Global Agriculture Packaging Market

Market Size in USD Billion

CAGR :

%

USD

4.98 Billion

USD

7.28 Billion

2024

2032

USD

4.98 Billion

USD

7.28 Billion

2024

2032

| 2025 –2032 | |

| USD 4.98 Billion | |

| USD 7.28 Billion | |

|

|

|

|

Agriculture Packaging Market Size

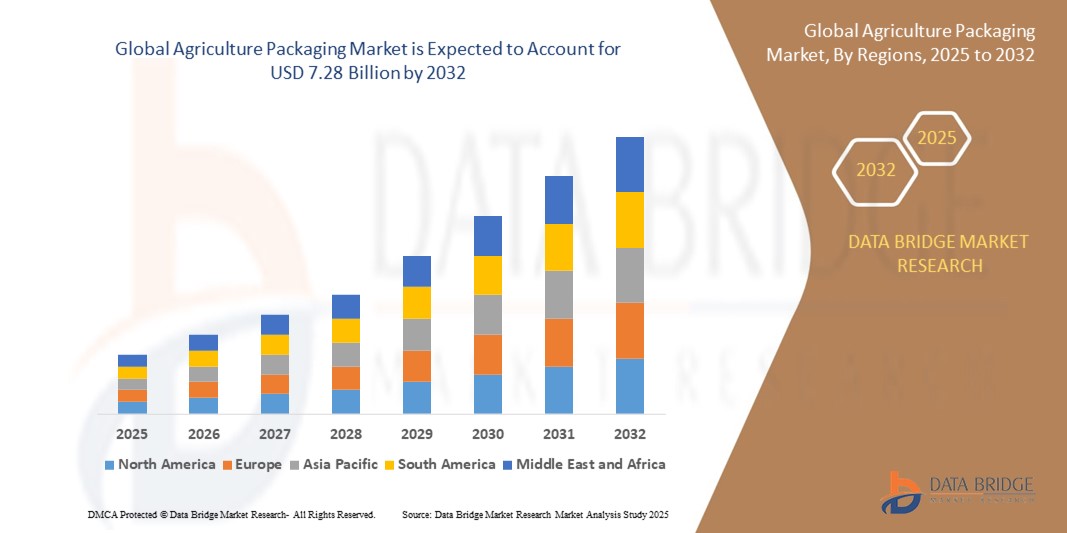

- The global agriculture packaging market size was valued at USD 4.98 billion in 2024 and is expected to reach USD 7.28 billion by 2032, at a CAGR of 4.87% during the forecast period

- The market growth is largely fuelled by the increasing demand for sustainable and durable packaging solutions to enhance the shelf life of agricultural produce and reduce post-harvest losses

- Rising global food demand, growth in exports of perishable goods, and advancements in packaging technologies are further contributing to market expansion

Agriculture Packaging Market Analysis

- The market is witnessing significant growth due to the growing emphasis on reducing food waste and ensuring product safety during transportation and storage

- Adoption of eco-friendly, biodegradable, and recyclable materials is gaining momentum in response to environmental regulations and consumer preferences for sustainable agriculture practices

- North America dominated the agriculture packaging market with the largest revenue share of 35.28% in 2024, driven by advancements in packaging technologies, high agricultural productivity, and growing demand for packaged produce across large-scale food retailers and exporters

- Asia-Pacific region is expected to witness the highest growth rate in the global agriculture packaging market, driven by increasing agricultural output, expanding exports of fruits, vegetables, and grains, and rising investments in modern packaging technologies across countries such as China, India, and Indonesia

- The bags or bins segment dominated the market with the largest revenue share of 34.6% in 2024, driven by their wide application in packaging food grains, seeds, and fertilizers. These packaging types offer ease of handling, cost-effectiveness, and protection against moisture and pests, making them a preferred choice across agricultural supply chains. The durability and scalability of bulk bags or bins also support efficient storage and long-distance transportation

Report Scope and Agriculture Packaging Market Segmentation

|

Attributes |

Agriculture Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Rising Demand for Biodegradable and Recyclable Packaging Materials in Agriculture • Expansion of Agri-Exports Boosting the Need for Durable and Compliant Packaging Solutions |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agriculture Packaging Market Trends

“Shift Toward Sustainable and Biodegradable Packaging Materials”

- Growing adoption of biodegradable and compostable materials such as bioplastics, paper-based laminates, and PLA films in agricultural packaging

- Rising global regulations and consumer demand for eco-friendly packaging alternatives that reduce plastic pollution

- Packaging manufacturers and exporters are investing in sustainable materials to enhance environmental credibility and brand loyalty

- Sustainable packaging helps meet international export regulations, particularly in Europe and North America

- For instance, Indian exporters are increasingly using jute sacks and biodegradable liners for grain and seed exports to comply with global sustainability norms

Agriculture Packaging Market Dynamics

Driver

“Rising Demand for Secure and Efficient Packaging to Reduce Post-Harvest Losses”

- Increasing focus on minimizing post-harvest losses, particularly in perishable produce such as fruits and vegetables

- Advanced packaging solutions offer protection against moisture, contamination, pests, and physical damage during transport and storage

- Efficient packaging extends shelf life, improves product quality, and boosts export competitiveness

- Demand is particularly strong in developing economies aiming to improve food supply chains and reduce waste

- For instance, farmers in Brazil have adopted hermetically sealed grain bags to significantly reduce spoilage during long-distance shipping

Restraint/Challenge

“High Cost of Sustainable and Advanced Packaging Materials”

- Biodegradable and eco-friendly packaging materials are more expensive than conventional plastic-based options

- Small and mid-sized farmers face financial constraints, limiting adoption of premium packaging solutions

- Transitioning to sustainable packaging often requires additional investment in equipment and staff training

- Inconsistent availability and supply chain limitations of green materials further elevate costs

- For instance, small-scale seed producers in Kenya face a 30–40% cost increase when switching from plastic sacks to compostable bags, discouraging widespread usage

Agriculture Packaging Market Scope

The agriculture packaging market is segmented on the basis of product, material, barrier type, and application.

• By Product

On the basis of product, the agriculture packaging market is segmented into pouches, bags or bins, silage bags or wraps, clamshells, bottle, trays, and others. The bags or bins segment dominated the market with the largest revenue share of 34.6% in 2024, driven by their wide application in packaging food grains, seeds, and fertilizers. These packaging types offer ease of handling, cost-effectiveness, and protection against moisture and pests, making them a preferred choice across agricultural supply chains. The durability and scalability of bulk bags or bins also support efficient storage and long-distance transportation.

The silage bags or wraps segment is expected to witness the fastest growth rate from 2025 to 2032, owing to their growing use in animal feed preservation. These bags enhance fermentation quality and prevent spoilage, leading to higher nutritional retention. The increased adoption of modern livestock farming practices is further propelling the demand for silage packaging.

• By Material

On the basis of material, the market is segmented into plastic, rigid, flexible, paper board, corrugated board, carton board, glass, jute, and others. The plastic segment held the largest revenue share in 2024, supported by its lightweight, low cost, and strong barrier properties. Plastic materials are widely used across various agricultural applications, particularly in seed and pesticide packaging, due to their water resistance and durability.

The jute segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for biodegradable and eco-friendly alternatives. Jute packaging is gaining traction in regions with sustainability mandates, offering renewable, reusable, and compostable options for grains and produce.

• By Barrier Type

On the basis of barrier type, the market is segmented into low-barrier, medium-barrier, and high-barrier. The high-barrier segment accounted for the largest market revenue share in 2024, due to its effectiveness in protecting agricultural products from moisture, oxygen, light, and contamination. High-barrier packaging is particularly important in maintaining the shelf life and quality of seeds and pesticides

The medium-barrier segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increased demand for balanced protection and cost-efficiency in packaging fresh produce and food grains. Medium-barrier packaging offers optimal functionality for many small to mid-size farms.

• By Application

On the basis of application, the agriculture packaging market is segmented into seeds and pesticides, silage, food grains, vegetables, and fruits. The seeds and pesticides segment led the market in 2024, driven by the increasing use of precision agriculture inputs and the need to preserve chemical integrity and shelf life. Tamper-resistant and moisture-proof packaging is critical in this category.

The vegetables and fruits segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising global demand for fresh produce, increasing exports, and greater use of modified atmosphere packaging (MAP) to reduce spoilage and extend freshness across the supply chain.

Agriculture Packaging Market Regional Analysis

- North America dominated the agriculture packaging market with the largest revenue share of 35.28% in 2024, driven by advancements in packaging technologies, high agricultural productivity, and growing demand for packaged produce across large-scale food retailers and exporters

- The region's emphasis on reducing post-harvest losses, improving supply chain efficiency, and extending the shelf life of agricultural products contributes significantly to the adoption of protective and functional packaging solutions

- The presence of well-established agribusiness firms, coupled with regulatory support for sustainable packaging initiatives, is further promoting innovation and expansion within the agriculture packaging sector

U.S. Agriculture Packaging Market Insight

The U.S. agriculture packaging market accounted for the largest revenue share of 78.3% in 2024 within North America, driven by the nation’s strong agricultural exports and the widespread use of modern packaging solutions across large farms and agribusinesses. The demand for durable, weather-resistant, and biodegradable materials is rising, particularly for grain, seed, and produce packaging. In addition, the growing shift toward automated and efficient packing systems in the U.S. agriculture sector is reinforcing market growth. The country also benefits from strong R&D capabilities and the early adoption of smart packaging technologies to ensure traceability and product safety.

Europe Agriculture Packaging Market Insight

The Europe agriculture packaging market is expected to witness the fastest growth rate from 2025 to 2032, supported by stringent environmental regulations, high emphasis on food safety, and the growing trend of organic farming. The demand for recyclable and compostable packaging materials is increasing, particularly in countries such as Germany, France, and the Netherlands. European agri-exporters are actively transitioning to low-impact materials to comply with evolving EU packaging standards. Furthermore, increased consumer awareness regarding food origin and sustainability is boosting the use of labeled and protective packaging in the region.

U.K. Agriculture Packaging Market Insight

The U.K. agriculture packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising adoption of eco-friendly packaging solutions and strong government initiatives targeting single-use plastic reduction. British farmers and distributors are increasingly using paper-based cartons, compostable wraps, and corrugated trays for fresh produce. The market is also benefiting from robust e-commerce growth in grocery and food delivery services, which demands enhanced packaging for food safety and branding.

Germany Agriculture Packaging Market Insight

The Germany agriculture packaging market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the country’s advanced agri-logistics systems and a strong focus on environmental responsibility. German agribusinesses are heavily investing in innovative packaging formats such as modified atmosphere packaging (MAP) and multi-layered biodegradable films to enhance product longevity and reduce environmental impact. The country’s strict adherence to EU green policies further accelerates the shift toward sustainable packaging alternatives for seeds, grains, and produce.

Asia-Pacific Agriculture Packaging Market Insight

The Asia-Pacific agriculture packaging market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing agricultural output, population growth, and a rising focus on food safety across emerging economies. Countries such as China, India, and Indonesia are investing in advanced packaging technologies to minimize food wastage and extend shelf life. Rapid urbanization and the expansion of organized retail and food exports are pushing the demand for durable and cost-effective packaging. Government initiatives supporting modern agri-infrastructure and cold chain development are also bolstering regional market expansion.

Japan Agriculture Packaging Market Insight

The Japan agriculture packaging market is expected to witness the fastest growth rate from 2025 to 2032, growth due to the country's strong demand for premium, traceable, and aesthetic packaging for its high-value agricultural products. With a well-developed distribution network and consumer preference for visually appealing and functional packaging, the country is adopting high-barrier and tamper-evident materials, particularly in fruits and vegetable packaging. In addition, Japan's emphasis on food hygiene, waste reduction, and recyclable packaging aligns with the growing market for sustainable materials.

China Agriculture Packaging Market Insight

The China agriculture packaging market accounted for the largest revenue share in Asia-Pacific in 2024, driven by high agricultural productivity, the growth of agri-exports, and rapid modernization in farming practices. Chinese packaging manufacturers are increasingly offering cost-effective yet durable options for a wide range of produce, grains, and seeds. The country’s aggressive push toward smart farming, digital traceability, and eco-friendly packaging policies is transforming the agriculture packaging landscape. Local innovation and government-backed initiatives are encouraging the use of biodegradable and high-barrier materials, particularly in export-focused segments.

Agriculture Packaging Market Share

The Agriculture Packaging industry is primarily led by well-established companies, including:

- TIPA Ltd (Israel)

- SmartSolve Industries (U.S.)

- Özsoy Plastik (Turkey)

- Ultra-Green Sustainable Packaging (U.S.)

- Hosgör Plastik (Turkey)

- Eurocell S.r.l (U.K.)

- Tetra Pak International S.A. (Switzerland)

- (U.S.), Kruger Inc. (Canada)

- Amcor PLC (Switzerland)

- Mondi (U.K.)

- International Paper Company (U.S.)

- Smurfit Kappa (U.S.)

- DS Smith (U.K.)

- Klabin SA (Brazil)

- Rengo Co. Ltd (Japan)

- WestRock Company (U.S.)

- Stora Enso (Sweden)

- Bemis manufacturing company (U.S.)

- Rocktenn (U.S.)

- BASF SE (Germany)

- Clearwater Paper Corporation (U.S.)

Latest Developments in Global Agriculture Packaging Market

- In November 2022, LATAM Cargo and Sonoco’s ThermoSafe entered a Global Master Lease Agreement for the Pegasus ULD temperature-controlled bulk shipping container. This agreement enables pharmaceutical freight forwarders to access Pegasus ULD containers directly from LATAM Cargo, enhancing logistics efficiency and reliability in temperature-sensitive cargo transport

- In November 2022, Sonoco acquired Westrock’s interest in RTS Packaging, gaining complete ownership of fourteen converting operations and one paper mill across the Americas. This acquisition strengthens Sonoco’s position in packaging solutions, particularly in the U.S., Mexico, and South America, broadening its manufacturing capabilities

- In May 2021, Mondi and SILBO collaborated to develop compostable paper-based packaging for Meade Farm Group, offering an eco-friendly alternative to non-biodegradable plastic bags. The bags feature a bio-based interior coating and are designed to be compostable, supporting sustainability in agricultural packaging

- In January 2021, K.M. Packaging announced its C-Range of compostable packaging products, including netting, shrink wrap, stretch wrap, sticky tape, and bags. Developed in collaboration with Treetop Biopak, these bio-plastic packaging materials are designed to be compostable, offering sustainable alternatives to traditional plastic packaging solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Agriculture Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Agriculture Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Agriculture Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.