Global Agriculture Rollers Market

Market Size in USD Million

CAGR :

%

USD

318.39 Million

USD

358.67 Million

2024

2032

USD

318.39 Million

USD

358.67 Million

2024

2032

| 2025 –2032 | |

| USD 318.39 Million | |

| USD 358.67 Million | |

|

|

|

|

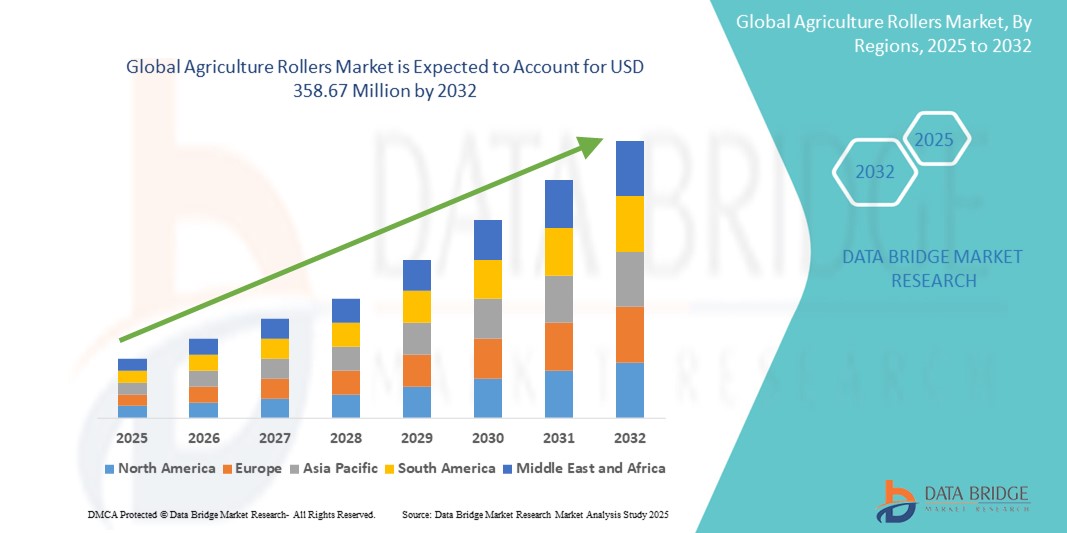

What is the Global Agriculture Rollers Market Size and Growth Rate?

- The global agriculture rollers market size was valued at USD 318.39 million in 2024 and is expected to reach USD 358.67 million by 2032, at a CAGR of 1.50% during the forecast period

- Agriculture rollers play a crucial role in soil preparation, ensuring optimal seedbed conditions by smoothing and firming the soil surface post-tillage. This enhances seed-to-soil contact, promotes uniform seed germination, and improves overall crop yields

- The market is influenced by rising demand for efficient farming equipment, particularly in regions focusing on agricultural productivity enhancements. Innovations in roller design, such as adjustable settings for different soil types and sizes, are further propelling market expansion

- Moreover, governmental initiatives promoting sustainable agriculture practices are encouraging farmers to adopt advanced equipment such as agriculture rollers, thereby driving market growth

What are the Major Takeaways of Agriculture Rollers Market?

- Concerns over declining soil quality drive the increasing focus on soil health due to intensive farming practices. Agriculture rollers play a crucial role in soil management by enhancing soil structure through compaction, which aids in water retention and nutrient distribution. Farmers are increasingly adopting agriculture rollers as part of their soil health management strategies to mitigate soil erosion and improve overall crop yields

- Government and agricultural organizations are promoting sustainable agriculture practices that prioritize soil health, thereby encouraging the adoption of equipment such as agriculture rollers that contribute to soil conservation and fertility improvement

- Europe dominated the agriculture rollers market with the largest revenue share of 38.7% in 2024, driven by advanced farming practices, strong agricultural mechanization, and widespread use of modern tillage and soil preparation equipment

- Asia-Pacific agriculture rollers market is projected to register the fastest CAGR of 14.2% from 2025 to 2032, driven by rapid agricultural modernization and increasing awareness of equipment-based efficiency

- The hydraulic rollers segment dominated the agriculture rollers market with the largest market revenue share of 61.3% in 2024, owing to their superior efficiency, ease of use, and adaptability across different terrains and soil conditions

Report Scope and Agriculture Rollers Market Segmentation

|

Attributes |

Agriculture Rollers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Agriculture Rollers Market?

“Increased Adoption of Precision Agriculture and Smart Technologies”

- A major trend reshaping the global agriculture rollers market is the integration of precision agriculture tools and smart technologies, enabling more efficient and effective land preparation and soil management. Farmers are increasingly using rollers with smart sensors, GPS capabilities, and IoT connectivity to optimize field operations

- For instance, companies such as Degelman Industries and Mandako are developing agriculture rollers that are compatible with precision farming platforms, enabling users to monitor ground pressure, soil compaction levels, and working widths in real-time to reduce fuel consumption and increase field productivity

- These smart rollers can be synced with farm management systems, allowing automatic adjustments based on crop and soil data, thereby ensuring uniform seedbed preparation and improved crop emergence. Integration with drones and remote monitoring also supports predictive maintenance and performance analysis

- The advancement in sensor-enabled rollers helps farmers reduce unnecessary passes over the field, preventing soil degradation and compaction while saving operational costs

- Companies such as HORSCH Maschinen GmbH and AMAZONEN-WERKE are investing heavily in smart roller technology, contributing to sustainable agriculture practices by enabling precision-ground operations

- This trend toward automation, data-driven farming, and sustainability is expected to be a long-term driver, especially in large-scale and commercial farming operations across developed regions

What are the Key Drivers of Agriculture Rollers Market?

- The increasing need for soil compaction and seedbed preparation in modern mechanized agriculture is a key driver fueling demand for advanced agriculture rollers globally

- For instance, in March 2024, HORSCH Maschinen GmbH announced a new line of high-performance rollers designed to enhance tillage efficiency in precision farming, responding to the rising demand for high-yield crop production

- In addition, government support for modern agricultural practices, particularly in North America and Europe, is boosting the uptake of heavy-duty, multi-purpose rollers. Subsidies and grants for farm mechanization further propel the market

- With increasing emphasis on maximizing crop yields, farmers are turning to rollers for effective soil conditioning, weed suppression, and moisture retention. Rollers offer a cost-effective way to enhance planting bed quality while reducing fuel usage and operational time

- The rise in large-scale farming and contract-based agricultural services is also supporting the demand for durable, efficient, and low-maintenance roller equipment, particularly in the U.S., Canada, Germany, and India

Which Factor is challenging the Growth of the Agriculture Rollers Market?

- One of the key challenges facing the agriculture rollers market is the high initial investment and maintenance costs associated with modern, high-capacity rollers, particularly for small-scale and subsistence farmers

- For instance, the adoption of premium models from brands such as Degelman Industries or Alamo Group Inc. is limited in cost-sensitive regions such as Sub-Saharan Africa and parts of Asia, where traditional manual tools still dominate

- In addition, limited awareness and lack of technical expertise among farmers, especially in emerging markets, reduce the potential for wide-scale adoption of smart and precision roller equipment

- Terrain limitations and fragmented landholdings in certain regions can also hinder the deployment of large and heavy rollers, affecting operational efficiency and soil health

- While innovation is driving down costs over time, bridging the affordability gap and offering flexible financing or rental options will be key to overcoming this barrier. Manufacturers are focusing on localized product development, offering more compact and affordable models suited for diverse geographies and soil types

- Addressing these affordability and accessibility challenges is essential for achieving mass adoption and ensuring the long-term success of agriculture rollers in global farming systems

How is the Agriculture Rollers Market Segmented?

The market is segmented on the basis of type, application, sales channel, material, roller diameter, roller width, and farming scale.

• By Type

On the basis of type, the agriculture rollers market is segmented into hydraulic rollers and non-hydraulic rollers. The hydraulic rollers segment dominated the agriculture rollers market with the largest market revenue share of 61.3% in 2024, owing to their superior efficiency, ease of use, and adaptability across different terrains and soil conditions. Farmers prefer hydraulic models for their adjustable pressure capabilities and compatibility with modern tractors, enabling optimized soil compaction for various crops.

The non-hydraulic rollers segment is expected to witness the fastest growth from 2025 to 2032 due to increasing demand in small-scale and traditional farming practices, especially in emerging economies where budget constraints and simplicity of operation are key considerations.

• By Application

On the basis of application, the agriculture rollers market is segmented into agricultural cereals, agricultural grassland, cotton, corn, and other crops. The agricultural cereals segment held the largest market revenue share of 37.6% in 2024, attributed to the widespread cultivation of cereal crops such as wheat and barley that require soil leveling and compaction for better germination and yield.

The corn segment is anticipated to witness the fastest CAGR from 2025 to 2032 due to increasing global corn cultivation, especially in regions such as North America and Asia-Pacific, where rollers play a vital role in optimizing planting conditions and soil aeration.

• By Sales Channel

On the basis of sales channel, the agriculture rollers market is segmented into direct sales, distributors, and online sales. The distributors segment dominated the market with the largest revenue share of 49.1% in 2024, as agricultural equipment is traditionally purchased through regional dealers offering after-sales service, customization, and physical demonstrations.

The online sales segment is expected to witness the fastest growth from 2025 to 2032, fueled by digitalization in agriculture, ease of price comparison, and improved logistics enabling the delivery of heavy machinery to remote farming areas.

• By Material

On the basis of material, the agriculture rollers market is segmented into steel, iron, and other materials. The steel segment accounted for the largest revenue share of 58.4% in 2024, driven by steel’s superior durability, resistance to corrosion, and high load-bearing capacity, making it ideal for repetitive heavy-duty use in various soil types.

The iron segment is anticipated to grow steadily during the forecast period, owing to its cost-effectiveness and prevalence in legacy equipment, especially among small and medium-sized farms.

• By Roller Diameter

On the basis of roller diameter, the agriculture rollers market is segmented into small, medium, and large. The medium diameter segment dominated the market with a revenue share of 44.8% in 2024, as these rollers offer a balanced combination of weight, efficiency, and tractor compatibility suitable for diverse crops and field conditions.

The large diameter segment is expected to witness the fastest CAGR from 2025 to 2032 due to their increasing use in large-scale farming operations requiring maximum soil compaction and reduced passes for improved fuel efficiency.

• By Roller Width

On the basis of roller width, the agriculture rollers market is segmented into narrow, standard, and wide. The standard width segment held the largest market share of 46.5% in 2024, driven by its compatibility with most tractor types and operational flexibility for medium to large fields.

The wide width segment is projected to grow at the fastest rate, fueled by increasing demand for high-efficiency equipment that reduces field passes and labor time in large farming areas.

• By Farming Scale

On the basis of farming scale, the agriculture rollers market is segmented into small, medium, and large. The medium-scale farming segment dominated with the largest revenue share of 42.9% in 2024, as this category benefits from both affordability and the need for mechanized operations, particularly in developing countries with expanding agricultural sectors.

The large-scale farming segment is expected to register the highest CAGR from 2025 to 2032, supported by industrial farming operations’ focus on automation, productivity, and large-field preparation efficiency.

Which Region Holds the Largest Share of the Agriculture Rollers Market?

- Europe dominated the agriculture rollers market with the largest revenue share of 38.7% in 2024, driven by advanced farming practices, strong agricultural mechanization, and widespread use of modern tillage and soil preparation equipment

- The region's emphasis on sustainable agriculture, increasing investments in precision farming, and subsidies for modern equipment enhance the adoption of Agriculture Rollers across key markets

- Countries such as Germany, France, and the U.K. are at the forefront of agricultural innovations, with Europe’s well-established farming infrastructure and supportive regulatory framework further accelerating market expansion

Germany Agriculture Rollers Market Insight

The Germany agriculture rollers market captured the largest share within Europe in 2024, driven by the country’s highly mechanized farming sector and strong focus on soil health. Germany’s large-scale farms, government support for agri-tech, and rising demand for high-yield crop cultivation promote the adoption of hydraulic and non-hydraulic rollers. Integration with advanced tractors and smart farming tools also supports growth in both commercial and mid-size farms.

France Agriculture Rollers Market Insight

The France agriculture rollers market is poised to grow at a robust CAGR during the forecast period, driven by a focus on sustainable land management and the country’s strong cereal and corn production. The increasing adoption of wide and heavy rollers for large-scale farming, especially in Northern France, along with favorable EU subsidies, is pushing market demand.

U.K. Agriculture Rollers Market Insight

The U.K. agriculture rollers market is experiencing steady growth owing to a rising shift towards conservation agriculture and mechanized grassland management. The demand for efficient crop rolling equipment is increasing, especially among medium-scale farms, while digitalization and the trend toward smart farming continue to shape purchasing behavior across the market.

Which Region is the Fastest Growing Region in the Agriculture Rollers Market?

Asia-Pacific agriculture rollers market is projected to register the fastest CAGR of 14.2% from 2025 to 2032, driven by rapid agricultural modernization and increasing awareness of equipment-based efficiency. Countries such as India, China, and Japan are investing heavily in farm mechanization, with government schemes encouraging the use of productivity-enhancing tools. The rise of contract farming, population growth, and a shift towards large-scale commercial agriculture are also accelerating demand across various crop types.

China Agriculture Rollers Market Insight

The China agriculture rollers market accounted for the largest revenue share in APAC in 2024, fueled by strong domestic manufacturing, vast agricultural land, and a government-driven push toward mechanization. Growing usage of iron and steel rollers for cereal and cotton crops and widespread availability through online and offline sales channels contribute significantly to market growth.

India Agriculture Rollers Market Insight

The India agriculture rollers market is witnessing rapid expansion due to rising rural income, PM-KUSUM and other agri-support schemes, and a transition from manual to semi-automated equipment. With the country's focus on multi-season cropping, the demand for durable and wide-range rollers has increased, particularly among small and medium-scale farmers.

Japan Agriculture Rollers Market Insight

The Japan agriculture rollers market is characterized by innovation in compact and smart agricultural tools, with increasing demand from precision farming and rice field preparation. The country’s aging farmer population is also encouraging the use of automated and easy-to-operate machinery, making Agriculture Rollers an essential part of mechanized farming systems.

Which are the Top Companies in Agriculture Rollers Market?

The agriculture rollers industry is primarily led by well-established companies, including:

- Ag Shield Manufacturing (Canada)

- Alamo Group Inc. (U.S.)

- AMAZONEN-WERKE H. DREYER SE & Co. KG (Germany)

- Bach-Run Farms Ltd. (Canada)

- BCS America (U.S.)

- Crescent Foundry (India)

- DALBO A/S (Denmark)

- Degelman Industries (Canada)

- Flaman (Canada)

- Fleming (U.K.)

- Hilltop Manufacturing (U.K.)

- HORSCH Maschinen GmbH (Germany)

- Husqvarna AB (Sweden)

- Mahindra & Mahindra Ltd. (India)

- Mandako (Canada)

- Remlinger Manufacturing (U.S.)

- Rite Way Mfg. Co. Ltd. (Canada)

- Summers Manufacturing Inc. (U.S.)

- Walter Watson Ltd. (U.K.)

- Wessex International (U.K.)

What are the Recent Developments in Global Agriculture Rollers Market?

- In February 2022, Case introduced its latest compactor models—the SV215E and SV217E single-drum vibratory rollers, designed to deliver rapid and uniform soil compaction across a variety of lift depths and material types. This launch enhances Case’s portfolio and strengthens its position in the road and soil compaction equipment market

- In April 2021, Brandt Agricultural Products unveiled a new line of land rollers featuring improved efficiency, including steel hydraulic lines, a hydraulic wing-latch system, powder-coated paint and primer, and a hydraulic hose management arm with premium couplers to minimize maintenance and protect tractor connections. This innovation reflects Brandt’s commitment to increasing durability and reducing maintenance in its roller product line

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.