Global Agriculture Sensing And Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

13.08 Billion

USD

27.64 Billion

2024

2032

USD

13.08 Billion

USD

27.64 Billion

2024

2032

| 2025 –2032 | |

| USD 13.08 Billion | |

| USD 27.64 Billion | |

|

|

|

|

Agriculture Sensing and Monitoring Devices Market Analysis

The agriculture sensing and monitoring devices market is experiencing significant growth, driven by advancements in precision farming technologies and the increasing adoption of smart farming methods. These devices play a crucial role in improving crop yield, optimizing resource utilization, and enhancing overall agricultural efficiency. Key innovations, such as real-time soil moisture sensors, GPS-enabled devices, and IoT-based monitoring systems, have revolutionized how farmers manage their fields. For instance, GPS-enabled sensors allow precise mapping of farmlands, while IoT-connected devices provide real-time data on soil conditions, weather, and crop health. The growing global population and the subsequent need to increase food production have further accelerated the adoption of these technologies. Governments and private players are heavily investing in research and development to advance sensing technologies, such as remote sensing drones and AI-powered analytics. For instance, Cropin Technology's recent launch of Sage, a real-time agri-intelligence platform, demonstrates the market’s focus on integrating AI and cloud-based solutions. With rising awareness about sustainable farming practices and the availability of cost-effective sensors, the market is poised for exponential growth, especially in regions such as Asia-Pacific and North America.

Agriculture Sensing and Monitoring Devices Market Size

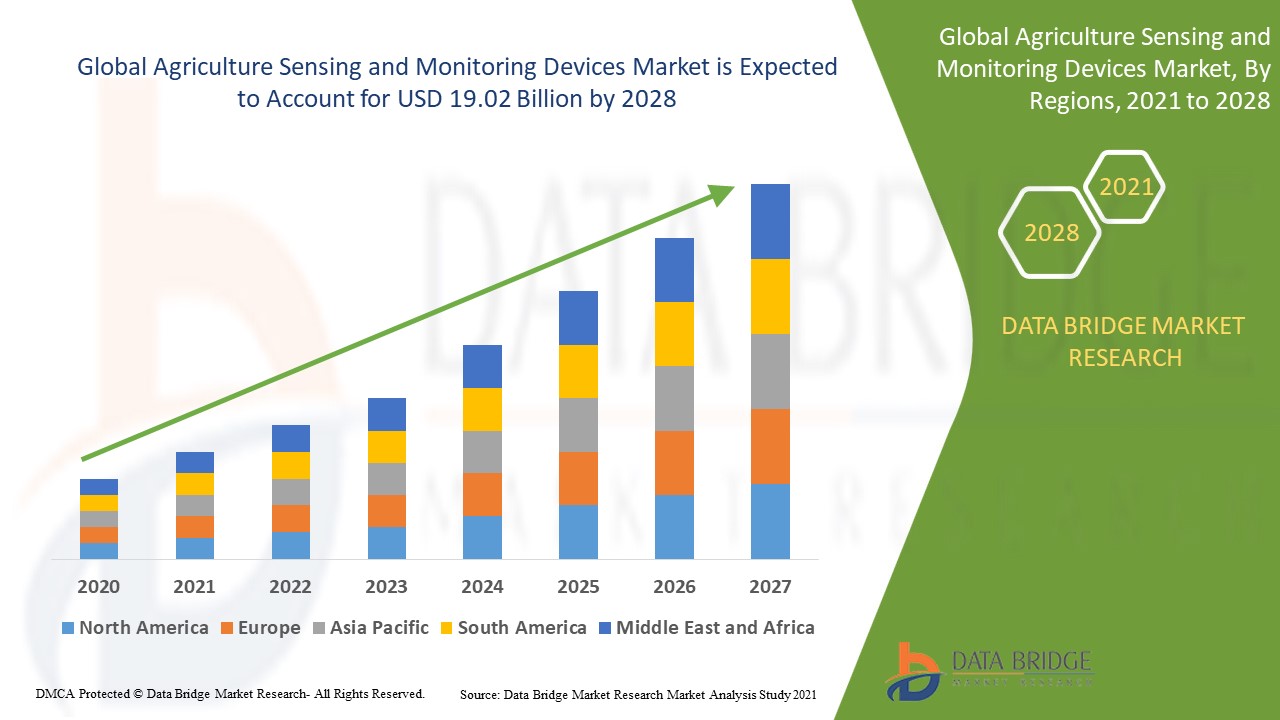

The global agriculture sensing and monitoring devices market size was valued at USD 13.08 billion in 2024 and is projected to reach USD 27.64 billion by 2032, with a CAGR of 9.80% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Agriculture Sensing and Monitoring Devices Market Trends

“Growing Integration of Internet of Things (IoT) and Artificial Intelligence (AI)”

A significant trend in the agriculture sensing and monitoring devices market is the growing integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies to enhance precision farming. IoT-enabled devices, such as soil moisture sensors, weather stations, and drones, are increasingly being paired with AI-driven analytics to provide actionable insights for farmers. For instance, Cropin Technology’s launch of its Sage platform in 2024, powered by Google Gemini, demonstrates how advanced mapping and real-time monitoring capabilities are transforming farm management. This platform offers grid-based mapping at granular levels, enabling precise decision-making for irrigation, fertilization, and pest control. Such advancements are improving resource utilization and reducing operational costs and environmental impact. With the global focus on sustainable agriculture and the rising demand for higher yields, the adoption of IoT and AI-powered monitoring devices is set to propel market growth, especially in emerging economies with expanding agricultural sectors.

Report Scope and Agriculture Sensing and Monitoring Devices Market Segmentation

|

Attributes |

Agriculture Sensing and Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Ag Leader Technology (U.S.), AgJunction Inc. (U.S.), Trimble Inc. (U.S.), AGCO Corporation (U.S.), Raven Industries Inc. (U.S.), Deere & Company (U.S.), DICKEY-john (U.S.), Farmers Edge Inc. (Canada), Grownetics (U.S.), Granular Inc. (U.S.), Climate LLC. (U.S.), and TOPCON CORPORATION (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agriculture Sensing and Monitoring Devices Market Definition

Agriculture sensing and monitoring devices refer to advanced tools and technologies designed to collect, analyze, and interpret data from agricultural fields to optimize farming practices. These devices include soil sensors, weather stations, drones, and IoT-enabled equipment that monitor parameters such as soil moisture, temperature, nutrient levels, crop health, and weather conditions.

Agriculture Sensing and Monitoring Devices Market Dynamics

Drivers

- Growing Adoption of Precision Agriculture Techniques

The growing adoption of precision agriculture techniques is significantly driving the demand for agriculture sensing and monitoring devices. As farmers increasingly focus on optimizing crop yields and improving resource utilization, these devices provide critical data for more efficient and sustainable farming practices. For instance, the use of soil moisture sensors and weather monitoring systems helps farmers make data-driven decisions on irrigation, reducing water waste and ensuring crops receive the right amount of nutrients at the right time. In addition, technologies such as GPS and drone-based imaging enable precise mapping of fields, allowing for targeted pesticide application and minimizing the overuse of chemicals. This shift towards precision agriculture is enhancing productivity and contributing to sustainability by reducing input costs and environmental impact. As a result, the adoption of these sensing and monitoring devices is becoming a vital component in modern farming, positioning them as a key driver in the market’s growth.

- Increasing Global Food Demand

With the global population steadily increasing, the need to produce more food sustainably has become a pressing concern, driving the accelerated adoption of advanced agricultural technologies such as sensing and monitoring devices. These technologies help farmers meet the growing demand for food by improving efficiency and boosting yields. For instance, sensors that track soil health, moisture levels, and temperature allow for precise irrigation, reducing water waste and ensuring crops receive optimal conditions for growth. In addition, the use of satellite-based monitoring systems provides real-time data on crop health, enabling early detection of diseases or nutrient deficiencies. This allows farmers to implement timely interventions, minimizing crop losses and improving overall productivity. As the demand for sustainable farming practices grows, the role of these technologies in enhancing food production becomes more critical, making agriculture sensing and monitoring devices a key driver in the market’s expansion. This trend is expected to continue as farmers seek innovative solutions to ensure food security in the face of a growing global population.

Opportunities

- Increasing Technological Advancements

Innovations in Internet of Things (IoT), wireless communication, and sensor technologies have significantly lowered the cost and complexity of implementing sensing and monitoring systems in agriculture, creating a substantial market opportunity. The development of low-cost, highly efficient sensors that communicate wirelessly has made it easier for farmers to adopt precision agriculture technologies without significant upfront investment. For instance, IoT-based soil moisture sensors provide real-time data on soil conditions, allowing farmers to optimize irrigation schedules, conserve water, and improve crop yields. These innovations also extend to advanced weather monitoring systems, which use wireless sensors to predict weather patterns, helping farmers make informed decisions about planting and harvesting. As these technologies become more accessible and affordable, their adoption is expected to accelerate, providing farmers with cost-effective solutions that enhance productivity while reducing environmental impact. This trend of decreasing costs coupled with increasing technological capabilities presents a clear opportunity for growth in the agriculture sensing and monitoring devices market.

- Increasing Government Regulations and Support

Many governments worldwide are actively promoting smart farming practices through subsidies, grants, and initiatives, creating a significant market opportunity for the agriculture sensing and monitoring devices market. For instance, in the United States, the USDA’s Environmental Quality Incentives Program (EQIP) provides financial assistance to farmers who adopt precision agriculture technologies, including soil moisture sensors, GPS tracking systems, and crop monitoring tools. Similarly, the European Union has invested in projects aimed at supporting digital transformation in agriculture, offering funding for precision farming equipment and training. These governmental incentives reduce the financial burden on farmers, making it easier for them to integrate advanced sensing and monitoring devices into their operations. As a result, farmers are able to enhance resource efficiency, improve crop yields, and reduce environmental impact. With continued government backing, the adoption of sensing and monitoring devices is expected to increase, creating a strong growth trajectory for the market.

Restraints/Challenges

- High Initial Costs

High initial costs remain a significant barrier to the adoption of agriculture sensing and monitoring devices, as advanced technologies such as soil sensors, drones, and IoT-enabled systems often come with substantial upfront investment requirements. For instance, precision agriculture systems that utilize multispectral imaging to assess crop health or real-time soil nutrient analysis tools can cost tens of thousands of dollars, making them unaffordable for many small-scale farmers, especially in developing regions. Smallholders, who are already operating on limited budgets, may find it difficult to justify the financial outlay for such devices, even though they have the potential to improve crop yields and reduce waste in the long term. In addition, the costs of maintaining and calibrating these devices can further burden farmers who are already struggling to stay afloat due to market uncertainties or climate-related risks. This financial barrier limits the adoption of these technologies, particularly in regions where the potential for precision agriculture is highest, but the economic capacity is lowest. As a result, high initial costs remain a significant market challenge, preventing the widespread implementation of advanced agricultural technologies and hindering their potential to transform farming practices globally.

- Lack of Technical Expertise

Lack of technical expertise is a major challenge in the agriculture sensing and monitoring devices market, as the successful use of these technologies requires a certain level of knowledge and skills. Farmers must operate these devices and understand how to maintain them and interpret the data they generate to make informed decisions about crop management and resource use. For instance, IoT-based soil sensors may provide valuable insights into soil moisture, temperature, and nutrient levels, but without proper training, farmers may misinterpret this data or fail to act on it effectively, resulting in suboptimal crop management. Furthermore, the maintenance and calibration of such devices require specialized knowledge that many farmers, especially those in rural or remote areas, may lack. Without access to training programs or technical support, these farmers may struggle to fully leverage the benefits of sensing and monitoring devices, leading to underperformance, equipment malfunction, or even abandonment of the technology. This lack of expertise can significantly slow down the adoption of these advanced tools, particularly among small-scale farmers, and is a key market challenge that must be addressed through education, training, and accessible technical support to ensure that farmers can make the most of these innovations.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Agriculture Sensing and Monitoring Devices Market Scope

The market is segmented on the basis of type and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Automation and Control Systems

- Sensing Devices

- Antennas/Access Points

Application

- Yield Monitoring

- Field Mapping

- Crop Scouting

Agriculture Sensing and Monitoring Devices Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, and application as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the agriculture sensing and monitoring devices market and is expected to maintain its dominance throughout the forecast period. This growth is driven by increasing awareness of the advantages of precision farming and smart farming techniques, which enhance efficiency and productivity. The deployment of advanced technologies in agriculture is helping to address the rising demand for food production in the region, fueled by population growth and urbanization. In addition, government initiatives and investments in precision agriculture are further boosting market expansion in this region.

North America is expected to exhibit the highest growth rate in the agriculture sensing and monitoring devices market during the forecast period. This growth can be attributed to the widespread adoption of smart and precision farming techniques, which optimize resource utilization and enhance crop yields. The region benefits from robust infrastructure support, including advanced technologies and research facilities, which facilitate the integration of innovative farming solutions. In addition, strong government initiatives and subsidies aimed at boosting agricultural productivity and addressing food security concerns further contribute to the market's rapid expansion in North America.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Agriculture Sensing and Monitoring Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Agriculture Sensing and Monitoring Devices Market Leaders Operating in the Market Are:

- Ag Leader Technology (U.S.)

- AgJunction Inc. (U.S.)

- Trimble Inc. (U.S.)

- AGCO Corporation (U.S.)

- Raven Industries Inc. (U.S.)

- Deere & Company (U.S.)

- DICKEY-john (U.S.)

- Farmers Edge Inc. (Canada)

- Grownetics (U.S.)

- Granular Inc. (U.S.)

- Climate LLC (U.S.)

- TOPCON CORPORATION (Japan)

Latest Developments in Agriculture Sensing and Monitoring Devices Market

- In July 2024, Cropin Technology Solutions Private Limited, a cloud-based agricultural solution provider, introduced a real-time agri-intelligence solution called Sage. Powered by Google Gemini, Sage transforms agricultural landscapes into grid-based maps with options of 5x5 km, 3x3 meters, and 10x10 meters

- In April 2023, Bosch BASF Smart Farming GmbH and AGCO Corporation announced a joint venture to integrate smart spraying technology with Fendt Rogator sprayers. This advanced solution incorporates weed identification technology developed by Bosch BASF, automated sensitivity thresholds, and targeted spraying capabilities

- In January 2023, CropX Technologies, a global leader in digital agronomic farm management solutions, acquired Tule Technologies, a precision irrigation company based in California. This acquisition enhanced the CropX Agronomic Farm Management System with new data capture technologies and expanded its market presence in California's drip-irrigated specialty crops

- In October 2022, Reinke Irrigation, a leading center pivot manufacturer, partnered with CropX Technologies to optimize water usage and maximize crop production through digital agronomic farm management solutions

- In August 2022, CropX Technologies launched a continuous nitrogen leaching monitoring capability, offering a simpler and faster alternative to traditional lab testing methods for monitoring nitrogen leaching events

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.