical differentiators in this evolving market

Agriculture Equipment Market Dynamics

Driver

“Increasing Need for Mechanization and Farm Productivity Enhancement”

- Rising demand for higher crop yields and efficient farming practices is pushing farmers to adopt mechanized and automated equipment. Advanced tractors, combine harvesters, and irrigation systems help in reducing labor costs and improving efficiency across large-scale farms. In addition, mechanization supports sustainable farming by minimizing overuse of water, fertilizers, and pesticides, which improves long-term soil health

- Farmers are increasingly aware of the benefits of precision agriculture, including reduced input usage, optimized water management, and better crop monitoring. This awareness is encouraging the adoption of connected machinery and digital farm management solutions. Integration with satellite mapping and AI-based forecasting allows for predictive crop management, reducing crop loss risk and enhancing profitability

- Government programs and international agencies promoting farm mechanization further support market growth. Subsidies, financial assistance, and training initiatives enable small and medium-sized farms to invest in modern equipment and technology. Public-private partnerships are also helping provide low-interest loans and equipment-sharing programs in emerging markets, facilitating widespread adoption

- For instance, in 2022, the U.S. Department of Agriculture provided grants for mechanization projects, leading to increased adoption of automated equipment and boosting the agriculture machinery market. Similar initiatives in Brazil, China, and India have enabled technology penetration in rural regions, raising farm productivity and fostering agricultural innovation

- While mechanization is driving the market, ensuring affordability, equipment reliability, and operator training remains critical for sustained adoption and long-term growth. Continuous education programs, after-sales maintenance, and digital tutorials are essential to empower farmers, especially in regions transitioning from traditional to mechanized farming

Restraint/Challenge

“High Cost of Advanced Machinery and Limited Access in Rural Regions”

- Advanced agricultural equipment, such as robotic harvesters, drone systems, and precision irrigation tools, carry high upfront costs, limiting accessibility for smallholder and marginal farmers. Cost sensitivity restricts market penetration in emerging economies. In addition, recurring maintenance and replacement parts add financial burden, discouraging long-term adoption

- In many rural areas, there is a lack of trained personnel capable of operating or maintaining complex machinery. Insufficient infrastructure and logistical barriers further reduce timely access to equipment, leading to underutilization and reduced efficiency. These gaps often result in dependency on local agents or service providers, increasing operational downtime and costs

- Supply chain challenges for specialized components, including sensors, engines, and automation systems, can result in delays or higher costs, restricting growth in remote or underdeveloped regions. Import restrictions, high transportation costs, and limited local manufacturing facilities exacerbate these challenges, hindering timely deployment of equipment

- For instance, in 2023, several farms in Sub-Saharan Africa reported difficulty accessing advanced tractors and harvesters, causing delays in planting and harvesting cycles, which negatively impacted yields. Limited availability of spare parts and local service centers further affected operational efficiency, highlighting the need for localized solutions

- While agricultural machinery continues to evolve technologically, addressing cost, accessibility, and training challenges is crucial. Stakeholders must focus on affordable, robust, and easily deployable solutions to unlock long-term market potential. Furthermore, initiatives promoting equipment leasing, cooperative ownership, and on-demand mechanization services can help bridge the gap for small-scale farmers

Agriculture Equipment Market Scope

The market is segmented on the basis of product and application.

• By Product

On the basis of product, the agriculture equipment market is segmented into tractors and harvesters. The tractors segment held the largest market revenue share in 2024, driven by their extensive use in plowing, planting, and irrigation activities across large and small-scale farms. Tractors offer enhanced operational efficiency, reduced labor dependency, and compatibility with various attachments, making them a preferred choice among farmers globally.

The harvesters segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing need for efficient crop collection and reduced post-harvest losses. Harvesters are particularly valuable in large-scale farming operations, enabling faster, more precise, and labor-saving harvesting of cereals, grains, and other crops, which ultimately improves yield and farm profitability.

• By Application

On the basis of application, the agriculture equipment market is segmented into hay & forage equipment and land development & seed bed preparation. The hay & forage equipment segment held the largest market revenue share in 2024, fueled by rising livestock farming and the demand for high-quality fodder. These machines help in timely cutting, conditioning, and baling, ensuring better feed availability and productivity.

The land development & seed bed preparation segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the adoption of precision farming practices and mechanized soil management. Equipment used for tilling, leveling, and seed bed preparation ensures optimal soil conditions, reduces manual labor, and improves planting efficiency, supporting higher crop yields and sustainable agricultural practices.

Agriculture Equipment Market Regional Analysis

- Asia-Pacific dominated the agriculture equipment market with the largest revenue share of 37.7% in 2024, driven by rapid adoption of mechanized farming, precision agriculture technologies, and government initiatives supporting modern agricultural practices

- Farmers in the region highly value advanced tractors, automated harvesters, and GPS-enabled machinery that optimize resource utilization, reduce labor dependency, and enhance crop yields

- This widespread adoption is further supported by rising disposable incomes, increasing awareness of sustainable farming practices, and the growing emphasis on food security, establishing Asia-Pacific as the key driver of the global agriculture equipment market

China Agriculture Equipment Market Insight

The China agriculture equipment market captured the largest revenue share in 2024 within Asia-Pacific, fueled by rapid urbanization, modernization of farms, and large-scale mechanization initiatives. The increasing use of precision machinery, automated tractors, and smart irrigation systems is improving operational efficiency and crop productivity. Government support through subsidies, training programs, and financial incentives is accelerating adoption among small, medium, and large farms. Moreover, the emergence of domestic manufacturers offering affordable and technologically advanced equipment is further strengthening market growth.

Japan Agriculture Equipment Market Insight

The Japan agriculture equipment market is expected to witness steady growth from 2025 to 2032 due to the country’s high focus on technological innovation, labor shortages, and aging farmer population. Japanese farmers are increasingly adopting robotics, GPS-enabled tractors, and automated harvesting equipment to enhance operational efficiency and reduce manual dependency. Integration of IoT and smart farm management solutions is contributing to precision agriculture practices and sustainable farming, driving demand for advanced agricultural machinery.

Europe Agriculture Equipment Market Insight

The Europe agriculture equipment market is expected to witness steady growth from 2025 to 2032, primarily driven by stringent environmental and efficiency regulations and rising demand for sustainable farming practices. The increasing use of smart machinery, automated tractors, and precision irrigation systems is fostering adoption across large and small farms. European farmers are also investing in equipment that ensures energy efficiency and reduced input wastage. The market is witnessing growth in both arable and livestock applications, with advanced machinery being integrated into modern farm management systems.

U.K. Agriculture Equipment Market Insight

The U.K. agriculture equipment market is expected to witness growth from 2025 to 2032, driven by the rising trend of smart farming and demand for efficient, high-performance machinery. Adoption is encouraged by government initiatives promoting digital farming and modernization of agricultural operations. The U.K.’s emphasis on precision farming, crop monitoring, and mechanized harvesting is increasing the need for advanced tractors, harvesters, and automated implements. E-commerce and dealer networks are also facilitating easier access to technologically advanced machinery, supporting market expansion.

Germany Agriculture Equipment Market Insight

The Germany agriculture equipment market is expected to witness substantial growth from 2025 to 2032, fueled by a focus on technological innovation, automation, and eco-friendly farming solutions. Farmers are adopting precision machinery, automated irrigation systems, and GPS-enabled tractors to increase efficiency and reduce environmental impact. Germany’s strong manufacturing base, coupled with supportive government policies, encourages investment in high-performance and durable farm equipment. The integration of machinery with digital farm management platforms is further promoting adoption across commercial and industrial farming sectors.

U.S. Agriculture Equipment Market Insight

North America is expected to witness substantial growth from 2025 to 2032, driven by the growing adoption of mechanized farming, advanced irrigation systems, and precision agriculture technologies. Farmers in the region highly value high-efficiency tractors, automated harvesters, and GPS-enabled machinery that optimize productivity, reduce labor costs, and improve yield management. This widespread adoption is further supported by government subsidies, advanced infrastructure, and increasing awareness of sustainable and precision farming practices, making North America a key market for agricultural machinery.

U.S. Agriculture Equipment Market Insight

The U.S. agriculture equipment market is expected to witness substantial growth from 2025 to 2032, fueled by the large-scale mechanization of farms and adoption of precision agriculture solutions. Farmers are increasingly leveraging automated tractors, combine harvesters, and GPS-guided systems to optimize resource utilization and boost crop yields. Government programs supporting farm mechanization, coupled with financial incentives for adopting modern equipment, are driving market expansion. In addition, the integration of IoT and farm management software is enhancing operational efficiency and data-driven decision-making, further propelling the industry.

Agriculture Equipment Market Share

The Agriculture Equipment industry is primarily led by well-established companies, including:

- AGCO Corporation (U.S.)

- FlieglAgro-Center GmbH (Germany)

- APV GmbH (Germany)

- Bellota Agrisolutions (Spain)

- CLAAS KGaAmbH (Germany)

- CNH Industrial N.V. (U.K.)

- Deere & Company (U.S.)

- Escorts Limited (India)

- HORSCH Maschinen GmbH (Germany)

- ISEKI & Co., Ltd. (Japan)

- J C Bamford Excavators Ltd (U.K.)

- Quivogne CEE GmbH (Kiwon RUS LLC) (Germany)

- Rostselmash (Russia)

- KRUKOWIAK (Poland)

- KUBOTA Corporation (Japan)

- KUHN SAS (France)

- LEMKEN GmbH & Co. KG (Germany)

- Mahindra & Mahindra Ltd. (India)

- MascarSpA (Italy)

- MaschioGaspardo S.p.A (Italy)

- MaterMacc S.p.A (Italy)

- Morris Equipment Ltd (U.K.)

- SDF S.p.A. (Italy)

- Tractors and Farm Equipment Limited (TAFE) (India)

- Väderstad AB (Sweden)

- Valmont Industries, Inc. (U.S.)

Latest Developments in Global Agriculture Equipment Market

- In February 2025, AGCO Corporation entered into a strategic supply agreement with SDF to deliver a streamlined range of low- to mid-horsepower tractors under the Massey Ferguson brand. This development aims to provide farmers with reliable, high-quality, and user-friendly equipment that enhances farm productivity and operational efficiency. The partnership strengthens Massey Ferguson’s global presence in the low- to mid-horsepower tractor segment, boosting market competitiveness and offering broader access to advanced agricultural machinery

- In December 2024, Fliegl Agrartechnik GmbH collaborated with Stapel GmbH to expand synergies in liquid manure technology and agricultural semi-trailer tractor units. This initiative focuses on creating innovative solutions that improve operational efficiency and address evolving farming needs. The partnership is expected to accelerate product development, enhance equipment performance, and reinforce both companies’ positions in the agriculture machinery market

- In September 2024, J C Bamford Excavators Ltd launched the new 370X model in its X Series of tracked excavators. This advanced excavator is designed to deliver superior productivity, durability, and reliability in the 35-40-ton category. The development strengthens JCB’s portfolio of heavy equipment solutions, enhances operational capabilities for construction and agricultural projects, and positively impacts market growth by offering cutting-edge machinery to industry professionals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Agriculture Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Agriculture Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Agriculture Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.