Global Agriculture Sensing And Imagery Systems Market

Market Size in USD Billion

CAGR :

%

USD

5.07 Billion

USD

9.39 Billion

2025

2033

USD

5.07 Billion

USD

9.39 Billion

2025

2033

| 2026 –2033 | |

| USD 5.07 Billion | |

| USD 9.39 Billion | |

|

|

|

|

Agriculture Sensing and Imagery Systems Market Size

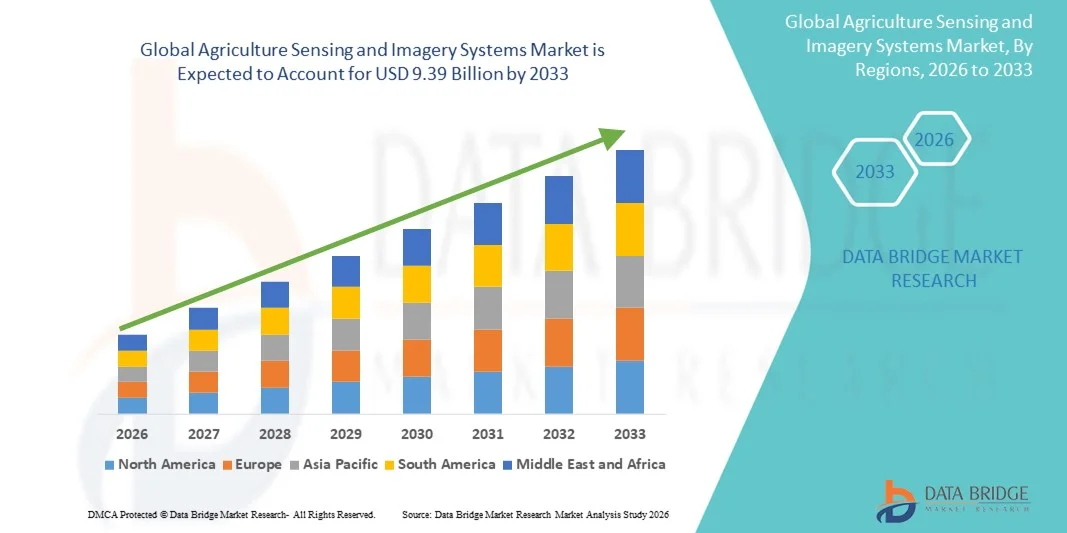

- The global agriculture sensing and imagery systems market size was valued at USD 5.07 billion in 2025 and is expected to reach USD 9.39 billion by 2033, at a CAGR of 8.00% during the forecast period

- The market growth is largely fueled by the increasing adoption of precision agriculture and technological advancements in sensing and imaging systems, enabling real-time monitoring of soil, crops, water, and livestock for optimized farm productivity

- Furthermore, rising demand for data-driven farming solutions that improve yield, reduce resource wastage, and support sustainable agricultural practices is establishing agriculture sensing and imagery systems as essential tools for modern farming operations. These converging factors are accelerating the uptake of advanced sensors, drones, and satellite imaging, thereby significantly boosting the industry's growth

Agriculture Sensing and Imagery Systems Market Analysis

- Agriculture sensing and imagery systems, encompassing soil, water, climate, and crop monitoring sensors, as well as multispectral and hyperspectral imaging technologies, are becoming critical for precision farming, offering actionable insights for improved decision-making in both large-scale and smallholder farms

- The escalating demand for these systems is primarily driven by the need for enhanced crop management, efficient resource utilization, reduced operational costs, and the growing emphasis on sustainable and climate-resilient agricultural practices worldwide

- North America dominated the agriculture sensing and imagery systems market in 2025, due to rapid technological adoption, high investment in precision agriculture, and widespread use of smart farming tools

- Asia-Pacific is expected to be the fastest growing region in the agriculture sensing and imagery systems market during the forecast period due to rising digitalization of agriculture, expanding government support, and the need to enhance food security

- Multispectral technology segment dominated the market with a market share of 64.8% in 2025, due to its widespread application in crop health assessment, pest detection, and vegetation mapping. Farmers and agronomists favor multispectral imaging for its balance between cost-effectiveness and actionable insights, as it provides critical data across key spectral bands for timely agricultural decision-making. The growing use of drones equipped with multispectral cameras further supports its market dominance

Report Scope and Agriculture Sensing and Imagery Systems Market Segmentation

|

Attributes |

Agriculture Sensing and Imagery Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agriculture Sensing and Imagery Systems Market Trends

Rising Adoption of Drone and Satellite Imaging in Precision Agriculture

- The agriculture sensing and imagery systems market is evolving rapidly with the increasing integration of drones and satellite imaging technologies aimed at improving crop monitoring, field analysis, and resource optimization. These solutions enable farmers to make precise decisions regarding irrigation, nutrient management, and pest control while reducing manual intervention and enhancing yield predictability

- For instance, Trimble Inc. has integrated aerial imagery from both drone and satellite platforms into its precision agriculture solutions to deliver field-level insights and crop health assessments. In addition, companies such as Planet Labs provide near-daily satellite imagery to support large-scale agricultural operations with continuous environmental monitoring and seasonal crop performance analysis

- Drone-based sensing technologies are being widely adopted due to their ability to capture high-resolution and real-time imagery that helps identify stress areas within fields. These systems utilize advanced multispectral and thermal sensors to detect moisture levels, nutrient deficiencies, and pest infestations early, improving overall farm efficiency and sustainability

- Satellite imagery offers a broader perspective for large-scale farms and cooperatives by enabling remote assessment of soil health, vegetation indices, and weather-related impacts. This comprehensive data collection contributes to strategic planning, allowing farmers to better allocate resources and optimize timing for planting or harvesting

- The increasing use of AI and machine learning in analyzing drone and satellite data further enhances the capability of sensing and imagery systems. Such integration transforms raw image data into actionable intelligence, helping farmers implement variable rate applications and predictive maintenance strategies for farm equipment

- The growing focus on climate resilience and sustainable agriculture is positioning drone and satellite imagery as essential tools for modern precision farming. Collectively, these advancements demonstrate the agricultural industry’s shift toward technology-driven operations designed to improve productivity while promoting environmental stewardship

Agriculture Sensing and Imagery Systems Market Dynamics

Driver

Increasing Demand for Data-Driven Farming to Optimize Yield and Resources

- The growing emphasis on data-driven agriculture is fueling the demand for sensing and imagery systems that provide farmers with accurate, real-time information about field conditions and crop health. This technological adoption is enabling more informed decision-making and efficient resource allocation across diverse agricultural zones

- For instance, Deere & Company has expanded its precision agriculture segment by integrating drone and sensor technologies into its John Deere Operations Center, enabling farmers to collect and analyze data to optimize inputs and yields. Such initiatives reflect how major players are leveraging sensing systems to promote intelligent farming practices and drive profitability

- The growing pressure to maximize output using limited natural resources has increased the importance of data collection tools such as multispectral cameras, soil sensors, and aerial imaging platforms. These technologies deliver essential insights into plant health and soil variation, leading to more precise fertilization, irrigation, and pest control strategies

- Government support and digital transformation in agriculture are also encouraging farmers to adopt sensing and imagery systems to ensure sustainable productivity. The data gathered supports compliance with environmental standards and enables farm-level reporting for sustainability certification programs

- As agricultural production becomes more reliant on digital innovation, the integration of sensing, analytics, and visualization tools is transforming the entire value chain. This shift toward optimized, data-driven farming solutions is becoming a cornerstone in achieving global food security and efficient resource utilization

Restraint/Challenge

High Initial Costs Limiting Adoption

- The high initial investment required for integrating sensing and imagery systems poses a major barrier to adoption, especially for small and medium-sized farms. The costs associated with drones, satellite subscriptions, sensors, and analytical software often exceed the budgets of many traditional farming operations

- For instance, AgEagle Aerial Systems Inc. reported that despite rising awareness of drone-based crop analytics, smaller farms remain hesitant to deploy such solutions due to hardware and operational costs. This limits widespread adoption outside large-scale commercial agriculture where financial capacity is stronger

- Maintenance expenses, software licensing, and data processing infrastructure further contribute to the overall cost burden, discouraging frequent use of such systems. Farmers in emerging economies face additional difficulties due to limited financing options and lack of supportive policies for technology adoption

- The complexity of integrating sensing systems with existing farm management software adds another layer of expense, often requiring technical expertise or third-party service providers. This increases dependence on external support and can slow down operational efficiency

- Sustained market growth will depend on cost reduction through technological innovation, affordable hardware design, and scalable subscription models. Collaborative efforts among technology providers, governments, and agricultural cooperatives will be vital in making sensing and imagery systems accessible to a wider farming community while ensuring long-term economic viability

Agriculture Sensing and Imagery Systems Market Scope

The market is segmented on the basis of sensor type, imaging technology, and application.

- By Sensor Type

On the basis of sensor type, the Agriculture Sensing and Imagery Systems market is segmented into humidity sensor, electrochemical sensor, mechanical sensor, airflow sensor, optical sensor, pressure sensor, water sensor, soil sensor, livestock sensor, and others. The soil sensor segment dominated the market with the largest revenue share in 2025 due to its critical role in monitoring key parameters such as moisture content, nutrient levels, and temperature, which directly influence crop yield. Farmers are increasingly adopting soil sensors to optimize irrigation and fertilizer application, improving efficiency and sustainability. The growing emphasis on precision agriculture and real-time field monitoring also strengthens the demand for soil sensors across large-scale and smallholder farms globally.

The optical sensor segment is anticipated to witness the fastest growth rate from 2026 to 2033, driven by its expanding use in advanced imaging and remote sensing applications. Optical sensors enable detailed crop health analysis by detecting variations in light reflection and chlorophyll levels, helping identify diseases and nutrient deficiencies early. Their integration with drones and satellite platforms enhances field coverage and data accuracy, promoting adoption among agritech service providers and government precision farming programs.

- By Imaging Technology

On the basis of imaging technology, the market is categorized into multispectral technology and hyperspectral technology. The multispectral technology segment accounted for the largest market share of 64.8% in 2025, owing to its widespread application in crop health assessment, pest detection, and vegetation mapping. Farmers and agronomists favor multispectral imaging for its balance between cost-effectiveness and actionable insights, as it provides critical data across key spectral bands for timely agricultural decision-making. The growing use of drones equipped with multispectral cameras further supports its market dominance.

The hyperspectral technology segment is expected to register the fastest growth rate during 2026–2033, fueled by its capability to capture highly detailed spectral information across hundreds of bands. This advanced imaging allows precise detection of subtle changes in crop composition, stress levels, and soil conditions. Increasing demand for high-resolution agricultural analytics from research institutions and government projects is driving adoption of hyperspectral systems, especially for sustainable farming and climate resilience applications.

- By Application

Based on application, the Agriculture Sensing and Imagery Systems market is segmented into dairy management, soil management, climate management, water management, and others. The soil management segment dominated the market in 2025 due to its vital role in improving agricultural productivity through precise soil condition monitoring. Farmers are increasingly deploying soil sensing and imagery systems to optimize nutrient management, enhance root-zone health, and ensure balanced irrigation. The growing focus on reducing resource wastage and improving yield quality across both developed and emerging economies contributes to the segment’s leadership.

The climate management segment is projected to grow at the fastest rate from 2026 to 2033, driven by the rising impact of climate variability on agriculture. These systems provide actionable insights into temperature, humidity, and precipitation trends, helping farmers adapt to changing weather patterns. Governments and agritech firms are investing in climate monitoring infrastructure integrated with AI-based prediction models, further accelerating the adoption of sensing and imagery technologies for climate-resilient farming practices.

Agriculture Sensing and Imagery Systems Market Regional Analysis

- North America dominated the agriculture sensing and imagery systems market with the largest revenue share in 2025, driven by rapid technological adoption, high investment in precision agriculture, and widespread use of smart farming tools

- The region’s focus on optimizing crop yields, conserving resources, and improving farm profitability has accelerated the deployment of advanced sensors and imaging technologies

- Strong government support for digital farming initiatives and the presence of major agritech companies further strengthen regional growth

U.S. Agriculture Sensing and Imagery Systems Market Insight

The U.S. agriculture sensing and imagery systems market captured the largest revenue share within North America in 2025, fueled by strong adoption of IoT-based agricultural solutions and drone-based imaging. Farmers in the U.S. are increasingly using real-time soil and crop monitoring tools to improve productivity and reduce input costs. The country’s robust technological infrastructure, combined with the integration of AI, GIS, and satellite imaging systems, continues to enhance precision agriculture practices across large-scale farms.

Europe Agriculture Sensing and Imagery Systems Market Insight

The Europe agriculture sensing and imagery systems market is projected to expand at a substantial CAGR during the forecast period, driven by increasing awareness of sustainable farming practices and strict environmental regulations. European farmers are adopting sensor-based technologies to reduce chemical usage and monitor soil and crop conditions accurately. The growing emphasis on data-driven agriculture, coupled with strong support for smart farming under the EU’s Common Agricultural Policy, promotes consistent market expansion across the region.

U.K. Agriculture Sensing and Imagery Systems Market Insight

The U.K. agriculture sensing and imagery systems market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising digital transformation in farming and growing demand for high-efficiency agricultural solutions. The government’s focus on precision agriculture through initiatives encouraging smart technologies adoption is driving the market. U.K. farmers increasingly utilize sensors and drones for crop mapping, weather monitoring, and yield optimization to combat resource constraints and maximize output.

Germany Agriculture Sensing and Imagery Systems Market Insight

The Germany agriculture sensing and imagery systems market is expected to grow at a considerable CAGR, driven by advanced farming infrastructure and the country’s focus on sustainable production. German farmers are early adopters of IoT-enabled agricultural equipment, integrating sensors and imaging systems for soil quality monitoring and livestock management. The emphasis on innovation, supported by research collaborations and government funding, is fostering the adoption of high-precision sensing systems across the country’s agriculture sector.

Asia-Pacific Agriculture Sensing and Imagery Systems Market Insight

The Asia-Pacific agriculture sensing and imagery systems market is poised to grow at the fastest CAGR from 2026 to 2033, propelled by rising digitalization of agriculture, expanding government support, and the need to enhance food security. Countries such as China, Japan, and India are heavily investing in precision agriculture to improve yield efficiency and minimize resource wastage. The increasing availability of cost-effective sensor-based tools and satellite imaging technologies is further driving market adoption in the region.

China Agriculture Sensing and Imagery Systems Market Insight

The China agriculture sensing and imagery systems market accounted for the largest revenue share in Asia-Pacific in 2025, supported by strong government investment in smart agriculture and rapid technological advancement. China’s expanding agricultural modernization programs promote the use of soil, water, and crop sensors to enhance production efficiency. The availability of affordable, domestically manufactured sensing devices and AI-integrated imaging systems is accelerating widespread adoption across the country’s farming communities.

Japan Agriculture Sensing and Imagery Systems Market Insight

The Japan agriculture sensing and imagery systems market is gaining traction due to the country’s advanced technology ecosystem and emphasis on automation in farming. Japanese farmers increasingly rely on remote sensing, drones, and AI-enabled imaging tools to address labor shortages and maintain high productivity levels. The nation’s commitment to smart agriculture and precision-based practices positions Japan as one of the fastest-growing markets for agricultural sensing and imagery systems in Asia-Pacific.

Agriculture Sensing and Imagery Systems Market Share

The agriculture sensing and imagery systems industry is primarily led by well-established companies, including:

- Acquity Agriculture (U.S.)

- Robert Bosch GmbH (Germany)

- BaySpec, Inc. (U.S.)

- Tetracam Inc. (U.S.)

- MicaSense, Inc. (U.S.)

- XIMEA Group (Germany)

- Teledyne Digital Imaging Inc. (U.S.)

- Resonon Inc. (U.S.)

- Auroras s.r.l. (Italy)

- TARANIS (Israel)

- Avidor High Tech (Israel)

- Honeywell International Inc. (U.S.)

- Pycno Industries, Inc. (U.S.)

- Spectrum Technologies, Inc. (U.S.)

- Stevens Water Monitoring Systems Inc. (U.S.)

- Sentek Technologies (Australia)

- Indrion Technologies India Pvt Ltd (India)

- Glana Sensors AB (Sweden)

- Acclima, Inc. (U.S.)

- CropX Inc. (Israel)

Latest Developments in Global Agriculture Sensing and Imagery Systems Market

- In July 2025, Planet Labs PBC signed a partnership with Farmdar, granting Farmdar access to Planet’s PlanetScope satellite imagery archive and Basemaps. This deal strengthens the precision‑agriculture value chain by enabling Farmdar’s AI models to deliver more accurate crop classification, boundary identification, and arable land mapping globally, thereby boosting demand for satellite‑based remote sensing solutions

- In July 2025, DJI Agriculture announced broader availability and accessible pricing of its Agras line of agricultural drones in the U.S., aiming to make high‑payload, precision‑spray drones more affordable. This initiative indirectly supports the imagery systems market by widening the drone‑platform base, fueling demand for integrated sensing, imaging, and analytics solutions among large‑scale farms and service providers

- In May 2025, John Deere & Co. acquired Sentera, a provider of drone‑based crop imagery and analytics, to integrate Sentera’s cameras and FieldAgent software into John Deere’s Operations Center. This acquisition heightens competitive pressure on precision‑imaging and sensor‑platform providers by creating a more integrated offering for farmers focused on real‑time field data, weed mapping, and actionable agronomic insights

- In April 2025, AgEagle Aerial Systems, Inc. launched the latest version of its “eBee VISION” software for autonomous drone navigation in environments where GNSS signals are weak or unavailable. This product launch advances the drone imagery sub‑segment by improving reliability in challenging conditions, expanding the potential use-cases for aerial sensing (including orchards, vineyards, and cloudy regions) and strengthening the overall imagery systems market

- In March 2025, Syngenta’s renewed multi‑year partnership with Planet Labs expanded access for users of Cropwise to 3‑metre resolution, near‑daily satellite imagery via Planet’s Dove constellation. This enhancement drives adoption of imaging technologies in farm operations because farmers gain more frequent and higher‑resolution insights into crop health, pest stress, and disease outbreaks, thus accelerating uptake of remote sensing platforms

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.