Global Agriculture Market

Market Size in USD Billion

CAGR :

%

USD

152.00 Billion

USD

314.16 Billion

2025

2033

USD

152.00 Billion

USD

314.16 Billion

2025

2033

| 2026 –2033 | |

| USD 152.00 Billion | |

| USD 314.16 Billion | |

|

|

|

|

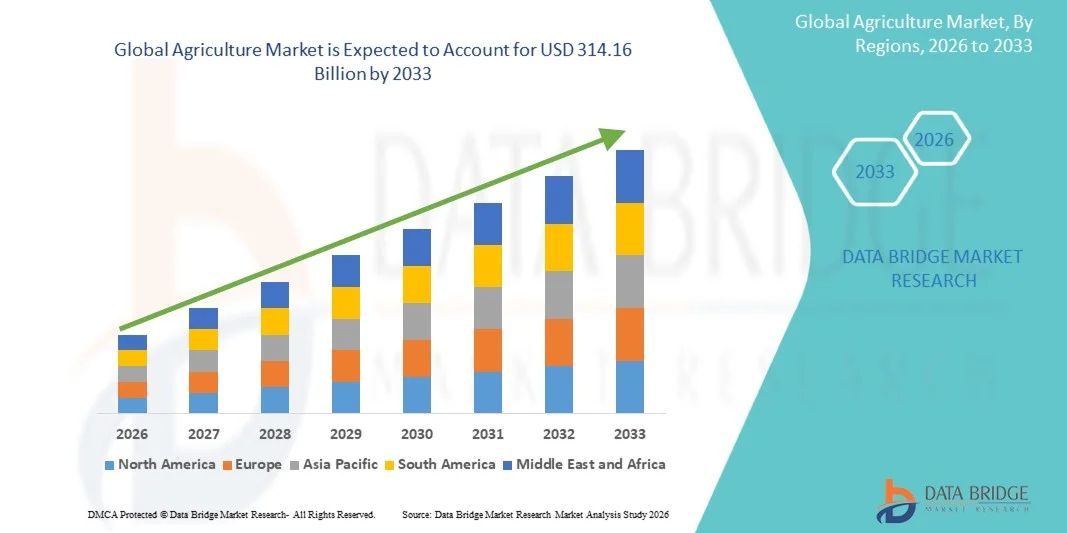

What is the Global Agriculture Market Size and Growth Rate?

- The global agriculture market size was valued at USD 152.00 billion in 2025 and is expected to reach USD 314.16 billion by 2033, at a CAGR of 9.50% during the forecast period

- Increasing adoption of precision farming technologies, rising use of smart irrigation systems, growth in agricultural robotics, demand for high-yield and sustainable crop management solutions, expansion of farm mechanization, and integration of IoT and AI in agriculture are some of the key factors driving the growth of the agriculture market

What are the Major Takeaways of Agriculture Market?

- Growing investment in agri-tech startups, expansion of smart farming solutions in developing countries, and rising government initiatives promoting modern agricultural practices are creating significant opportunities for market growth

- Challenges such as high initial investment costs, lack of skilled labor, and limited awareness of advanced farming solutions in certain regions may restrain market expansion during the forecast period

- North America dominated the agriculture market with a 39.98% revenue share in 2025, driven by strong adoption of advanced farming technologies, precision agriculture tools, automated irrigation systems, and high investment in R&D across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.21% from 2026 to 2033, driven by rapid modernization of farms, increasing government support, adoption of digital agriculture tools, and expansion of agritech startups across China, India, Japan, South Korea, and Southeast Asia

- The Crop Production segment dominated the market with a 45.7% share in 2025, driven by increasing demand for cereals, vegetables, fruits, and oilseeds across developing and developed economies

Report Scope and Agriculture Market Segmentation

|

Attributes |

Agriculture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agriculture Market?

“Increasing Adoption of Smart, AI-Enabled, and IoT-Integrated Agriculture Solutions”

- The agriculture market is witnessing strong adoption of smart, AI-powered platforms, IoT-connected sensors, and precision farming tools designed to enhance crop monitoring, yield prediction, and resource optimization

- Manufacturers are introducing cloud-enabled platforms, real-time data analytics, and multi-sensor integrated systems that offer advanced forecasting, automated alerts, and seamless compatibility with farm management software

- Growing demand for cost-efficient, scalable, and field-deployable solutions is driving adoption across large farms, agribusiness enterprises, and precision agriculture service providers

- For instance, companies such as Trimble, IBM, SAP, Oracle, and Wipro have upgraded their agriculture platforms with AI analytics, remote monitoring, and cloud integration for enhanced farm productivity

- Increasing need for rapid decision-making, precise resource allocation, and predictive analytics is accelerating the shift toward integrated, cloud-based, and AI-driven agriculture platforms

- As agriculture becomes more technology-driven and data-centric, these solutions remain vital for sustainable farming, real-time monitoring, and optimized crop management

What are the Key Drivers of Agriculture Market?

- Rising demand for AI-enabled, IoT-integrated agriculture tools to improve crop yield, reduce resource wastage, and enhance farm productivity

- For instance, in 2025, leading companies such as Trimble, IBM, and SAP enhanced their agriculture portfolios with advanced sensor integration, predictive analytics, and remote monitoring capabilities

- Growing adoption of precision agriculture, automated irrigation, drone monitoring, and farm management software is boosting demand across North America, Europe, and Asia-Pacific

- Advancements in AI, cloud computing, machine learning algorithms, and sensor accuracy have strengthened performance, usability, and operational efficiency

- Rising focus on sustainable agriculture, smart resource management, and regulatory compliance is creating demand for data-driven farming solutions

- Supported by steady investments in agri-tech R&D, digital farming initiatives, and IoT-enabled platforms, the agriculture market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Agriculture Market?

- High costs associated with AI-enabled platforms, IoT sensors, and precision farming tools restrict adoption among smallholder farmers and emerging markets

- For instance, during 2024–2025, supply chain disruptions, rising component prices, and high software licensing costs increased deployment expenses for several global vendors

- Complexity in integrating multiple sensors, platforms, and data analytics tools increases the need for skilled personnel and technical training

- Limited awareness in rural areas regarding smart agriculture capabilities, platform integration, and digital literacy slows adoption

- Competition from traditional farming methods, low-cost standalone tools, and region-specific agricultural apps creates pricing pressure and reduces differentiation

- To address these issues, companies are focusing on scalable platforms, user training programs, cloud-enabled analytics, and cost-optimized solutions to increase global adoption of AI and IoT-driven Agriculture technologies

How is the Agriculture Market Segmented?

The market is segmented on the basis of type, nature, and distribution channel.

• By Type

On the basis of type, the agriculture market is segmented into Animal Produce, Crop Production, and Rural Activities. The Crop Production segment dominated the market with a 45.7% share in 2025, driven by increasing demand for cereals, vegetables, fruits, and oilseeds across developing and developed economies. Precision farming technologies, IoT-enabled sensors, and AI-based monitoring systems are extensively applied in crop cultivation to optimize yields, reduce wastage, and manage resources efficiently. Animal Produce and Rural Activities segments are also significant, supported by livestock farming, dairy production, and rural service initiatives.

The Rural Activities segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rising adoption of smart agriculture solutions, rural development programs, and automation in livestock management, creating opportunities for technology-enabled growth in rural enterprises.

• By Nature

On the basis of nature, the agriculture market is segmented into Organic and Conventional farming. The Conventional segment dominated the market with a 52.3% share in 2025, as traditional farming practices, large-scale crop production, and established supply chains continue to support global demand. Conventional farming benefits from mechanized equipment, fertilizers, and pesticide-based crop management techniques.

Organic farming, is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing consumer awareness of food safety, rising demand for chemical-free produce, and government-backed organic certification programs. Adoption of organic techniques in vegetables, fruits, and dairy, coupled with growth in sustainable agriculture initiatives, is accelerating the market penetration of organic produce globally.

• By Distribution Channel

On the basis of distribution channel, the agriculture market is segmented into Supermarkets or Hypermarkets, Convenience Stores, E-Commerce, and Other Distribution Channels. The Supermarkets or Hypermarkets segment dominated the market with a 48.6% share in 2025, driven by organized retail expansion, urban consumer demand, and preference for one-stop shopping. These channels provide standardized quality, bulk purchasing options, and easy accessibility for agricultural products.

E-Commerce, however, is expected to grow at the fastest CAGR from 2026 to 2033, fueled by rapid digital adoption, smartphone penetration, and increased consumer preference for online grocery shopping. Online platforms allow consumers to access fresh produce, animal products, and specialty items conveniently, creating new opportunities for agricultural brands and technology-enabled distribution systems.

Which Region Holds the Largest Share of the Agriculture Market?

- North America dominated the agriculture market with a 39.98% revenue share in 2025, driven by strong adoption of advanced farming technologies, precision agriculture tools, automated irrigation systems, and high investment in R&D across the U.S. and Canada. High utilization of farm management software, sensor-based crop monitoring, and AI-driven analytics continues to fuel demand for Agriculture solutions across commercial farms, agribusinesses, and government agricultural programs

- Leading companies in North America are developing integrated agriculture platforms with cloud-based monitoring, data analytics, and predictive insights, strengthening the region’s technological leadership. Continuous investment in smart farming, agritech startups, and sustainability initiatives is expected to drive long-term market expansion

- High availability of skilled workforce, supportive government policies, and strong innovation ecosystems further reinforce North America’s dominance in the agriculture market

U.S. Agriculture Market Insight

The U.S. is the largest contributor in North America, supported by widespread adoption of precision farming, AI-based crop monitoring, drone-assisted farming, and data-driven decision-making across large-scale farms and agribusinesses. Rising demand for sustainable agricultural practices, smart irrigation systems, and advanced farm management software intensifies the adoption of Agriculture solutions. Presence of major agritech startups, research institutions, and strong funding for technology-driven agriculture further drives market growth.

Canada Agriculture Market Insight

Canada contributes significantly to regional growth, driven by precision agriculture adoption, government-backed farm modernization programs, and investment in crop monitoring technologies. Smart farming solutions, automated machinery, and IoT-based irrigation systems are increasingly deployed across Canadian farms. Supportive policies, skilled workforce, and focus on sustainable agriculture accelerate regional market penetration.

Asia-Pacific Agriculture Market

Asia-Pacific is projected to register the fastest CAGR of 9.21% from 2026 to 2033, driven by rapid modernization of farms, increasing government support, adoption of digital agriculture tools, and expansion of agritech startups across China, India, Japan, South Korea, and Southeast Asia. High demand for smart irrigation, crop monitoring, farm management software, and AI-enabled precision agriculture accelerates market adoption. Rising investment in agricultural technology, supply chain optimization, and e-agriculture platforms is expected to further fuel growth across the region.

China Agriculture Market Insight

China is the largest contributor in Asia-Pacific due to significant investments in smart agriculture, precision farming, and digital crop monitoring solutions. Rising development of AI-based agriculture, IoT-enabled farm devices, and government-backed modernization programs drives adoption of Agriculture solutions. Local manufacturing and competitive pricing further boost domestic and export demand.

Japan Agriculture Market Insight

Japan shows steady growth supported by high-tech farming, robotics-assisted agriculture, and continuous adoption of digital farm management systems. Strong focus on quality, efficiency, and sustainable agriculture drives the adoption of advanced Agriculture solutions. Increasing modernization of rural farming and high-tech horticulture reinforces long-term market expansion.

India Agriculture Market Insight

India is emerging as a major growth hub, driven by rising adoption of smart farming solutions, farm management platforms, and government-led digital agriculture initiatives. Growing demand for IoT-enabled crop monitoring, AI-assisted analytics, and irrigation management solutions accelerates market penetration. Increasing investments in rural digital infrastructure and agritech startups further support growth.

South Korea Agriculture Market Insight

South Korea contributes significantly due to advanced technology adoption, high-performance farm management platforms, and integration of AI, robotics, and IoT in agriculture. Rapid development of precision farming, vertical farming, and smart greenhouses drives Agriculture solution adoption. Technological innovation, strong manufacturing capability, and increasing digital farming ecosystem support sustained market expansion.

Which are the Top Companies in Agriculture Market?

The agriculture industry is primarily led by well-established companies, including:

- Trimble Inc. (U.S.)

- IBM Corporation (U.S.)

- Wipro (India)

- SAP SE (Germany)

- Iteris (U.S.)

- Taranis (Israel)

- Oracle Corporation (U.S.)

- Conservis Corporation (U.S.)

- Geosys Inc. (U.S.)

- Xylem Inc. (U.S.)

- PrecisionHawk (U.S.)

- Gro Intelligence (U.S.)

What are the Recent Developments in Global Agriculture Market?

- In April 2025, Taylor Farms, a leading salad industry company, acquired FarmWise, an AI-powered weeding startup facing financial challenges, demonstrating Taylor Farms’ dedication to adopting advanced technologies and improving efficiency and sustainability in agricultural practices. This acquisition reinforces the company’s long-term vision of tech-driven farm operations

- In January 2025, John Deere unveiled a range of autonomous vehicles, including an autonomous tractor, crewless dump truck, autonomous lawn mower, and a specialized orchard tractor, to address labor shortages and boost productivity in agriculture, landscaping, and construction sectors. These innovations mark a significant step toward automation in farming and related industries

- In October 2024, Kubota North America expanded its crop monitoring services by acquiring Bloomfield Robotics, a company specializing in AI-driven plant imaging and analytics for specialty crops, supporting Kubota’s commitment to precision agriculture and improved crop management. This acquisition strengthens Kubota’s technological capabilities in smart farming solutions

- In September 2024, Corteva and Pairwise formed a collaboration to advance gene editing technologies, focusing on enhancing climate resilience in agriculture, aiming to develop crops better suited for changing environmental conditions. This partnership underlines the growing role of biotechnology in sustainable farming practices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.