Global Agrigenomics For Crops Market

Market Size in USD Billion

CAGR :

%

USD

2.10 Billion

USD

3.74 Billion

2024

2032

USD

2.10 Billion

USD

3.74 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 3.74 Billion | |

|

|

|

|

Agrigenomics for Crops Market Size

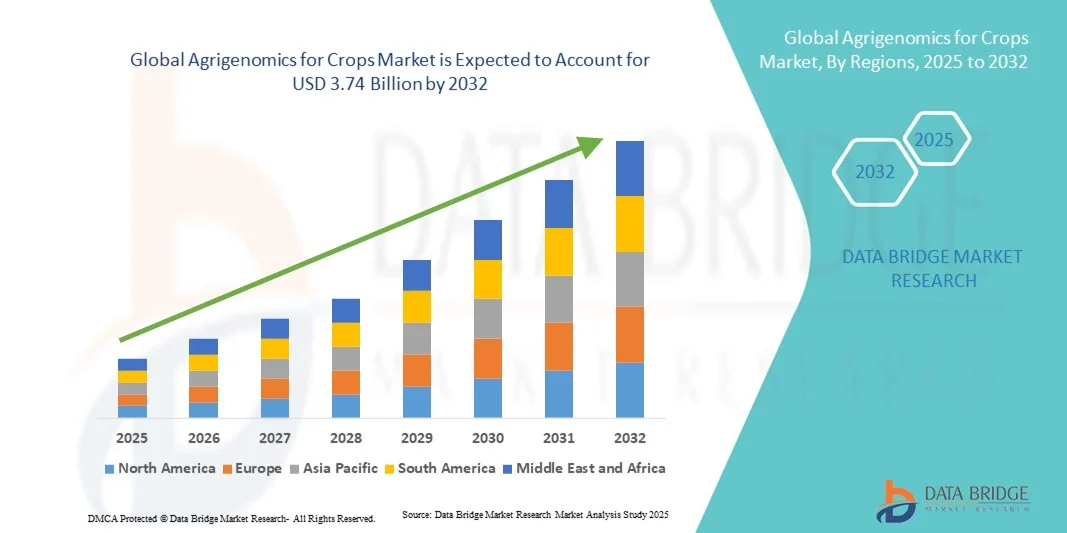

- The global agrigenomics for crops market size was valued at USD 2.1 billion in 2024 and is expected to reach USD 3.74 billion by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is largely fueled by the increasing adoption of genomic technologies and advancements in DNA sequencing methods, which are transforming crop breeding and improvement processes. The rising focus on developing high-yield, pest-resistant, and climate-resilient crops is driving the demand for agrigenomics solutions across research institutions and agricultural biotechnology companies

- Furthermore, growing investments in agricultural biotechnology and government-backed initiatives promoting sustainable and precision farming practices are strengthening the market outlook. These developments are accelerating the integration of genomics into modern agriculture, enhancing crop productivity, and ensuring food security at a global scale

Agrigenomics for Crops Market Analysis

- Agrigenomics for crops involves the application of genomics technologies, such as sequencing, genotyping, and bioinformatics, to analyze plant genomes and identify desirable traits for breeding and cultivation. These technologies enable researchers and farmers to make data-driven decisions for improving crop quality, yield, and resilience against environmental stresses

- The rising demand for agrigenomic solutions is primarily fueled by the need for advanced breeding techniques, increasing food demand due to population growth, and the push toward climate-smart agriculture. Continuous innovation in next-generation sequencing and molecular marker technologies is further propelling the expansion of the agrigenomics for crops market worldwide

- North America dominated the agrigenomics for crops market in 2024, due to the high adoption of advanced genomic technologies and strong investment in agricultural biotechnology

- Asia-Pacific is expected to be the fastest growing region in the agrigenomics for crops market during the forecast period due to growing population pressure, increasing food demand, and rising investments in agricultural biotechnology

- Next generation sequencing segment dominated the market with a market share of 42% in 2024, due to its high accuracy, scalability, and ability to analyze multiple genes simultaneously. NGS has become essential for crop genomic studies aimed at understanding complex traits and improving stress tolerance. Its integration with bioinformatics pipelines has enhanced data interpretation, supporting decision-making in molecular breeding and crop improvement

Report Scope and Agrigenomics for Crops Market Segmentation

|

Attributes |

Agrigenomics for Crops Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Agrigenomics for Crops Market Trends

Integration of AI and Bioinformatics in Crop Genomic Analysis

- The integration of artificial intelligence and advanced bioinformatics in crop genomics is driving a revolution in precision breeding and trait selection. By leveraging machine learning models and big data analytics, researchers can decode complex genetic architectures, identify gene functions, and accelerate the development of superior crop varieties with enhanced performance

- For instance, companies such as Bayer Crop Science and Corteva Agriscience are actively deploying AI-driven genomic selection platforms. These systems process massive genomic datasets to predict breeding outcomes, streamline the identification of beneficial alleles, and enable rapid decision-making in product pipelines

- AI-powered algorithms facilitate multi-omics data integration, combining genomic, phenotypic, and environmental datasets to generate actionable insights for crop improvement. This holistic approach empowers breeders to pinpoint traits associated with yield, disease tolerance, and climate adaptability, making the selection process more efficient and targeted

- Bioinformatics tools are transforming raw sequencing data into meaningful biological knowledge by automating processes such as variant calling, gene annotation, and structural variation analysis. The continuous evolution of open-source bioinformatics platforms is lowering entry barriers and fostering collaboration across research institutions and industry players

- The trend toward cloud-based agrigenomic data analysis is enabling global collaboration and democratizing access to high-powered computational resources. Through shared platforms, organizations can accelerate discoveries, validate findings, and drive innovation in crop trait optimization

- The convergence of AI, cloud technologies, and next-generation bioinformatics is rewriting the rules of crop development. This trend is pushing the boundaries of what is possible in trait enhancement, resource optimization, and sustainability across the global agricultural sector

Agrigenomics for Crops Market Dynamics

Driver

Rising Demand for High-Yield and Stress-Resistant Crop Varieties

- A primary driver for the expansion of agrigenomics in crops is the urgent need to develop high-yield and resilient varieties that can withstand the challenges of climate change, pests, and resource constraints. Modern agrigenomic techniques are expediting trait discovery and stack multiple beneficial genes, ensuring crops meet global food security requirements and evolving consumer preferences

- For instance, Syngenta is leveraging next-generation sequencing and gene editing technologies in its global breeding programs. The company has achieved significant advances in developing drought-resistant maize and disease-resistant soybean by unlocking key genetic traits through genomic selection

- High-yield crop varieties derived from comprehensive genetic analysis are crucial for maximizing productivity from limited arable land, especially as the world population continues to grow. Breeding programs can now target select genes controlling yield, nutrient efficiency, and stress adaptation

- The escalating frequency of extreme weather events and the spread of crop diseases have heightened the industry’s focus on developing stress-tolerant and multi-resistant cultivars. Genomic tools enhance the ability of breeders to introduce such traits in commercial varieties with greater precision and speed

- The adoption of agrigenomic selection methods is accelerating innovation and reducing the time-to-market for advanced seed products. This trend underscores the pivotal role of genomics in sustaining food production, profitability, and agricultural resilience under unpredictable environmental conditions

Restraint/Challenge

High Cost and Complexity of Genomic Data Interpretation

- The high cost and complexity involved in processing and interpreting crop genetic data remain a significant barrier for widespread adoption, especially among small and mid-sized agricultural enterprises. Genomic analysis requires substantial investment in sequencing technologies, computational infrastructure, and skilled personnel capable of managing large and diverse agrigenomic datasets

- For instance, smaller seed companies or public breeding institutions often face resource constraints in implementing advanced genomic analysis workflows. Despite decreasing sequencing costs, expenditures on data storage, software licenses, and sustained training for bioinformatics specialists can hinder accessibility and scalability

- The complexity of identifying meaningful gene-trait associations from high-dimensional datasets can present technical challenges. Raw data must undergo rigorous quality checks, statistical validation, and integration with phenotypic data before actionable insights can be generated

- Interpreting multi-omics data demands robust analytical pipelines and cross-disciplinary collaboration between geneticists, plant breeders, and data scientists. This increases the operational complexity and slows down the pace of innovation, particularly in regions with limited technical infrastructure

- Addressing these challenges through collaborative research models, open-source analytics, and targeted investment in capacity building will be essential for overcoming barriers to technology adoption. Progress in cost-effective and user-friendly bioinformatics solutions is likely to drive broader uptake and ensure that agrigenomics contributes meaningfully to crop improvement worldwide

Agrigenomics for Crops Market Scope

The market is segmented on the basis of sequencing, service offering, technology, and end user.

- By Type of Sequencing

On the basis of type of sequencing, the agrigenomics for crops market is segmented into PCR based, whole genome, hybridization-based, restriction digest, Sanger sequencing, Illumina Hi Seq family, Pacbio sequencers, Solid sequencers, and others. The Illumina Hi Seq family segment dominated the largest market revenue share in 2024 owing to its high-throughput capability, accuracy, and scalability for large-scale crop genome analysis. This sequencing type is widely adopted for detecting genetic variations, mapping traits, and improving crop yields through precision breeding programs. The increasing use of Illumina technology in identifying genome-wide markers and enhancing seed quality across diverse crops further supports its strong market position.

The Pacbio sequencers segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the growing demand for long-read sequencing and structural variant detection in complex plant genomes. Pacbio platforms offer superior read lengths and accuracy, making them suitable for de novo assembly and haplotype phasing in crops such as wheat, maize, and rice. The ability to generate comprehensive genomic insights that support gene discovery and resistance breeding programs is expected to boost adoption among crop researchers and seed developers.

- By Service Offering

On the basis of service offering, the market is segmented into gene expression profiling, DNA fingerprinting, genotyping, genetic purity assessment, trait purity analysis, DNA extraction and purification, DNA/RNA sequencing, marker-assisted selection, and others. The genotyping segment dominated the largest revenue share in 2024 as it forms the foundation for identifying genetic markers linked to desirable crop traits such as drought resistance and yield improvement. The growing use of SNP genotyping arrays and sequencing-based genotyping for crop improvement initiatives has strengthened its dominance. Governments and private firms are heavily investing in genotyping platforms to accelerate the development of climate-resilient and high-yield crops.

The marker-assisted selection segment is projected to register the fastest growth from 2025 to 2032, fueled by its critical role in precision breeding and genetic enhancement of crops. This approach enables faster identification of target traits, reducing breeding cycles and development costs. Increasing integration of bioinformatics and molecular tools for selecting superior germplasm in maize, rice, and soybean is further driving the adoption of marker-assisted services among research institutions and seed companies.

- By Technology

On the basis of technology, the agrigenomics for crops market is segmented into real-time PCR (qPCR), microarrays, next generation sequencing, capillary electrophoresis, and others. The next generation sequencing (NGS) segment dominated the largest market share of 42% in 2024 due to its high accuracy, scalability, and ability to analyze multiple genes simultaneously. NGS has become essential for crop genomic studies aimed at understanding complex traits and improving stress tolerance. Its integration with bioinformatics pipelines has enhanced data interpretation, supporting decision-making in molecular breeding and crop improvement.

The real-time PCR (qPCR) segment is expected to witness the fastest growth rate from 2025 to 2032 owing to its cost efficiency, speed, and precision in gene quantification and expression analysis. qPCR technology is widely used for validating gene expression levels identified in sequencing studies and plays a vital role in transgenic crop research. The growing adoption of portable qPCR systems for on-field testing and rapid genetic diagnosis is further supporting its expansion in agricultural genomics.

- By End User

On the basis of end user, the market is segmented into research organizations, farmers, cell manufacturers, and others. The research organizations segment accounted for the largest market revenue share in 2024 owing to the growing number of genomic studies focused on improving crop resilience and productivity. These organizations are leveraging high-throughput sequencing and molecular breeding tools to develop genetically superior crop varieties. Funding support from governments and agricultural biotechnology firms for genomics-based crop improvement projects has also strengthened their market position.

The farmers segment is projected to register the fastest growth from 2025 to 2032, driven by increasing awareness about the benefits of genomic data in improving crop quality and yield outcomes. Farmers are progressively adopting genomics-based solutions for seed selection, pest resistance, and soil compatibility analysis. The availability of affordable genomics services and integration with digital agriculture platforms is making advanced genetic insights more accessible to farming communities, accelerating adoption at the ground level.

Agrigenomics for Crops Market Regional Analysis

- North America dominated the agrigenomics for crops market with the largest revenue share in 2024, driven by the high adoption of advanced genomic technologies and strong investment in agricultural biotechnology

- The region benefits from the presence of leading agrigenomics companies, extensive R&D infrastructure, and government support for precision agriculture

- Increasing demand for genetically enhanced crops with improved yield, pest resistance, and stress tolerance is fueling market growth. Farmers and research institutions in the region are rapidly implementing sequencing and genotyping technologies to improve crop breeding efficiency and sustainability

U.S. Agrigenomics for Crops Market Insight

The U.S. agrigenomics for crops market captured the largest revenue share in 2024 within North America, driven by strong investment in agricultural genomics research and widespread adoption of molecular breeding techniques. The country’s advanced biotechnology ecosystem and collaborations between government, research bodies, and seed companies are accelerating genomic innovation. Increasing focus on crop improvement programs aimed at climate resilience and higher productivity continues to boost market expansion. The U.S. also leads in deploying next generation sequencing (NGS) technologies to optimize seed quality and ensure food security.

Europe Agrigenomics for Crops Market Insight

The Europe agrigenomics for crops market is projected to grow at a significant CAGR during the forecast period, supported by strong governmental initiatives promoting sustainable agriculture and food traceability. The region’s emphasis on crop genetic improvement for disease resistance and yield optimization is fostering widespread adoption of genomics-based solutions. Research institutions across Europe are investing in next generation sequencing, genotyping, and marker-assisted breeding to accelerate crop innovation. The increasing focus on reducing chemical dependency and improving biodiversity further propels the regional market.

U.K. Agrigenomics for Crops Market Insight

The U.K. agrigenomics for crops market is expected to expand at a steady CAGR, driven by a strong focus on agri-biotech innovation and government support for genomic research. Research organizations are leveraging genomics to enhance seed quality, crop resilience, and agricultural sustainability. The U.K.’s well-developed biotechnology infrastructure and public-private partnerships in crop science are contributing to market expansion. Rising interest in data-driven breeding and genome editing technologies such as CRISPR is also stimulating growth.

Germany Agrigenomics for Crops Market Insight

The Germany agrigenomics for crops market is anticipated to grow at a substantial CAGR through 2032, fueled by the nation’s strong emphasis on research, innovation, and sustainable agriculture. Germany’s agricultural biotechnology sector is advancing the use of molecular tools for improving crop performance and environmental adaptability. The government’s support for digital farming and genetic improvement initiatives is further driving market adoption. The country’s precision farming culture and focus on environmentally friendly crop enhancement techniques enhance its leadership position in Europe.

Asia-Pacific Agrigenomics for Crops Market Insight

The Asia-Pacific agrigenomics for crops market is projected to register the fastest CAGR from 2025 to 2032, driven by growing population pressure, increasing food demand, and rising investments in agricultural biotechnology. Rapid advancements in genomic research and government initiatives supporting crop improvement are propelling market growth in countries such as China, Japan, and India. Expanding research collaborations, coupled with the development of cost-effective sequencing platforms, are making genomic tools more accessible to regional agricultural sectors.

China Agrigenomics for Crops Market Insight

China dominated the Asia-Pacific market with the largest revenue share in 2024, attributed to substantial government funding for genomics-based agricultural research and the rapid adoption of NGS technologies. The country’s focus on enhancing crop yields, food security, and resistance to environmental stress is fueling large-scale genomics initiatives. Strong domestic biotechnology companies and partnerships with research institutions are supporting continuous innovation and development of genetically improved crop varieties.

India Agrigenomics for Crops Market Insight

India is expected to witness the fastest growth rate in the Asia-Pacific region, supported by government-led agricultural modernization programs and expanding private investment in genomics-based crop research. The increasing adoption of molecular breeding, genotyping, and DNA fingerprinting for seed quality assurance is enhancing productivity and crop resilience. The rising demand for high-yield and climate-adaptive crops, combined with the presence of emerging agri-biotech startups, is propelling market growth in the country.

Agrigenomics for Crops Market Share

The agrigenomics for crops industry is primarily led by well-established companies, including:

- Eurofins Scientific (Luxembourg)

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- LGC Limited (U.K.)

- Illumina, Inc. (U.S.)

- Zoetis (U.S.)

- NEOGEN Corporation (U.S.)

- GALSEQ srl (Italy)

- IntegraGen (France)

- Biogenetic Services, Inc. (U.S.)

- Daicel Arbor Biosciences (U.S.)

- Tecan Trading AG (Switzerland)

- SciGenom Labs Pvt. Ltd. (India)

- Genotypic Technology Pvt. Ltd. (India)

- LC Sciences, LLC. (U.S.)

- AgriGenome Labs Pvt. Ltd. (India)

- ArrayGen Technologies Pvt. Ltd. (India)

- UD-GenoMed Medical Genomic Technologies Ltd. (Israel)

- CEN4GEN Institute for Genomics and Molecular Diagnostics (Canada)

- BGI (China)

Latest Developments in Global Agrigenomics for Crops Market

- In October 2025, Verinomics launched its advanced Genesis and Genova platforms, integrating AI-driven analytics and transgene-free genome editing to accelerate crop trait discovery and precision breeding. This development is expected to enhance the efficiency of agrigenomic research by reducing time-to-market for improved crop varieties. The launch strengthens Verinomics’ position in the global agrigenomics landscape by providing scalable tools for high-throughput genomic data processing and crop optimization

- In September 2025, Leads Agri Genetics inaugurated India’s first private Centre of Excellence (CoE) for Cattle & Plant Genomics in Greater Noida, offering integrated sequencing, genotyping, and bioinformatics services. This launch represents a major boost for India’s agrigenomics ecosystem by enhancing local R&D capabilities and reducing dependence on global facilities. The CoE aims to accelerate innovation in crop improvement, livestock genetics, and agricultural sustainability through genomic research

- In August 2025, Verinomics entered into a five-year strategic partnership with Pinnacle Seed to co-develop next-generation leafy green varieties featuring higher disease resistance and better agronomic performance. This collaboration marks a key milestone in bridging genomics with commercial seed production, supporting sustainable agriculture and productivity improvement. The initiative is projected to expand the use of AI-guided breeding systems, with the first commercial varieties expected to enter the market by 2026

- In January 2025, Syngenta Crop Protection announced a collaboration with TraitSeq, an AI-driven analytics company, to integrate genomic biomarkers and artificial intelligence in developing next-generation biostimulants. This partnership underscores the growing convergence of biotechnology and agrigenomics, fostering innovation in crop health management. The collaboration is expected to support the creation of data-driven, genome-informed crop enhancement products, advancing precision agriculture globally

- In December 2024, Pairwise entered into a licensing agreement with the International Maize and Wheat Improvement Center (CIMMYT), granting access to its Fulcrum™ gene-editing platform for use across staple crops such as maize, wheat, sorghum, and groundnut. This agreement aims to democratize access to advanced gene-editing tools for developing nations and strengthen global food security. The collaboration is anticipated to accelerate the creation of climate-resilient, high-yield crops, driving growth in agrigenomics applications across Asia, Africa, and Latin America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.